Mendoza or somewhere else could be better from a living long term standpoint

agreed, and since ~99% of humans aren't millionaire investors, that's a pretty big point

🙂 most people will never own more than 1 property; you'd be in the 0.01% of humans on the planet, wealth-wise, even with 2 small paid-off apartments in any big city

Buenos Aires is just too big of a dirty city for me, and there are too many street people who bother me on restaurant patios. i would never live there long-term, but visiting for a weekend would be fine if i had to. no plans to go back, just like one visit to NYC was enough for me (did you know NYC had trash on the sidewalks even in 2014? i was mindblown that they hadn't figured-out dumpsters yet)

regardless, new builds/

pozo may be going up, but luckily the market will always be there to help us; as new apartments go up 20%, the rich Argies...and there are thousands...will list their houses/apartments/lots for sale, and supply will go up, so there will always be options for us. i love

@earlyretirement and he's right about Argentina, but of course he's incentivized for you to buy something with his company

@Uncle Wong so he'll even tell you to trust no one and make sure you do all the due diligence. but like asking a surgeon if you need surgery, asking a successful investor if investing in the city and area and types of investments he makes is a good idea...of course buying in Palermo/Recoleta/etc. will be the answer. but the most important part is - are you buying to get cheap in

pozo, sit on it with 300 USD/month and sell at a certain price point in the future? or are you buying some place to live part or all of the year?

because these are important; i wouldn't be UNhappy totally if i bought a small apartment with G&D in CABA, but overall right now i am happy about some things:

1. CABA is too big and i find the upsides not worth the downsides. Mendoza is much more my style because i am "boring"

2. i don't have anyone under or over me, i have a 168 m2 house that i don't have to ask permission to remodel or do projects. and my expenses are super cheap.

3. i have a 3-car garage and am in a walkable area that is also quiet most of the day and all of the night.

4. i paid 133,000 USD sale price with Bitcoin directly, whereas G&D wanted me to sell Bitcoin for cash dollars and pay them in mostly USD cash, and also wanted me to declare a low number on the deed. the only sacrifice i had to make on my sale was declaring 40% on the title, which EVERY person insisted along the way. so, even with earlyretirement there is a good chance you'll be doing things in the black as well, which most of the time shouldn't be an issue because he'll give you the pros and cons of all of that.

if i had a ton of capital and wanted to be a professional flipper, i would have started with BuySellBA and learned the process there with the first sale, then decided after. but i don't want to flip properties in CABA, i want to run 1-2 rentals and clean/manage them myself. Mendoza's tourism was better for this business model, since i'll also be living in one of them, and i have the unpopular opinion that BsAs isn't that amazing of a lifestyle for me

I plan to take their advice and go high end. Mike was great and even referred me to one of their clients who talked to me on the phone for 1.5 hours! He bought 2 properties already with BuySellBA and hired them to do everything including closing and also hired their interior designer and he finished his property in November 2024 and he said he is making double digit returns! He even showed me the Zelle payments he gets each month.

most likely you won't have any issues, but keep in mind that the guy selling you an apartment will always convince you of this, just like a realtor will show you the houses at the top of your budget

🙂

I wish I bought a long time ago!

eh, what would you have saved, 10,000 USD total? i think there will be a shitload of new

pozo projects as Argentina leaves 3rd-world status and focuses on property rights. have you done the math of what you "missed" on this? because there are a ton of things that would have been better returns if you could have predicted the future

you can potentially purchase and down the line sell for 1.5x or 2x where as anywhere else the chances are less likely

yeah but "potentially" is important. and there are investors claiming the same things about every city in the world, where people are selling real estate. Doug Casey in Salta thinks it's the greatest investment. people in Paraguay think buying there for cheap will pay-out if Paraguay develops more /shrug

if a good friend asked me about buying an apartment in BsAs, i would insist they spend a full month living in that neighborhood first (a great $750 USD investment to learn more than any online research can do), and to visit 3 other cities like Cordoba, Mendoza, and maybe somewhere in Patagonia etc., first. - there's just SO much about Buenos Aires that i despised, whereas i landed at EZE in Nov2023 assured i would buy an apartment ASAP. then it became less and less appealing as i ran/walked many many miles around that city for 4 months

🙂

but i'm a weirdo and live differently than others. luckily we have an uncensored forum where i can even disagree with the owner, unlike the old censored forum and its communist tyrant. happy weekend all! rates for Sat/Sun:

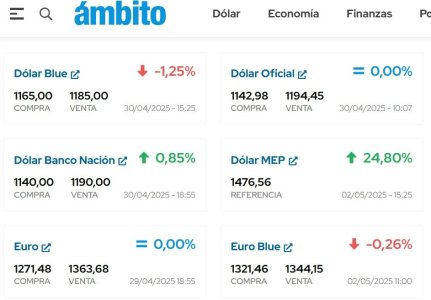

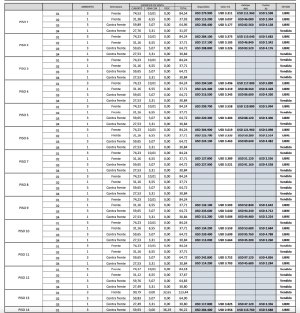

Blue 1155 / 1175

Official 1120 / 1167

MEP 1144, minus 7% would be estimated

1064 (low!)

Santander's MEP not available on weekend, but showing 1138 / 1144

Crypto 1165

WU 1143

i haven't been using my US cards much, so if anyone has any data, post it here

🙂