BuySellBA

Administrator

In Greater Buenos Aires, rents have accumulated increases of up to 60% and the gap with sales prices is growing -Ambito Financiero

Source:

www.ambito.com

www.ambito.com

October 15, 2025

In which area of the GBA real estate market did prices increase the most and where supply is growing? The dollar and the fall in credit are slowing down purchase transactions.

A project in the Santos Lugares area, in the 3 de Febrero district, an expanding area in the western corridor of Greater Buenos Aires. Pexels.

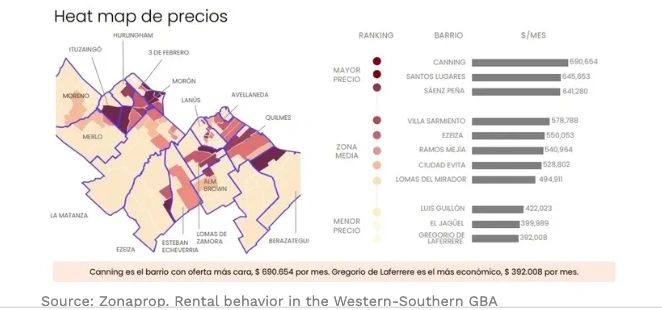

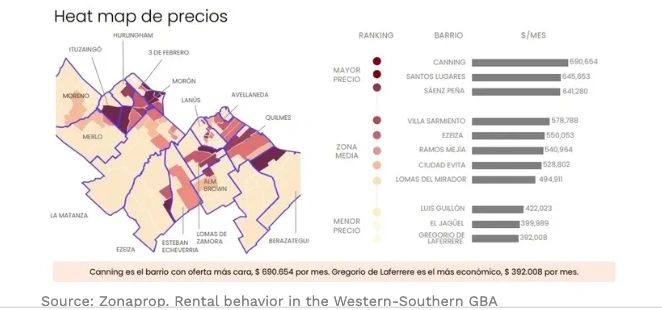

According to a recent survey, rental prices in the western-southern Greater Buenos Aires (GBA) region rose 2.5% in September and are now up 34.7% so far in 2025. Over the past twelve months, the increase was 57.3%, exceeding inflation by more than 26 points, which hovered around 31.3%. In the northern suburbs , the year-over-year increase stands at 43.3%, with a monthly increase of 2.8% and a cumulative variation of 29.6% since January.

According to Zonaprop's analysis, in the west-south corridor, a one-bedroom apartment with 50 square meters rents for an average of $550,707 per month, while a two-bedroom apartment with 70 square meters reaches $730,183.

In the north, one-bedroom apartments are priced at $678,258 and two-bedroom apartments are priced at $962,552 per month. Annual returns range between 5% and 6%, with areas requiring 16 to 20 years of rental income to recover the investment.

According to Bertomeu, supply has improved since the repeal of the Rental Law. Many owners who had taken their properties off the market decided to relist them, although turnover remains high. “A well-presented property with a reasonable price rents out in an average of 30 to 45 days. The most sought-after segment continues to be small apartments and family homes, which are usually available for no more than two months,” he noted.

Source: Zonaprop. Rental behavior in the Western-Southern GBA

Demand, however, remains strong. "While there's more supply than last year, it's still not enough. Inquiries are focused on functional properties, moderately priced and in good condition. In general, well-located properties are rented immediately," the specialist assures.

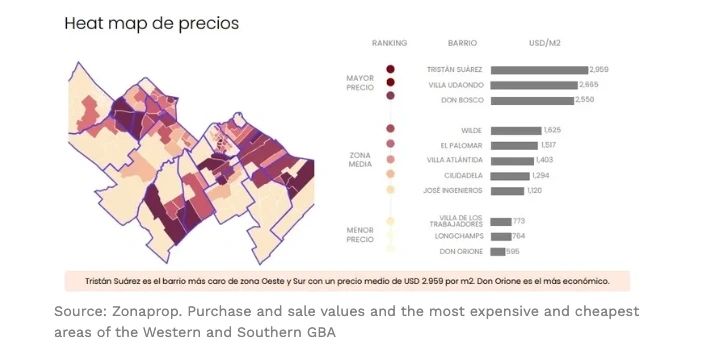

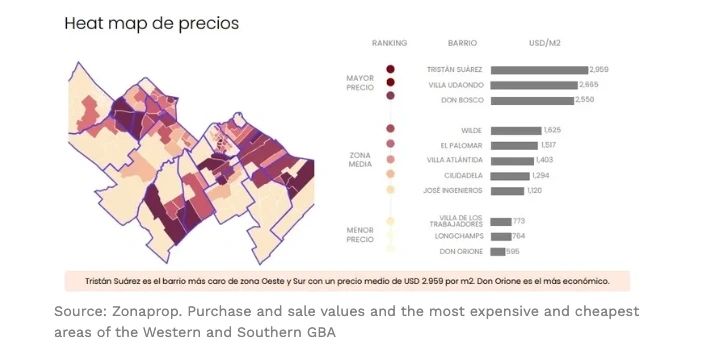

In the sales market, the square meter in the west-south is at $1,637 , with a slight increase of 0.1% in the last month and an annual increase of just 2%. A one-bedroom apartment costs around $82,438 , while a two-bedroom apartment averages $117,764 .

Among the most expensive neighborhoods are Tristán Suárez ( US$2,959/m2 ), Villa Udaondo ( US$2,665/m2 ), and Don Bosco ( US$2,550/m2 ). Don Orione, on the other hand, has the lowest prices, at US$550/m2 , followed by Longchamps ( US$764/m2 ) and Villa de los Trabajadores ( US$773/m2 ).

For Bertomeu, the rise of the dollar and the new credit access conditions are cooling transactions. “During the second and third quarters, we saw a rebound thanks to mortgage loans, but with the increase in rates and the higher credit score required by Banco Nación, many buyers were left out. Today, cash transactions are once again predominant.”

“What's coming in rents out quickly, within a month of being advertised. Supply remains tight, as many tenants prefer to renew rather than move, to avoid additional costs,” said Gómez. In his view, demand continues to far outstrip the number of available units.

Regarding sales, activity is steady, but with a predominance of cash transactions. "Buyers are moving in the range of $70,000 to $200,000 , depending on the type of property. There are many inquiries about whether the units are eligible for credit, but actual sales are made in cash and with cash," he says.

Reference prices in Lanús Centro show brand- new one-bedroom homes starting at $80,000 , two-bedroom homes starting at $100,000 , and two-bedroom homes with a garage starting at $160,000 , or townhouses without a garage starting at $90,000 . "The risk is that, with less supply, owners will start raising prices," warns the broker.

In Avellaneda, a one-bedroom apartment starts at $450,000 a month.

The average price per square meter in the western-southern GBA (which includes the southern corridor) remains at US$1,637 , although some neighborhoods are selling for more than US$2,500/m2 . The gross annual yield is 6.25% , with areas such as Paso del Rey and Llavallol offering returns of 8% to 9%.

In the North, more supply and competition

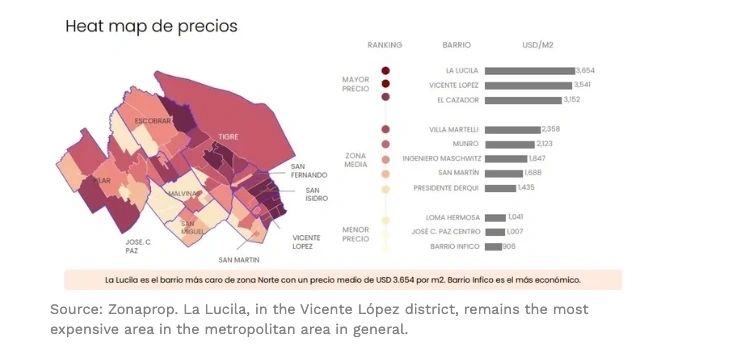

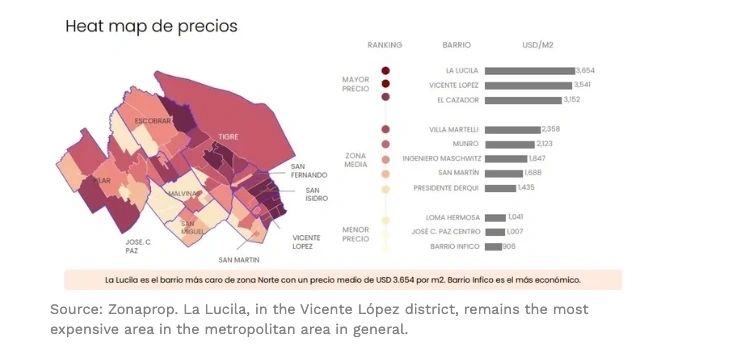

In the north, the situation is different. The average price per square meter is US$2,350 , with a monthly increase of 0.6% and a 5.3% variation for the year. A one-bedroom apartment costs US$115,692 , and a two-bedroom apartment costs US$175,453 .

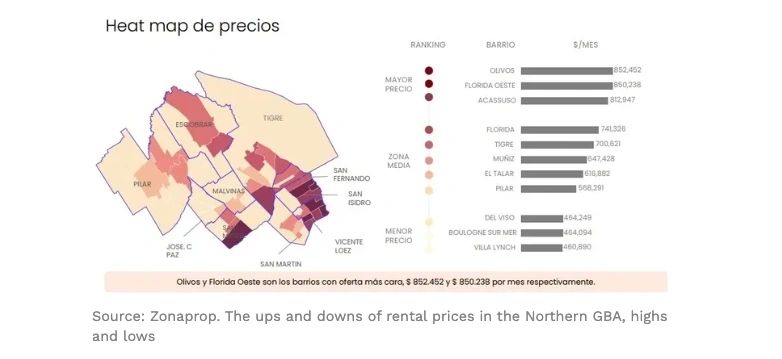

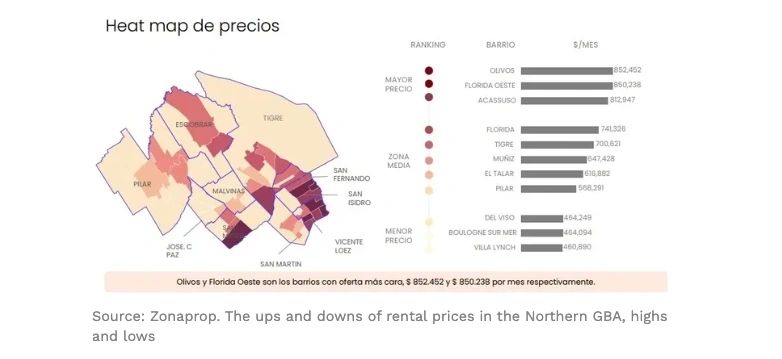

In Vicente López, Olivos, and La Lucila, rents are among the highest in the metropolitan area: a one-bedroom apartment costs between $500,000 and $800,000 , and a two-bedroom apartment between $800,000 and $1,300,000 . Family homes start at $1,200,000 and go up to $3,000,000 , depending on location and size.

Daniel Salaya Romera , of Salaya Romera Properties, explains that since the Decree that liberalized contract conditions, supply has multiplied. “Today, there are eight times more units listed. Tenants have more options, they make counteroffers, and the placement periods have been extended. Anything that's overpriced isn't rented,” he warns.

The northern corridor is also facing a slowdown in mortgage lending . "Banks depleted their existing stock with incentives from the Central Bank, and with the rise in reserve requirements and interest rates, lending plummeted. The equation doesn't add up: they receive 60-day deposits and should lend for 20 years," he explains.

In recent months, purchase demand has focused on ready-to-move-in units in established areas. “Vicente López, Olivos, and Núñez have become the most dynamic residential area. Many companies have moved to the Libertador Corridor, and employees are looking to live close to work. The area offers connectivity, services, security, and quality of life,” he summarizes.

The average gross annual return in the north is 5.02% , which implies approximately 19.9 years of rental income to recover the investment. Neighborhoods such as Bella Vista, Don Torcuato, and José C. Paz Oeste top the list with returns of 8% to 9%, while La Lucila and Vicente López have the lowest rates, around 3.6%.

For Salaya Romera, the key lies in the balance between supply and demand. “The market moves, but with a different logic. Those who set unrealistic prices end up with empty properties. Today, values are set by tenants and buyers, not by owners,” he concluded.

www.buysellba.com

Source:

En el Gran Buenos Aires, los alquileres acumulan alza de hasta 60% y crece la brecha con los precios de venta

En qué corredor del mercado inmobiliario del GBA se incrementaron más y donde crece la oferta. El dólar y la caída del crédito frenan operaciones de compra.

October 15, 2025

In which area of the GBA real estate market did prices increase the most and where supply is growing? The dollar and the fall in credit are slowing down purchase transactions.

A project in the Santos Lugares area, in the 3 de Febrero district, an expanding area in the western corridor of Greater Buenos Aires. Pexels.

According to a recent survey, rental prices in the western-southern Greater Buenos Aires (GBA) region rose 2.5% in September and are now up 34.7% so far in 2025. Over the past twelve months, the increase was 57.3%, exceeding inflation by more than 26 points, which hovered around 31.3%. In the northern suburbs , the year-over-year increase stands at 43.3%, with a monthly increase of 2.8% and a cumulative variation of 29.6% since January.

According to Zonaprop's analysis, in the west-south corridor, a one-bedroom apartment with 50 square meters rents for an average of $550,707 per month, while a two-bedroom apartment with 70 square meters reaches $730,183.

In the north, one-bedroom apartments are priced at $678,258 and two-bedroom apartments are priced at $962,552 per month. Annual returns range between 5% and 6%, with areas requiring 16 to 20 years of rental income to recover the investment.

Heading West

Lorena Bertomeu , of Bertomeu Properties, explained that in her area—which includes Morón, Merlo, Haedo, Padua, and Ituzaingó—rental prices have stabilized after several months of increases. “A one-bedroom apartment without a garage costs between $420,000 and $450,000, while with a garage it reaches $500,000. Two-bedroom apartments cost between $620,000 and $670,000, and two- or three-bedroom houses range from $800,000 to $1,200,000 per month,” she explains.According to Bertomeu, supply has improved since the repeal of the Rental Law. Many owners who had taken their properties off the market decided to relist them, although turnover remains high. “A well-presented property with a reasonable price rents out in an average of 30 to 45 days. The most sought-after segment continues to be small apartments and family homes, which are usually available for no more than two months,” he noted.

Source: Zonaprop. Rental behavior in the Western-Southern GBA

Demand, however, remains strong. "While there's more supply than last year, it's still not enough. Inquiries are focused on functional properties, moderately priced and in good condition. In general, well-located properties are rented immediately," the specialist assures.

In the sales market, the square meter in the west-south is at $1,637 , with a slight increase of 0.1% in the last month and an annual increase of just 2%. A one-bedroom apartment costs around $82,438 , while a two-bedroom apartment averages $117,764 .

Among the most expensive neighborhoods are Tristán Suárez ( US$2,959/m2 ), Villa Udaondo ( US$2,665/m2 ), and Don Bosco ( US$2,550/m2 ). Don Orione, on the other hand, has the lowest prices, at US$550/m2 , followed by Longchamps ( US$764/m2 ) and Villa de los Trabajadores ( US$773/m2 ).

For Bertomeu, the rise of the dollar and the new credit access conditions are cooling transactions. “During the second and third quarters, we saw a rebound thanks to mortgage loans, but with the increase in rates and the higher credit score required by Banco Nación, many buyers were left out. Today, cash transactions are once again predominant.”

High demand in the south

In the southern suburbs, rents are also rising sharply. Leandro Gómez of Gómez Propiedades said that in Avellaneda and Lanús, one-bedroom apartments start at $450,000 and reach $600,000 per month, while two-bedroom apartments range from $800,000 to $1,200,000 . Two- or four-bedroom homes are priced at around $1,500,000 per month, with variations depending on size and amenities.“What's coming in rents out quickly, within a month of being advertised. Supply remains tight, as many tenants prefer to renew rather than move, to avoid additional costs,” said Gómez. In his view, demand continues to far outstrip the number of available units.

Regarding sales, activity is steady, but with a predominance of cash transactions. "Buyers are moving in the range of $70,000 to $200,000 , depending on the type of property. There are many inquiries about whether the units are eligible for credit, but actual sales are made in cash and with cash," he says.

Reference prices in Lanús Centro show brand- new one-bedroom homes starting at $80,000 , two-bedroom homes starting at $100,000 , and two-bedroom homes with a garage starting at $160,000 , or townhouses without a garage starting at $90,000 . "The risk is that, with less supply, owners will start raising prices," warns the broker.

In Avellaneda, a one-bedroom apartment starts at $450,000 a month.

The average price per square meter in the western-southern GBA (which includes the southern corridor) remains at US$1,637 , although some neighborhoods are selling for more than US$2,500/m2 . The gross annual yield is 6.25% , with areas such as Paso del Rey and Llavallol offering returns of 8% to 9%.

In the North, more supply and competition

In the north, the situation is different. The average price per square meter is US$2,350 , with a monthly increase of 0.6% and a 5.3% variation for the year. A one-bedroom apartment costs US$115,692 , and a two-bedroom apartment costs US$175,453 .

In Vicente López, Olivos, and La Lucila, rents are among the highest in the metropolitan area: a one-bedroom apartment costs between $500,000 and $800,000 , and a two-bedroom apartment between $800,000 and $1,300,000 . Family homes start at $1,200,000 and go up to $3,000,000 , depending on location and size.

Daniel Salaya Romera , of Salaya Romera Properties, explains that since the Decree that liberalized contract conditions, supply has multiplied. “Today, there are eight times more units listed. Tenants have more options, they make counteroffers, and the placement periods have been extended. Anything that's overpriced isn't rented,” he warns.

The northern corridor is also facing a slowdown in mortgage lending . "Banks depleted their existing stock with incentives from the Central Bank, and with the rise in reserve requirements and interest rates, lending plummeted. The equation doesn't add up: they receive 60-day deposits and should lend for 20 years," he explains.

In recent months, purchase demand has focused on ready-to-move-in units in established areas. “Vicente López, Olivos, and Núñez have become the most dynamic residential area. Many companies have moved to the Libertador Corridor, and employees are looking to live close to work. The area offers connectivity, services, security, and quality of life,” he summarizes.

The average gross annual return in the north is 5.02% , which implies approximately 19.9 years of rental income to recover the investment. Neighborhoods such as Bella Vista, Don Torcuato, and José C. Paz Oeste top the list with returns of 8% to 9%, while La Lucila and Vicente López have the lowest rates, around 3.6%.

For Salaya Romera, the key lies in the balance between supply and demand. “The market moves, but with a different logic. Those who set unrealistic prices end up with empty properties. Today, values are set by tenants and buyers, not by owners,” he concluded.

www.buysellba.com