BuySellBA

Administrator

Neither Palermo nor Belgrano: the three neighborhoods that saw the greatest increase in property prices in the last year - La Nacion Propiedades

Source:

www.lanacion.com.ar

www.lanacion.com.ar

July 30, 2025

Interest in the real estate market is growing, and a report reveals updated values area by area.

Which neighborhoods have seen the biggest price increases in the last year?Shutterstock

The square meter of property listings has been rising in the City of Buenos Aires for almost two years , but not all areas saw the same increases. In fact, although the average increase last year was almost 7%, some neighborhoods saw double that growth.

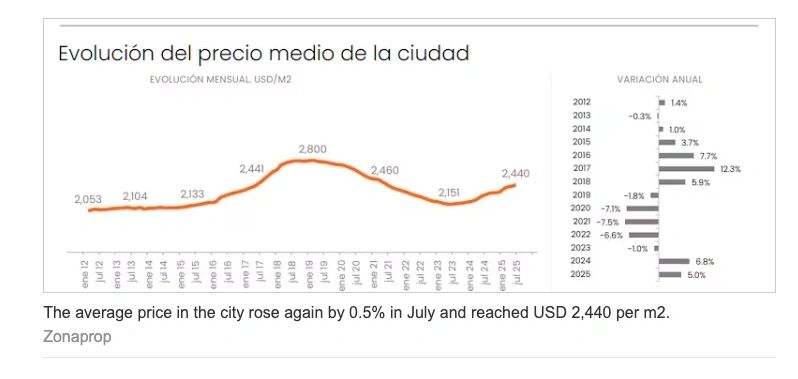

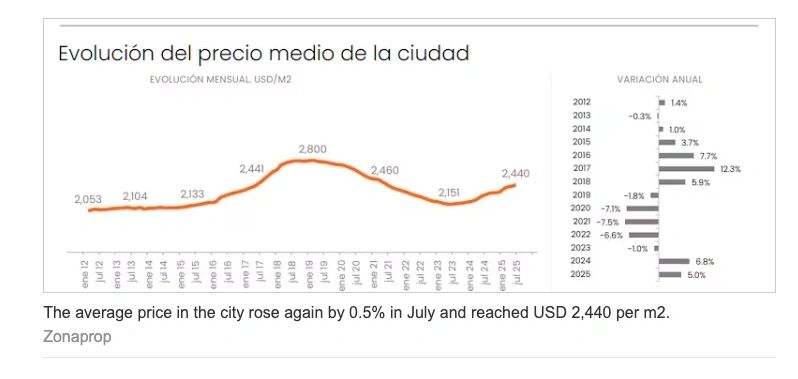

This was revealed in a report by Zonaprop, which states that the average square meter of apartment sales in Buenos Aires City reached US$2,440 in July, registering a 0.5% monthly increase. So far this year, the price has accumulated a 5% increase, although prices have risen 6.7% over the past 12 months.

The average square meter of sales for apartments in Buenos Aires City was US$2,440 in July.

Thus, a 40 m² studio apartment sells for an average of US$106,978; a 50 m² one-bedroom apartment averages US$128,988; and a 70 m² two-bedroom apartment averages US$178,155.

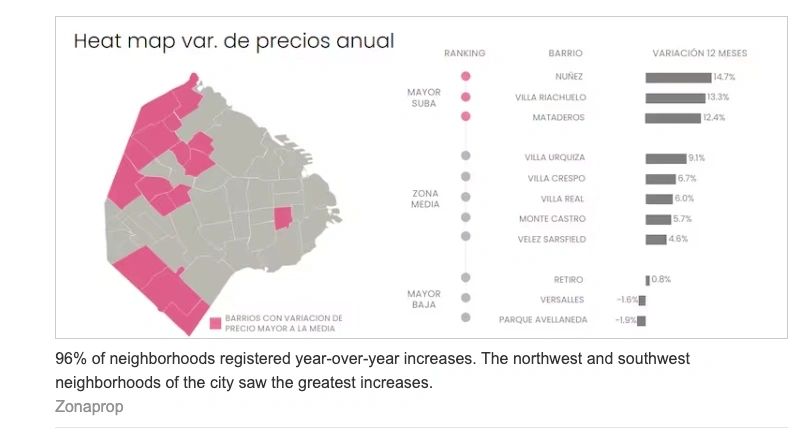

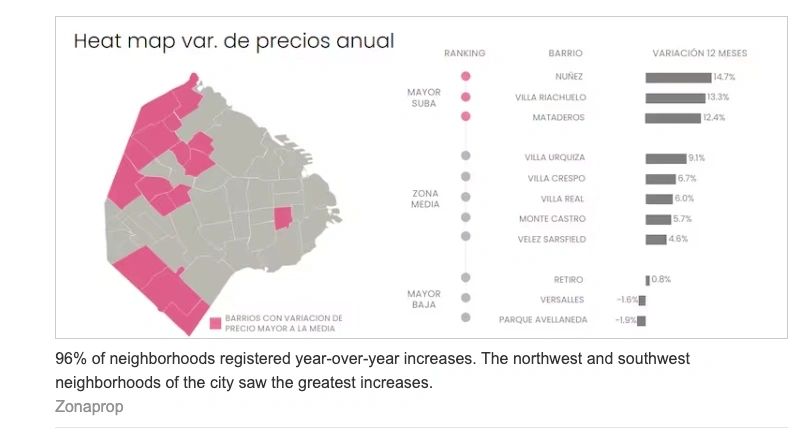

If the analysis is carried out by neighborhood, Núñez is the one that has seen the greatest price increases in the last year, with a 14.7% increase . It is followed by Villa Riachuelo, which saw a 13.3% increase, and finally, Mataderos, with a 12.4% year-over-year increase in published sales prices.

On the other hand, among the neighborhoods with the greatest price drops are Parque Avellaneda, with a 1.9% decrease. Versalles follows, with a 1.6% drop. Finally, Retiro completes the podium, although in this case, it did not see a price decrease, but rather had the smallest year-over-year increase, at 0.8%.

It's worth noting that 96% of the city's neighborhoods recorded year-over-year increases. The map indicates in color that the neighborhoods in the northwest of the city and some in the southwest saw the greatest increases.

The average square meter is US$1,815. Thus, a 170 m² house with two bedrooms averages US$297,761. A larger house, with 260 m² and four bedrooms, averages US$488,509.

If the analysis focuses on neighborhoods, Palermo has the most expensive housing stock, with an average square meter of US$3,499. It is followed by Belgrano (US$2,951/m²) and Recoleta (US$2,446/m²). On the other hand, Villa Soldati (US$699/m²), Nueva Pompeya (US$757/m²), and La Boca (US$820/m²) have the most affordable housing stock in the city.

However, if the analysis focuses on apartments, the ranking changes slightly: Puerto Madero has the most expensive listings on the market (US$6,124/m²), followed by Palermo (US$3,416/m²) and Núñez (US$3,284/m²). Lugano, meanwhile, has the most affordable listings in the area, with an average square meter of US$1,070/m². It is followed by Nueva Pompeya (US$1,437/m²) and Parque Avellaneda (US$1,564/m²).

If we look at the neighborhoods again, Lugano has the highest profitability, with a 9.2% return. It is followed by Nueva Pompeya, with 8.4%, and Parque Avellaneda, with 7.8%. On the other hand, Puerto Madero has the lowest return on investment (3.7%) . It is followed by Palermo (4.2%) and Núñez (4.4%).

www.buysellba.com

Source:

Ni Palermo, ni Belgrano: los tres barrios que más aumentaron el precio de las propiedades en el último año

El interés por el mercado inmobiliario crece y un informe revela los valores zona por zona actualizados

July 30, 2025

Interest in the real estate market is growing, and a report reveals updated values area by area.

Which neighborhoods have seen the biggest price increases in the last year?Shutterstock

The square meter of property listings has been rising in the City of Buenos Aires for almost two years , but not all areas saw the same increases. In fact, although the average increase last year was almost 7%, some neighborhoods saw double that growth.

This was revealed in a report by Zonaprop, which states that the average square meter of apartment sales in Buenos Aires City reached US$2,440 in July, registering a 0.5% monthly increase. So far this year, the price has accumulated a 5% increase, although prices have risen 6.7% over the past 12 months.

The average square meter of sales for apartments in Buenos Aires City was US$2,440 in July.

Thus, a 40 m² studio apartment sells for an average of US$106,978; a 50 m² one-bedroom apartment averages US$128,988; and a 70 m² two-bedroom apartment averages US$178,155.

If the analysis is carried out by neighborhood, Núñez is the one that has seen the greatest price increases in the last year, with a 14.7% increase . It is followed by Villa Riachuelo, which saw a 13.3% increase, and finally, Mataderos, with a 12.4% year-over-year increase in published sales prices.

On the other hand, among the neighborhoods with the greatest price drops are Parque Avellaneda, with a 1.9% decrease. Versalles follows, with a 1.6% drop. Finally, Retiro completes the podium, although in this case, it did not see a price decrease, but rather had the smallest year-over-year increase, at 0.8%.

It's worth noting that 96% of the city's neighborhoods recorded year-over-year increases. The map indicates in color that the neighborhoods in the northwest of the city and some in the southwest saw the greatest increases.

How much does a house cost in Buenos Aires?

If the price analysis is extended to homes , they rose 1.1% in July, although they have accumulated an increase of 5.3% so far in 2025 and 6.1% in the last 12 months.The average square meter is US$1,815. Thus, a 170 m² house with two bedrooms averages US$297,761. A larger house, with 260 m² and four bedrooms, averages US$488,509.

If the analysis focuses on neighborhoods, Palermo has the most expensive housing stock, with an average square meter of US$3,499. It is followed by Belgrano (US$2,951/m²) and Recoleta (US$2,446/m²). On the other hand, Villa Soldati (US$699/m²), Nueva Pompeya (US$757/m²), and La Boca (US$820/m²) have the most affordable housing stock in the city.

However, if the analysis focuses on apartments, the ranking changes slightly: Puerto Madero has the most expensive listings on the market (US$6,124/m²), followed by Palermo (US$3,416/m²) and Núñez (US$3,284/m²). Lugano, meanwhile, has the most affordable listings in the area, with an average square meter of US$1,070/m². It is followed by Nueva Pompeya (US$1,437/m²) and Parque Avellaneda (US$1,564/m²).

What is the profitability in CABA today?

Real estate investment is gradually regaining its appeal, although it fell slightly in July, reaching 5.39% gross annual growth . Thus, it takes 18.6 years of rental income to recover the investment , 21.3% less than what was required a year ago.If we look at the neighborhoods again, Lugano has the highest profitability, with a 9.2% return. It is followed by Nueva Pompeya, with 8.4%, and Parque Avellaneda, with 7.8%. On the other hand, Puerto Madero has the lowest return on investment (3.7%) . It is followed by Palermo (4.2%) and Núñez (4.4%).

www.buysellba.com