The Central Bank data reveals Argentina's household irregular credit portfolio hit ARS 5.3 trillion in November 2025, with personal loans and credit cards accounting for 77.2% of the total, contrasting low 3% delinquency in secured mortgages.

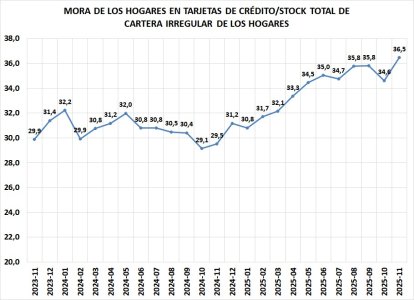

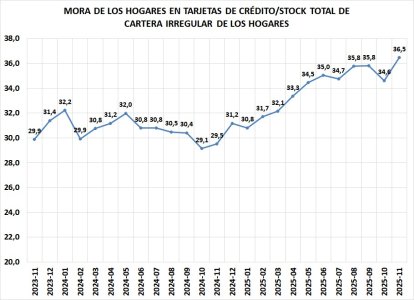

- The attached graph tracks credit card delinquency as a share of irregular household debt, showing a climb from 29% in late 2023 to 34.6% by November 2025, underscoring escalating consumer debt pressures.

- This trend mirrors national figures where family loan delinquency reached 8.8%—highest since 2010—amid debts equaling 140% of monthly incomes, highlighting persistent economic challenges despite inflation controls.