BuySellBA

Administrator

Purchase and sale transactions increase despite the rising dollar and the fall in mortgage lending - La Nacion Propiedades

Source:

www.lanacion.com.ar

www.lanacion.com.ar

October 23, 2025

Deeds in the City of Buenos Aires rose in September, but it did not surprise the market.

By Candela Contreras

In September, the real estate market showed positive signs despite the current context. Shutterstock

Despite all expectations, September saw its biggest jump since the return of UVA mortgage loans —in May 2024. The figures for the ninth month of the year in both the province of Buenos Aires and the City are surprising to a sector where bank financing lines are virtually nonexistent , the exchange rate is rising steadily (despite attempts to stabilize it), and the pre-election period is putting both potential borrowers and the market in general in jeopardy.

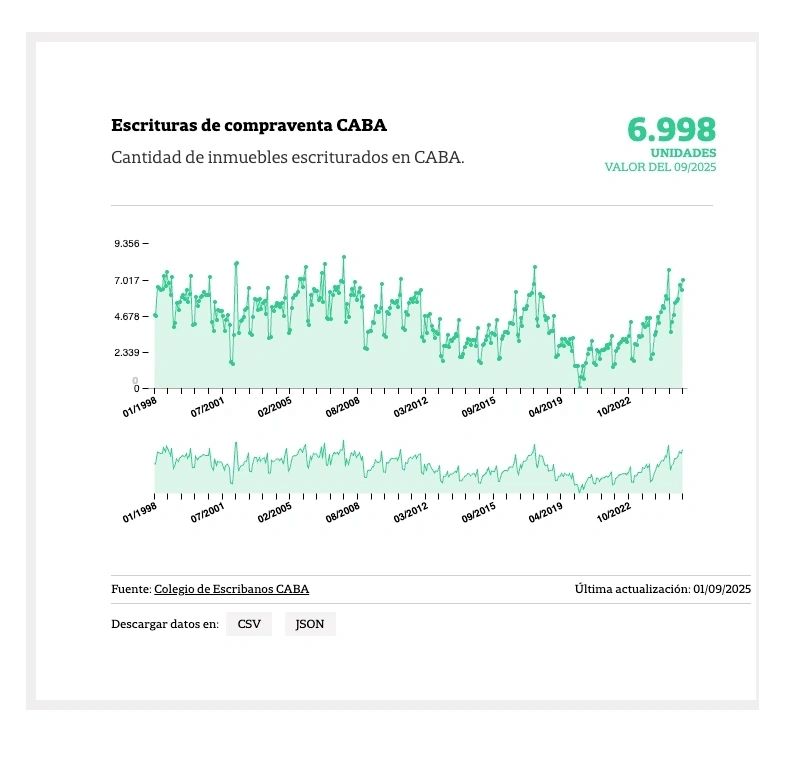

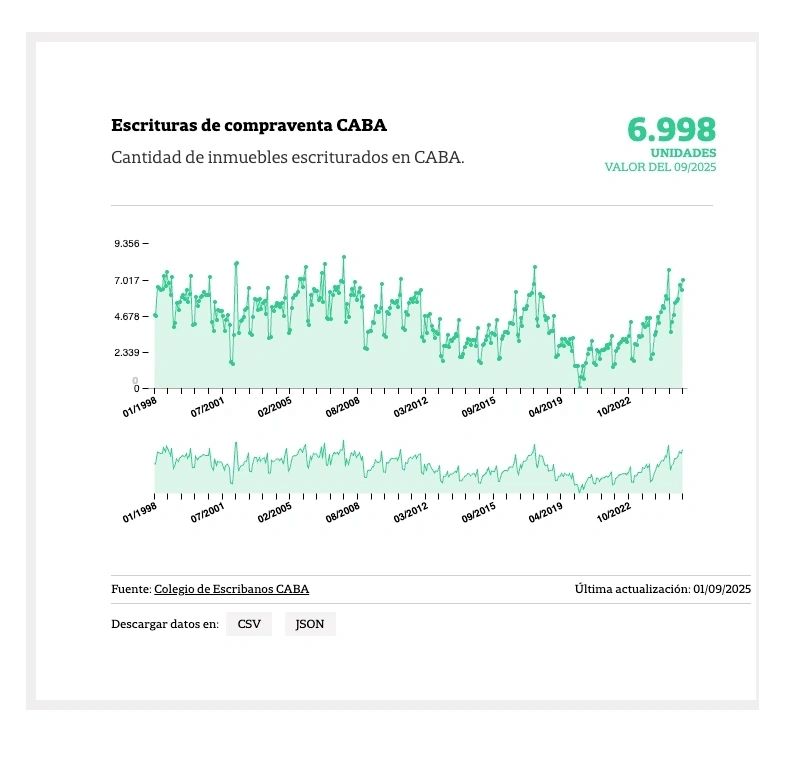

To put this into context, according to data from the Buenos Aires Notary Association , 6,998 deeds were signed in September , 9.9% more than the 6,370 closed in August . Meanwhile, year-over-year, the increase was 35.7% . It was the best third September in the entire historical series in almost 30 years.

The total amount involved reached $1,162,355 million (a 139.8% year-over-year increase), with an average transaction value of $166,098,185 (equivalent to US$116,608). This demonstrates that the used car average ticket departments were the main protagonists during this period, but will be the most affected when the data for the following months are known.

However, the used segment has a major advantage : historically low prices and a price-to-asset ratio that makes it relatively cheaper than other instruments in the Argentine economy.

So far this year, nearly 50,000 transactions have been formalized, of which more than 10,000 were mortgage-backed. That is, more than 20% of the total were purchased with a mortgage loan. Despite these numbers, there's still a long way to go to increase that percentage and it's still far from the UVA boom during Mauricio Macri's administration, when it reached 2,300 mortgage-backed deeds in one month.

In September, 14,366 deeds of sale were formalized in the province of Buenos Aires. Ricardo Pristupluk

"The increase in the number of mortgages continues to highlight the importance of financing in market dynamics. It's a decisive factor in sustaining growth and expanding housing affordability," Longhi emphasizes.

www.buysellba.com

Source:

Crecen las operaciones de compraventa pese al dólar en alza y la caída del crédito hipotecario

Las escrituras en la Ciudad de Buenos Aires subieron en septiembre, pero no sorprendió al mercado

October 23, 2025

Deeds in the City of Buenos Aires rose in September, but it did not surprise the market.

By Candela Contreras

In September, the real estate market showed positive signs despite the current context. Shutterstock

Despite all expectations, September saw its biggest jump since the return of UVA mortgage loans —in May 2024. The figures for the ninth month of the year in both the province of Buenos Aires and the City are surprising to a sector where bank financing lines are virtually nonexistent , the exchange rate is rising steadily (despite attempts to stabilize it), and the pre-election period is putting both potential borrowers and the market in general in jeopardy.

To put this into context, according to data from the Buenos Aires Notary Association , 6,998 deeds were signed in September , 9.9% more than the 6,370 closed in August . Meanwhile, year-over-year, the increase was 35.7% . It was the best third September in the entire historical series in almost 30 years.

The total amount involved reached $1,162,355 million (a 139.8% year-over-year increase), with an average transaction value of $166,098,185 (equivalent to US$116,608). This demonstrates that the used car average ticket departments were the main protagonists during this period, but will be the most affected when the data for the following months are known.

However, the used segment has a major advantage : historically low prices and a price-to-asset ratio that makes it relatively cheaper than other instruments in the Argentine economy.

So far this year, nearly 50,000 transactions have been formalized, of which more than 10,000 were mortgage-backed. That is, more than 20% of the total were purchased with a mortgage loan. Despite these numbers, there's still a long way to go to increase that percentage and it's still far from the UVA boom during Mauricio Macri's administration, when it reached 2,300 mortgage-backed deeds in one month.

In September, 14,366 deeds of sale were formalized in the province of Buenos Aires. Ricardo Pristupluk

What happened to the deeds signed with a mortgage loan?

As for mortgages, September also saw an increase . In the ninth month of the year, 2,440 were signed , representing a 186% increase compared to the same month last year, and a 7% increase compared to August ."The increase in the number of mortgages continues to highlight the importance of financing in market dynamics. It's a decisive factor in sustaining growth and expanding housing affordability," Longhi emphasizes.

www.buysellba.com