All the Answers

Well-known member

Private Health Isurance "Prepagas": how the cap on installments will influence April inflation data - Infobae

Source:

Prepagas: cómo va a influir el tope a las cuotas en el dato de inflación de abril

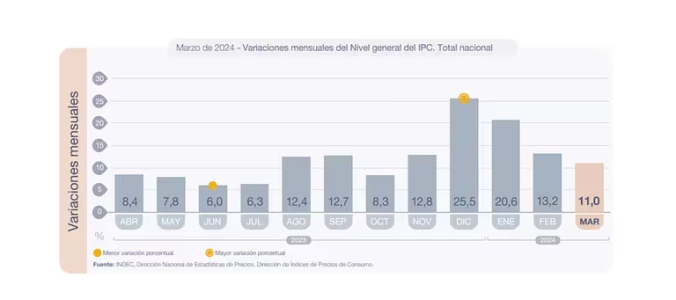

De aplicarse linealmente la orden oficial de retrotraer parte de los aumentos aplicados desde de diciembre, el IPC de este mes podría recortar medio punto según estimaciones de especialistas. Esa diferencia podría ayudar a anotar por primera vez un dato mensual de un dígito

April 18, 2024

If the official order to roll back part of the increases applied since December is applied linearly, this month's CPI could cut half a point according to specialist estimates. That difference could help record single-digit monthly data for the first time

By Matías Barbería

Specialists estimate the impact of the prepaid cap on the April CPI at a maximum of half a point (EFE)

The Government's order for prepaid companies to partially roll back the increases they applied since December may be the key for the April consumer price index, which will be made public in the middle of next month, to show a return of monthly inflation to a digit, a valued milestone among official dispatches.

Yesterday, the Executive ordered that 75% of prepaid medicine companies lower the price of their fees, since they will have to recalculate the increases they applied since December taking the Consumer Price Index as a basis for the calculation. At the same time, the Health Superintendency presented a precautionary measure before the Court to return money to users.

The resolution was issued by the Ministry of Industry and Commerce at the request of the National Consumer Defense Commission, which “determined that there are multiple indications of a collusive agreement between the main prepaid medicine companies in the country,” according to official information.

The measure rolls back the increases carried out since December of last year and authorizes prepaid companies to apply, at most, the consumer price index to calculate any increase . This limit applies, in principle, for the next six months and has immediate application for invoices that are being sent at this time.

According to different calculations, prepaid medicine companies applied average increases to their fees of between 137% and 160% from December to this point. To do so, they relied on the publication of the decree of necessity and urgency 70 of last year. The DNU of deregulation of the economy promoted as one of the main measures of this same Government. In this way, the decision to put a regulatory cap on the increases represents a kind of retreat for the administration of Javier Milei .

The main explicit argument of the intervention in the prepaid medicine market was the suspicion of cartelization in the sector. The impact it had on the cost of living may well have also weighed, a “war against the middle class” according to the Minister of Economy, Luis Caputo , who would have declared the sector. But one more official obsession may be weighing behind the official turn: showing, every month, a slowdown in the Indec inflation data.

“How the measure is implemented by prepaid companies will have an impact on the INDEC price index, via the Health category. If there are returns, it will be necessary to see if Indec applies the same in the April quota, in which case its value would fall and then rise again, but less than it fell. If there are no returns, again, we must see if the quota and the indices are recalculated backwards or simply a lower quota value is imputed from April,” considered an Outlier report.

"In either case, with differences in magnitude, it is clear that there is a specific effect on the April price index, which will favor the records for that month and that, if they increase, for example, the value of co-payments or additions to the fees or the options or quality of the benefits available without reimbursement are reduced, will not necessarily reflect a reduction in household health spending of the same magnitude,” the analysis added.

However, even if the application is immediate and impeccable, the impact will not be enormous, according to experts.

In April the 10% barrier for monthly inflation data could be broken

“If you eliminate the increase, inflation would drop half a point. But that is not the concept: it is adjusting for inflation, which is why I do not think it will be completely eliminated,” commented Camilo Tiscornia , head of C&T, to Infobae.

The key to clarify is how this month's ballots will be issued.

“If they already invoiced with the original increase, it is a scenario. If they have not billed yet and apply what the government said, there would actually be a 29% drop in fees. It is clearly night and day for inflation this month. Anyway, if it is not applied in April, it will be in May,” he added.

“We expected a figure of eight or nine, and this cuts half a point of inflation in principle,” said Sebastián Menescaldi of EcoGo regarding the high frequency index prepared by the consulting firm. “These are the conversations that now arise, just as it was with the supermarkets before and the promotions, well now it is with the prepaid ones and later some more will arise. It helps, at least for the CPI data,” he added.

But even though the impact is not enormous, it can have an important symbolic effect, according to an analysis by Emmanuel Álvarez Agis in a PxQ report. It would allow the first monthly single-digit inflation data of the Milei era .

“According to what was surveyed by the CPI Indec, the accumulated increase for prepaid medicine between January and March was 100%, the salary was 51% (assuming an increase of 18% for the March RIPTE) and the of general inflation (CPI) 52 percent. A retraction of the quotas to the values of December 10 could imply a reduction in the CPI of between -0.3 percentage points and -0.5 percentage points, helping to return to the monthly figure in April," the report considered.

As revealed by Indec, the accumulated increase for prepaid medicine between January and March was 100%

The focus on showing the best possible inflation data seems to have gained relevance for the government, even above respecting the maxims of economic orthodoxy and the principle of not intervening in the market, as suggested by a series of heterodox turns pointed out by PxQ:

- The indication to the food and beverage sector of the continuity of the crawling-peg at 2% per month that unleashed announcements of bimonthly and quarterly freezes by some retailers.

- The official displeasure with pricing strategies based on 2x1 in the mass consumption sector and the selective opening of imports.

- The indication regarding lower rates of increases for gasoline prices .

- The attempt to put a ceiling on joint ventures .

- Intervention in the prepaid medicine market .

“The combination of fiscal adjustment and the pseudo exchange rate anchor with this late and disorderly income policy allows us to harbor hopes of a slowdown in inflation. It remains to understand the political costs of this intervention in the market by LLA and closely follow the dynamics of regulated prices, particularly those with fiscal impact (tariffs),” the analysis concluded.