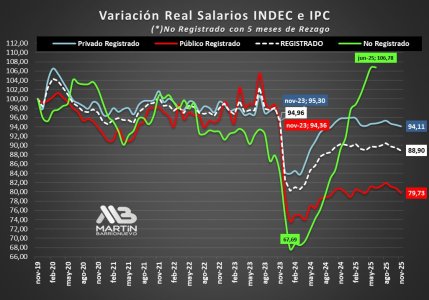

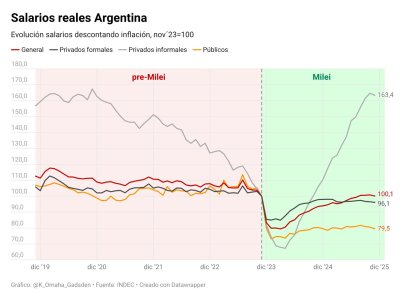

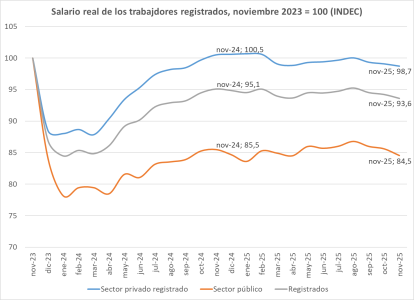

The numbers from INDEC don't look good. Looks like the formal economy employment salaries are falling now. Registered workers look like they are below the baseline. The numbers are the numbers. Private formal workers look about 6% the base, total registered 11% below and public sector workers 20% below. After 2 years of adjustment under Milei the majority of formal workers still hasn't recovered their purchasing power. That doesn't sound like a real turn away to me.

Public sector is dead. Collapsed in late 2023 when Milei took over and never rebounded. If fiscal adjustment is being financed by shrinking public salaries in real terms then for millions of workers, living standards are structurally lower.

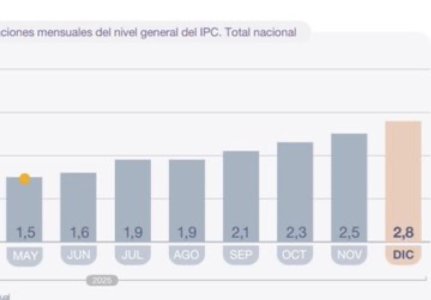

November shows another drop in real wages. Registered wages are dealing again and not stabilizing.

Even after inflation slowed down, wages are slipping again.

The jump up in informal wages good news bad news. Good that people in the black can get jobs but sort of means that if informal wages are outperforming formal wages then the labor market is distorted and broken. This is NOT a sign of a healthy working economy. This does not seem healthy to me.

So even if macro indicators improved, workers haven't returned to their prior purchasing levels prior to Milei.

View attachment 10260