James Bond

Well-known member

Pretty much everyone got it wrong with few exceptions

It is really hard to guess what the exchange rate is when it isn't floating free. Let's see how it finishes out the year. I see it went above 1,200 today to 1,210.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

Pretty much everyone got it wrong with few exceptions

This would be great if more developers let you pay outside of Argentina. When I bought my property a few years ago I had to get the cash to Argentina and had to use cuevas. I don't even think it was actually legal. Hopefully I don't have any problems when I sell.No doubt Mike, saving 4-5% on the purchase price is a biggie and much appreciated

What caused it to go up today? I just saw that the Central Bank sold $599 million bucks today! I thought they were buying dollars. Why did they sell so much?It is really hard to guess what the exchange rate is when it isn't floating free. Let's see how it finishes out the year. I see it went above 1,200 today to 1,210.

No doubt the amount of cash Argentines have in cash is massive. The most in the world. $22.16 Billion came back in cash and that is just a drop in the bucket compared to how much cash they are holding outside of the banking system.Everyone I know in Argentina deal with cash. I still have many acquaintances and friends that never use any credit or debit cards. They pay everything cash still. Estimated that there is about $277 to $350 Billion dollars hidden! This is a huge amount of GDP. The $20 billion that came back is nothing. Probably only about 8% of total undeclared.

This was most frustrating part for me of buying here. I bought many years ago before anyone allowed payment outside of Argentina. I paid a lot of money for nothing but getting cash here. Same experience counting out cash. Same experience as you @Betsy Ross with seller demanding replacement bills! She was rejecting older bills, marked bills even bills that were ok but had a slight crease.

I asked my friend in real estate and he told me still sellers are insisting on cash. Even people that have accounts outside Argentina are insisting on cash. I asked about crypto and he said no one is doing that and he works for a big company. @earlyretirement are you seeing any crypto currency transactions?

Correct. I have been saying that we will not know the true price of the Argentine peso until it is floating freely with no intervention by the government.It is really hard to guess what the exchange rate is when it isn't floating free. Let's see how it finishes out the year. I see it went above 1,200 today to 1,210.

Fortunately with President Milei, he got rid of the requirement by foreigners to get a permit to sell their properties where they typically scrutinize everything. Of course if the regime changes they could always change it back. That is why it's essential to structure payment for real estate legally. You never know in the future if some government scrutinizes how money entered the country and what the laws were at the time of the purchase. You never should think about who the President is when you purchased but who the President will be when you want to sell. By doing everything legally you don't have to worry about any potential issues.This would be great if more developers let you pay outside of Argentina. When I bought my property a few years ago I had to get the cash to Argentina and had to use cuevas. I don't even think it was actually legal. Hopefully I don't have any problems when I sell.

I posted about this today. Toyota exited their carry trade position.What caused it to go up today? I just saw that the Central Bank sold $599 million bucks today! I thought they were buying dollars. Why did they sell so much?

No doubt the amount of cash Argentines have in cash is massive. The most in the world. $22.16 Billion came back in cash and that is just a drop in the bucket compared to how much cash they are holding outside of the banking system.

It is crazy annoying to pay % to bring cash into Argentina but unfortunately, with currency controls, there is no free way to get cash here. The ideal situation is that the seller has an account outside of Argentina to avoid all of this. Crypto still isn't in vogue from sellers. I deal with tons of purchases and there is absolutely no appetite at all from sellers to receive crypto. They still want cash. People wanting to use their crypto are having to use stable coins and send them to Argentina and pay fees to get it here. With the volatility, there is no interest vs. getting cash in Argentina.

Correct. I have been saying that we will not know the true price of the Argentine peso until it is floating freely with no intervention by the government.

Fortunately with President Milei, he got rid of the requirement by foreigners to get a permit to sell their properties where they typically scrutinize everything. Of course if the regime changes they could always change it back. That is why it's essential to structure payment for real estate legally. You never know in the future if some government scrutinizes how money entered the country and what the laws were at the time of the purchase. You never should think about who the President is when you purchased but who the President will be when you want to sell. By doing everything legally you don't have to worry about any potential issues.

I posted about this today. Toyota exited their carry trade position.

De nada. Yes, with carry trade it can shift suddenly. Posted an article on X today about the 4 things to worry about this summer.Thank you for posting why Central Bank sell so many dollars. I did not understand why. I worry that many companies play with carry trade issue. If they all exit at same time the devaluation can be massive I think. I don't know about such things but my friends that work for bank tell me that it can change suddenly.

De nada. Yes, with carry trade it can shift suddenly. Posted an article on X today about the 4 things to worry about this summer.

Taken from this article which was spot on.

Los cuatro riesgos del verano para el plan Milei - PLAN M

Los cuatro riesgos del verano para el plan Milei - PLAN M %www.planm.com.ar

This is what it sounds like that even if Argentina is doing great stuff if Brazil's exchange rate keeps tanking it will become a problem. I think I read that this happened before. Seems like a lot of similarities.Good analysis. That is the thing. Even if Argentina is on the right track this situation with Brazil if it gets worse could pull Argentina into many problems. Same thing with Trump. Things will be out of the control of Milei.

I'm old enough to remember the Asian Contagion when the Thai central bank managed to tank the economy of nearly every country in Southeast Asia. I'm seriously hoping Brazil doesn't do that for South AmericaGood analysis. That is the thing. Even if Argentina is on the right track this situation with Brazil if it gets worse could pull Argentina into many problems. Same thing with Trump. Things will be out of the control of Milei.

Yep. Remember that. Ugly times. That is a concern if Brazil real continues to tank. It will have serious contagion affects for Argentina. No matter what Argentina does there will be pain.I'm old enough to remember the Asian Contagion when the Thai central bank managed to tank the economy of nearly every country in Southeast Asia. I'm seriously hoping Brazil doesn't do that for South America

How bad do you think the Real would have to be to cause problems for Argentina???Yep. Remember that. Ugly times. That is a concern if Brazil real continues to tank. It will have serious contagion affects for Argentina. No matter what Argentina does there will be pain.

De nada. Yes, with carry trade it can shift suddenly. Posted an article on X today about the 4 things to worry about this summer.

Taken from this article which was spot on.

Los cuatro riesgos del verano para el plan Milei - PLAN M

Los cuatro riesgos del verano para el plan Milei - PLAN M %www.planm.com.ar

As I mentioned, things can shift suddenly when people exit their carry trade positions. People are starting to exit out of their carry trade positions. Posted about it here:

The Central Bank of Argentina in 6 DAYS loses 30% of the USD they have purchased this year

Look at the numbers. The beautiful thing about numbers is that #'s never lie.

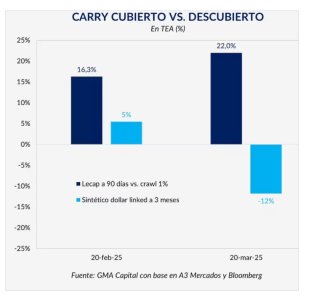

Argentine Peso Investments Were Previously Attractive

• Until last week, the interest rate differential made it profitable for investors to stay in pesos rather than dollarizing.

• Market conditions allowed for a positive carry trade, where investors earned a return by holding Argentine pesos.

A Sudden Reversal Has Occurred

• Interest rates for 90-day peso investments have surged by 600 basis points, indicating increased risk in holding pesos.

• This suggests that investors are demanding higher compensation for the risk of remaining in the peso.

Covered Carry Trade Has Collapsed

• The three-month covered carry trade (which arbitrages between peso and dollar returns) has gone from +5% to -12% annually.

• This means investors are now losing money trying to profit from peso holdings, which signals a rush to dollarize and a race to the exits.

Investors Are Willing to Pay a Premium to Exit Pesos

• The fact that investors are dollarizing “at any cost” suggests a loss of confidence in the peso’s stability.

• This could reflect concerns over devaluation risks, inflation persistence, or policy uncertainties.

What This Means for Argentina

• If this trend continues, it could lead to exchange rate pressure and higher inflation, as more investors shift away from pesos.

• This shift could be a sign of renewed fears of currency instability, which would complicate President Milei’s economic strategy.

View attachment 8949

That is a lesson that many in Argentina have learned over time. Always save in dollars and not in pesos. If people lose confidence things can turn very quickly. From all accounts, everyone believes the peso is overvalued.I never trust in the peso. We always keep our savings in dollars. Always. Even if the peso gets strong for a few months the dollar always comes back eventually. That is why we never save in pesos. I am afraid this time is not different.

I don't know anyone that saves their savings in pesos! Most buy enough when the rate is attractive to cover a few months of expenses. We have seen this play out before. Many thought this time was different with Milei but I am watching him stumble at a time when they can't make any mistakes. October is a long way away and the other party will throw obstacles.That is a lesson that many in Argentina have learned over time. Always save in dollars and not in pesos. If people lose confidence things can turn very quickly. From all accounts, everyone believes the peso is overvalued.

Is there any websites that have real time crypto rates? I see the websites use it but today is a holiday. Where are you seeing updated crypto rates? I guess it makes sense the blue or MEP or CCL would lag the crypto rate.Crypto rate looks like it keeps going up so that is probably where the blue rate will go.

Receive personalized job market insights from seasoned expats in your area

Discover local cultural nuances and festivities shared by community members

Get your tailored expat living guide curated by experienced locals