Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Argentina and the IMF: Can This Marriage Be Saved?

- Thread starter Finance Prof

- Start date

It is hilarious reading some of the responses to this woman from the IMF that said she had a good meeting with Milei. Is the IMF actually going to give the funds? They keep posting over and over how the meetings are going well and then never had over the money.

The rug pull to Milei's millions of followers probably didn't help. Now he is illegally trying to put people on the Supreme Court. Doubt any of these things are helping his cause at all.

Vero

Well-known member

I don't agree with what he is doing with the Supreme Court judge. We have rules and laws and we can't complain about Cristina and allow Milei to do unconstitutional things. I worry for the future.The rug pull to Milei's millions of followers probably didn't help. Now he is illegally trying to put people on the Supreme Court. Doubt any of these things are helping his cause at all.

The IMF for over a year say the talks are going well but they have not announced money yet. I wonder how long this can go on.

Cardiac Arrest

Active member

Milei keeps saying the IMF funds are coming soon. Been saying that for a year now. When will it come? What is the delay???

www.voanews.com

www.voanews.com

In address to Congress, Argentine president promises IMF deal, lauds economic wins

Revisiting the economic themes of his 2023 presidential campaign ahead of crucial midterm elections in October, Milei declared: 'We went from talking about hyperinflation to talking about long-term stability'

www.voanews.com

www.voanews.com

Nasdaq

Well-known member

The IMF funds are close to coming and once they do you will see an explosion of euphoria.

Things sure changed quickly once Trump reiterated that he will impose tariffs. If he really does it there will probably be a recession.

They must be close as he is going to ask Congress to agree which the IMF requires so it must be close.

President to seek Congress support for IMF deal ‘in coming days’

Milei’s request to Congress is a key step because IMF agreements are required by law to be approved by legislative branch to be enacted.

Uncle Wong

Well-known member

Interesting article on Milei and the IMF.

unicornriot.ninja

unicornriot.ninja

Chainsaws, Chaos, and Javier Milei: How IMF Meddling and Hubris Fueled Argentina’s Reality TV Presidency - UNICORN RIOT

In Buenos Aires, Javier Milei, a fiery congressman with a penchant for theatrics and unfiltered invective, delivered his bombastic address on live television. Clad in his signature leather jacket and gesturing wildly, Milei railed against the political elite, vowing to obliterate the “parasitic...

earlyretirement

Moderator

Sounds like some big $$$$ is coming soon.

According to UBS strategists, the International Monetary Fund (IMF) could provide Argentina with a new program worth up to $20 billion.

This new program would cover both principal and interest payments to the IMF during the remainder of President Javier Milei's term. The UBS analysts expect that at least 30% of the new package would be made available this year, based on past IMF deals.

While the specific breakdown of $12 billion for loan principal repayment and $8 billion in "new" funding is not explicitly mentioned in the search results, the overall figure of up to $20 billion aligns with the UBS projection.Argentina has a history of significant IMF support, including a $57.1 billion loan agreement in 2018, which was the largest in the Fund's history at that time.

The current discussions for a new program come as Argentina continues to face economic challenges and seeks to stabilize its economy.

According to UBS strategists, the International Monetary Fund (IMF) could provide Argentina with a new program worth up to $20 billion.

This new program would cover both principal and interest payments to the IMF during the remainder of President Javier Milei's term. The UBS analysts expect that at least 30% of the new package would be made available this year, based on past IMF deals.

While the specific breakdown of $12 billion for loan principal repayment and $8 billion in "new" funding is not explicitly mentioned in the search results, the overall figure of up to $20 billion aligns with the UBS projection.Argentina has a history of significant IMF support, including a $57.1 billion loan agreement in 2018, which was the largest in the Fund's history at that time.

The current discussions for a new program come as Argentina continues to face economic challenges and seeks to stabilize its economy.

Finance Prof

Well-known member

They don't want to have to sell their dollars but they are forced into it when locals are all rushing to buy dollars. That big move yesterday signals that people are going to get out of their carry trade positions. Things can move quickly once rumors spread. Usually they can't keep it a secret and word travels fast.Why does the Central Bank buy a few million dollars every day and then friday they sold almost half a billion dollars in dollars? Help someone that does not understand anything understand this?

Uncle Wong

Well-known member

But would the USA really force Argentina to severe ties with China? This seems totally unrealistic. And would Argentina do it? If the IMF funds don't come sounds like it is lights out.

cryptoslate.com

cryptoslate.com

US may withdraw support for Argentina if it continues accord with China

The US conditions its support for Argentina's $20 billion IMF loan on President Javier Milei ending a currency swap agreement with China.

earlyretirement

Moderator

Washington, DC: IMF staff and the Argentine authorities have reached a staff-level agreement on a comprehensive economic program that could be supported by a 48-month arrangement under the Extended Fund Facility (EFF) totaling US$20 billion (SDR 15.267 billion or 479 percent of quota), subject to approval by the IMF Executive Board.The agreement builds on the authorities’ impressive early progress in stabilizing the economy, underpinned by a strong fiscal anchor, that is delivering rapid disinflation and a recovery in activity and social indicators. The program supports the next phase of Argentina’s homegrown stabilization and reform agenda aimed at entrenching macroeconomic stability, strengthening external sustainability, and unlocking strong and more sustainable growth, while also managing the more challenging global backdrop.The IMF Executive Board is expected to consider the proposed arrangement in the coming days.

IMF Reaches Staff-Level Agreement with Argentina on a 48-Month Extended Fund Facility (EFF)

IMF staff and the Argentine authorities have reached a staff-level agreement on a comprehensive economic program that could be supported by a 48-month arrangement under the Extended Fund Facility (EFF) totaling US$20 billion (SDR 15.267 billion or 479 percent of quota), subject to approval by...

www.imf.org

They can't. Argentina is too in bed with China now.But would the USA really force Argentina to severe ties with China? This seems totally unrealistic. And would Argentina do it? If the IMF funds don't come sounds like it is lights out.

US may withdraw support for Argentina if it continues accord with China

The US conditions its support for Argentina's $20 billion IMF loan on President Javier Milei ending a currency swap agreement with China.cryptoslate.com

Today Caputo all but admitted this is unsustainable the exchange rate.

Caputo reconoce que el actual sistema cambiario no es "consistente" ni "sostenible"

En medio de la discusión con el FMI por el régimen cambiario, el ministro hizo una llamativa afirmación en el comunicado sobre la renovación del swap.

Just like this says, Argentina is a deadbeat and things aren't really much different and will blow up like last times.

www.thenation.com

www.thenation.com

The Post-Future Has Arrived in Argentina—and It Looks Remarkably Like the Past

Javier Milei’s right-wing government is racking up new debt with the IMF. It’s part of a vicious cycle the country seems unable to break.

www.thenation.com

www.thenation.com

Betsy Ross

Well-known member

The IMF debt seems like a ticking time bomb that will eventually have to get paid back. I don't care how much of a great deal they got. It all needs to be paid back. I never liked the IMF. Borrowed dollars to check an IMF box for Central Bank Reserves box even though it's a loan and NOT an asset. I know it gives them more time but I am worried about all this debt.

Finance Prof

Well-known member

Balance sheets can be deceptively simple. Take, for example, a home: the property appears as an asset, while the mortgage is listed as a liability. The homeowner’s equity—the difference between the two—is what contributes to net worth. The underlying structure can be more revealing than any individual number.The IMF debt seems like a ticking time bomb that will eventually have to get paid back. I don't care how much of a great deal they got. It all needs to be paid back. I never liked the IMF. Borrowed dollars to check an IMF box for Central Bank Reserves box even though it's a loan and NOT an asset. I know it gives them more time but I am worried about all this debt.

In the case of the Central Bank of Argentina (BCRA), a similar principle applies. When the central bank increases bank reserves, it’s recorded as an asset. However, if those reserves stem from borrowed funds, the corresponding liability (the loan principal) offsets the gain. The net effect on net foreign reserves is essentially neutral.

That said, these financial maneuvers aren’t entirely meaningless. Liberalizing imports and exports introduces transitional imbalances: the country needs immediate access to dollars for import purchases, while dollar inflows from exports typically lag. Ideally, exports would rise to compensate—but Argentina faces structural challenges on that front, including an overvalued peso and weak global commodity prices, both of which suppress export competitiveness.

President Milei is attempting a full-spectrum overhaul—pulling every economic lever available. But the system he inherited was already deeply entangled. Much of the fiscal deficit driving inflation stemmed from a mix of direct transfer programs (like social security, food aid, and scholarships) and indirect subsidies (energy, gas, and infrastructure). By slashing these to curb inflation, the government has inadvertently contracted domestic consumption, reduced employment, weakened tax revenues, and dampened import demand—all while a stronger peso further erodes the competitiveness of Argentine exports.

In short, it’s a high-risk balancing act with significant short-term costs and uncertain long-term outcomes.

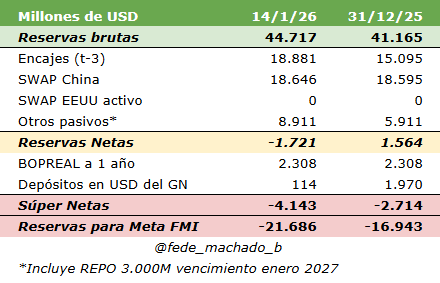

Looks to me like still debt, debt and more debt.

Seems like very little of the net reserve is usable by Argentina.

Encajes (Required bank reserves)

USD 18.9BThis is depositors’ money held at the central bank

- The BCRA cannot spend it

- Not a debt, but not usable reserves

China swap (USD 18.6B)

- It is a currency swap line, not cash

- It can be used only under conditions

- It creates a liability to China if drawn

- It is not an immediate payable debt, but it reduces net reserves

So to be conservative this is owed.

Other passives (USD 8.9B)

Includes:

- Repos

- Short-term obligations

- Temporary financing tools

“Super Net Reserves” (–USD 4.1B)

Conservative estimate and admittedly a worst-case accessibility stance.

- Subtracts even more items

- Used by IMF analysts and bond traders

- Assumes worst-case accessibility

“Reserves for IMF Target” (–USD 21.7B)

This is a scary number. IMF set reserve targets for Argentina by this time and it's $21.7 billion short. So looks like more waivers, resetting of targets, renegotiations and rolling over more debt.

Finance Prof

Well-known member

I wonder if the Foreign Exchange Purchases are going to go into a separate and identifiable account at the Central Bank. Because the changes in Gross Reserves that the Central Bank Balance Sheet reports so far are due to an endless number of causes and accounting tricks, which have very little to do with actual Foreign Exchange Purchases.

For example, Treasury Deposits, the Swap with China, the reserve requirements on dollar deposits, and several short-term liabilities of the BCRA have absolutely nothing to do with foreign exchange purchases.

For example, Treasury Deposits, the Swap with China, the reserve requirements on dollar deposits, and several short-term liabilities of the BCRA have absolutely nothing to do with foreign exchange purchases.

Betsy Ross

Well-known member

Well another year of fiscal surplus which is wonderful. And it sounds like it is good enough for the IMF.

Argentina posted fiscal surplus of 1.4% of GDP in 2025 - Buenos Aires Herald

The country achieved fiscal balance for a second consecutive year, the first time that had happened since 2008, according to Economy Minister Luis Caputo

buenosairesherald.com

overstayed

Member

I would think if they can keep a fiscal balance and spend less than they take in they should improve. But still can't see how they will pay off all their tens of billions in debt? Consumers are not spending. Maybe through agriculture? Milei seems to be trying to keep his friendships with China and the USA.Well another year of fiscal surplus which is wonderful. And it sounds like it is good enough for the IMF.

Argentina posted fiscal surplus of 1.4% of GDP in 2025 - Buenos Aires Herald

The country achieved fiscal balance for a second consecutive year, the first time that had happened since 2008, according to Economy Minister Luis Caputobuenosairesherald.com

Similar threads

- Replies

- 6

- Views

- 286

- Replies

- 14

- Views

- 459

- Replies

- 5

- Views

- 399

- Replies

- 3

- Views

- 463

Community Insight...

Engage explore adapt in your expat community.

Receive personalized job market insights from seasoned expats in your area

Discover local cultural nuances and festivities shared by community members

Get your tailored expat living guide curated by experienced locals