BuySellBA

Administrator

The most listened to economist in the real estate sector predicts what will happen in the market - La Nacion Propiedades

Source:

www.lanacion.com.ar

www.lanacion.com.ar

July 16, 2025

Federico González Rouco gave a comprehensive overview of the current situation in the sector.

By Candela Contreras

The economist Federico González RoucoFabian Malavolta

"The tone has changed," was the phrase with which Federico González Rouco decided to begin his presentation, titled "High costs, credit, and greater stability: the new scenario," at the tenth edition of the Real Estate Summit organized by LA NACION, the most popular gathering in the sector.

With a critical but hopeful perspective, the housing economist proposed a shift in the sector's conversation : "We're no longer just talking about renting; now we're also talking about credit and the challenges of construction. There are challenges, certainly, but with 'better' problems."

The new tone reflects a change in the cycle. Although stability is not complete and tensions persist, the return of mortgage lending measured in UVA (Purchasing Value Units) and greater predictability in some variables have raised expectations in the real estate sector, which until very recently felt paralyzed.

However, González Rouco did not shy away from the difficulties. “ The current economic climate is not the same for everyone ,” he warned. “Those who compete with imports lose; those who depend on market movements grow; and those who depend on appreciation depend on the market,” he said, adding: “ For construction, it’s worse; for purchasing, it’s better .”

González Rouco urged us to stop thinking in terms of cycles and learn to live with a scenario of currency appreciation if it becomes established. Fabian Malavolta

One of the data he emphasized in his presentation was that construction costs have doubled in dollar terms in the last year . González Rouco was emphatic: “We can't expect imports to do all the work. At most, they can lower costs by 10%. Structural changes are needed to lower costs, but also to promote sales prices that are acceptable.”

He also focused on a key mismatch: the growing gap between the dynamism of sales and construction activity. “The bottleneck will be how the brokerage sector grows without construction keeping pace. The gap between construction and brokerage has never been so large, except during the pandemic. And it's not sustainable,” he stated.

Mortgage lending — the central theme of his analysis—returned to the scene in 2024, after a five-year blackout. According to the data presented, nearly 20,000 loans have been granted so far this year , with another 10,000 to be added in 2024. “We haven't reached the peak of 2017/2018, but the improvement is substantial,” he emphasized.

Even so, he pointed out two major obstacles: rising interest rates and a lack of liquidity. "The average interest rate at banks—except for the National Bank—rose four points," he warned. This point is important because when banks raise rates on their loans, it makes it more difficult to access them, because the installment becomes more expensive and, consequently, so does demonstrable income.

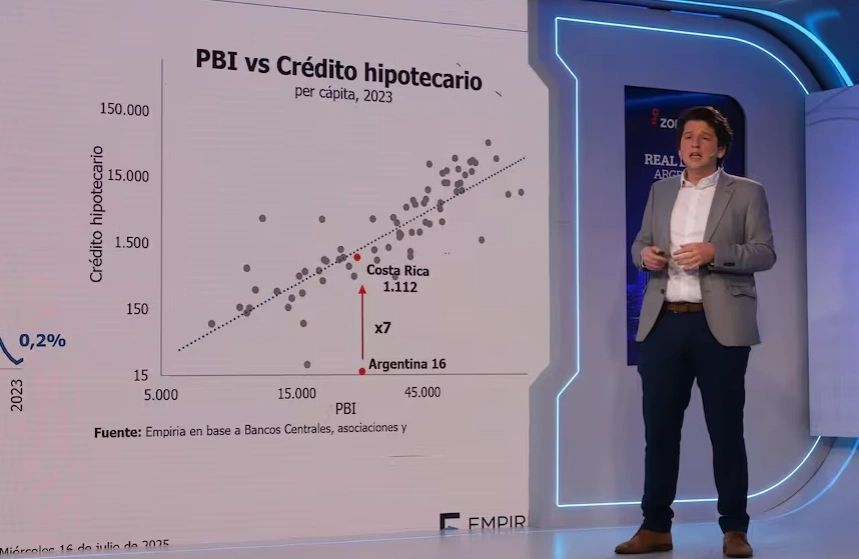

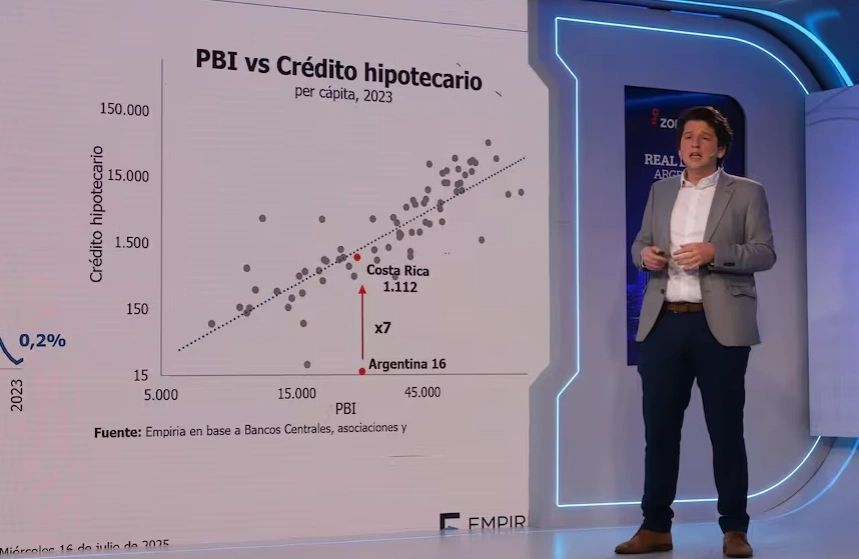

The historical comparison was revealing. “To put it into perspective: credit started from almost zero. The 2020-2023 period was the worst in Argentine history in terms of new loans and market volume. Today, mortgage loans represent just 0.2% of GDP . We are one of the countries in the world with the least mortgage loans,” he explained. He also provided regional data: “Paraguay has the equivalent of 130,000 more loans than us, and Chile has 1,800,000. So, with the exception of Venezuela, we are the worst off in Latin America .”

González Rouco closed his presentation with a series of reflections. He urged us to stop thinking in terms of cycles and learn to live with a scenario of currency appreciation if it consolidates . He also maintained that, as long as no one proves otherwise, mortgage lending will continue to be a temporary phenomenon. "Demand is infinite, even during a crisis," he asserted. But he cautioned that, while important, not everything can be measured in financial terms: "The analysis of rates versus alternative returns or rent versus monthly payments is important, but not everything fits into Excel," he said.

Finally, he offered a phrase that summed up the sector's new landscape: "It's not sustainable for intermediaries to celebrate and developers to suffer. The other side of the river is spectacular, but the river itself is quite complicated."

www.buysellba.com

Source:

El economista más escuchado en el sector inmobiliario anticipa qué pasará en el mercado

Federico González Rouco dio un panorama exhaustivo sobre la actualidad del rubro

July 16, 2025

Federico González Rouco gave a comprehensive overview of the current situation in the sector.

By Candela Contreras

The economist Federico González RoucoFabian Malavolta

"The tone has changed," was the phrase with which Federico González Rouco decided to begin his presentation, titled "High costs, credit, and greater stability: the new scenario," at the tenth edition of the Real Estate Summit organized by LA NACION, the most popular gathering in the sector.

With a critical but hopeful perspective, the housing economist proposed a shift in the sector's conversation : "We're no longer just talking about renting; now we're also talking about credit and the challenges of construction. There are challenges, certainly, but with 'better' problems."

The new tone reflects a change in the cycle. Although stability is not complete and tensions persist, the return of mortgage lending measured in UVA (Purchasing Value Units) and greater predictability in some variables have raised expectations in the real estate sector, which until very recently felt paralyzed.

However, González Rouco did not shy away from the difficulties. “ The current economic climate is not the same for everyone ,” he warned. “Those who compete with imports lose; those who depend on market movements grow; and those who depend on appreciation depend on the market,” he said, adding: “ For construction, it’s worse; for purchasing, it’s better .”

González Rouco urged us to stop thinking in terms of cycles and learn to live with a scenario of currency appreciation if it becomes established. Fabian Malavolta

One of the data he emphasized in his presentation was that construction costs have doubled in dollar terms in the last year . González Rouco was emphatic: “We can't expect imports to do all the work. At most, they can lower costs by 10%. Structural changes are needed to lower costs, but also to promote sales prices that are acceptable.”

He also focused on a key mismatch: the growing gap between the dynamism of sales and construction activity. “The bottleneck will be how the brokerage sector grows without construction keeping pace. The gap between construction and brokerage has never been so large, except during the pandemic. And it's not sustainable,” he stated.

Mortgage loans

Mortgage lending — the central theme of his analysis—returned to the scene in 2024, after a five-year blackout. According to the data presented, nearly 20,000 loans have been granted so far this year , with another 10,000 to be added in 2024. “We haven't reached the peak of 2017/2018, but the improvement is substantial,” he emphasized.

Even so, he pointed out two major obstacles: rising interest rates and a lack of liquidity. "The average interest rate at banks—except for the National Bank—rose four points," he warned. This point is important because when banks raise rates on their loans, it makes it more difficult to access them, because the installment becomes more expensive and, consequently, so does demonstrable income.

The historical comparison was revealing. “To put it into perspective: credit started from almost zero. The 2020-2023 period was the worst in Argentine history in terms of new loans and market volume. Today, mortgage loans represent just 0.2% of GDP . We are one of the countries in the world with the least mortgage loans,” he explained. He also provided regional data: “Paraguay has the equivalent of 130,000 more loans than us, and Chile has 1,800,000. So, with the exception of Venezuela, we are the worst off in Latin America .”

González Rouco closed his presentation with a series of reflections. He urged us to stop thinking in terms of cycles and learn to live with a scenario of currency appreciation if it consolidates . He also maintained that, as long as no one proves otherwise, mortgage lending will continue to be a temporary phenomenon. "Demand is infinite, even during a crisis," he asserted. But he cautioned that, while important, not everything can be measured in financial terms: "The analysis of rates versus alternative returns or rent versus monthly payments is important, but not everything fits into Excel," he said.

Finally, he offered a phrase that summed up the sector's new landscape: "It's not sustainable for intermediaries to celebrate and developers to suffer. The other side of the river is spectacular, but the river itself is quite complicated."

www.buysellba.com