BuySellBA

Administrator

The group behind the Le Parc towers goes public to finance new real estate projects - La Nacion Propiedades

Source:

www.lanacion.com.ar

www.lanacion.com.ar

June 24, 2025

The high-end real estate company announces its Initial Public Offering as part of its growth and expansion strategy.

The developer behind Le Parc announced the launch of its Initial Public Offering (IPO).Lucia Pereyra

In order to finance its expansion and strengthen its role as a significant player in the high-end real estate sector , both locally and globally, RAGHSA, a leading high-end real estate developer with over 55 years of experience in the Argentine market, announced today the launch of its Initial Public Offering (IPO). It will list its shares on the stock exchange , allowing external investors to purchase shares in the company.

The company, founded in 1969 by Moisés Khafif and recognized for landmark projects under the Le Parc brand and AAA corporate buildings , will seek with this move to strengthen its capital structure and finance the next generation of ventures . "This offer comes at a time when RAGHSA is fully and solidly consolidated, ready to move forward firmly with new developments," explained Mariano Vega, the company's general manager.

"The main objective of the offering is to continue strengthening its capital structure to maintain sustainable growth . The company will focus on expanding its portfolio and optimizing its operations to continue leading the high-end real estate market ," they explained in a statement obtained by LA NACION .

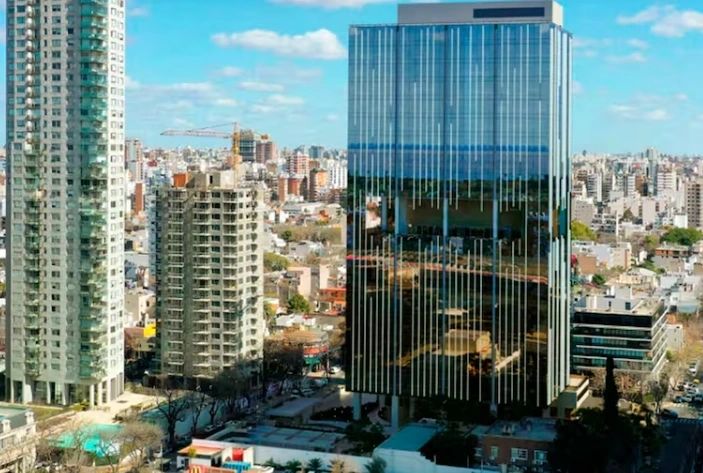

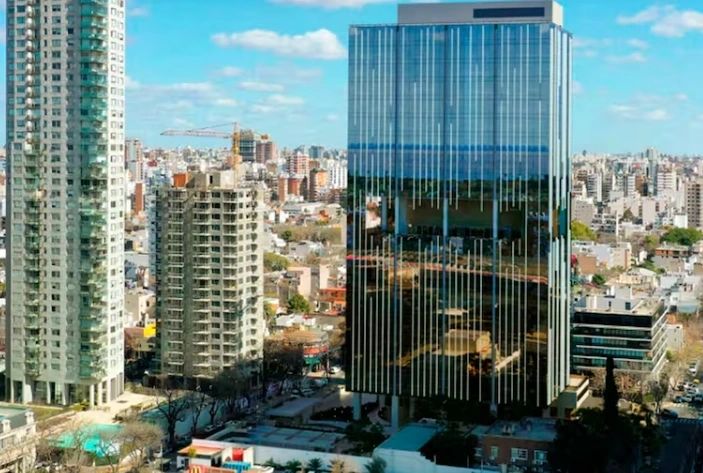

The tower that JP Morgan completed leasing in Núñez and that Raghsa will develop

Among the most notable projects they are working on is a 50,000 m² corporate building , which will be built on a 2,800 m² plot of land in the northern part of Buenos Aires. With an estimated investment of US$110 million , the project will add 145,000 m² of rentable space to the company's corporate portfolio.

"With this new building, we project an additional 20% growth in rentable square meters of commercial offices, after having increased that figure by 50% over the last five years," explained Vega, who emphasized that the company measures its progress based on the surface area placed on the market .

“We strategically measure our growth through increased rentable square meters. In the last five years, we've achieved a 50% increase in rentable square meters of commercial offices in Argentina . Upon completion of our next building, we project an additional 20% growth in this area,” Vega commented.

"We are convinced that this initiative will significantly contribute to strengthening our company's reputation, increasing its prestige, solidity, credibility, and transparency. Our goal is to consolidate our position in a highly competitive market, while always maintaining the ability to respond quickly and with excellence to the demands of the capital markets," Vega concluded.

www.buysellba.com

Source:

El grupo detrás de las torres Le Parc desembarca en la Bolsa para financiar nuevos proyectos inmobiliarios

La empresa inmobiliaria de alta gama anuncia su Oferta Pública Inicial como parte de su estrategia de crecimiento y expansión

June 24, 2025

The high-end real estate company announces its Initial Public Offering as part of its growth and expansion strategy.

The developer behind Le Parc announced the launch of its Initial Public Offering (IPO).Lucia Pereyra

In order to finance its expansion and strengthen its role as a significant player in the high-end real estate sector , both locally and globally, RAGHSA, a leading high-end real estate developer with over 55 years of experience in the Argentine market, announced today the launch of its Initial Public Offering (IPO). It will list its shares on the stock exchange , allowing external investors to purchase shares in the company.

The company, founded in 1969 by Moisés Khafif and recognized for landmark projects under the Le Parc brand and AAA corporate buildings , will seek with this move to strengthen its capital structure and finance the next generation of ventures . "This offer comes at a time when RAGHSA is fully and solidly consolidated, ready to move forward firmly with new developments," explained Mariano Vega, the company's general manager.

"The main objective of the offering is to continue strengthening its capital structure to maintain sustainable growth . The company will focus on expanding its portfolio and optimizing its operations to continue leading the high-end real estate market ," they explained in a statement obtained by LA NACION .

The tower that JP Morgan completed leasing in Núñez and that Raghsa will develop

Among the most notable projects they are working on is a 50,000 m² corporate building , which will be built on a 2,800 m² plot of land in the northern part of Buenos Aires. With an estimated investment of US$110 million , the project will add 145,000 m² of rentable space to the company's corporate portfolio.

"With this new building, we project an additional 20% growth in rentable square meters of commercial offices, after having increased that figure by 50% over the last five years," explained Vega, who emphasized that the company measures its progress based on the surface area placed on the market .

“We strategically measure our growth through increased rentable square meters. In the last five years, we've achieved a 50% increase in rentable square meters of commercial offices in Argentina . Upon completion of our next building, we project an additional 20% growth in this area,” Vega commented.

Offer details

The IPO will offer a minimum of 23,830,213 Class "A" common shares , each with one vote, expandable to 41,482,223 shares. The indicative price range is $907 to $1,685 per share, which includes the par value plus the share premium. The final price will be determined through the book-building process , based on market demand."We are convinced that this initiative will significantly contribute to strengthening our company's reputation, increasing its prestige, solidity, credibility, and transparency. Our goal is to consolidate our position in a highly competitive market, while always maintaining the ability to respond quickly and with excellence to the demands of the capital markets," Vega concluded.

www.buysellba.com