BuySellBA

Administrator

Unthinkable: Property sales have been growing steadily in the city for three years - La Nacion Propiedades

Source:

www.lanacion.com.ar

www.lanacion.com.ar

June 30, 2025

Unlike the Province, in CABA the data is encouraging for the real estate market

By Carolina Contreras

In the City of Buenos Aires, the situation remains encouraging for the real estate sector.Soledad Aznarez

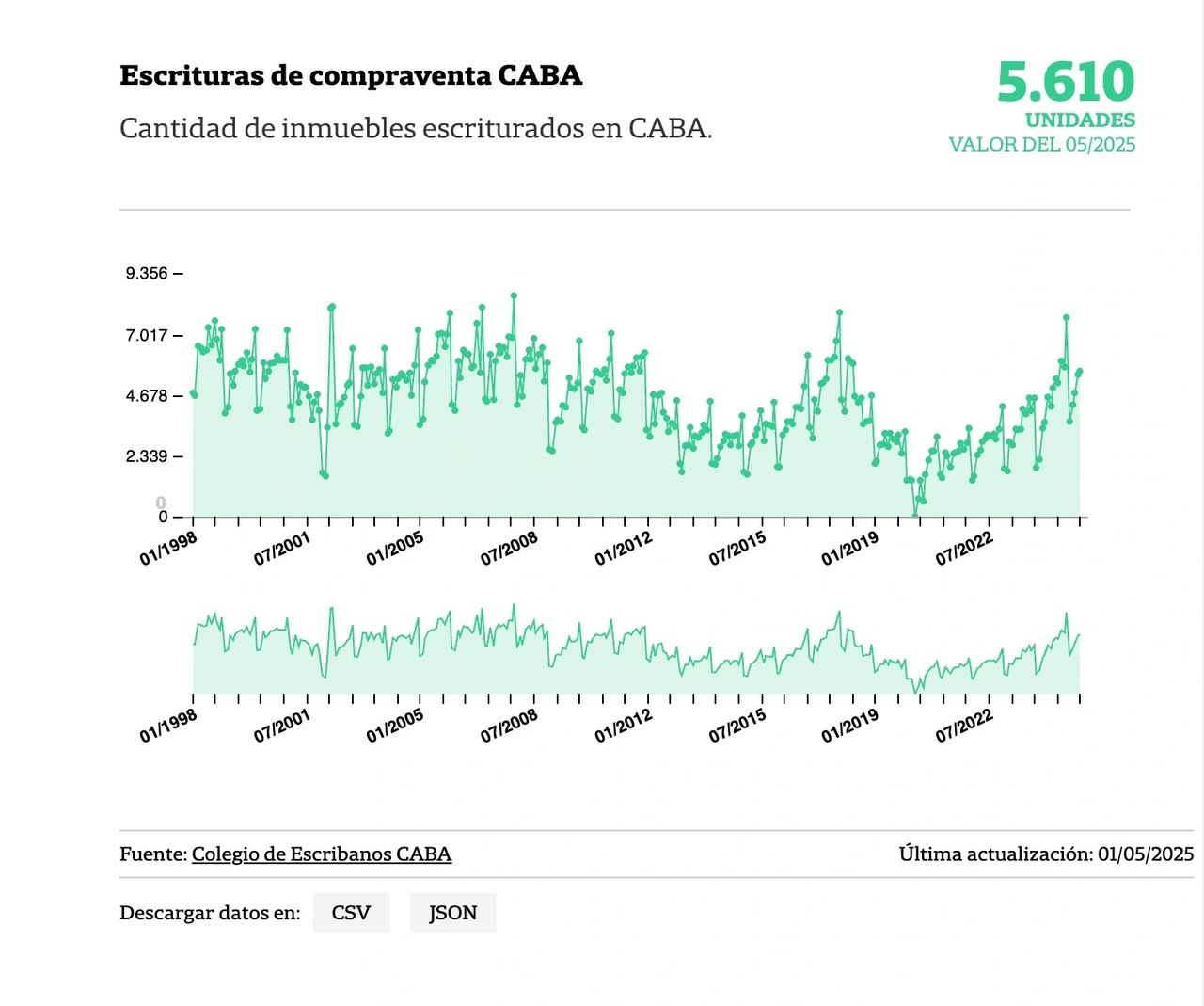

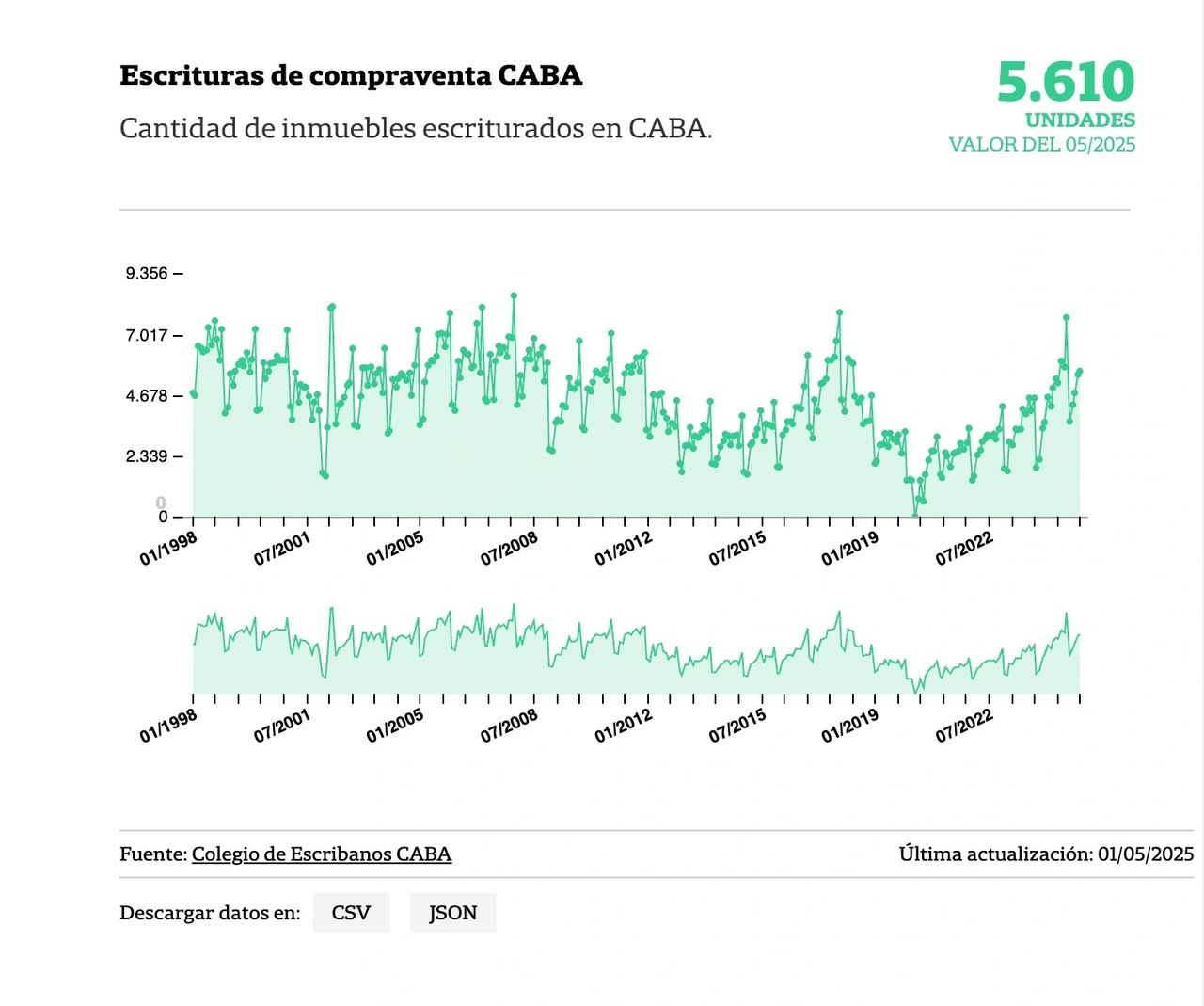

The Autonomous City of Buenos Aires continues to show signs of recovery. In May, there was an increase in the number of deeds processed : 5,610 transactions were completed , representing a 22% year-over-year increase . The total amount involved was $782.636 billion , a 125.9% increase in pesos compared to May of last year.

Compared to April (when 5,471 deeds were signed), the number grew by 2.6%. The average transaction amount was $139,507,455 (equivalent to US$119,307 at the average official exchange rate), representing an increase of 90.2% in pesos and 46.9% in dollars .

One of the most striking data points in the city was the jump in mortgage deeds : 1,300 mortgages were signed in May , an 822% increase compared to the same month last year. In the first five months of the year, there have already been 5,394 bank-financed transactions .

"We've completed three consecutive years of year-over-year growth, that is, 36 months of uninterrupted positive growth. Another encouraging fact is that credit transactions are increasing a little every month," emphasized Jorge De Bártolo, president of the Buenos Aires Notaries Association. He added: " We believe it's preferable to continue growing like this, with a more stable dollar environment, where people see that it's possible to pay a mortgage payment . "

Tour of for sale signs in the Colegiales, Belgrano, Palermo, and Villa Crespo neighborhoods. Real estate agencies. For sale. Mortgage loans.Daniel Basualdo

For his part, Alan Flexer, residential and development manager at Narvaez, is positive about the data and adds that "if the announcements regarding the use of dollars are implemented, they will add another tool to boost the buying and selling movement."

But, unlike CABA and despite the record, one piece of data turned on a warning light : in comparison with April, the market showed a drop of 3.12% and, in particular, the number of mortgage deeds fell more abruptly , which once again puts the obstacles that persist in accessing mortgage credit at the center of the debate .

According to the survey, 1,992 bank-financed transactions were completed in May . Although this number represents the best May since 2018 and a 471% year-over-year increase (last year, only 349 mortgages were signed that month), the monthly figure showed a 6% drop compared to April (when 2,110 were signed). It is also important to clarify that the first lines of loans had only just begun to be launched in May 2024, so the year-over-year comparison with respect to credit will not be very relevant.

In the first five months of the year, 47,966 deeds were signed in the Province, with a monthly average of 9,593 transactions, representing a 48.31% increase compared to the same period in 2024.

"In May, we saw the continuation of the year-over-year growth trend we've been observing for several months. Beyond the slight decline compared to April, we continue to see positive signs in the overall market performance," acknowledged Guillermo Longhi, president of the provincial Notaries Association.

The decline may seem minor in the broader context , but it hasn't gone unnoticed by the sector, which is closely monitoring the evolution of credit conditions. Between February and May, each month alone surpassed the number of mortgages signed in all of 2024. However, the new conditions imposed by banks are beginning to slow this momentum . In many cases, banks raised rates between two and five times in a matter of months, and access for self-employed workers and independent contractors remains limited, restricting the scope of financing.

In the province, mortgage deeds fell significantly in the last month. Shutterstock

The bank's president agreed: "Although the year-over-year figures remain very positive, we see a slight decrease in mortgage sales compared to the previous month. We believe one of the reasons may be the increase in interest rates from some banks, which is making the installment higher and, consequently, reducing the number of people eligible ."

To understand the rate hike, it's important to understand the current market situation: demand outstrips supply of funds. Banks finance their portfolios with short-term deposits (generally less than 90 days), while UVA loans extend to 20 or even 30 years . This difference creates tension: "You can't finance for 30 years if your deposits are for 30 days," several specialists analyze.

This gap creates a liquidity problem : every time loans are granted, banks need to fund themselves at a higher rate to maintain their supply. The system's natural response is to raise the Annual Nominal Rate (ANR) to moderate access. "There is a huge demand that has grown very quickly, and at the same time, funding mortgage loans is expensive for banks because these loans have very high ticket prices," says Federico González Rouco, an economist specializing in housing.

This makes loans more expensive and reduces the number of people who can afford to own their own homes.

Likewise, the president of the College expressed hope: "The strong year-over-year growth in the number of mortgages confirms the impact that greater availability of credit options is having. We hope this process will continue and expand, to facilitate access to housing and strengthen the sector as a whole."

“ The drop in inventory is very noticeable . There's very little of it. When a house comes in, it's listed for a higher price because there's high demand and low supply. What's at the right price sells quickly , and then there's no replacement. The drop in deed prices likely has something to do with that,” said Alejandro Soto Acebal, manager of the Varela Kramer real estate agency, which operates in the northern part of Greater Buenos Aires.

The broker explained that " listing prices today are more aligned with actual selling prices . There is no longer as much difference between what is asked and what is paid. This has narrowed the negotiation margin, and consequently, the closing price of transactions has risen."

In this regard, he warned that credit isn't driving the market as expected : "I haven't seen a large increase in mortgages; they haven't seen the expected growth. There's less credit than cash transactions: for every four deeds, one is with a mortgage. That's not what's being done most."

However, to bring some calm, he assured that to see how the market evolves, we must wait for the coming months, which tend to have the most activity (September, October, and November). These periods were also the ones with the highest activity in UVA mortgage loans in 2024, so they will be key to making an accurate year-over-year comparison.

www.buysellba.com

Source:

Impensado: desde hace tres años las ventas de propiedades no paran de crecer en la ciudad

A diferencia de la Provincia, en CABA los datos son alentadores para el mercado inmobiliario

June 30, 2025

Unlike the Province, in CABA the data is encouraging for the real estate market

By Carolina Contreras

In the City of Buenos Aires, the situation remains encouraging for the real estate sector.Soledad Aznarez

The Autonomous City of Buenos Aires continues to show signs of recovery. In May, there was an increase in the number of deeds processed : 5,610 transactions were completed , representing a 22% year-over-year increase . The total amount involved was $782.636 billion , a 125.9% increase in pesos compared to May of last year.

Compared to April (when 5,471 deeds were signed), the number grew by 2.6%. The average transaction amount was $139,507,455 (equivalent to US$119,307 at the average official exchange rate), representing an increase of 90.2% in pesos and 46.9% in dollars .

One of the most striking data points in the city was the jump in mortgage deeds : 1,300 mortgages were signed in May , an 822% increase compared to the same month last year. In the first five months of the year, there have already been 5,394 bank-financed transactions .

"We've completed three consecutive years of year-over-year growth, that is, 36 months of uninterrupted positive growth. Another encouraging fact is that credit transactions are increasing a little every month," emphasized Jorge De Bártolo, president of the Buenos Aires Notaries Association. He added: " We believe it's preferable to continue growing like this, with a more stable dollar environment, where people see that it's possible to pay a mortgage payment . "

Tour of for sale signs in the Colegiales, Belgrano, Palermo, and Villa Crespo neighborhoods. Real estate agencies. For sale. Mortgage loans.Daniel Basualdo

For his part, Alan Flexer, residential and development manager at Narvaez, is positive about the data and adds that "if the announcements regarding the use of dollars are implemented, they will add another tool to boost the buying and selling movement."

The situation in the Province: the number of mortgage transactions is decreasing

In May, the province of Buenos Aires reached its highest volume of deeds in the last 13 years . A total of 11,790 sales transactions were signed , representing a year-over-year increase of 24.65% compared to the same month in 2024, according to data from the Buenos Aires Notary Association.But, unlike CABA and despite the record, one piece of data turned on a warning light : in comparison with April, the market showed a drop of 3.12% and, in particular, the number of mortgage deeds fell more abruptly , which once again puts the obstacles that persist in accessing mortgage credit at the center of the debate .

According to the survey, 1,992 bank-financed transactions were completed in May . Although this number represents the best May since 2018 and a 471% year-over-year increase (last year, only 349 mortgages were signed that month), the monthly figure showed a 6% drop compared to April (when 2,110 were signed). It is also important to clarify that the first lines of loans had only just begun to be launched in May 2024, so the year-over-year comparison with respect to credit will not be very relevant.

In the first five months of the year, 47,966 deeds were signed in the Province, with a monthly average of 9,593 transactions, representing a 48.31% increase compared to the same period in 2024.

"In May, we saw the continuation of the year-over-year growth trend we've been observing for several months. Beyond the slight decline compared to April, we continue to see positive signs in the overall market performance," acknowledged Guillermo Longhi, president of the provincial Notaries Association.

The decline may seem minor in the broader context , but it hasn't gone unnoticed by the sector, which is closely monitoring the evolution of credit conditions. Between February and May, each month alone surpassed the number of mortgages signed in all of 2024. However, the new conditions imposed by banks are beginning to slow this momentum . In many cases, banks raised rates between two and five times in a matter of months, and access for self-employed workers and independent contractors remains limited, restricting the scope of financing.

In the province, mortgage deeds fell significantly in the last month. Shutterstock

Why did credit slacken?

Despite a 471% year-over-year increase in mortgages (from 349 in May 2024 to 1,992 this year), the monthly decline highlights a key obstacle: rising loan rates. In recent weeks, several lenders have adjusted their rates by between two and five percentage points, making monthly payments more expensive .The bank's president agreed: "Although the year-over-year figures remain very positive, we see a slight decrease in mortgage sales compared to the previous month. We believe one of the reasons may be the increase in interest rates from some banks, which is making the installment higher and, consequently, reducing the number of people eligible ."

To understand the rate hike, it's important to understand the current market situation: demand outstrips supply of funds. Banks finance their portfolios with short-term deposits (generally less than 90 days), while UVA loans extend to 20 or even 30 years . This difference creates tension: "You can't finance for 30 years if your deposits are for 30 days," several specialists analyze.

This gap creates a liquidity problem : every time loans are granted, banks need to fund themselves at a higher rate to maintain their supply. The system's natural response is to raise the Annual Nominal Rate (ANR) to moderate access. "There is a huge demand that has grown very quickly, and at the same time, funding mortgage loans is expensive for banks because these loans have very high ticket prices," says Federico González Rouco, an economist specializing in housing.

This makes loans more expensive and reduces the number of people who can afford to own their own homes.

Likewise, the president of the College expressed hope: "The strong year-over-year growth in the number of mortgages confirms the impact that greater availability of credit options is having. We hope this process will continue and expand, to facilitate access to housing and strengthen the sector as a whole."

Fall of the scriptures

Beyond the credit crunch, another explanation for the 3% month-over-month decline in deeds in general lies in the shortage of available product .“ The drop in inventory is very noticeable . There's very little of it. When a house comes in, it's listed for a higher price because there's high demand and low supply. What's at the right price sells quickly , and then there's no replacement. The drop in deed prices likely has something to do with that,” said Alejandro Soto Acebal, manager of the Varela Kramer real estate agency, which operates in the northern part of Greater Buenos Aires.

The broker explained that " listing prices today are more aligned with actual selling prices . There is no longer as much difference between what is asked and what is paid. This has narrowed the negotiation margin, and consequently, the closing price of transactions has risen."

In this regard, he warned that credit isn't driving the market as expected : "I haven't seen a large increase in mortgages; they haven't seen the expected growth. There's less credit than cash transactions: for every four deeds, one is with a mortgage. That's not what's being done most."

However, to bring some calm, he assured that to see how the market evolves, we must wait for the coming months, which tend to have the most activity (September, October, and November). These periods were also the ones with the highest activity in UVA mortgage loans in 2024, so they will be key to making an accurate year-over-year comparison.

www.buysellba.com