Carlhunter

New member

How much can the dollar go this year according to a major Wall Street bank - Infobae

Source:

www.infobae.com

www.infobae.com

January 31, 2024

The Bank of America made its projections on the official and parallel exchange rate, with a comparison with other currencies of emerging countries

By Juan Gasalla

Argentina is rapidly losing exchange competitiveness due to high inflation.

One of the main Wall Street banks that closely follows the Argentine economy made projections on the exchange rate, after the devaluation of the official dollar at the end of 2023, and taking into account the recent spiraling of inflation.

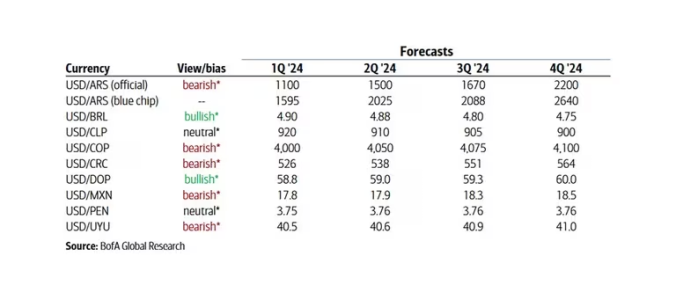

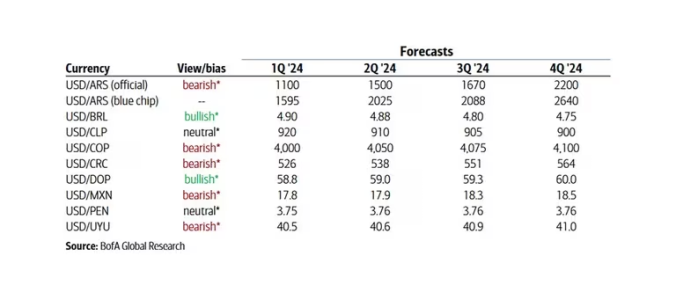

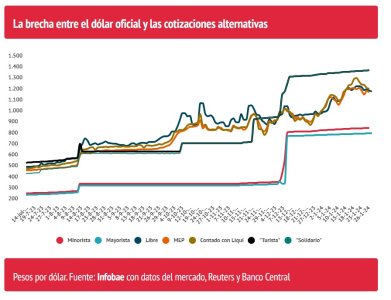

This is Bank of America (BofA), which projected an official dollar at 2,200 pesos by the end of the year , an increase of 172.1% for all of 2024 . If the high inflation expected for the current year is taken into account, it would not be a dramatic devaluation, especially when compared to the exchange rate jump that the official dollar experienced throughout 2023, of 356.3%, from 177.16 to 808.45 pesos.

Likewise, the analysts of the North American banking giant estimated a rise in the “blue chip” or “cash with settlement” dollar of 162.7% , from $1,004.92 at the close of 2023 to 2,640 pesos by the end of 2024.

Bank of America's projections for the dollar in Argentina and the region.

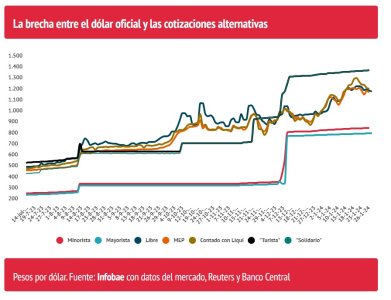

In this regard, a fact worth highlighting is the narrowing of the exchange rate “gap,” which currently ranges between 50% and 60% depending on the parallel price of the dollar to be considered. In BofA's calculations, this would be reduced to 20% by the end of the year . However, it would not be encouraging if Javier Milei 's government were forced to maintain the exchange rate "hold" throughout 2024, since this control over the dollar is the root of the difference between prices.

Another conclusion that can be seen is the chronic weakness of the Argentine currency compared to other countries in the region. For example, at present the Argentine and Chilean pesos have a close “one to one” relationship. But towards the end of the year the currency of the neighboring country would stabilize at an exchange rate of 900 per dollar, while in our country it would jump to 2,200 pesos. Therefore, the “one on one” with Chile will play in favor of the trans-Andean country at 2.4 Argentine pesos for one Chilean peso.

To give dimension to the devaluation that specialists expect, we must remember that during the critical year 2002 the official dollar rose from one peso, with the collapse of convertibility, to 3.38 pesos at the end of that year, 238% , although with an abysmal difference in terms of the inflation rate , which 22 years ago reached 41% in twelve months, which meant a historically high exchange rate in real terms during the government of Eduardo Duhalde .

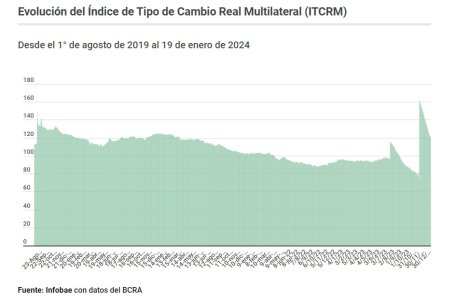

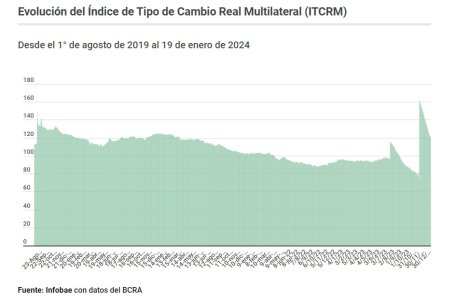

An example of this relationship, which allows an approximation to determine whether the dollar is “expensive” or “cheap,” is the Multilateral Real Exchange Rate Index (ITCRM) that measures the Central Bank, based on the rate of inflation and devaluation of Argentina and its main trading partners.

The ITCRM reached a historical peak of 208 points - on a base of 100 theoretical balance - on June 25, 2002, when the official dollar touched 4 pesos. This same index reached 162 points on December 14, 2023 , immediately after the devaluation announced by Minister Luis Caputo , which took the wholesale dollar to 800 pesos.

Today this official exchange rate, which is used for foreign trade operations, is paid at 825.80 pesos, but given the inflationary impulse, exchange competitiveness was losing ground, and the ITCRM settled at 119 points on January 29, this year, just above the 114 points of August 14, 2023, when the then Minister of Economy Sergio Massa applied an exchange rate jump of $62.65 or 21.8% in one day, to take the official dollar to 350 pesos. It seems far away in time, but less than six months have passed since that event.

On the other hand, the ITCRM is now clearly below the 148 points of August 14, 2019, after the wholesale dollar climbed on August 12 from $45.40 to $55.75 in one day, a rise of 22 .8%, after the PASO of that year that consecrated the presidential formula of Alberto Fernández and Cristina Kirchner .

Source:

A cuánto puede llegar el dólar este año según un importante banco de Wall Street

El Bank of America hizo sus proyecciones sobre el tipo de cambio oficial y paralelo, con una comparación con otras monedas de países emergentes

January 31, 2024

The Bank of America made its projections on the official and parallel exchange rate, with a comparison with other currencies of emerging countries

By Juan Gasalla

Argentina is rapidly losing exchange competitiveness due to high inflation.

One of the main Wall Street banks that closely follows the Argentine economy made projections on the exchange rate, after the devaluation of the official dollar at the end of 2023, and taking into account the recent spiraling of inflation.

This is Bank of America (BofA), which projected an official dollar at 2,200 pesos by the end of the year , an increase of 172.1% for all of 2024 . If the high inflation expected for the current year is taken into account, it would not be a dramatic devaluation, especially when compared to the exchange rate jump that the official dollar experienced throughout 2023, of 356.3%, from 177.16 to 808.45 pesos.

Likewise, the analysts of the North American banking giant estimated a rise in the “blue chip” or “cash with settlement” dollar of 162.7% , from $1,004.92 at the close of 2023 to 2,640 pesos by the end of 2024.

Bank of America's projections for the dollar in Argentina and the region.

In this regard, a fact worth highlighting is the narrowing of the exchange rate “gap,” which currently ranges between 50% and 60% depending on the parallel price of the dollar to be considered. In BofA's calculations, this would be reduced to 20% by the end of the year . However, it would not be encouraging if Javier Milei 's government were forced to maintain the exchange rate "hold" throughout 2024, since this control over the dollar is the root of the difference between prices.

Another conclusion that can be seen is the chronic weakness of the Argentine currency compared to other countries in the region. For example, at present the Argentine and Chilean pesos have a close “one to one” relationship. But towards the end of the year the currency of the neighboring country would stabilize at an exchange rate of 900 per dollar, while in our country it would jump to 2,200 pesos. Therefore, the “one on one” with Chile will play in favor of the trans-Andean country at 2.4 Argentine pesos for one Chilean peso.

To give dimension to the devaluation that specialists expect, we must remember that during the critical year 2002 the official dollar rose from one peso, with the collapse of convertibility, to 3.38 pesos at the end of that year, 238% , although with an abysmal difference in terms of the inflation rate , which 22 years ago reached 41% in twelve months, which meant a historically high exchange rate in real terms during the government of Eduardo Duhalde .

An example of this relationship, which allows an approximation to determine whether the dollar is “expensive” or “cheap,” is the Multilateral Real Exchange Rate Index (ITCRM) that measures the Central Bank, based on the rate of inflation and devaluation of Argentina and its main trading partners.

The ITCRM reached a historical peak of 208 points - on a base of 100 theoretical balance - on June 25, 2002, when the official dollar touched 4 pesos. This same index reached 162 points on December 14, 2023 , immediately after the devaluation announced by Minister Luis Caputo , which took the wholesale dollar to 800 pesos.

Today this official exchange rate, which is used for foreign trade operations, is paid at 825.80 pesos, but given the inflationary impulse, exchange competitiveness was losing ground, and the ITCRM settled at 119 points on January 29, this year, just above the 114 points of August 14, 2023, when the then Minister of Economy Sergio Massa applied an exchange rate jump of $62.65 or 21.8% in one day, to take the official dollar to 350 pesos. It seems far away in time, but less than six months have passed since that event.

On the other hand, the ITCRM is now clearly below the 148 points of August 14, 2019, after the wholesale dollar climbed on August 12 from $45.40 to $55.75 in one day, a rise of 22 .8%, after the PASO of that year that consecrated the presidential formula of Alberto Fernández and Cristina Kirchner .