BuySellBA

Administrator

The fact that angered construction developers: 'Everything goes to used properties - La Nacion Propiedades

Source:

www.lanacion.com.ar

www.lanacion.com.ar

June 30, 2025

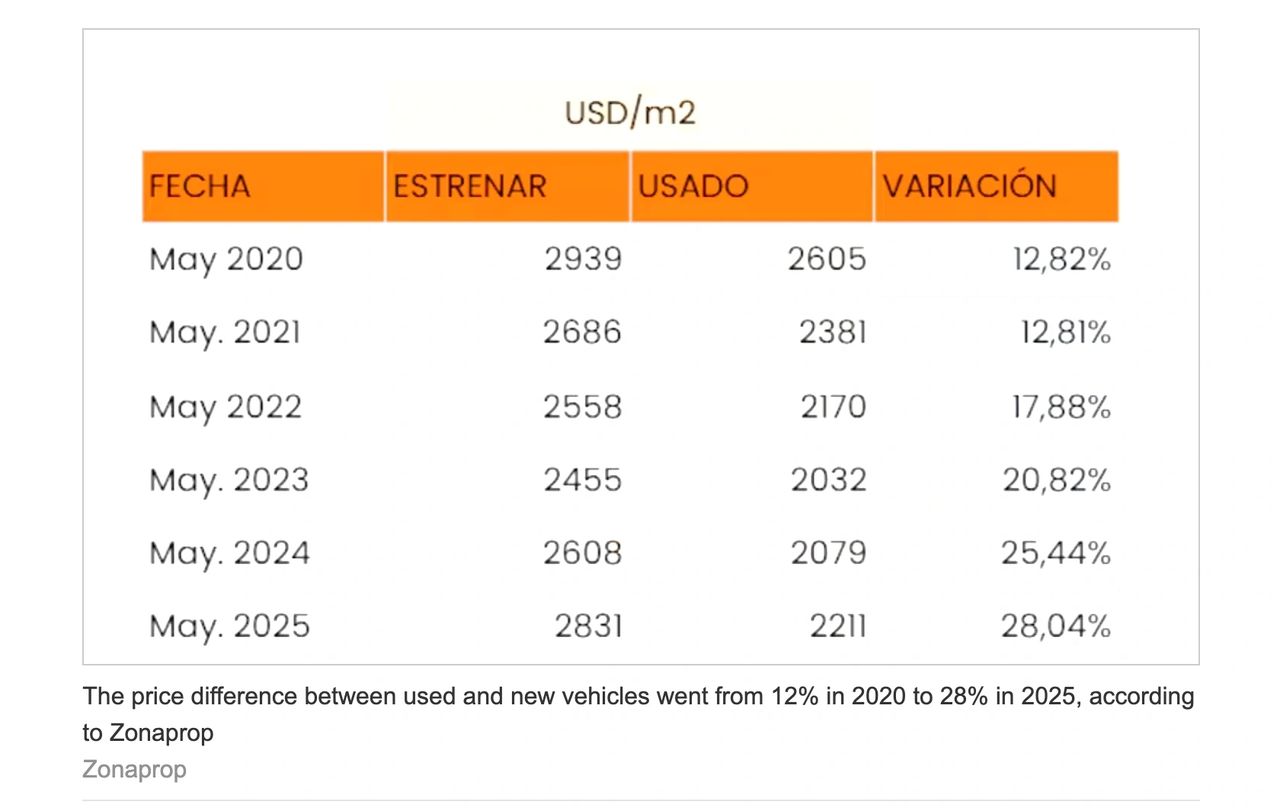

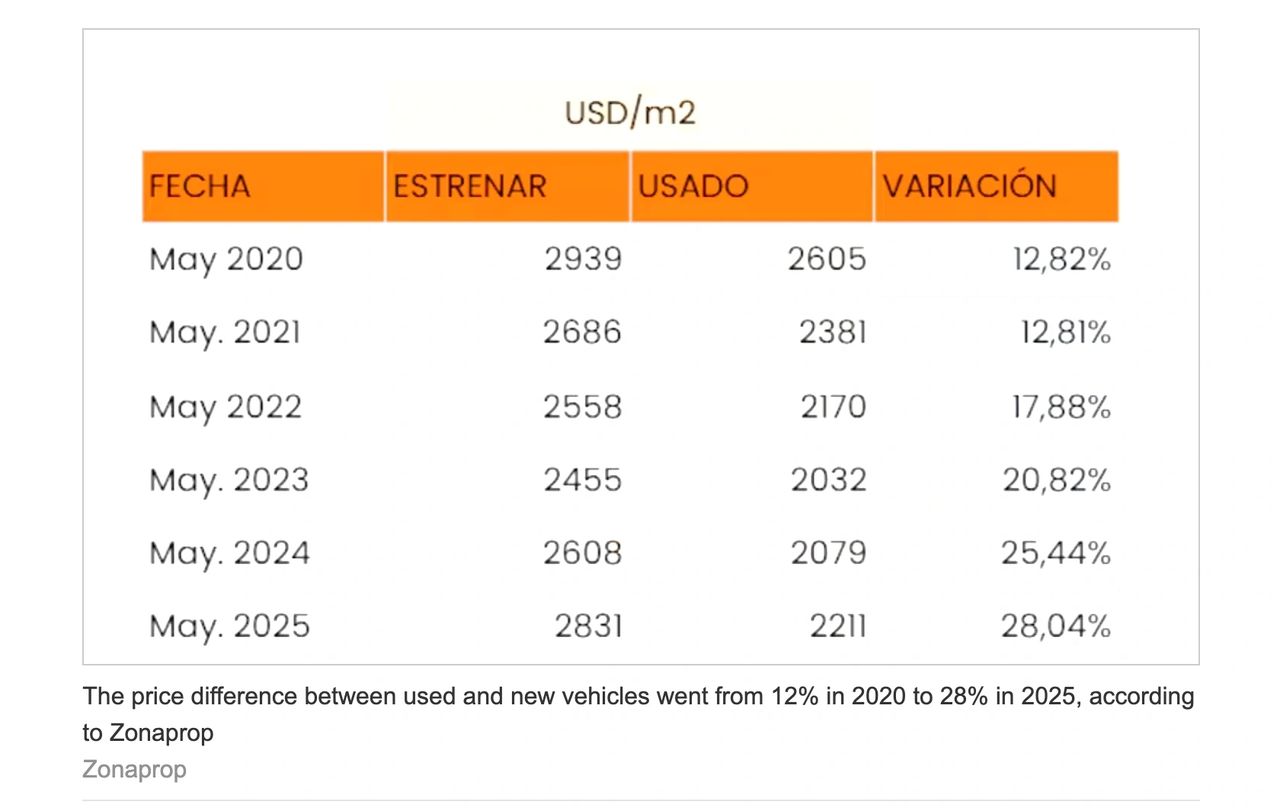

A report by Zonaprop shows how the price gap between new and used apartments widened from 11% to 28%.

Puerto Madero is the neighborhood with the most expensive used apartments in the city. PATRICIO PIDAL/AFV

The price gap between used and brand-new apartments in the city of Buenos Aires reached its highest point in at least five years in May 2025: the value per square meter of a new unit is 28% higher than that of a used one. This is revealed by a Zonaprop report, which, based on published advertisements, traces a clear trend: in May 2020, the difference was 11.3%, and the gap has continued to widen since then.

This trend marks a shift in the dynamics of the real estate market, where used homes are consolidating as the most affordable option, while new homes continue to be pressured by rising construction costs.

In May 2020, a new apartment cost US$2,939 per square meter, while a used one cost US$2,605. The difference between the two was US$334, equivalent to a gap of 11.37%. Five years later, in May 2025, the price of a new apartment per square meter will be US$2,831, while that of a used one is US$2,211. The difference is US$620, representing a gap of 28.04%. In other words, the gap grew not only in absolute terms (from US$334 to US$620), but also in percentage terms, doubling its value over that period.

Construction costs have increased by 126% since October 2023, making new units more expensive.

During these five years, used apartment prices began a downward trend in mid-2020, bottoming out in 2023 and registering a slight recovery since then . In parallel, the price of new units fell slightly until the end of 2022, but resumed an upward trend starting in October 2023, driven primarily by the 126% cumulative increase in construction costs since October 2023. This coincides with the same period in which new apartment prices increased.

This scenario makes used homes gain prominence as a more affordable alternative, especially in neighborhoods where the difference with new homes is more pronounced . According to Zonaprop, Puerto Madero is the neighborhood with the most expensive used homes (US$5,625/m²) , followed by Palermo (US$3,138/m²) and Núñez (US$2,927/m²). At the other end of the spectrum, Villa Soldati, Villa Lugano, and Nueva Pompeya offer the most affordable used units , with prices ranging between US$916 and US$1,087 per square meter.

View of homes in Villa Lugano, one of the neighborhoods with the lowest prices per square meterGonzalo Colini

Puerto Madero leads the ranking of neighborhoods with the highest prices per square meter for used units.Shutterstock

Given this scenario, the real estate market is facing greater segmentation between new and used properties. While developers grapple with rising costs that make new homes more expensive, buyers are seeking refuge in used homes, whose price gap has become more attractive and, in addition, are suitable for mortgage purchases. The difference between the two segments, which has doubled since 2020, is now one of the key factors in understanding the demand for new units.

www.buysellba.com

Source:

El dato que enojó a los empresarios de la construcción: “Todo es para el usado”

Un informe de Zonaprop muestra cómo se amplió la diferencia de precios entre departamentos nuevos y usados que pasó del 11% al 28%

June 30, 2025

A report by Zonaprop shows how the price gap between new and used apartments widened from 11% to 28%.

Puerto Madero is the neighborhood with the most expensive used apartments in the city. PATRICIO PIDAL/AFV

The price gap between used and brand-new apartments in the city of Buenos Aires reached its highest point in at least five years in May 2025: the value per square meter of a new unit is 28% higher than that of a used one. This is revealed by a Zonaprop report, which, based on published advertisements, traces a clear trend: in May 2020, the difference was 11.3%, and the gap has continued to widen since then.

This trend marks a shift in the dynamics of the real estate market, where used homes are consolidating as the most affordable option, while new homes continue to be pressured by rising construction costs.

In May 2020, a new apartment cost US$2,939 per square meter, while a used one cost US$2,605. The difference between the two was US$334, equivalent to a gap of 11.37%. Five years later, in May 2025, the price of a new apartment per square meter will be US$2,831, while that of a used one is US$2,211. The difference is US$620, representing a gap of 28.04%. In other words, the gap grew not only in absolute terms (from US$334 to US$620), but also in percentage terms, doubling its value over that period.

Construction costs have increased by 126% since October 2023, making new units more expensive.

During these five years, used apartment prices began a downward trend in mid-2020, bottoming out in 2023 and registering a slight recovery since then . In parallel, the price of new units fell slightly until the end of 2022, but resumed an upward trend starting in October 2023, driven primarily by the 126% cumulative increase in construction costs since October 2023. This coincides with the same period in which new apartment prices increased.

This scenario makes used homes gain prominence as a more affordable alternative, especially in neighborhoods where the difference with new homes is more pronounced . According to Zonaprop, Puerto Madero is the neighborhood with the most expensive used homes (US$5,625/m²) , followed by Palermo (US$3,138/m²) and Núñez (US$2,927/m²). At the other end of the spectrum, Villa Soldati, Villa Lugano, and Nueva Pompeya offer the most affordable used units , with prices ranging between US$916 and US$1,087 per square meter.

View of homes in Villa Lugano, one of the neighborhoods with the lowest prices per square meterGonzalo Colini

Puerto Madero leads the ranking of neighborhoods with the highest prices per square meter for used units.Shutterstock

Given this scenario, the real estate market is facing greater segmentation between new and used properties. While developers grapple with rising costs that make new homes more expensive, buyers are seeking refuge in used homes, whose price gap has become more attractive and, in addition, are suitable for mortgage purchases. The difference between the two segments, which has doubled since 2020, is now one of the key factors in understanding the demand for new units.

www.buysellba.com