great link, love it when people journal things like that! props, @Camel

note that there are some serious issues with how Rubilar was reported to perform (versus his very bold claims in the old forum for years). the client asked if a quick USA trip would interrupt the 2 years of continuous residence, and Rubilar assured them no (he most recently ha assured 7 months in Argentina per calendar year is sufficient), yet that did not end up being the case for the judge.

i know everyone wants to believe most lawyers are professional and all of that, but i still believe the $6,500 USD contains money to bribe certain judges. i have no proof other than commonsense and the way the world works; the same thing happens with physicians prescribing certain brands of medications, medical folks referring certain 'associates', etc. (or lobbying from various entities/SuperPACs). it's not evil, it's just how most high positions get paid more. this makes sense why some lawyers keep changing judges until they get certain ones

🙂 the report from @camel shows how he wasn't informed about 1: the parent-name-delay of 4 years, 2: the rejection from leaving Argentina for a short time in the USA that Rubilar approved, 3: the weird process of demanding to be arrested by the USA Embassy, and 4: Rubilar's continual Nazi-name-calling strategies (and i imagine some 'Roman serf slave feudal law' comments as well) that may have put @camel's case in jeopardy to set a precedent for other Rubilar cases.

also, on the old censored forums,

@bwyonsea/

@Bajo_cero2 never responds to criticisms; if i was running a business and offering advice online, i would absolutely never sit quietly if people were questioning my integrity. i would immediately offer evidence for why i'm following the ethical and legal way (not only to get more clients, but to show i'm acting in good faith). but one of hundreds of criticisms like

"key to the resolution of that case turned out to be the exact thing [Rubilar] claims is never needed - residency. (That he repeats this claim in this very thread, knowing full well the circumstances of the case, is every bit the chutzpah I’ve come to expect from the learned gentleman.)"

...goes unanswered like almost all questions/criticisms. this is why i never hired Rubilar, and why i wouldn't recommend it to anyone unless there was literally no other choice (there probably is). too many unanswered questions, too many criticisms that he ignores (but spends time on the forum answering other questions and posting about Roman slavery racism laws), and too high of a price with zero guarantee (and the mothafucka wants 6k USD

cash; bro, it's Argentina, that would be over eight thousand 1,000-Peso notes, or carrying around thousands of USD (which are almost impossible to get unless you bring them on the flight)...just accept electronic payment like everyone else! we all know you upper-class folks have several USD offshore accounts; everyone does.

i read it the same as well. but once the Residency lawyer got residency, it seemed to unlock the Citizenship case Rubilar had already started. who knows!

yeah, i agree as a last resort, but probably just spending some money to get legit Residency would be quicker and cheaper for 95% of people. no idea!

--------------------------

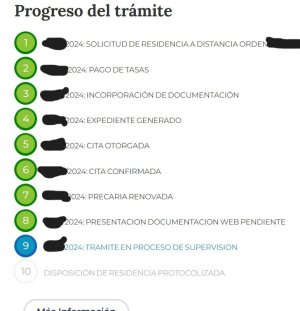

continuing on with the process in Cordoba Province, my status on Migraciones' site

https://www.migraciones.gov.ar/accesible/consultaTramitePrecaria/ConsultaUnificada.php (which you do

NOT receive an email about, so i've been checking it every morning with coffee)

finally changed from "

Supervision" to "

DISPOSICIÓN DE RESIDENCIA PROTOCOLIZADA" - which shows as the last step...yet i still have a button to Attach a PDF. website poor design/glitch, or am i suddenly going to need to show

deposited Peso money in my Argentine bank account at the last minute of my 90-day

Precaria? lots of unknowns still, but overall my lady and i have been quite successful at doing everything without hiring a translator/expediter/lawyer (i did pay for 3 short consultations when i was first in BsAs to see if they had any sort of common theme - they did not).

the last i was told by the Cordoba Migraciones is that 5x-salary needs to be

transferred every month i want residency. they told my girlfriend a few weeks later that she just needed to deposit a 5x-salary

once into her

Banco Nacion account. this is a huge difference; transferring would be at official rate, probably taxed, and certainly incurring fees 12 times a year...yet she might be able to take out Pesos with WesternUnion and deposit cash at the Blue rate only

once to get her DNI. what the hell! will update more later. as of May2024 the salary is:

234,315 Pesos

x5 is

1,171,575 Pesos/month

which at 1298 ARS/USD on WU site right now without fees, would be

$903 USD one time for her, supposedly to get a DNI and a year's worth of

Residencia Rentista. that would be amazing! and the debit MasterCard that comes with the

BNA/

BancoNacion account has some offers to use for local spends on groceries and services, though i haven't tried any yet:

https://bna.com.ar/personas/descuentosypromociones

**note that her

Precaria was granted the day she had her appointment (in the office at 10:45, didn't get seen until 13:30, wasn't done until 14:00) but she has an "

Intimacion" to complete - she was told within 30 days to show a stamped piece of paper that the million-ish Pesos are in her

BNA savings account (the paper actually says she has 90 days). she

was able to use an electronic

Precaria (i've been calling it a pre-

Precaria, the one that was in-between her Tourist Visa for 9 days until her initial appointment at

Migraciones) to open a "

cuenta de ahorros" at BNA - the staff didn't seem to notice a difference between a 9-day Precaria and a 90-day "real" Precaria...i played dumb translating for her, and it worked! they asked her for her Social Security Number (could be related to USA and Argentina eventually sharing tax stuff?) but i didn't have to do that, so i told the bank employee that she didn't feel comfortable since so many scams "

estafas" in the USA involve the SSN. she was a bit confused, but i explained that a

DNI number is thrown-around in Argentina, but a SSN is

neverrrrrr just mentioned at the grocery store; it's basically just for direct government interactions. my girlfriend was able to get her "

Constancia" proof of Argentine bank account by using her passport number only (and maybe her parcel number/parcel County tax ID in the USA, not sure).

so, the

next step is seeing if a Western Union cash deposit will work for proof, and how to get a stamped paper that the deposit was done. and if i can do the same, avoiding doing it 12 times per year. maybe i'll master this stuff and charge a small price to be a

Migraciones/

RadEx guide in the future, if i learn enough

😉

now, to travel a bit in Argentina during the 90-day period! no car, but renting a car for 2 days to move my pup has been somewhat doable. i'll update more when i learn if in 2024 you can renew

Precarias online within 5 or 10 days (i was told both), and how the process is actually done (end of July i'll post here). if anyone has a

reliable cheap vehicle they want to lease to me or sell to me, i'm starting to research if it is worth it (but has prices are so high at 1050 Pesos/liter...maybe the global oil price drop will help, or the Milei cabinet will delete some gas tax laws). i found @BowTiedMara's substack post about it here:

The road to bureaucracy hell is paved with forms and declarations

www.bowtiedmara.io