BuySellBA

Administrator

What is the down payment on a $100,000 mortgage loan and which banks still have active lines? - Ambito Financiero

Source:

www.ambito.com

www.ambito.com

September 25, 2025

By José Luis Cieri

Banks have applied higher rates, some exceeding 15%, and stricter requirements, but they remain in place. What is the outlook for this scenario? Economists and specialists project.

A couple is doing the math with a calculator in hand to see if they can get a mortgage loan to buy their own house.Pexels

The mortgage market is going through a period of tension . The combination of rising interest rates, in some cases exceeding 15%, strict scoring, higher formal income requirements, and more stringent loan approval conditions has reduced accessibility for a large portion of the middle class. Even so, some institutions maintain active lines of credit, allowing certain sectors to evaluate whether it is worth taking the step toward homeownership or waiting for greater macroeconomic stability.

A year ago, the outlook was different. Several banks had relaunched UVA-adjusted products with low rates, which fueled a recovery in mortgage lending . However, rising financing costs and economic uncertainty halted that cycle. Today, the central question remains the same: How much does the down payment cost to purchase a $100,000 home, and who can afford it?

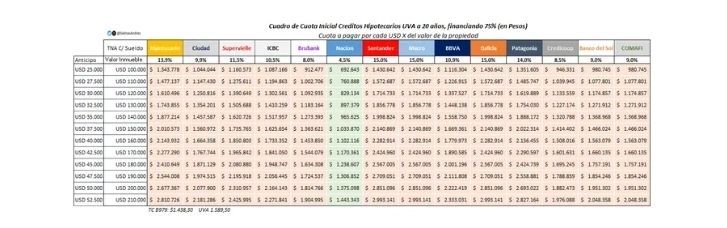

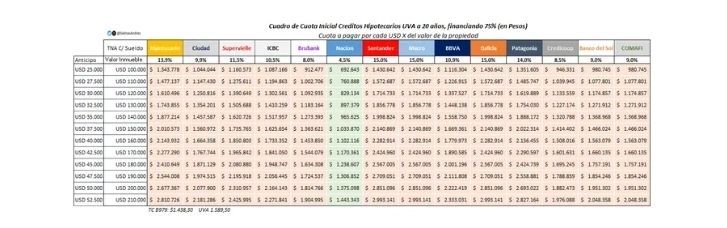

The specialist outlined the differences in concrete numbers: "The difference in the installment between BNA, which is the cheapest bank, and Galicia, Santander, or Macro, which are the most expensive, is almost one million pesos for a US$100,000 property financed over 20 years at 75% of the value."

This exercise, he explained, allows for comparison with the rental of an equivalent property, although he cautioned that it should be considered as one more element of the analysis and not the only variable.

Regarding the required income, Salinas was categorical: "We should roughly assume that the loan payment should be one-third of a family's net income. If the payment is $700,000, the family income should be around $2,100,000."

That number comes from a specific simulation: "For a 20-year mortgage loan with the BNA (4.5% APR), financing 75% of a US$100,000 property, the down payment is around $700,000. If we do the same exercise with the system's average rate, the down payment rises to $1,000,000, which requires an income of around $3,000,000," he added.

The possibility of adding co-debtors opens another door, although it doesn't always solve the problem. "The problem with this is that while demonstrating a higher income allows you to get more loans, the key is who pays. If the co-debtor is your partner and you both buy the house, that's one thing. But if you only recruit a family member to lend you more and not to pay, it can get really complicated," he warned.

Comparisons between banks, rates, and down payments as of Wednesday, September 23. Source: Andrés Salinas, economist and professor at the University of La Matanza

Regarding the main obstacles, Salinas noted that the high interest rate remains the central factor. "The higher the rate, the higher the monthly payment, and the greater the income needed to maintain the monthly payment-to-income ratio," he explained. He also mentioned the reduction in financing percentages, especially for second homes, and stricter credit scoring requirements.

The difference between signing a deed with a mortgage lender on 3 different days:

In just three days, the buyer went from needing $25,000 to $17,898, a savings equivalent to the value of a used car.

Adding to this difficulty is the exchange rate dynamic. "The rise in the dollar causes the property's value to increase in pesos , which means a larger loan and a higher down payment. If we combine rising rates with higher values in pesos, the situation becomes even more complicated," he explained.

Hausermann also pointed out an additional problem that had already affected those who had taken out mortgages in previous years: “While real estate prices in dollars rose moderately, UVA debts adjusted for inflation grew much faster, even exceeding the current value of the property. This generated equity losses for borrowers and weakened bank guarantees, discouraging both the supply and demand for mortgages.”

Regarding income, the consultant agreed that the mortgage-to-income ratio is the main obstacle. “With UVA rates of over 17% per year, almost no household can afford the down payments. If we look at a more moderate scenario from a few months ago, with the dollar at $1,300 and rates of 8% plus a 10-year UVA, financing 70% of a $100,000 apartment implied a monthly payment of close to $1,100,000. That required demonstrable income of $3,700,000 plus prior savings of 30% of the property's value and the deed fees. This barrier was already very high, and with the rise of the dollar and rates, it became even worse,” he indicated.

Used 2-bedroom apartments are among the best-selling so far.

Regarding the obstacles facing applicants, Hausermann listed several: “The first is informal employment, which makes it difficult to prove income under banking standards. Many have the ability to pay, but don't meet the required documentation. Added to this are lengthy appraisal processes, delays in preparing the credit file, and notarial bureaucracy. The result is that even with solvency, approval times are long, in some cases exceeding 90 days, and access is restricted for a small segment of the population.”

Faced with this scenario, the developer decided to offer direct financing to investors, with fixed installments in dollars and no interest. An apartment in Palermo valued at US$70,000 can be purchased with a US$25,000 down payment and the remainder in 30 interest-free installments. In this way, they seek to create affordable and predictable options, independent of the conditions imposed by banks or constant economic fluctuations.

“Today, we have 60 buildings delivered, 10% under construction, and 40 more plots of land in our portfolio. Our goal is to work in direct contact with the public, with the greatest possible transparency. We trust that rates will drop again and that mortgage lending will be reactivated, because this not only drives sales, but also makes it easier for those who sell a property to reinvest in new projects or real estate assets,” Barrera concluded.

www.buysellba.com

Source:

Cuál es la cuota inicial de un crédito hipotecario de u$s100.000 y qué bancos aún sostienen las líneas activas

Los bancos aplicaron tasas más altas, algunos pasan el 15%, y requisitos más duros, pero se mantienen. Qué escenario proyectan economistas y especialistas.

September 25, 2025

By José Luis Cieri

Banks have applied higher rates, some exceeding 15%, and stricter requirements, but they remain in place. What is the outlook for this scenario? Economists and specialists project.

A couple is doing the math with a calculator in hand to see if they can get a mortgage loan to buy their own house.Pexels

The mortgage market is going through a period of tension . The combination of rising interest rates, in some cases exceeding 15%, strict scoring, higher formal income requirements, and more stringent loan approval conditions has reduced accessibility for a large portion of the middle class. Even so, some institutions maintain active lines of credit, allowing certain sectors to evaluate whether it is worth taking the step toward homeownership or waiting for greater macroeconomic stability.

A year ago, the outlook was different. Several banks had relaunched UVA-adjusted products with low rates, which fueled a recovery in mortgage lending . However, rising financing costs and economic uncertainty halted that cycle. Today, the central question remains the same: How much does the down payment cost to purchase a $100,000 home, and who can afford it?

Accounts

For Andrés Salinas , an economist and professor at the University of La Matanza (UNLAM), Banco Nación remains the most competitive option on the market. "The lowest initial installments are in line with banks with the lowest interest rates. Currently, BNA is by far the most popular with an APR of 4.5%, followed by Brubank with 8%, and then Credicoop with 8.5%," he explained.The specialist outlined the differences in concrete numbers: "The difference in the installment between BNA, which is the cheapest bank, and Galicia, Santander, or Macro, which are the most expensive, is almost one million pesos for a US$100,000 property financed over 20 years at 75% of the value."

This exercise, he explained, allows for comparison with the rental of an equivalent property, although he cautioned that it should be considered as one more element of the analysis and not the only variable.

Regarding the required income, Salinas was categorical: "We should roughly assume that the loan payment should be one-third of a family's net income. If the payment is $700,000, the family income should be around $2,100,000."

That number comes from a specific simulation: "For a 20-year mortgage loan with the BNA (4.5% APR), financing 75% of a US$100,000 property, the down payment is around $700,000. If we do the same exercise with the system's average rate, the down payment rises to $1,000,000, which requires an income of around $3,000,000," he added.

The possibility of adding co-debtors opens another door, although it doesn't always solve the problem. "The problem with this is that while demonstrating a higher income allows you to get more loans, the key is who pays. If the co-debtor is your partner and you both buy the house, that's one thing. But if you only recruit a family member to lend you more and not to pay, it can get really complicated," he warned.

Comparisons between banks, rates, and down payments as of Wednesday, September 23. Source: Andrés Salinas, economist and professor at the University of La Matanza

Regarding the main obstacles, Salinas noted that the high interest rate remains the central factor. "The higher the rate, the higher the monthly payment, and the greater the income needed to maintain the monthly payment-to-income ratio," he explained. He also mentioned the reduction in financing percentages, especially for second homes, and stricter credit scoring requirements.

To the rhythm of the dollar's fluctuations

In just three days, the exchange rate significantly changed the amount a buyer needed to secure a mortgage. The property costs US$100,000, the bank lends 75% in pesos, and the buyer must put down 25%. The difference between one day and the next meant a savings of thousands of dollars.The difference between signing a deed with a mortgage lender on 3 different days:

- Friday 19th: the bank covered US$75,000, the buyer had to pay US$25,000 in advance .

- Monday 22nd: the bank covered US$79,456, the advance dropped to US$20,544 .

- Tuesday 23rd: the bank covered US$82,102, the advance fell to US$17,898 .

In just three days, the buyer went from needing $25,000 to $17,898, a savings equivalent to the value of a used car.

The consultants' diagnosis

Real estate consultant and certified public accountant Luis Hausermann emphasized that mortgage lending in Argentina has yet to take off due to market conditions. "One of the main reasons is the level of interest rates being offered. There's very little supply today, and some banks have UVA rates of over 17% per year, which makes it practically unaffordable for the average borrower," he said.Adding to this difficulty is the exchange rate dynamic. "The rise in the dollar causes the property's value to increase in pesos , which means a larger loan and a higher down payment. If we combine rising rates with higher values in pesos, the situation becomes even more complicated," he explained.

Hausermann also pointed out an additional problem that had already affected those who had taken out mortgages in previous years: “While real estate prices in dollars rose moderately, UVA debts adjusted for inflation grew much faster, even exceeding the current value of the property. This generated equity losses for borrowers and weakened bank guarantees, discouraging both the supply and demand for mortgages.”

Regarding income, the consultant agreed that the mortgage-to-income ratio is the main obstacle. “With UVA rates of over 17% per year, almost no household can afford the down payments. If we look at a more moderate scenario from a few months ago, with the dollar at $1,300 and rates of 8% plus a 10-year UVA, financing 70% of a $100,000 apartment implied a monthly payment of close to $1,100,000. That required demonstrable income of $3,700,000 plus prior savings of 30% of the property's value and the deed fees. This barrier was already very high, and with the rise of the dollar and rates, it became even worse,” he indicated.

Used 2-bedroom apartments are among the best-selling so far.

Regarding the obstacles facing applicants, Hausermann listed several: “The first is informal employment, which makes it difficult to prove income under banking standards. Many have the ability to pay, but don't meet the required documentation. Added to this are lengthy appraisal processes, delays in preparing the credit file, and notarial bureaucracy. The result is that even with solvency, approval times are long, in some cases exceeding 90 days, and access is restricted for a small segment of the population.”

Electoral scenario

The tightening of mortgage loan requirements has been particularly noticeable in recent weeks. Pablo Barrera , team leader and commercial manager of Alto Grande Desarrollos and M&M Propiedades, noted that the electoral process had a negative impact on the market: “Many banks stopped offering loans or significantly tightened their requirements. In our case, we have a project in Canning financed by Banco Nación, and we saw how approvals became much more difficult.”Faced with this scenario, the developer decided to offer direct financing to investors, with fixed installments in dollars and no interest. An apartment in Palermo valued at US$70,000 can be purchased with a US$25,000 down payment and the remainder in 30 interest-free installments. In this way, they seek to create affordable and predictable options, independent of the conditions imposed by banks or constant economic fluctuations.

“Today, we have 60 buildings delivered, 10% under construction, and 40 more plots of land in our portfolio. Our goal is to work in direct contact with the public, with the greatest possible transparency. We trust that rates will drop again and that mortgage lending will be reactivated, because this not only drives sales, but also makes it easier for those who sell a property to reinvest in new projects or real estate assets,” Barrera concluded.

www.buysellba.com