All the Answers

Well-known member

What are the best investment alternatives in the face of a new Central Bank rate cut? - Infobae

Source:

Cuáles son las mejores alternativas de inversión ante una nueva baja de tasas del Banco Central

Los rendimientos en pesos a través de los canales más difundidos -plazos fijos y cuentas remuneradas- siguen negativos respecto de la inflación. Los analistas encuentran potencial en acciones y bonos, y también en el dólar

May 03, 2024

Yields in pesos through the most widespread channels - fixed terms and remunerated accounts - remain negative with respect to inflation. Analysts find potential in stocks and bonds, and also in the dollar

By Juan Gasalla

With high inflation and low rates it is necessary to look for investment alternatives (Adrián Escandar)

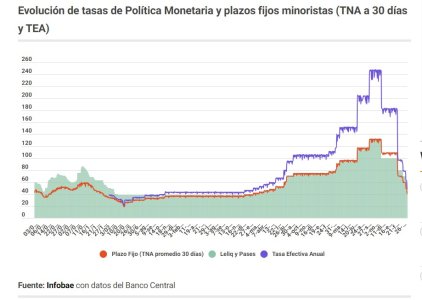

Just one week after the last cut, the Central Bank board decided this Thursday to reduce the monetary policy rate. The downward adjustment of yields in pesos, the fifth since Javier Milei came to the Government, left the monetary policy rate at 50% annual nominal.

This rate will be even lower for the retail public, since the returns on fixed terms and also on paid accounts will fall below the 40% threshold , a negative real rate with respect to the expected inflation in the next twelve months.

Therefore, it is time to evaluate alternatives to obtain some type of profit from the eventual surplus of pesos through other financial assets, in some cases more risky and sophisticated, but also with fundamentals to take into account given the economic context.

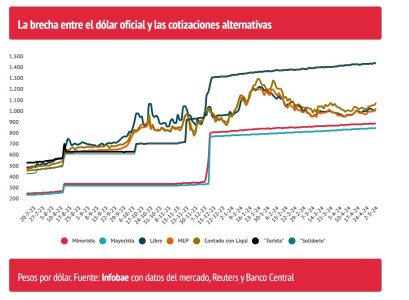

Juan Manuel Franco , Chief Economist of the SBS Group, explained that “this reinforces the policy that the current Government has been carrying out: negative real rates in pesos, which seek to reduce the real stock of remunerated liabilities of the Central Bank, a necessary condition, in our opinion. understand, to begin to remove the ironclad controls of change that persist to this day. In relation to the exchange rate, we were already seeing some buying pressure in 'cash with settlement' and MEP, which we believe could continue , although on the sidelines. We say this, given that in these markets 'the flow rules' and therefore the focus is more on the side of export settlements."

“That said, and thinking about alternatives for savers, since the rate of fixed-term placements in pesos will drop again after the BCRA cut, we believe that the most conservative could opt directly for dollars , with a cash settlement that is in minimum real levels since 2019, so it would be a bet on tranquility, even if there were greater real appreciation of the peso for some time to come. Meanwhile, for those who must necessarily invest in local currency, we believe that Lecap rates are very low and we prefer CER at these levels, given that part of the relative price adjustment still remains, especially rates that were postponed, therefore that we could eventually see some pressure from that side,” described the SBS Group expert.

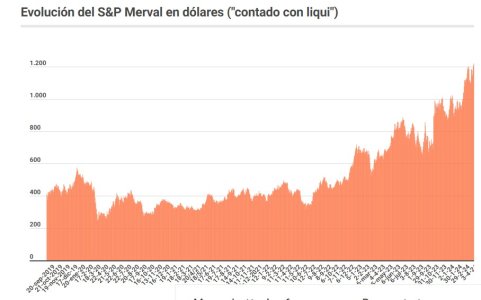

As for quotes, the initial movement on Thursday was given by stocks, with an S&P Merval that rose 3.5% to a new maximum in pesos, and also with dollars traded on the Stock Market , which advanced more than 2% , with a “contado con liqui” above $1,100 and the MEP dollar above $1,060, in both cases the highest prices since February 21.

“The recent rearrangement in financial dollars has been orderly, even in the face of another BCRA rate reduction based on successive signs of slowing inflation, given that any shock is ruled out – even in the face of a more challenging external climate – and "It anticipates that the 2% in the crawling-peg will be extended , so scenarios of greater exchange rate appreciation are validated," commented economist Gustavo Ber .

Stocks and bonds in dollars

“For those who are more risky, we emphasize that we have a constructive view for global bonds in dollars and for equities in the energy sector in the medium term. Our analyzes indicate that with Internal Rates of Return equally high as those of Ecuador, the short tranche of the Globals (GD29 and GD30) has an upside (margin for upside), which may be greater if we go to even lower rates. That said, the global context and possible volatility in international markets must also be taken into account, which could limit the short-term upside. Meanwhile, for equities we like companies like Pampa, YPF and Vista , without leaving aside papers with extremely attractive prospects such as Mercado Libre ,” said Juan Manuel Franco.Jorge Fedio , technical analyst at Clave Bursátil, highlighted that “ YPF renews its climb on the range of its maximum records, now on its bullish structure, in 'bullish continuity'. YPF skyrocketed prices, reaching the range of maximum records, Vaca Muerta in production is once again in the news. Apparently, the local investor is not deterred by the trial and the USD 16 billion committed.”

Source: Rava Bursátil-prices in dollars.

Fedio also observed a “bullish continuity” for the shares of Argentine banks , which have been reaping increases between 60% and 95% in dollars in 2024. “The banks are now the bullish key, they were the most delayed in the Merval and now Those who are projected to be in the bullish advance will be the ones who lead the present bullish eruption. They have money left over that they must distribute among different private businesses, the thing is that the State no longer takes it at gigantic rates to finance its deficit. The market's bet has been on 'change' and 'change' won and, as expected, the stock market exploded, prices shot up in favor, now with the half-sanction of the Bases Law much better. The Milei phenomenon not only aroused local interest, but also global interest. We have already seen the worst, now the Stock Market is betting on a much better future, with the 180° turn, of an Argentina that is once again the 'opportunity' for us and the entire investing world," he predicted.

Analyst Salvador Di Stefano recalled that “shares measured in dollars have grown 82.6% in the last twelve months. The AL30 bond has grown 186.4% in dollars in the last twelve months. Bond yields have more than doubled those of stocks. This seems logical, the Government assures you of a fiscal surplus, and this implies that it will honor the contracts.”

Di Stefano warned that “shares in this context rise, but they cannot be left out of a recessionary scenario, without investment in public works, and higher costs of public services. The big winners in the financial world are sovereign dollar bonds, at least for now and only for now. The TX26 inflation-adjusted peso bond rose 414.5% in pesos, against an inflation rate of 290%. If we measure their performance in MEP dollars, they rose 116.5%, the clear winner being sovereign bonds, with no rival in sight.”