BuySellBA

Administrator

How the group behind the largest office rental operation in Buenos Aires thinks and views the country - La Nacion Propiedades

Source:

www.lanacion.com.ar

www.lanacion.com.ar

June 02, 2025

Adolfo Ramírez Escudero, president of CBRE in Spain and Latin America, explained why they decided to expand their operations in the country and detailed the opportunities in the office, logistics, and agribusiness real estate sectors.

By Dolores Pasman and Ariel Goldfard

Adolfo Ramírez Escudero, president of CBRE in Spain and Latin America, analyzes the potential of the industrial real estate market.Augusto Famulari - The Nation

Afew days ago, the largest office leasing transaction was announced: JP Morgan leased an entire new office building in Núñez. The transaction was closed by CBRE, and for the company's managers, it wasn't just another signing. Although CBRE spokespersons clarify that they don't speak on behalf of the bank, they have a clear understanding of the reasons behind this decision.

“The project is based on consolidating and expanding back-office operations in a location where costs are competitive and talent is qualified ,” explained Adolfo Ramírez Escudero, president of CBRE for Spain and Latin America, adding that “the quality of the talent , the university education , the level of English , and the possibility of finding suitable spaces make Argentina a logical choice.”

According to the executive, these types of decisions are not made based on the fluctuations in inflation or interest rates in month L, but rather on a thorough evaluation of structural variables. "Previously, conditions for stability were not met; now we see a scenario of greater macroeconomic predictability, although the future is not entirely clear," he told LA NACION.

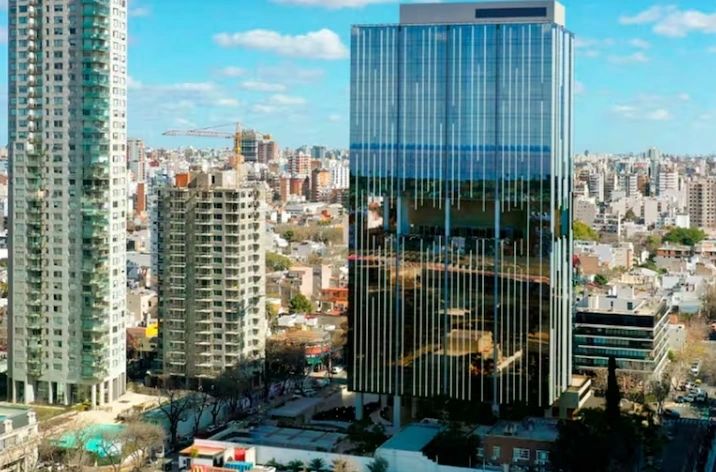

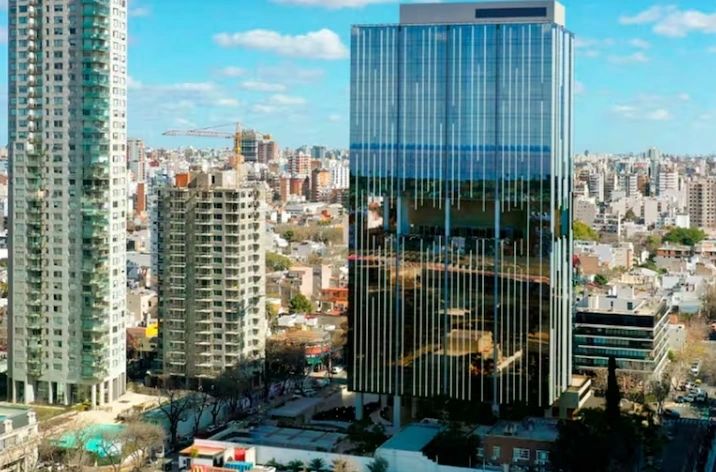

The office building that JP Morgan rented in Núñez

The executive also addressed Argentina's macroeconomic situation: he believes that " the country is at a turning point and that, specifically, the real estate sector can benefit from this moment."

One of the points he highlighted was the relationship between cost and quality. "The cost in Argentina, in terms of quality and talent, is very competitive," Ramírez Escudero stated. He also explained that, while office rent is among the highest in Latin America, this factor represents only 10% of the total cost. "What matters is labor costs and the ability to scale operations with local talent," he indicated.

Ramírez Escudero highlights the importance of talent and macroeconomic stability for the growth of the real estate market in Argentina.Augusto Famulari - The Nation

Argentina's reputation for investment was another topic the executive addressed. "The country has a complex historical memory for investors. From the corralito (corralito) to restrictions on capital outflows, there's a distrust that doesn't heal in six months," he was blunt, though optimistic: "Capital is selfish. If it sees things changing and opportunities emerging, it returns." Along the same lines, Nicolás Cox , executive director of CBRE Argentina and Chile, agreed that while "it's still in its infancy, long-term planning is already underway. We see interest in energy, mining, and, over time, also in real estate, which is by definition a long-term investment."

“For example, in New York, JP Morgan was the first to announce the return to a 5x0 regime, meaning full in-person service Monday through Friday, and that involves square footage,” added Ana González Ferrero, senior advisory director at CBRE Argentina.

He also stated that offices have been transformed into experiences, and that amenities, ranging from premium nap rooms and cafeterias to vaccination services, are more valued today than ever.

Offices adapt to new ways of working, with flexible spaces and amenities that boost productivity.Gentleness

Ramírez Escudero argued that “non-presentiality has costs, not only in productivity, but also in creativity and relationship-building .” Cox also emphasized that “office design must adapt to flexibility: hybrid meetings, collaborative spaces, and appropriate technology.”

Demand for logistics space in Argentina is driving the construction of taller, more flexible warehouses.MercadoLibre

The challenge, as in other sectors, is the lack of capital. "Building is done only on demand. And since there's no financing, development is slow," he noted.

On the other hand, they highlighted that the agroindustrial sector is another vertical in which the firm is committed to growth. “Argentina has 39 million productive hectares, 70% of which are leased lands. This creates a dynamic market for buying, selling, and leasing land ,” explained González Ferrero. In this regard, Ramírez Escudero highlighted a growing model: “Many producers sell their land to invest in technology and then lease it. This way, they put that capital to work in their own business. We saw this in Europe, and it could begin to happen here as well.”

González Ferrero explained that, following the rise of digital nomads and the subsequent decline with the rise of the dollar, the hotel sector began to reshape itself toward more specific experiences. "They're looking for niches, boutique offerings, and higher-quality services," he indicated.

The multi-family residential and hotel market in Buenos Aires shows unmet demand and opportunities to convert old assets into high-quality products.Soledad Aznarez

Something similar is happening with multi-family housing and student housing , segments that are already established in other countries and that still have room for growth in Argentina. " There is unmet demand across all housing categories ," said Ramírez Escudero. However, he warned that one of the main obstacles is the lack of adequate financing to sustain these assets over the long term.

Cox agreed and emphasized that access to debt is key: "Without leverage, it becomes unviable to maintain a rental building."

In Argentina, demand exists, but structural conditions are still lacking for the sector to take off. “Building a data center requires 10 times more stability than building homes. These are multimillion-dollar investments that require reliable, continuous, and affordable energy,” explained Ramírez Escudero.

Data centers are a strategic asset that requires high energy stability for their operation.Sashkin - Shutterstock

Cox added that the main bottleneck isn't connectivity—which can be solved through international cables—but rather access to stable, affordable energy. "We're talking about consumption of between 30 and 50 megawatts per hour, with availability levels of 99.99%. Without that standard, the business doesn't work," he stated.

González Ferrero indicated that many international companies test opportunities in Argentina, but end up opting for more predictable markets. "They compare and choose Uruguay. They find more stability there," he noted.

Ultimately, the countries with the most significant developments in this industry in Latin America are Brazil and Chile , with emerging movements in Colombia and Mexico.

São Paulo, Brazil's main economic and financial center, reflects the region's real estate dynamism.Shutterstock - Shutterstock

Despite the contrasts, he maintained that the region as a whole offers an attractive combination of youthful demographics, unmet demand, and growing economic integration. "The world is tending to converge, and Latin America can join that trend if it can resolve its internal constraints," he stated.

In this context, he noted that Argentina must offer higher returns than other markets to offset the risk, especially for those taking the first steps. "We must be generous with investors who bet first," he concluded.

www.buysellba.com

Source:

Cómo piensa y ve al país el grupo que estuvo detrás de la mayor operación de alquiler de oficinas en Buenos Aires

Adolfo Ramírez Escudero, presidente de CBRE en España y Latinoamérica, explicó por qué decidieron ampliar su operación en el país y detalló las oportunidades en el real estate de oficinas, logística y agroindustria

June 02, 2025

Adolfo Ramírez Escudero, president of CBRE in Spain and Latin America, explained why they decided to expand their operations in the country and detailed the opportunities in the office, logistics, and agribusiness real estate sectors.

By Dolores Pasman and Ariel Goldfard

Adolfo Ramírez Escudero, president of CBRE in Spain and Latin America, analyzes the potential of the industrial real estate market.Augusto Famulari - The Nation

Afew days ago, the largest office leasing transaction was announced: JP Morgan leased an entire new office building in Núñez. The transaction was closed by CBRE, and for the company's managers, it wasn't just another signing. Although CBRE spokespersons clarify that they don't speak on behalf of the bank, they have a clear understanding of the reasons behind this decision.

“The project is based on consolidating and expanding back-office operations in a location where costs are competitive and talent is qualified ,” explained Adolfo Ramírez Escudero, president of CBRE for Spain and Latin America, adding that “the quality of the talent , the university education , the level of English , and the possibility of finding suitable spaces make Argentina a logical choice.”

According to the executive, these types of decisions are not made based on the fluctuations in inflation or interest rates in month L, but rather on a thorough evaluation of structural variables. "Previously, conditions for stability were not met; now we see a scenario of greater macroeconomic predictability, although the future is not entirely clear," he told LA NACION.

The office building that JP Morgan rented in Núñez

The executive also addressed Argentina's macroeconomic situation: he believes that " the country is at a turning point and that, specifically, the real estate sector can benefit from this moment."

One of the points he highlighted was the relationship between cost and quality. "The cost in Argentina, in terms of quality and talent, is very competitive," Ramírez Escudero stated. He also explained that, while office rent is among the highest in Latin America, this factor represents only 10% of the total cost. "What matters is labor costs and the ability to scale operations with local talent," he indicated.

Ramírez Escudero highlights the importance of talent and macroeconomic stability for the growth of the real estate market in Argentina.Augusto Famulari - The Nation

Argentina's reputation for investment was another topic the executive addressed. "The country has a complex historical memory for investors. From the corralito (corralito) to restrictions on capital outflows, there's a distrust that doesn't heal in six months," he was blunt, though optimistic: "Capital is selfish. If it sees things changing and opportunities emerging, it returns." Along the same lines, Nicolás Cox , executive director of CBRE Argentina and Chile, agreed that while "it's still in its infancy, long-term planning is already underway. We see interest in energy, mining, and, over time, also in real estate, which is by definition a long-term investment."

Offices: demand picks up

One of the sectors showing signs of recovery is office rentals . According to executives, the pandemic had slowed both supply and demand, but now companies are returning to in-person operations.“For example, in New York, JP Morgan was the first to announce the return to a 5x0 regime, meaning full in-person service Monday through Friday, and that involves square footage,” added Ana González Ferrero, senior advisory director at CBRE Argentina.

He also stated that offices have been transformed into experiences, and that amenities, ranging from premium nap rooms and cafeterias to vaccination services, are more valued today than ever.

Offices adapt to new ways of working, with flexible spaces and amenities that boost productivity.Gentleness

Ramírez Escudero argued that “non-presentiality has costs, not only in productivity, but also in creativity and relationship-building .” Cox also emphasized that “office design must adapt to flexibility: hybrid meetings, collaborative spaces, and appropriate technology.”

Logistics and industry: another great opportunity

Another development axis that CBRE representatives consider strategic is the industrial and logistics sector . "We see growing demand, limited supply, and a paradigm shift in the type of warehouses needed: more height, more flexibility, closer proximity to urban centers," said Ramírez Escudero. In this regard, they see room for growth in e-commerce-related warehousing, with a last-mile approach.

Demand for logistics space in Argentina is driving the construction of taller, more flexible warehouses.MercadoLibre

The challenge, as in other sectors, is the lack of capital. "Building is done only on demand. And since there's no financing, development is slow," he noted.

On the other hand, they highlighted that the agroindustrial sector is another vertical in which the firm is committed to growth. “Argentina has 39 million productive hectares, 70% of which are leased lands. This creates a dynamic market for buying, selling, and leasing land ,” explained González Ferrero. In this regard, Ramírez Escudero highlighted a growing model: “Many producers sell their land to invest in technology and then lease it. This way, they put that capital to work in their own business. We saw this in Europe, and it could begin to happen here as well.”

Housing and hospitality: two businesses with potential

Housing and hospitality are two industries with potential businesses. CBRE warned that both the hotel and multifamily residential markets have one thing in common : unmet demand and assets with potential for redevelopment. In Buenos Aires, many hotels located in strategic areas have not received investment in the last 15 years. " There are buildings in the downtown area that could be transformed into premium products ," said Ramírez Escudero, who emphasized that this represents a clear opportunity if the context is favorable.González Ferrero explained that, following the rise of digital nomads and the subsequent decline with the rise of the dollar, the hotel sector began to reshape itself toward more specific experiences. "They're looking for niches, boutique offerings, and higher-quality services," he indicated.

The multi-family residential and hotel market in Buenos Aires shows unmet demand and opportunities to convert old assets into high-quality products.Soledad Aznarez

Something similar is happening with multi-family housing and student housing , segments that are already established in other countries and that still have room for growth in Argentina. " There is unmet demand across all housing categories ," said Ramírez Escudero. However, he warned that one of the main obstacles is the lack of adequate financing to sustain these assets over the long term.

Cox agreed and emphasized that access to debt is key: "Without leverage, it becomes unviable to maintain a rental building."

Data centers: a strategic asset

Global digitalization and the rise of artificial intelligence have turned data centers into a strategic asset in the real estate world.In Argentina, demand exists, but structural conditions are still lacking for the sector to take off. “Building a data center requires 10 times more stability than building homes. These are multimillion-dollar investments that require reliable, continuous, and affordable energy,” explained Ramírez Escudero.

Data centers are a strategic asset that requires high energy stability for their operation.Sashkin - Shutterstock

Cox added that the main bottleneck isn't connectivity—which can be solved through international cables—but rather access to stable, affordable energy. "We're talking about consumption of between 30 and 50 megawatts per hour, with availability levels of 99.99%. Without that standard, the business doesn't work," he stated.

González Ferrero indicated that many international companies test opportunities in Argentina, but end up opting for more predictable markets. "They compare and choose Uruguay. They find more stability there," he noted.

Ultimately, the countries with the most significant developments in this industry in Latin America are Brazil and Chile , with emerging movements in Colombia and Mexico.

Latin America and the vision of the region

In his analysis of the region, Adolfo Ramírez Escudero emphasized that Latin America combines diverse realities with a shared growth potential. Mexico and Brazil account for much of the economic and real estate activity , while Chile is consolidating its position as a stable haven, offering opportunities in logistics and technology.

São Paulo, Brazil's main economic and financial center, reflects the region's real estate dynamism.Shutterstock - Shutterstock

Despite the contrasts, he maintained that the region as a whole offers an attractive combination of youthful demographics, unmet demand, and growing economic integration. "The world is tending to converge, and Latin America can join that trend if it can resolve its internal constraints," he stated.

In this context, he noted that Argentina must offer higher returns than other markets to offset the risk, especially for those taking the first steps. "We must be generous with investors who bet first," he concluded.

www.buysellba.com