All the Answers

Well-known member

Milei spoke again about the exit from the stocks: the plan to avoid an exchange crisis and the pending idea of dollarization - Infobae

Source:

Milei volvió a hablar de la salida del cepo: el plan para evitar una crisis cambiaria y la idea pendiente de dolarizar

El Presidente reconoció que este mismo año podría liberarse el mercado cambiario, aunque para eso se está analizando una reforma del sistema financiero. El proyecto que estudia su equipo para evitar una corrida

May 02, 2024

The President acknowledged that this year the exchange market could be freed, although a reform of the financial system is being analyzed for that purpose. The project that his team is studying to avoid a bullfight

By Federico Galligani

President Javier Milei with his economic team

Shortly after the Bases Law and the fiscal package obtained half a sanction in the Chamber of Deputies, President Javier Milei was optimistic about the future of the economy in Argentina and revealed that “at some point in the year” the Government will open the stocks , although he clarified that for that to happen we first have to “do a few things”, among which would be a modification of the financial system.

Recently, the national president mentioned in several radio and television interviews that, although his idea is to open the exchange market as soon as possible, he will only promote it when there is some guarantee that the measure will not cause a run. banking.

“I would be quite cautious, but we are doing things very much in that direction. Now we are expanding the Bopreal so that those who have trapped dividends begin to find a way out and, at the same time, we are strongly lowering the interest rate,” he expressed this Wednesday in dialogue with journalists Luis Majul and Esteban Trebucq in El Observador .

In this sense, the head of state stressed that “the most important thing about the Base Law is that it affects the long-term dynamics of the Argentine economy,” so the initiative that Congress is debating would be one of the important points in the plan of the current administration.

According to what sources from Milei's economic team told Infobae , the idea of this management continues to be to move towards a currency competition that would lead to dollarization , although for that it would be necessary to move forward with a reform of the financial system that, however, , would not come through another law, but through “tools that themselves promote a more efficient market.”

“The proposal is to go to a combination where traditional banking is dedicated to short-term credit, while the capital market is in charge of long-term credit ,” said an advisor close to the President.

The President confirmed that he will implement free currency competition in the future (REUTERS)

What worries this administration in the event of a possible exit from the stocks is not so much the savers who can go and buy dollars, but, above all, the large importers who have outstanding debts in that currency and, by massively accessing the currency, could push for a devaluation.

“ We are in a minefield and we have to tread carefully. To release the stocks, a few things have to be done, such as finishing releasing the trapped dividends, cleaning the Central Bank's balance sheet and resolving the paid liabilities,” they warned those around the libertarian leader.

One of the Government's intentions, then, is to separate those interested in buying the North American currency into two groups: those who have debts due in the short term will be able to acquire it through the BCRA , while they will be encouraged to go get it at the capital markets to those that have commitments with longer maturities.

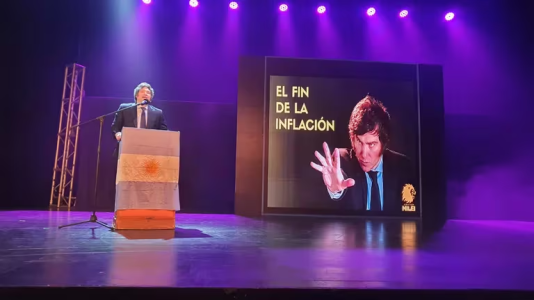

In his book “The End of Inflation ,” which he published during the presidential campaign, Milei explained a large part of the economic plan that he planned to carry out if he won the elections and already mentioned the final objective of “advancing a path of measures that in the end it ends with the elimination of the Central Bank.”

In that text, one of the invited writers was the former Minister of Economy Domingo Cavallo , author of convertibility, who assured that “you cannot think about a reform when you start from intervened exchange markets and with many exchange controls, not only commercial, but even of all types of transactions.”

Former Economy Minister Domingo Cavallo

In this sense, the former Menem official pointed out the need to first carry out “a very profound reform of the State at its three levels: national, provincial and municipal”, to “eliminate the fiscal deficit in a structural and sustainable manner over time”, as well as as well as “letting relative prices find their equilibrium level between supply and demand.”

This first part of the program that Cavallo recommends in the book coincides with the policy that the Government carried out in the little more than four months it has been in office, so one could intuit that the next step will be “a monetary reform.”

However, in his work, Milei himself ruled out implementing a system of parity with the dollar, as happened in the '90s : “The question is what was the problem that convertibility had. To tell the truth, many economists already knew about it before, because it had the same problems as the Peel Law (...) every time the government attacked the banks, took loans and then did not pay. That ended in a bullfight, with issuance and generation of inflationary jumps. They corrected the parity and then continued. That is to say, we already knew this problem. “It was precisely what happened in Argentina,” he said.

Javier Milei at the presentation of his book "The end of inflation"

On the other hand, the President was leaning at that time in favor of a Simons bank , a scheme invented by Henry Simons and which consists of dividing financial entities into two sectors, one that is responsible for guaranteeing the deposits that the public will demand and will use permanently and another dedicated to investment.

This mechanism was also created in order to avoid runs and, although the national president's economic team is analyzing all possibilities, for the moment the tool that would be used to get out of the stocks in Argentina would be a little different.

“To do this, we must stop the three possible taps of monetary issuance, which are the external sector, financing from the treasury and a run. Once these three mechanisms are closed, we are going to launch the currency competition and, since the amount of pesos is fixed, if individuals needed to increase monetization, what they could do, for example, is take the dollars out of the mattress and put them inside the system,” the head of state anticipated this Wednesday.