Carljunior

New member

Production, consumption and sales: the first numbers of the real economy at the beginning of the Milei government - Infobae

Source:

www.infobae.com

www.infobae.com

January 22, 2024

Official and private estimates accounted for key indicators. The impact of devaluation and price acceleration

File photograph in which the hands of a food seller and a buyer were recorded, at the Central Fruit and Vegetable Market, in the town of Tápiales, in Buenos Aires (Argentina). EFE/Juan Ignacio Roncoroni

The Government of Javier Milei will enter the seventh week of its mandate and the beginning of the economic plan that accompanied the start of the libertarian mandate has already shown a first impact on the real economy numbers. The devaluation of mid-December and the liberalization of prices implied a marked decline in economic activity linked to consumption and factory production suffered the effect of the shock program.

Official and private numbers have already begun to reflect data for full December. The Indec reported that the inflation of that first month of government exceeded 25% monthly and the increase in wholesale prices was above 54 percento. Business chambers made estimates on the impact on their sectors and some consulting firms also measured other figures such as tax and foreign trade.

In December the Consumption Indicator (CI) prepared by the Argentine Chamber of Commerce and Services (CAC) showed a contraction of 2.4% versus November. “In this way, the downward trend in consumption is ratified given that December was the sixth month with a negative monthly variation. Despite this, the CI varied 0.7% compared to December 2022 and accumulated growth of 3.3% year-on-year in 2023, although, in absolute terms, the loss of dynamism seen in recent months continued to deepen.”

“With inflation at high levels and accelerating, and a consequent loss of purchasing power, the increase in consumption in interannual terms is explained for an advance in consumer decisions. The perception of a very probable decrease in the purchasing power of savings in the future due to price increases led consumers to decide to spend their money in the present - which is where it is most valuable in this scenario - and not in the future. , stated the CAC. “The expectation of a strong devaluation prior to the change of government produced a strong stocking in consumers, with the fear of a subsequent loss of purchasing power,” he added.

A report from the Argentine Confederation of Medium Enterprises (CAME) reflected a collapse in sales of SME businesses of 13.7% in December, which meant that throughout 2023 consumption in this type of business fell 3.4 percent. Compared to November, operations fell by 11.2 percent.

Source: CAME

“Consumers found themselves at the end of 2023 with an abrupt price change in goods and services, which limited their ability to buys. Nor was the market generous in financing options and offers, which forced the available resources to be carefully managed,” they analyzed from that entity.

A report from Scentia, for its part, indicated that in December independent self-service stores recorded a drop of 2.9% compared to the same month last year, as a result of a 0.5% decrease in theand 4.2% in the interior of the country. “This channel accumulated 14 uninterrupted months of drops until September until September, October and November. In December, a drop was recorded again,” highlighted this consultancy firm specializing in consumption. Buenos Aires Metropolitan Area

December's economic performance worsened what was already a negative trend: the year closed with a fall in industrial activity of 2.6% and only two of the seven sectors surveyed by CAME showed slightly positive records for the year: Food and beverages, the least dispensable category of consumption, which showed a growth of 2.9%, and Textiles and clothing, which in the annual balance grew 3.3 percent. All other items showed year-on-year declines, which stretched to -16.7% in the Paper and Printing sector.

Source: CAME

The most impressive thing, however, is the data from the December collapse, in which the seven sectors showed double-digit declines: from -10.2% in Textiles and Clothing and -15.2 in Food and Beverages to -35. .7% Metal, machinery and equipment and transport material.

The last photo of the year in terms of trade exchange was influenced by the December devaluation, which changed the conditions for foreign trade, with a more favorable exchange rate for exports and more expensive imports due to the increase in the PAIS tax.

“The result: the trade balance was positive for USD 1,018 million, after 10 consecutive months of balance in the red. The accumulated balance in the year, therefore, is negative for USD 6,926 million. In total, Argentine trade accumulated USD 9,528 million in December, -14.4% less than in 2022. On a year-on-year basis, exports fell -13.8% in December and imports -15.2%," Epyca stated. .

Source: Analytica

The interest on the debt represented 1.8% of GDP, so that the financial deficit was around 5%, just 0.4% lower than that observed in 2022. The OPC explained that the negative real variation observed in resources is due mainly due to the decrease in tax revenues, which fell 1% year-on-year. This evolution was marked by real falls in Export Duties (57% year-on-year) and Income Tax (21.5%) partially offset by positive real variations in VAT collection (8.2%) and COUNTRY tax (1180 percent).

In the opposite direction, non-tax income increased (61.2% year-on-year) and property income (33.3%) originated, in the first case, from the awarding of 5G service licenses ($308,651 million and without execution in 2022) and in the second, for the interests generated by the Sustainability Guarantee Fund (FGS), according to the report.

The consulting firm Analytica, in its monthly Fiscal Monitor, also collected its first impressions of the Milei government in terms of public spending. According to that report, real spending accrued without seasonality decreased 31% compared to November, and 33.8% in interannual terms.

“Although a cut was not observed in nominal terms, the monthly inflation of 25.5% implied an important liquefaction. Among the items with the greatest adjustments compared to December 2022 are public works (-69.4%), spending on goods and services (-56.6%), retirements and pensions (-38.3%) and social programs (-31.5%). The only item that showed an increase in year-on-year terms were transfers to provinces (+6.9%),” they measured.

Source:

Producción, consumo y ventas: los primeros números de la economía real en el inicio del gobierno de Milei

Estimaciones oficiales y privadas dieron cuenta de indicadores clave. El impacto de la devaluación y la aceleración de los precios

January 22, 2024

Official and private estimates accounted for key indicators. The impact of devaluation and price acceleration

File photograph in which the hands of a food seller and a buyer were recorded, at the Central Fruit and Vegetable Market, in the town of Tápiales, in Buenos Aires (Argentina). EFE/Juan Ignacio Roncoroni

The Government of Javier Milei will enter the seventh week of its mandate and the beginning of the economic plan that accompanied the start of the libertarian mandate has already shown a first impact on the real economy numbers. The devaluation of mid-December and the liberalization of prices implied a marked decline in economic activity linked to consumption and factory production suffered the effect of the shock program.

Official and private numbers have already begun to reflect data for full December. The Indec reported that the inflation of that first month of government exceeded 25% monthly and the increase in wholesale prices was above 54 percento. Business chambers made estimates on the impact on their sectors and some consulting firms also measured other figures such as tax and foreign trade.

Consumption and sales

In December the Consumption Indicator (CI) prepared by the Argentine Chamber of Commerce and Services (CAC) showed a contraction of 2.4% versus November. “In this way, the downward trend in consumption is ratified given that December was the sixth month with a negative monthly variation. Despite this, the CI varied 0.7% compared to December 2022 and accumulated growth of 3.3% year-on-year in 2023, although, in absolute terms, the loss of dynamism seen in recent months continued to deepen.”

“With inflation at high levels and accelerating, and a consequent loss of purchasing power, the increase in consumption in interannual terms is explained for an advance in consumer decisions. The perception of a very probable decrease in the purchasing power of savings in the future due to price increases led consumers to decide to spend their money in the present - which is where it is most valuable in this scenario - and not in the future. , stated the CAC. “The expectation of a strong devaluation prior to the change of government produced a strong stocking in consumers, with the fear of a subsequent loss of purchasing power,” he added.

A report from the Argentine Confederation of Medium Enterprises (CAME) reflected a collapse in sales of SME businesses of 13.7% in December, which meant that throughout 2023 consumption in this type of business fell 3.4 percent. Compared to November, operations fell by 11.2 percent.

Source: CAME

“Consumers found themselves at the end of 2023 with an abrupt price change in goods and services, which limited their ability to buys. Nor was the market generous in financing options and offers, which forced the available resources to be carefully managed,” they analyzed from that entity.

A report from Scentia, for its part, indicated that in December independent self-service stores recorded a drop of 2.9% compared to the same month last year, as a result of a 0.5% decrease in theand 4.2% in the interior of the country. “This channel accumulated 14 uninterrupted months of drops until September until September, October and November. In December, a drop was recorded again,” highlighted this consultancy firm specializing in consumption. Buenos Aires Metropolitan Area

Industrial activity

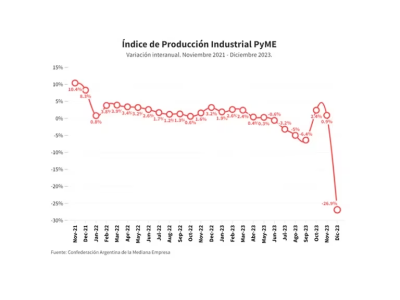

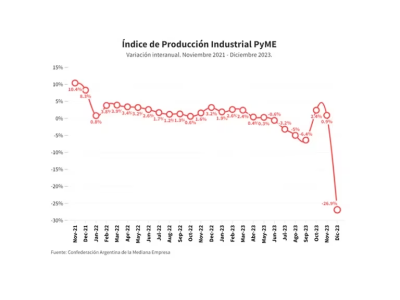

CAME, for its part, also published this Sunday its monthly survey of manufacturing activity in small and medium-sized industries, and registered a year-on-year drop of 26.9% according to the Industrial Production Index (IPI).December's economic performance worsened what was already a negative trend: the year closed with a fall in industrial activity of 2.6% and only two of the seven sectors surveyed by CAME showed slightly positive records for the year: Food and beverages, the least dispensable category of consumption, which showed a growth of 2.9%, and Textiles and clothing, which in the annual balance grew 3.3 percent. All other items showed year-on-year declines, which stretched to -16.7% in the Paper and Printing sector.

Source: CAME

The most impressive thing, however, is the data from the December collapse, in which the seven sectors showed double-digit declines: from -10.2% in Textiles and Clothing and -15.2 in Food and Beverages to -35. .7% Metal, machinery and equipment and transport material.

Foreign trade

Based on the latest updated year-end data that Indec released on the trade balance, the consulting firm Epyca concluded that “exports increased 3.1% a>” they mentioned in a recent report. -9.5% compared to the previous month and imports fellThe last photo of the year in terms of trade exchange was influenced by the December devaluation, which changed the conditions for foreign trade, with a more favorable exchange rate for exports and more expensive imports due to the increase in the PAIS tax.

“The result: the trade balance was positive for USD 1,018 million, after 10 consecutive months of balance in the red. The accumulated balance in the year, therefore, is negative for USD 6,926 million. In total, Argentine trade accumulated USD 9,528 million in December, -14.4% less than in 2022. On a year-on-year basis, exports fell -13.8% in December and imports -15.2%," Epyca stated. .

Spending cut

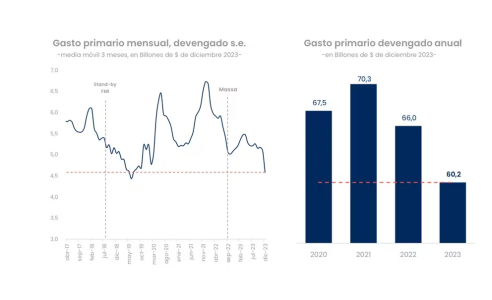

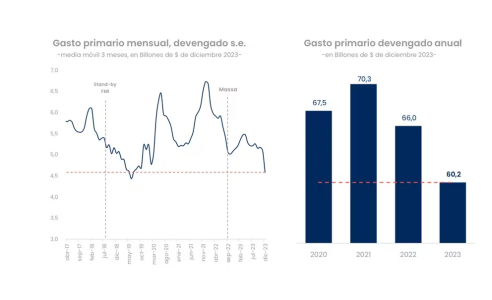

The budget execution of the National Public Administration registered a deficit primary result in the order of 3.2% of GDP during 2023, reported the Congressional Budget Office (CPO). This result takes into consideration the accrued expense and not the cash basis (what was actually paid) so the final data, which will be known this Monday by of the Ministry of Finance, could be lower.

Source: Analytica

The interest on the debt represented 1.8% of GDP, so that the financial deficit was around 5%, just 0.4% lower than that observed in 2022. The OPC explained that the negative real variation observed in resources is due mainly due to the decrease in tax revenues, which fell 1% year-on-year. This evolution was marked by real falls in Export Duties (57% year-on-year) and Income Tax (21.5%) partially offset by positive real variations in VAT collection (8.2%) and COUNTRY tax (1180 percent).

In the opposite direction, non-tax income increased (61.2% year-on-year) and property income (33.3%) originated, in the first case, from the awarding of 5G service licenses ($308,651 million and without execution in 2022) and in the second, for the interests generated by the Sustainability Guarantee Fund (FGS), according to the report.

The consulting firm Analytica, in its monthly Fiscal Monitor, also collected its first impressions of the Milei government in terms of public spending. According to that report, real spending accrued without seasonality decreased 31% compared to November, and 33.8% in interannual terms.

“Although a cut was not observed in nominal terms, the monthly inflation of 25.5% implied an important liquefaction. Among the items with the greatest adjustments compared to December 2022 are public works (-69.4%), spending on goods and services (-56.6%), retirements and pensions (-38.3%) and social programs (-31.5%). The only item that showed an increase in year-on-year terms were transfers to provinces (+6.9%),” they measured.