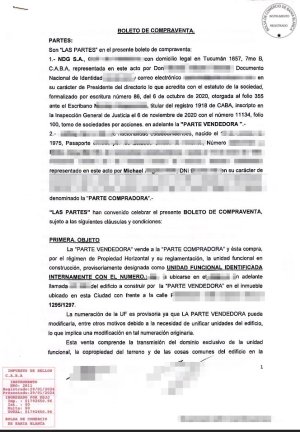

yep, for sale price 92,300 example, 60% was 55,000 in cash from Cueva and 40% was 37,300 from declared Bitcoin. i still have my G&D consultation note...i didn't press the issue about declaring, since i was just hearing the sales pitch, but i certainly didn't ASK to pay in the Black ahahahah, why would i do that? i'm not Argentine and i don't have permanent residency or citizenship

😛

this was a building with a lot of progress, not a

pozo that was still being planned and dug, so that could be the difference. it was also before all the chainsaw law-deletions, ~Dec2023, so things maybe changed. but aside from earlyretirement vouching for them, G&D didn't offer anything that different from other sales pitches in CABA. and i wanted to pay directly in Crypto, which they couldn't accept, so it just didn't work-out.

I got 1,080 on purchases with my American credit card with the official at 100 and the MEP at 1143. Did the credit cards stop using the MEP rate? Any experiences with that @StatusNomadicus? Are you still tracking this?

thanks for the data point, and yep i have been a dirtbag about my Twitter profile posts, but i'm still saving data. if you got 1080 on Visa or Mastercard, without foreign transaction fees muddling the data, that would mean +7% should have been about 1155.6 MEP posted rate, which tracks with the current 1144.11 rate right now in the AM on Monday 12May2025

like i've been posting here, with the real-world MEP rate being so low compared to Blue

1155 and banks like Santander that will same-day swap USD for ARS at

1138 right now, it doesn't make sense to use US credit/debit cards unless it's your only option (no DNI, no

Cueva access), or if it's just a small amount and you don't care. but if you have 1000 USD to spend this month, you'd get in Pesos right now:

A. MEP posted minus ~7% cards 1,064,023

B. MEP Santander online swap 1,138,110

C. Blue 1155 minus ~3% fee 1,120,350

...which would mean you'd have 74,087 Pesos

less from MEP versus Santander MEP this month, or about $65 USD less, or

losing 6.5% on everything you spend. some people may not care, but over a year if i'm spending say 12,000 USD for my entire life in 2025, with these current rates using a credit card versus Santander, even with the current "bad" rates for ARS/USD, i would be

losing $780 USD annually assuming minus 6.5%

maybe someone else can chip-in and explain better, and give their strategy for maximizing Pesos/Dollars

🙂

8% less. It is never the MEP rate.

correct, usually 6.5 to 7.0 percent less for me. the scammer banks really should be fined for not posting the true rate. it's another thing that would make Argentina more serious of a country

40% is crazy. @StatusNomadicus did you consult a lawyer and accountant about that?

i've talked to dozens of people in 3 provinces and aside from earlyretirement, zero people say to declare 100% - any Argentine is going to do what 99% of people do here, declare the lowest possible and hope for reforms in the future. as my

Escribana said, i would be literally the only house in many kilometers with a value of 133k USD when every other neighbor is in the 15k-60k range. you'd stand-out a ton, and will pay more taxes, and if i had done my Title in Bitcoin they were even more worried about having ARCA/AFIP/property tax folks being more nosy about my sale. /shrug

40% is absolutely not crazy, though. many people have been doing less, like 20%, for many years. cops, judges, realtors, notaries, etc. - no one likes to talk about any of this, except for BuySellBA

RIP, especially since yesterday was Mother's Day in the US, and you are a good person for pausing life to handle family stuff. we will be here in Argentina when you're done

🙂 sounds like you didn't lose much money (you made some? i'm not that interested to try to do the math), but agreed i would NEVER do any of this remotely, and wouldn't try anything at all in Argentina without a local wife or family, or in my case unless it was "free" money from Bitcoin and zero risk, UNLESS it was through

@earlyretirement @BuySellBA - no one else would be honest with you and support before and after.

could have been the new law that deleted 1 of the 2 property sale taxes (i also only had to pay one instead of two, which saved me like 1500 USD or something)

"lucky" meaning worked hard, saved money, researched for days and days, networked, paid consultations, had enough savings liquid to take advantage, made a huge risk in a country that may have remained communist for another 4 years...yes, according to a Peronist with zero life experience, they were "lucky" lol, get the f*ck out of here...why are you on an Expat forum? seriously you and Larry add nothing here and just waste everyone's life.

see above. who would want to meet you? you literally lurk on an Expat forum and post the same "i'm poor. other evil lucky people are rich. argentina is expensive in dollars. Milei evil!" every day you post here makes everyone's life less enjoyable

sure, i don't need to watch a Realtor's youtube video to know they are going to say "now is the time to buy, don't miss it" - i'm just giving you my perspective on moving to BsAs to buy an apartment and liking Cordoba and then Mendoza WAY more than the BsAs New York City feel. if you're an investor that buys stuff you won't ever live in, of course you're in a 1% niche category compared to an Expat moving somewhere else...sounds like you've got a good plan! as always, i just enjoy arguing the minority position. CABA really is great for short-term rentals and all of that; i just hated so many things (that i hate in all big cities) and Mendoza isn't a small town or a place where people only go for the weekends ahahahhaha, ask all the Porteños where they travel to for a week/end at a time, regularly. my dog's buddy at the park here is owned by a guy from Buenos Aires who is trying to move here, but right now just works the 4 summer months

🙂 i personally know 5 people who moved from BsAs and prefer Mendoza. it's just, like everyone else like Wally said, a completely different place. but i disagree it is like Oklahoma

😉 faaaaaaar from. the problem is that 95% of permatourists have never been outside CABA, much less outside of the province, and much less lived in the other bigger cities. i have, 11 months in airbnbs in 3 provinces aside from Santa Fe that i wasn't interested in the crime...i ran something like 400 miles in that time and saw so much of Buenos Aires/Cordoba/Mendoza on-foot, so i don't claim to know what is a good real estate investment, but i'm confident i've experienced much more of Argentina in my short time, without a car, than many people here who have lived in Argentina for years

😛

seriously

@Uncle Wong - ask people you meet how they liked Mendoza when they went. Argentina is huuuuuuge and isn't just "Buenos Aires has everything and the other small poor boring places aren't worth more than a weekend" - it's like all the Latin America tourists that come to the USA and go to NYC, Miami, and Los Angeles - gross! i would never live in any of those, and have never enjoyed a visit

which example? no worries mang, do your thing. just gave the advice to spend a few hundred bucks to fly and visit Cordoba, Mendoza, and maybe Bariloche before investing hundreds of thousands of dollars.

My friend told me that a property can sit on the market for years and years without being able to exit.

nahhhh, here's the thing: if houses/apartments want to sell, they just need to list at the correct price. they aren't selling because they are listing too high. in Mendoza for example, a shitty house has been listed for 135,000 USD for over a year. i toured it twice. i would have paid 100k for it and remodeled myself. but the owner is a retired doctor who inherited it, and she lives there, and her bills are SO CHEAP in Argentina that she can sit on it for years. the house i bought was listed for 6 years at 155,000 then 150,000 then 135,000 and i offered 130,00 and we made a deal at 133,00 with terms in my favor. you're conflating two things:

1. smaller cities have less turnover. but turnover really only matters to people buying a place to invest in and rent, which would be 5% of buyers maybe...they are investors.

2. Argies are rich in generational wealth and the cost of living in so low in Dollars that THOUSANDS of properties will sit empty for many years because the expenses are like 200 USD a year, and they expect to sell for tens of thousands of dollars more.

very different things. if a property needs to be sold, it would happen in a month. the wealthy here have more than 1 house in their family and many sit vacant while they wait for what they want.