All the Answers

Well-known member

The IMF praised Argentina's "impressive" progress and estimated that the economy will fall 2.8% and that inflation will be 150% - Infobae

Source:

El FMI elogió el “impresionante” avance de Argentina y estimó que la economía caerá 2,8% y que la inflación será del 150%

Tras el impacto inicial para este año, el organismo espera un fuerte rebote de la actividad y una desaceleración de la suba de precios para 2025; qué dijo el economista del organismo sobre los desafíos del Gobierno; este martes Caputo viaja a la asamblea en Washington

April 16, 2024

After the initial impact for this year, the organization expects a strong rebound in activity and a slowdown in price increases by 2025; what the agency's economist said about the Government's challenges; This Tuesday Caputo travels to the assembly in Washington

By Mariano Boettner and Agustín Maza

Milei and Georgieva, during a meeting at the Davos Forum last January

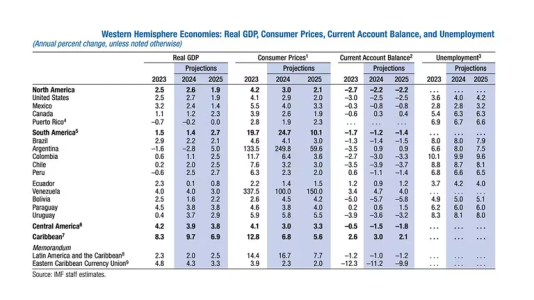

The International Monetary Fund (IMF) maintained its recession and inflation projections for the Argentine economy this year, days before a new chapter in the back-and-forth between the Casa Rosada and the organization that will take place in Washington. The Global Economic Outlook (WEO) report , released today, stated that the country will have a 2.8% drop in GDP and that the price increase will accumulate 150% , with a marked rebound expected and a strong inflationary slowdown by 2025. .

The organization's chief economist, Pierre Olivier Gourinchas, stated in a press conference in which the WEO was released that, “in Argentina the authorities are implementing a very ambitious stabilization plan to restore macroeconomic stability.”

“As you know, the plan focuses on a strong fiscal anchor that eliminates, in particular, any financing of the government by the Central Bank, which was one of the factors that led to very high inflation figures in previous years. And that is already showing its effects. “We see this sharp drop in inflation month after month,” he assured.

“That's why the progress so far has been really impressive. The authorities have been able to record a fiscal surplus for the first time in more than a decade. And of course, this will take some time and require strong political implementation. Much more needs to be done, and much more needs to be done on a broader scale,” he stated.

“So I think we are watching this situation closely. Our teams here at the Fund are in close contact with the authorities. But progress, once again, has been quite marked. Now, whether it is V, U or L, let us agree that we prefer V to U to L,” he explained about the pace of the country's recovery.

Caputo will hold meetings with representatives of the IMF and the Treasury.

This Tuesday, the Minister of Economy Luis Caputo , accompanied by the Secretary of Finance Pablo Quirno and the president of the Central Bank Santiago Bausili , will travel to the North American capital to participate from Wednesday in the spring assembly in the Western Hemisphere, one of the two main meetings held by the Monetary Fund each year. The Argentine delegation plans to hold various meetings, among which they will meet with representatives of the IMF and the North American Treasury, "in which dialogue will continue about the reforms that are being developed in Argentina to organize the economy," according to the Palacio de Tax authorities.

It will be a new episode of the conversations that began since the beginning of the libertarian mandate with the IMF to turn the current program towards a new direction that may include additional financial support. During his stay in Washington, Caputo will also participate in meetings of the International Monetary and Financial Committee (IMFC) and the Joint Ministerial Committee for Development (DC) of the IMF and the World Bank .

At these events, they officially reported, the world economy, the evolution of financial markets and issues related to the agency's mandate and the financial resources necessary to promote economic development and poverty reduction in developing countries will be discussed.

In this framework, the organization presented this Tuesday its April update of the World Economic Outlook (WEO) in which it publishes its main global economic estimates. “Global growth, which is estimated to be 3.2% in 2023, is projected to continue the same in 2024 and 2025 ,” the IMF said, implying a 0.1% improvement in the outlook compared to what the IMF expected. organism in January.

The IMF's perspectives on Argentina

Regarding Argentina specifically, the IMF assured that the economy fell by 1.6% in 2023 and that the recession will be more serious this year , with -2.8% , in line with what it had already estimated in January and which is the base scenario drawn up by the technical staff that prepared the last quarterly goal review report, which was approved by the board of directors at the end of January. That prolonged recession will cause unemployment to rise from 6.6% to 8 percent . By 2025, in any case, he considers that the rebound will be very marked , 5 percent .

In the case of inflation, the Monetary Fund maintained the projection of 250% on average and 149.4% end to end . It is an estimate that was well below the pattern expected by the local market, which through the Survey of Market Expectations (REM) carried out by the Central Bank marks a consensus projection slightly lower than 190 percent . In the same way, the organization believes that in 2025 the collapse in the price rhythm will be marked, up to 59.6 percent and 45% end to end.

The IMF has been reiterating general support for the economic course of Javier Milei's government, with some objections raised regarding social and retirement spending, the "quality" of the fiscal adjustment and the exit from the stocks in a "calibrated" manner . The Fund recognizes that the economic plan is explained by a “ strong fiscal anchor , the elimination of financing from the Central Bank and the elimination of impediments to growth.”

Caputo will travel to Washington this Tuesday to participate in the IMF Spring Assembly.

The organization also has an eye on the local political “environment.” Looking ahead, the Monetary Fund asked the Government to seek broad support for its measures, in the midst of ongoing negotiations to obtain support from the governors for the new version of the omnibus law , and while the mega DNU awaits treatment in Deputies after the rejection of the Senate.

The Government will need, according to the IMF, “pragmatism” to “gain political and social support for the reforms ,” as spokesperson Julie Kozack recently mentioned . “The technical team and the Government are in negotiations for the current program. We continue to provide support to establish foundations for growth, it is premature to discuss modalities for a potential program in the future,” concluded the official, in reference to the technical conversations initiated with the Caputo and Bausili team.

What the IMF sees for the world this year

“Growth is historically slow , due to short-term factors such as still high borrowing costs and the withdrawal of fiscal support, and the longer-term effects of the COVID-19 pandemic and the Russian invasion of Ukraine, the weak productivity growth and increasing geoeconomic fragmentation,” the IMF said.

Pierre-Olivier Gourinchas, IMF chief economist REUTERS/Ken Cedeno/File Photo

And regarding inflation, he mentioned that “global general inflation is expected to decrease from 6.8% in 2023 to 5.9% in 2024 and 4.5% in 2025, and that advanced economies will reach their goals before the emerging and developing.

Regarding the drivers and risks that the global economy will have this year, the Monetary Fund assured that “the risks to the global outlook are now quite balanced.” “On the negative side, the new price escalation arising from geopolitical tensions, for example, from the war in Ukraine and the conflict in Gaza and Israel , could, together with the persistence of underlying inflation in countries with labor shortages, work, raise interest rate expectations and reduce asset prices.”

“The heterogeneous dynamics of disinflation among major economies could also cause currency fluctuations that would put pressure on financial sectors. “High interest rates could slow the economy more than expected, as the expiration and renegotiation of fixed-rate mortgages and high household indebtedness could lead to financial strain ,” the updated IMF report continued.

On the contrary, other elements would act as a push for the world economy: “A fiscal policy that is more lax than necessary and assumed in the projections could increase economic activity in the short term, under penalty of a more costly subsequent adjustment of the policy.” ”said the IMF. “ Inflation could reduce faster than expected if the labor activity rate continues to increase, which would allow central banks to advance their easing plans. “Artificial intelligence and deeper-than-expected structural reforms could boost productivity,” he concluded.