BuySellBA

Administrator

The best July in 20 years: more than 13,000 deeds in the Buenos Aires real estate market - Ambito Financiero

Source:

www.ambito.com

www.ambito.com

August 22, 2025

By José Luis Cieri

Mar del Plata is one of the cities where the most home sales transactions were carried out in July.

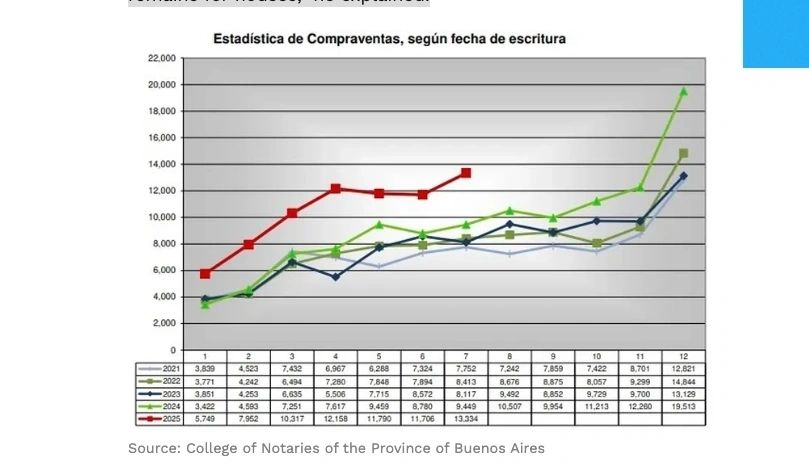

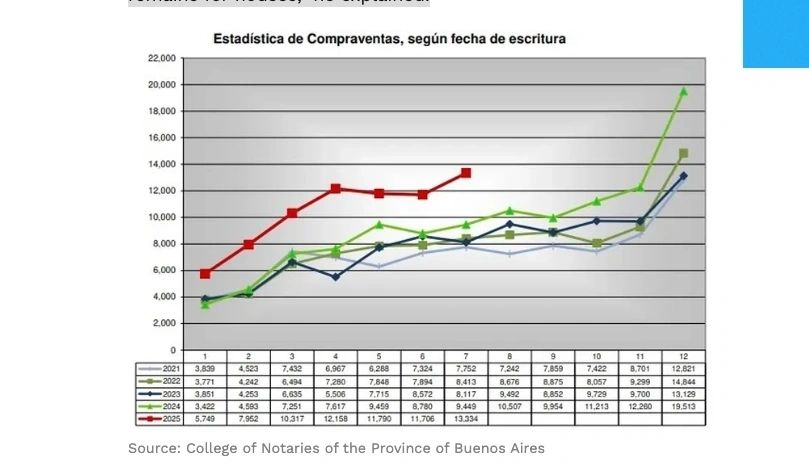

The real estate market in the province of Buenos Aires reached its best performance in the last 20 years in July. According to the Buenos Aires Notaries Association, 13,334 sales were recorded, representing a year-over-year increase of 41% compared to the 9,449 transactions in July 2024. The increase was also seen in the month-on-month comparison: in June there were 11,706, representing a 14% increase.

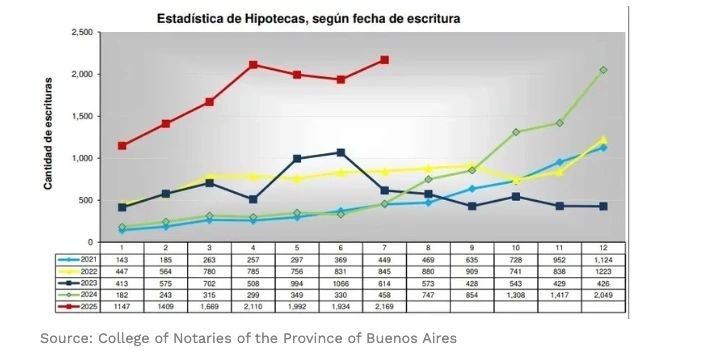

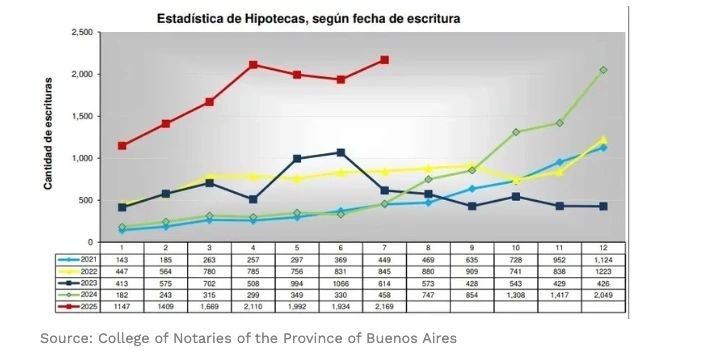

In terms of mortgage loans , the increase was even more marked. During the seventh month of the year, 2,169 mortgage deeds were recorded, 374% more than the same period last year, when there had been 458. Month-on-month growth was also seen, in this case, at 12%.

The president of the provincial Notaries Association, Guillermo Longhi , noted that mortgage leverage largely explains the current dynamic. “The upswing in sales during the month of July is largely due to the growth in mortgage lending, especially for those seeking their first home. It should also be noted that the emerging economic stability is rekindling interest in real estate among all market players, including investors who see attractive opportunities and values,” he stated.

He also emphasized the central role of legal certainty: "The involvement of a notary public is essential in every real estate transaction. Their role is to verify the legitimacy of the documentation, safeguard the rights of the parties, and ensure that the transaction is carried out within the current legal framework."

Referring to the specific case of Mar del Plata , Longhi highlighted a sustained surge in construction. "We're seeing a very dynamic market for building along the waterfront and in the Güemes area, which attracts a mid-high segment. At the same time, in recent years, gated community developments have begun to grow in the northern and southern areas, driven by the presence of schools, markets, and clinics that consolidate urban life outside the city center."

"The decision of clients to withdraw their savings in response to the measures implemented by the government also played a role. In my opinion, many decided to buy in July for fear of a spike in the dollar and prices before the elections," he indicated.

Regarding prices, he specified: "The most sought-after properties are investment apartments, between $35,000 and $45,000, and one- and two-bedroom apartments eligible for mortgage loans. There is also a group of clients looking for houses, even for renovations, in the range of $90,000 to $100,000, often combining the sale of a small apartment with a mortgage."

Regarding the outlook, Ledain warned of signs of caution: "In the last 30 or 40 days, a slowdown has been noted due to rising mortgage interest rates, which is generating uncertainty. Added to this is the delay in salary payments. In any case, we are hopeful that the market's pace will improve, provided the economy shows exchange rate, monetary, and financial stability."

In this regard, Ledain highlighted the role of loans: "Mortgage loans play an important role because they allow many people to access their homes. Although the percentage of loans taken out is still low, the wheels have started to turn."

Regarding the offer, he emphasized: "Properties that have complete documentation and plans that match the construction are sold, because that's what the banks require. Transactions are also being made on properties that are at a reasonable price."

The central area of La Plata, in the provincial capital, is dynamic, and July was the best year for operations in 20 years.

In Ciudad Bell, demand is concentrated in one- or two-bedroom homes between $130,000 and $180,000, eligible for bank financing. One-bedroom apartments with amenities have also gained popularity due to their security and convenient common services. In La Plata, a studio apartment starts at $65,000, while a one-bedroom apartment starts at $85,000. A two-bedroom house starts at $200,000.

Regarding the outlook, Otero Rossi stated: “So far, this is the best year in a long time, but confidence needs to be consolidated. We should get used to the fact that a building under construction and financed will be more expensive than a finished one. The price per square meter of construction won't go down. For developers, if divisible mortgages are implemented, the sector will become more active.”

www.buysellba.com

Source:

El mejor julio en 20 años: más de 13.000 escrituras en el mercado inmobiliario bonaerense

Cuáles son las causas del repunte, precios y las viviendas que más se venden. Las hipotecas crecieron 374% con 2.169 operaciones.

August 22, 2025

By José Luis Cieri

Mar del Plata is one of the cities where the most home sales transactions were carried out in July.

The real estate market in the province of Buenos Aires reached its best performance in the last 20 years in July. According to the Buenos Aires Notaries Association, 13,334 sales were recorded, representing a year-over-year increase of 41% compared to the 9,449 transactions in July 2024. The increase was also seen in the month-on-month comparison: in June there were 11,706, representing a 14% increase.

In terms of mortgage loans , the increase was even more marked. During the seventh month of the year, 2,169 mortgage deeds were recorded, 374% more than the same period last year, when there had been 458. Month-on-month growth was also seen, in this case, at 12%.

The president of the provincial Notaries Association, Guillermo Longhi , noted that mortgage leverage largely explains the current dynamic. “The upswing in sales during the month of July is largely due to the growth in mortgage lending, especially for those seeking their first home. It should also be noted that the emerging economic stability is rekindling interest in real estate among all market players, including investors who see attractive opportunities and values,” he stated.

Demand trends

Longhi clarified that the choice varies depending on the size of the city. "Today, we see that most citizens are turning to buying apartments in large cities, while in smaller towns, the preference remains for houses," he explained.

He also emphasized the central role of legal certainty: "The involvement of a notary public is essential in every real estate transaction. Their role is to verify the legitimacy of the documentation, safeguard the rights of the parties, and ensure that the transaction is carried out within the current legal framework."

Referring to the specific case of Mar del Plata , Longhi highlighted a sustained surge in construction. "We're seeing a very dynamic market for building along the waterfront and in the Güemes area, which attracts a mid-high segment. At the same time, in recent years, gated community developments have begun to grow in the northern and southern areas, driven by the presence of schools, markets, and clinics that consolidate urban life outside the city center."

Vision from the sector

Lilian Ledain , the new president of the Real Estate Chamber of the Province of Buenos Aires (CIBA), believes the upswing is linked to both credit and money laundering. "The transformation of the Buenos Aires real estate market is due in part to mortgage loans. Those who qualify prefer to buy and pay a higher down payment than rent, with the difference that they have access to their own home.""The decision of clients to withdraw their savings in response to the measures implemented by the government also played a role. In my opinion, many decided to buy in July for fear of a spike in the dollar and prices before the elections," he indicated.

Regarding prices, he specified: "The most sought-after properties are investment apartments, between $35,000 and $45,000, and one- and two-bedroom apartments eligible for mortgage loans. There is also a group of clients looking for houses, even for renovations, in the range of $90,000 to $100,000, often combining the sale of a small apartment with a mortgage."

Regarding the outlook, Ledain warned of signs of caution: "In the last 30 or 40 days, a slowdown has been noted due to rising mortgage interest rates, which is generating uncertainty. Added to this is the delay in salary payments. In any case, we are hopeful that the market's pace will improve, provided the economy shows exchange rate, monetary, and financial stability."

In this regard, Ledain highlighted the role of loans: "Mortgage loans play an important role because they allow many people to access their homes. Although the percentage of loans taken out is still low, the wheels have started to turn."

Prices and preferences in "the City of Diagonals"

Dolores Otero Rossi , director of Otero Rossi Real Estate City Bell, focused on the progress of the Buenos Aires capital and its surrounding areas. "The confidence generated by a macroeconomy that is becoming more organized, the emergence of new mortgage loans, and the fact that prices have not yet risen as expected have boosted the market," she explained.Regarding the offer, he emphasized: "Properties that have complete documentation and plans that match the construction are sold, because that's what the banks require. Transactions are also being made on properties that are at a reasonable price."

The central area of La Plata, in the provincial capital, is dynamic, and July was the best year for operations in 20 years.

In Ciudad Bell, demand is concentrated in one- or two-bedroom homes between $130,000 and $180,000, eligible for bank financing. One-bedroom apartments with amenities have also gained popularity due to their security and convenient common services. In La Plata, a studio apartment starts at $65,000, while a one-bedroom apartment starts at $85,000. A two-bedroom house starts at $200,000.

Regarding the outlook, Otero Rossi stated: “So far, this is the best year in a long time, but confidence needs to be consolidated. We should get used to the fact that a building under construction and financed will be more expensive than a finished one. The price per square meter of construction won't go down. For developers, if divisible mortgages are implemented, the sector will become more active.”

www.buysellba.com