BuySellBA

Administrator

Property sales haven't fallen for 41 months, but one piece of data is a warning to the market - La Nacion Propiedades

Source:

www.lanacion.com.ar

www.lanacion.com.ar

July 24, 2025

Property sales continue to grow, although mortgage lending is slowing.

By Maria Josefina Lanzi

Mortgage property sales fell in the city. JULIAN BONGIOVANNI

Since the rise of mortgage lending in Argentina in April of last year, interest in property purchases has grown, setting records. Today, the number of purchase and sale transactions continues to increase month on month compared to the same period last year, although mortgages are showing a slowdown.

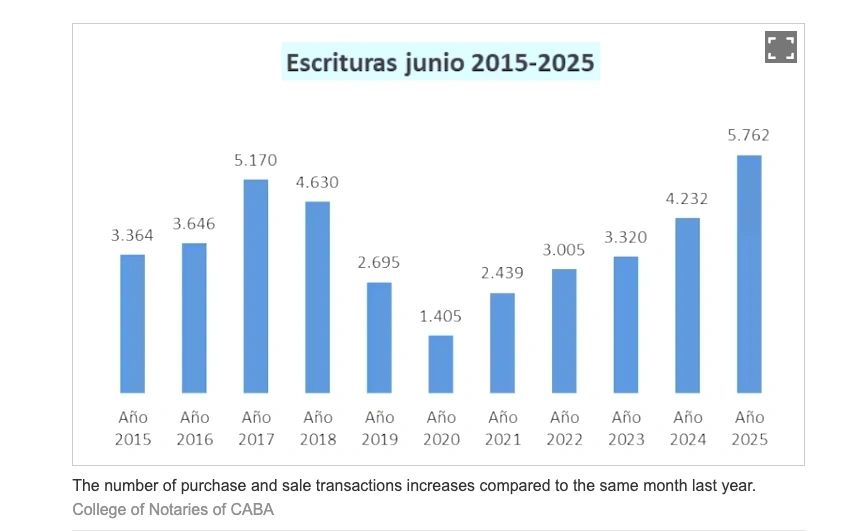

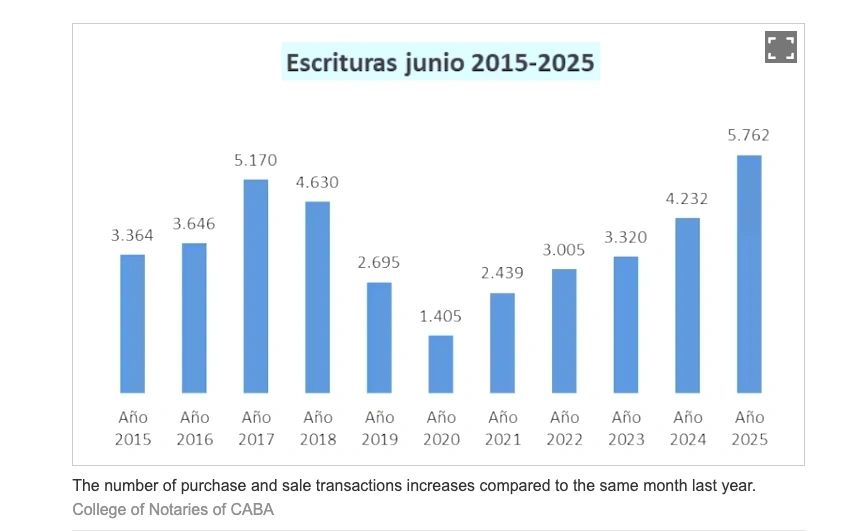

This was revealed in a report from the Notaries Association of the City of Buenos Aires, which shows that 5,762 deeds were signed in June, representing a 36.1% increase compared to the same month last year. Compared to May 2025, the number of deeds grew by 2.7%, with 5,610 signed in that month. Meanwhile, the total amount of transactions completed in June increased by 128.6%, to $827.688 billion.

These transaction numbers represent 41 consecutive months of increases compared to the same month last year. They also represent nearly 30,000 deeds in the first six months of the year, which is almost 50% more than the same period in 2024 (when there were almost 20,000).

Regarding the share of mortgage loans in transactions, this revealed two realities: on the one hand, there was a 957.4% increase compared to the same month last year (at a time when mortgage lending had not yet taken off), given that 1,216 mortgage deeds were executed ; on the other hand, there was a 6.46% decrease compared to May of this year.

"It speaks of stagnation, of having reached a ceiling, although it's a marginal drop from one month to the next, and the level remains above 1,200, so it's not that significant," shared Federico González Rouco, an economist specializing in housing who works at the consulting firm Empiria.

It's worth adding that mortgages represented 21% of total transactions in June, when "there were times when it was barely 2-3%, although with the UVA boom, it was almost 4 out of 10," the Buenos Aires Notaries Association adds.

The credit freeze can be explained by the rise in interest rates that banks have been implementing on their loan lines. This limits access to loans, as it increases the cost of installments and requires a higher salary to qualify for credit. At the same time, " funding mortgage loans is expensive for banks, as these loans have very high ticket prices," explains González Rouco, adding: " They require tools such as portfolio titling or securitization, which enable long-term financing and are realized through retirement funds, pension insurance, among others, but these still do not exist in Argentina today."

Properties: Nearly 30,000 deeds were signed in the first six months of the year in Buenos Aires.Uladzimir Zuyeu - Shutterstock

“It’s the best June of the decade and the seventh in the historical series that began in 1998,” says Jorge De Bártolo, president of the Buenos Aires Notaries Association, adding: “On the other hand, it was also the best June for mortgage deeds since they began to be measured in 2009. However , another reading tells us that we may be seeing these mortgage loan figures reach their peak, because this month marked a deceleration of the upward trend (1,300 in May).”

“ The dynamics of the first six months of the year show a very dynamic real estate market , with genuine demand and also mortgage demand, and with year-on-year growth that places it at the best figures of the last 18 years,” shares Fabián Achával, of the eponymous real estate agency, adding: “This is because it is clearly the moment for used properties, given the difference they have compared to brand new or under construction properties. Furthermore, in historical terms, real prices are at 2006 levels, so there is a clear buying signal; anyone who buys a property today knows they will be buying at a lower price than in a year.”

In the Province of Buenos Aires, 11,706 property sales were registered in June.Ricardo Pristupluk

The authorities of the Notaries Association emphasized that the volume of deeds remains high, consolidating the positive trend seen throughout the year.

Regarding credit, there was also a year-over-year increase, with 1,934 mortgage transactions signed, representing a 486% increase compared to the 330 mortgages registered in the same month a year earlier. However, in the monthly comparison, there was a slight drop of 2.91%, given that 1,992 bank-financed transactions had been completed in May .

“In June, we once again saw notable year-over-year growth, demonstrating a sustained recovery in the sector. Although there was a slight decrease compared to May, the level of activity remains high,” says Guillermo Longhi, president of the Notaries Association of the Province of Buenos Aires. Regarding mortgage lending, he shares: “The significant increase in the number of mortgages reaffirms the positive impact of credit instruments. It is crucial that this trend continues and deepens, as access to financing is essential to continue strengthening the sector.”

www.buysellba.com

Source:

Hace 41 meses que no caen las ventas de propiedades pero un dato alerta al mercado

La compraventa de propiedades sigue creciendo, aunque el crédito hipotecario muestra un enfriamiento

July 24, 2025

Property sales continue to grow, although mortgage lending is slowing.

By Maria Josefina Lanzi

Mortgage property sales fell in the city. JULIAN BONGIOVANNI

Since the rise of mortgage lending in Argentina in April of last year, interest in property purchases has grown, setting records. Today, the number of purchase and sale transactions continues to increase month on month compared to the same period last year, although mortgages are showing a slowdown.

This was revealed in a report from the Notaries Association of the City of Buenos Aires, which shows that 5,762 deeds were signed in June, representing a 36.1% increase compared to the same month last year. Compared to May 2025, the number of deeds grew by 2.7%, with 5,610 signed in that month. Meanwhile, the total amount of transactions completed in June increased by 128.6%, to $827.688 billion.

These transaction numbers represent 41 consecutive months of increases compared to the same month last year. They also represent nearly 30,000 deeds in the first six months of the year, which is almost 50% more than the same period in 2024 (when there were almost 20,000).

Regarding the share of mortgage loans in transactions, this revealed two realities: on the one hand, there was a 957.4% increase compared to the same month last year (at a time when mortgage lending had not yet taken off), given that 1,216 mortgage deeds were executed ; on the other hand, there was a 6.46% decrease compared to May of this year.

"It speaks of stagnation, of having reached a ceiling, although it's a marginal drop from one month to the next, and the level remains above 1,200, so it's not that significant," shared Federico González Rouco, an economist specializing in housing who works at the consulting firm Empiria.

It's worth adding that mortgages represented 21% of total transactions in June, when "there were times when it was barely 2-3%, although with the UVA boom, it was almost 4 out of 10," the Buenos Aires Notaries Association adds.

The credit freeze can be explained by the rise in interest rates that banks have been implementing on their loan lines. This limits access to loans, as it increases the cost of installments and requires a higher salary to qualify for credit. At the same time, " funding mortgage loans is expensive for banks, as these loans have very high ticket prices," explains González Rouco, adding: " They require tools such as portfolio titling or securitization, which enable long-term financing and are realized through retirement funds, pension insurance, among others, but these still do not exist in Argentina today."

Properties: Nearly 30,000 deeds were signed in the first six months of the year in Buenos Aires.Uladzimir Zuyeu - Shutterstock

“It’s the best June of the decade and the seventh in the historical series that began in 1998,” says Jorge De Bártolo, president of the Buenos Aires Notaries Association, adding: “On the other hand, it was also the best June for mortgage deeds since they began to be measured in 2009. However , another reading tells us that we may be seeing these mortgage loan figures reach their peak, because this month marked a deceleration of the upward trend (1,300 in May).”

“ The dynamics of the first six months of the year show a very dynamic real estate market , with genuine demand and also mortgage demand, and with year-on-year growth that places it at the best figures of the last 18 years,” shares Fabián Achával, of the eponymous real estate agency, adding: “This is because it is clearly the moment for used properties, given the difference they have compared to brand new or under construction properties. Furthermore, in historical terms, real prices are at 2006 levels, so there is a clear buying signal; anyone who buys a property today knows they will be buying at a lower price than in a year.”

How were the properties sold in the province of Buenos Aires?

Meanwhile, in the Province of Buenos Aires, 11,706 property sales were recorded in June, according to figures from the Buenos Aires Notary Association. These figures also reflect a 33% increase compared to the same month last year. However, compared to May, there was a slight decrease of 0.7%, when 11,790 transactions were completed.

In the Province of Buenos Aires, 11,706 property sales were registered in June.Ricardo Pristupluk

The authorities of the Notaries Association emphasized that the volume of deeds remains high, consolidating the positive trend seen throughout the year.

Regarding credit, there was also a year-over-year increase, with 1,934 mortgage transactions signed, representing a 486% increase compared to the 330 mortgages registered in the same month a year earlier. However, in the monthly comparison, there was a slight drop of 2.91%, given that 1,992 bank-financed transactions had been completed in May .

“In June, we once again saw notable year-over-year growth, demonstrating a sustained recovery in the sector. Although there was a slight decrease compared to May, the level of activity remains high,” says Guillermo Longhi, president of the Notaries Association of the Province of Buenos Aires. Regarding mortgage lending, he shares: “The significant increase in the number of mortgages reaffirms the positive impact of credit instruments. It is crucial that this trend continues and deepens, as access to financing is essential to continue strengthening the sector.”

www.buysellba.com