Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: this_feature_currently_requires_accessing_site_using_safari

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Western Union

- Thread starter Eric2006

- Start date

Robert07

New member

This is my personal interpretation, but here's my explanation.What accounts for the significant difference between the Western Union exchange rate and the blue dollar rate in the past month?

Remittance companies like Western Union, involved in the dollar-to-peso conversion process in Argentina, play a crucial role in the Contado con Liquidación (CCL) system. In this setup, they receive pesos in Argentina and pay out dollars in the USA. The cycle depends on efficiently unloading pesos, prompting these companies to adjust their "WU rate" accordingly. When there's a surplus of pesos, they increase the rate to attract more remittance transactions. Conversely, during periods of reduced CCL activity, they can lower the rate to enhance their profit margins.

Therefore, a decrease in the WU Rate suggests that, for some reason, there's a decline in the amount of money being sent out of the country through the CCL mechanism. However, this may seem counterintuitive at first glance.

Richard02

New member

Certainly, considering that physical currency isn't physically sent out of the country, only orders are involved.This is my personal interpretation, but here's my explanation.

Remittance companies like Western Union, involved in the dollar-to-peso conversion process in Argentina, play a crucial role in the Contado con Liquidación (CCL) system. In this setup, they receive pesos in Argentina and pay out dollars in the USA. The cycle depends on efficiently unloading pesos, prompting these companies to adjust their "WU rate" accordingly. When there's a surplus of pesos, they increase the rate to attract more remittance transactions. Conversely, during periods of reduced CCL activity, they can lower the rate to enhance their profit margins.

Therefore, a decrease in the WU Rate suggests that, for some reason, there's a decline in the amount of money being sent out of the country through the CCL mechanism. However, this may seem counterintuitive at first glance.

Western Union receives pesos from immigrants or others in Argentina who intend to pay someone abroad. These same pesos are then paid to expats in Argentina in exchange for dollars sent to Western Union abroad by a sender. The receipts that Western Union obtains abroad are then disbursed to the beneficiaries.

Marleny

Member

Holy smokes! The Criptodolar (https://www.dolarito.ar/) has gone up to $1,200 today! Now that Javier Milei has won I wonder where the blue dollar will go? I'm very happy that Javier Milei won. It won't be easy for Argentina no matter who won but happier times ahead hopefully.

Colin

Member

Wow, the lines at the Western Union offices are really long. I've never seen anything like this. I've seen long lines but not this long. Maybe it's because it's a holiday weekend?

The MEP rate today when I was looking at it was around 920 to 933 to $1 USD (https://www.dolarito.ar) and the Western Union rate was only 835 to $1 USD when I checked earlier today. This means it's probably a better deal to just use your credit card now!

Western Union might be around the same or maybe even lower. I saw this:

www.cronista.com

www.cronista.com

The MEP rate today when I was looking at it was around 920 to 933 to $1 USD (https://www.dolarito.ar) and the Western Union rate was only 835 to $1 USD when I checked earlier today. This means it's probably a better deal to just use your credit card now!

Western Union might be around the same or maybe even lower. I saw this:

Se viene otro dólar para las exportaciones, tras la reunión de Massa con su gabinete

Maduran las primeras medidas económicas tras las elecciones. La fórmula de Massa y el gabinete para fomentar la oferta de divisas y evitar una devaluación del tipo de cambio oficial.

earlyretirement

Moderator

You will almost always get a better rate by just bringing $100 US dollar bills to Argentina and exchanging at an exchange house.

You can see today's rates at: https://www.ambito.com/contenidos/dolar.html

Money matters are a bit confusing for the typical tourist. You can see all those crazy rates for different things but if you bring $100 US bills you will get about what is printed at the Blue Dollar rate on that link.

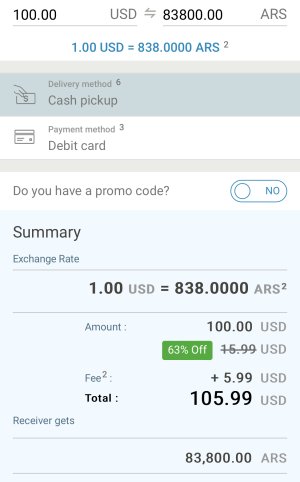

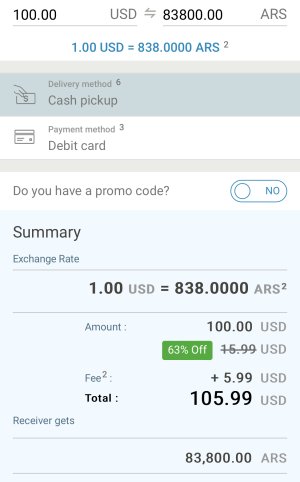

Here is today's rate that I got sending $100 US via Western Union. 838 pesos to $1 US and I had to pay $5.99 fee. That fee adds insult to injury where I could have received 1,050 pesos to $1 US at an exchange house.

But to make matters more complicated, sometimes the Western Union rate is actually higher than the Blue Dollar rate. There were a few times this summer in July 2023 that Western Union was paying even more than the Blue Dollar rate. It's rare but it's always good to compare the exchange rate on that website above.

You can see today's rates at: https://www.ambito.com/contenidos/dolar.html

Money matters are a bit confusing for the typical tourist. You can see all those crazy rates for different things but if you bring $100 US bills you will get about what is printed at the Blue Dollar rate on that link.

Here is today's rate that I got sending $100 US via Western Union. 838 pesos to $1 US and I had to pay $5.99 fee. That fee adds insult to injury where I could have received 1,050 pesos to $1 US at an exchange house.

But to make matters more complicated, sometimes the Western Union rate is actually higher than the Blue Dollar rate. There were a few times this summer in July 2023 that Western Union was paying even more than the Blue Dollar rate. It's rare but it's always good to compare the exchange rate on that website above.

Marleny

Member

Wow, this is great news then because this means we can just use our foreign credit card and get as good if not better rate? Great news! Thanks Javier Milei!Wow, the lines at the Western Union offices are really long. I've never seen anything like this. I've seen long lines but not this long. Maybe it's because it's a holiday weekend?

The MEP rate today when I was looking at it was around 920 to 933 to $1 USD (https://www.dolarito.ar) and the Western Union rate was only 835 to $1 USD when I checked earlier today. This means it's probably a better deal to just use your credit card now!

Western Union might be around the same or maybe even lower. I saw this:

Se viene otro dólar para las exportaciones, tras la reunión de Massa con su gabinete

Maduran las primeras medidas económicas tras las elecciones. La fórmula de Massa y el gabinete para fomentar la oferta de divisas y evitar una devaluación del tipo de cambio oficial.www.cronista.com

Today in the afternoon I got a quote to send myself a Western Union and the rate was 940 pesos to $1USD. Visa was giving 945 to $1USD. Why would anyone use Western Union for most things. Yes I know if they have to pay rent or something but why would you not use credit cards whenever you can?

Last month foreign credit cards were way behind. I hope this trend keeps up! I love getting frequent flyer points AND having a better rate than WU!

Also as an aside note, I can never get Western Union to send money to my local bank account. It never works! I have to use the Remitly App but the exchange rate isn't as good as WU but I guess the sending fee is usually lower at around $2.99 for $100. So maybe it's the same.

Last month foreign credit cards were way behind. I hope this trend keeps up! I love getting frequent flyer points AND having a better rate than WU!

Also as an aside note, I can never get Western Union to send money to my local bank account. It never works! I have to use the Remitly App but the exchange rate isn't as good as WU but I guess the sending fee is usually lower at around $2.99 for $100. So maybe it's the same.

earlyretirement

Moderator

It can all be very confusing. See this post to get details about the MEP rate:But what rate exactly do you get when you use a foreign credit card? Is it the MEP rate? Last week the MEP was posted around 860 pesos to $1 US but I only got 810 to $1 US. Does anyone know exactly what the rate is?

Newcomer - Foreign Credit Card purchases at MEP rate?

Forgive this newbie but I'm coming to Buenos Aires for 1 month in a few weeks. I read that foreigners can use their credit cards from their home countries (I am American) and I will get a special exchange rate. I read some old articles and I found these...

www.expatsba.com

Finance Prof

Well-known member

You should learn how to use crypto and other stable coins to transfer funds. It's a great alternative.

Crazy as that is much better than the blue dollar rate I see onlineBut what rate exactly do you get when you use a foreign credit card? Is it the MEP rate? Last week the MEP was posted around 860 pesos to $1 US but I only got 810 to $1 US. Does anyone know exactly what the rate is?

Cotización del dólar hoy, dólar blue | Ámbito

Cotización y el precio del dólar hoy. Seguí la información sobre el dólar, el dólar blue, dólar MEP, dólar CCL, dólar ahorro, dólar turista, el dólar Banco Nación, y el dólar mayorista minuto a minuto.

I have been checking the past several days and the rates aren't changing too much. Before that the blue dollar rate was about what Western Union was offering a few weeks ago.

It's a major hassle using WU for me because I have to go wait in line and pay fees, etc. I wish I brought more cash with me so I didn't have to hassle with WU. But great I can use my foreign credit card on everything else but I can't do that with many expenses where I need cash.

I'm not sure how I feel about crypto. It is all so confusing. I keep reading about accounts getting locked up, high fees and I saw the on the old forum!

US Justice Department seizes 9M USDT amid $225M illicit funds frozen by Tether

Officials with the U.S. Justice Department reported they had seized $9 million in USDT as part of an investigation into a romance scammer organization.

Colin

Member

Yesterday the official "white" rate was only 365 pesos to $1 US and today I looked at:

www.dolarito.ar

www.dolarito.ar

And it's showing the official rate at 800!

Dólar hoy, cotización del dólar, precio del dólar, dólar blue, precio histórico del dólar, valor del UVA | Dolarito.ar

Seguí la cotización del dólar minuto a minuto, compara cotizaciones, visualiza los valores históricos, conocé el precio del dólar, evolución del valor UVA

And it's showing the official rate at 800!

Similar threads

- Replies

- 11

- Views

- 116

- Replies

- 11

- Views

- 333

- Replies

- 0

- Views

- 114

- Replies

- 6

- Views

- 123

- Replies

- 8

- Views

- 154

Community Insight...

Engage explore adapt in your expat community.

Receive personalized job market insights from seasoned expats in your area

Discover local cultural nuances and festivities shared by community members

Get your tailored expat living guide curated by experienced locals