BuySellBA

Administrator

The challenge of building homes that cost 60% more in dollars: Is price plateauing coming? - Ámbito Financiero

Source:

El desafío de construir viviendas con un costo 60% más caro en dólares: ¿llega el amesetamiento de precios?

Informe privado confirmó que el valor para edificar subió de u$s1.200 a u$s1.900 por m2 en 18 meses. Márgenes ajustados y panorama del mercado inmobiliario.

July 03, 2025

By José Luis Cieri

A private report confirmed that building prices rose from $1,200 to $1,900 per square meter in 18 months. Tight margins and a real estate market outlook.

The challenge will be to navigate this adjustment with realistic projects, more precise strategies, and products that respond to the demands of a market that is reconfiguring itself with new rules and costs.

The real estate market has several facets. Following the repeal of the Rental Law , the supply of properties multiplied, and sales transactions grew with the closing of the exchange rate gap and the reappearance of mortgage loans . However, these are transactions with existing properties. This analysis focuses on the cost of building new homes.

According to INDEC data, the overall economy has already recovered to peak activity levels like those seen in 2015, 2018, and 2022, but construction has not managed to reach those peaks. Although it has shown some recovery, it is still 30% below those peaks.

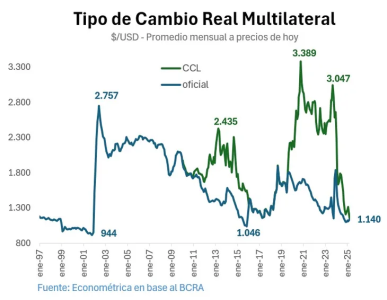

The construction industry in Argentina is going through a difficult time, as confirmed by an analysis by the consulting firm Econométrica (led by economist Ramiro Castiñeira ). In recent months, real estate developers have expressed the difficulty of facing much higher costs in dollars. Economist Martín Grandes Kerlleñevich , of CONICET (National Commission for the Promotion of Consumer Protection) and a specialist in housing policies, highlighted that the increase in costs in pesos has doubled previous values while the free dollar has remained relatively stable.

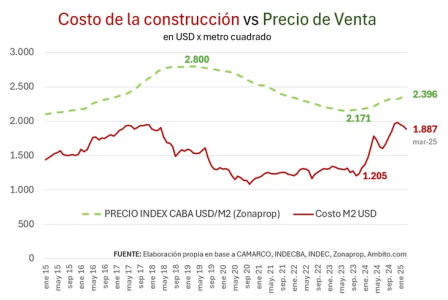

"The problem isn't just the cost itself, but the dynamics with which inputs rose compared to sales prices that fluctuated much less," explained Luis Hauserman , a real estate consultant and certified public accountant, also with Econométrica. According to his calculations, in the City of Buenos Aires, the cost of building a square meter of collective housing increased from US$1,205 in November 2023 to US$1,887 in March 2025. That is, a 57% increase in US dollars.

Source: Econometric Consulting

In contrast, data from Zonaprop shows that sales prices for apartments in the city rose only 15% over the same period, from US$2,171 to US$2,396 per square meter on average. This gap between costs and potential revenue is key to understanding the decline in business profitability.

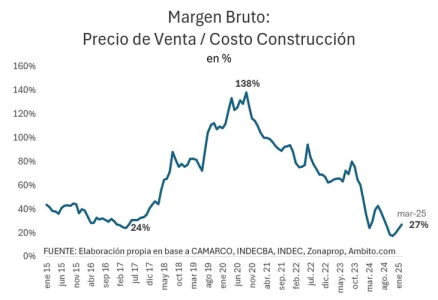

Today, the estimated gross margin, the difference between sales price and construction cost, is around 27%. For projects with three-year development and sales periods, this implies an internal rate of return ( IRR) of around 9% per year. For four years, the return falls to 6% per year. For reference, a five-year U.S. Treasury bond yields around 4%.

Source: Econometric Consulting

For Hauserman, this scenario forces us to adjust expectations and rethink strategies. “We have to adapt to lower margins or find ways to contain costs. Competition is fierce, even in a market that isn't perfectly competitive, because every developer seeks to differentiate itself through product and quality,” he explained.

Components of construction costs

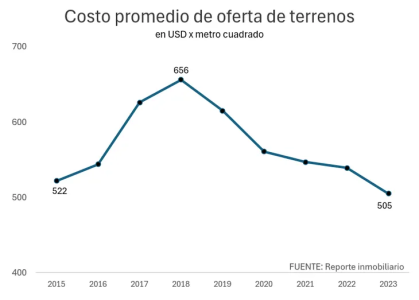

Land represents the most dollarized and essential resource for new developments. In high-demand areas, lot owners often impose conditions in dollars, making access to land for construction more expensive.

According to an analysis by Econometrica, the impact of land on total construction costs historically ranged between 25% and one-third. Today, the average value is around US$500 per square meter.

Source: Econometric Consulting

“Exchange remains a common mechanism for accessing land. Owners receive new units in exchange for the lot, which provides a degree of flexibility. However, the final price of the land is always determined in dollars and is key to the cost structure,” Grandes Kerlleñevich explained.

Labor, on the other hand, is paid in pesos and depends on collective bargaining negotiations and the evolution of formal wages. Although not directly linked to the exchange rate, high inflation and salary adjustments impacted pesos, which were then converted into dollars at the new real exchange rate.

Materials, on the other hand, show a much more direct relationship with the dollar. A significant portion is imported or depends on international prices, which exposes costs to each exchange rate fluctuation.

Source: Econometric Consulting

Over the past year and a half, the land has remained more stable, but labor, materials, and fees have quickly become more expensive. The combination has driven the cost per square meter from $1,200 to $1,900 in just 18 months.

The market at the crossroads

The sector is at a critical juncture. Costs are rising in dollar terms, but sales prices are not keeping pace. For Damián Tabakman , president of the Chamber of Urban Developers (CEDU), this leaves developers facing a difficult dilemma.

"In this context, much more precision in calculations is required, along with prudence to avoid overbidding or committing to unsustainable prices, and creativity to create attractive products that can be sold with tighter margins," Tabakman explained.

Source: Econometric Consulting

Economist Grandes emphasized that monetary policy over the last year was crucial in understanding this dynamic. "Fiscal balance and a Central Bank that stopped issuing currency contributed to the peso's recovery, and this real appreciation increased all dollar costs in the economy," he explained.

Although the official exchange rate rose slightly after the end of the currency controls, inflation reduced the real price of the free dollar, consolidating a lower exchange rate in real terms. This was reflected in higher dollar costs for the entire economy, including construction.

However, property prices in Argentina tend to be more stable and serve as a safe haven. Although construction costs jumped 60% in a year and a half, property sales prices increased significantly less.

"A highly depreciated peso meant low costs in dollars, around $1,200 per square meter. With the recovery of the peso's purchasing power, the cost dropped to $1,900," Hauserman said.

Even so, the same period showed that the formal salary in dollars rose from around US$500 to US$1,100. That is, not only did costs rise, but so did the population's purchasing power.

According to Econométrica, this phenomenon has two sides. On the one hand, higher costs in dollars reduce margins. On the other, the resurgence of mortgage loans and the growth of wages in dollars strengthen potential demand and can sustain higher prices in the medium term.

"If credit expands again on a sustained basis, buyers will be able to pay prices that validate these costs. This is a possible scenario if macroeconomic stability is maintained," Grandes explained.

Moderation and plateauing

In this regard, Tabakman maintained that construction costs are showing signs of plateauing. “Fortunately, they are stabilizing. That provides predictability and helps with better planning,” he explained. He also described a specific opportunity for the sector: “We must keep an eye on Vaca Muerta (Neuquén). Its development potential is impressive. It's a great opportunity to focus on.”

Tabakman warned that the pre-election climate could influence investment decisions during the second half of the year. "It's difficult because at this stage, people tend to postpone decisions. But after the election, if the government implements a second-generation plan, the outlook could change significantly and accelerate activity by 2026," he concluded.

www.buysellba.com