The new rise in financial dollars undermines two pillars of the emergency plan that Milei launched - Infobae

Source:

www.infobae.com

www.infobae.com

January 18, 2024

The exchange gap causes distortions, especially in foreign trade. For the Government it implies complications with the policy of keeping the official dollar frozen and very negative rates in relation to the level of inflation.

By Pablo Wende

FILE PHOTO: American one hundred dollar bills. REUTERS/Lee Jae-Won/File

Although it was not an unexpected movement, the rise in financial dollars in January goes beyond what the economic team led by the minister expected Luis Caputo. The fall in the exchange rate gap in December was influenced by the strong adjustment of the official exchange rate and the seasonal demand for pesos. But the trend quickly turned around and no one can be sure that a ceiling has been reached.

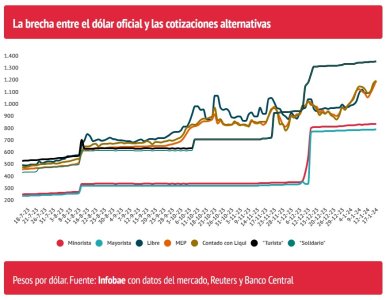

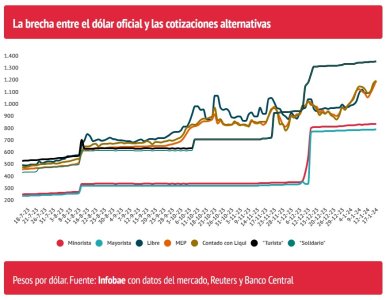

The gap measured by the cash value with liquidation (yesterday it closed at $1,273) is already at levels of 50%, while taking into account the free dollar (which ended at $1,225) it exceeds 45%. The increases in the different exchange rates yesterday were greater than 5%.

The problems generated by the increase in the gap do not differ from those that Kirchnerism had to face at the time. The most relevant is that it artificially increases imports, given the possibility of accessing a much more convenient exchange rate. Between the official dollar value plus the PAIS tax, the quote for companies that import reaches $950, clearly well below the different financial exchange rates.

At the same time, it generates resistance from exporters to liquidate, because they receive an exchange rate that is far from the market value. In reality, they end up waiting for a new devaluation that will improve their profitability.

These problems were present before, both during the administration of Cristina Kirchner in her second term and especially with Alberto Fernández. But they reappear now despite the fact that it is a government that does not agree with the exchange rate. A gap that exceeds levels of 40% to 50% necessarily causes this type of distortions in the behavior of companies, particularly related to foreign trade.

The increase in financial dollars and consequently the gap so far in January puts strong pressure on two pillars of the emergency plan defined by the President, Javier Milei, together with Caputo.

One of these factors is the adjustment of the official dollar at a rate of 2% monthly, when inflation was 25% in December and would exceed 20% in January. This causes it to fall behind in real terms, increasing the expectation of a new devaluation jump. The increase in the gap undoubtedly puts more pressure on it and could modify the Economy's plans, which consist of keeping it almost in the freezer at least until March and using it as an anti-inflationary anchor.

In this context of increasing exchange rate gap, it would be difficult for this plan to be maintained without variations. Of course, a faster adjustment of the official dollar, that is, another devaluation, would have a strong impact on inflation in the coming months, after the flash in prices in December and at the start of 2024.

The interest rate is the other key variable that is affected by this exchange rate pressure. With yields well below inflation, it is increasingly difficult to sustain this policy of strongly negative yields.

Of course the Central Bank has its motivation to do so, since it seeks a liquefaction of monetary liabilities, with rates of barely 100% annually when annual inflation reached 211% last month. In this way, between liabilities that grow at a rate much lower than prices and the absorption that is being carried out - for example through the placement of the bonus for importers, Bopreal - the objective is that there is less amount of pesos that pressure about the dollar. But it is a process that will take time.

The Central, meanwhile, continues to accumulate dollars. Yesterday it bought USD 208 million and so far this year it has totaled USD 1,975 million. It is helped by the low demand still from importers, something that will be reversed in the coming weeks.

Obviously the objective is to reach the second quarter as best as possible, which is when the liquidation of the cereal companies begins due to the coarse harvest, which would contribute an additional USD 20,000 million compared to this year. But the path to get to that moment still presents many obstacles.

Source:

La nueva suba de los dólares financieros jaquea dos pilares del plan de emergencia que puso en marcha Milei

La brecha cambiaria ya tocó el 50% y provoca distorsiones, sobre todo en comercio exterior. Para el Gobierno implica complicaciones con la política de mantener el dólar oficial freezado y tasas muy negativas en relación con el nivel de inflación

January 18, 2024

The exchange gap causes distortions, especially in foreign trade. For the Government it implies complications with the policy of keeping the official dollar frozen and very negative rates in relation to the level of inflation.

By Pablo Wende

FILE PHOTO: American one hundred dollar bills. REUTERS/Lee Jae-Won/File

Although it was not an unexpected movement, the rise in financial dollars in January goes beyond what the economic team led by the minister expected Luis Caputo. The fall in the exchange rate gap in December was influenced by the strong adjustment of the official exchange rate and the seasonal demand for pesos. But the trend quickly turned around and no one can be sure that a ceiling has been reached.

The gap measured by the cash value with liquidation (yesterday it closed at $1,273) is already at levels of 50%, while taking into account the free dollar (which ended at $1,225) it exceeds 45%. The increases in the different exchange rates yesterday were greater than 5%.

The problems generated by the increase in the gap do not differ from those that Kirchnerism had to face at the time. The most relevant is that it artificially increases imports, given the possibility of accessing a much more convenient exchange rate. Between the official dollar value plus the PAIS tax, the quote for companies that import reaches $950, clearly well below the different financial exchange rates.

At the same time, it generates resistance from exporters to liquidate, because they receive an exchange rate that is far from the market value. In reality, they end up waiting for a new devaluation that will improve their profitability.

These problems were present before, both during the administration of Cristina Kirchner in her second term and especially with Alberto Fernández. But they reappear now despite the fact that it is a government that does not agree with the exchange rate. A gap that exceeds levels of 40% to 50% necessarily causes this type of distortions in the behavior of companies, particularly related to foreign trade.

The increase in financial dollars and consequently the gap so far in January puts strong pressure on two pillars of the emergency plan defined by the President, Javier Milei, together with Caputo.

One of these factors is the adjustment of the official dollar at a rate of 2% monthly, when inflation was 25% in December and would exceed 20% in January. This causes it to fall behind in real terms, increasing the expectation of a new devaluation jump. The increase in the gap undoubtedly puts more pressure on it and could modify the Economy's plans, which consist of keeping it almost in the freezer at least until March and using it as an anti-inflationary anchor.

In this context of increasing exchange rate gap, it would be difficult for this plan to be maintained without variations. Of course, a faster adjustment of the official dollar, that is, another devaluation, would have a strong impact on inflation in the coming months, after the flash in prices in December and at the start of 2024.

All financial and free dollars were comfortably above 1,200 pesos and cash with settlement was almost close to 1,300 pesos. The increase in the gap complicates the strategy outlined by the new Government of maintaining the exchange rate almost frozen after the December devaluation and also maintaining very negative interest rates in relation to inflation.

The interest rate is the other key variable that is affected by this exchange rate pressure. With yields well below inflation, it is increasingly difficult to sustain this policy of strongly negative yields.

Of course the Central Bank has its motivation to do so, since it seeks a liquefaction of monetary liabilities, with rates of barely 100% annually when annual inflation reached 211% last month. In this way, between liabilities that grow at a rate much lower than prices and the absorption that is being carried out - for example through the placement of the bonus for importers, Bopreal - the objective is that there is less amount of pesos that pressure about the dollar. But it is a process that will take time.

The Central, meanwhile, continues to accumulate dollars. Yesterday it bought USD 208 million and so far this year it has totaled USD 1,975 million. It is helped by the low demand still from importers, something that will be reversed in the coming weeks.

Obviously the objective is to reach the second quarter as best as possible, which is when the liquidation of the cereal companies begins due to the coarse harvest, which would contribute an additional USD 20,000 million compared to this year. But the path to get to that moment still presents many obstacles.