BuySellBA

Administrator

Property prices: the change in supply could halt the rise - La Nacion Propiedades

Source:

Los precios de las propiedades: el cambio de tendencia en la oferta que podría detener la suba

En un mercado que sigue despegando, un indicador en la ciudad de Buenos Aires cambió de dirección y presenta un nuevo escenario para quienes ponen en venta su propiedad

June 04, 2025

In a market that continues to take off, an indicator in the city of Buenos Aires changed direction and presents a new scenario for those who put their property up for sale.

By Maria Josefina Lanzi

When the market was experiencing a decline in the stock of properties for sale, the offer has grown in recent months and marked a change in trend.Uladzimir Zuyeu - Shutterstock

The real estate traffic light has remained green for over a year. From listing prices continuing to rise, sales transactions steadily increasing month after month, to the increasing share of mortgage loans in property deeds , everything indicates that the market is slowly continuing to take off. At the same time, another index, which has marked a change in trend in recent months, is alerting real estate brokers.

On the one hand, there are many figures that show good news; a closer look at the aforementioned indicators reveals that publication values continue to rise.

Apartment prices in Buenos Aires City have increased by 3.9% so far this year, according to Zonaprop's May report , and have accumulated a 10.7% increase since the beginning of 2024. This represents 22 months of monthly growth and 15 consecutive months of year-on-year increases .

Meanwhile, sales transactions have been surpassing previous records month after month: in April, 5,471 deeds were signed in the city of Buenos Aires, representing a 50% increase compared to the same month in 2024.

Looking back at previous months, year-on-year growth was 93.7% in January and 94% in February. Furthermore, looking back at recent months, we see that 18,156 transactions were recorded in the first four months, the second-highest figure in the last 18 years.

Purchase and sale transactions have been exceeding month-on-month compared to a year ago: in April, 50% more deeds were signed compared to the same month in 2024.Shutterstock

The macroeconomic context is also helpful, as the recent lifting of the currency controls will streamline transactions in a market traditionally governed by dollars. In this regard, visits to real estate websites bode well: according to figures from Daniel Bryn, there were 13,922,000 online searches in May, representing a 13% year-over-year increase.

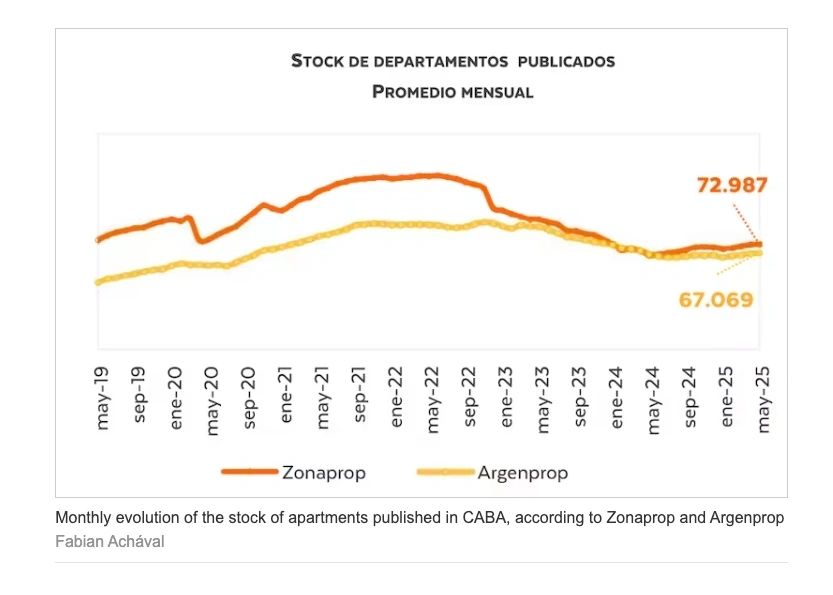

Now, as mentioned before, another of the sector's indicators turned yellow on the real estate traffic light. With the reactivation of sales, the listing stock had been declining and new supply was not being replenished at the same rate as sales, but according to figures from the Real Estate Radar, prepared by the Fabián Achával real estate agency, "we have detected three months of year-over-year growth, after 29 consecutive months of decline." More precisely, in May, supply grew 10.6% compared to May of the previous year: there are 72,000 apartments for sale and 106,000 properties across all types, according to Zonaprop.

Why is the supply of properties for sale in Buenos Aires increasing?

In a growing market with positive numbers like those mentioned above , supply levels appear to be a paradox. In this regard, industry experts have their own hypotheses regarding this apparent contradiction.Achával analyzed the data, initially thinking that the increase in listings could be due to a rise in the number of properties under construction listed, which, due to the sharp increase in costs, could lead to unsold properties. However, his research, based on figures analyzed by Soledad Balayan, owner of Maure Inmobiliaria, shows that "since January 2024, the under-construction segment has seen an 82% drop in supply, while the increase in the supply of used properties over 50 years old has been 21%."

Based on this data, the broker estimates that the increase in inventory may come from a group of people who had withdrawn their properties from sale, given the drop in prices from 2019 onward, and who are now putting their properties back on the market. "The inventory on offer went from 165,000 properties in 2022 to around 100,000 in 2024. Today, those owners may be returning because they see better prices and more demand in the market ," explains Achával.

The supply of properties for sale has accumulated three months of year-on-year growth, after 29 consecutive months of declines.Daniel Basualdo

“When Javier Milei's DNU (Decree of the New Urban Development Plan) was passed in December 2023, the supply of rental properties grew, as the law regulating this activity was repealed and once again became an attractive investment. That initial surge has now leveled off, and people who had perhaps offered their apartments for rent again have terminated their contracts and are now offering them on the buying and selling market ,” Balayan analyzes.

Santiago Mieres, from the eponymous real estate agency, agrees that this phenomenon of rising property listings is occurring in Buenos Aires City, although he clarifies that the situation is different in the northern and western regions. "Many homeowners who had been waiting to see how the market would react to loans are now finding prices are rising. Added to this is the new labor market situation, which requires more in-person work (which is causing people who might have wanted to migrate to the north or suburban areas to return to the capital), stability in the new government, and the legalization of property rights, which has generated a lot of movement in property sales in Buenos Aires City and has motivated many reluctant homeowners to put their properties back on the market."

On the other hand, in places like the north and west , he clarifies that the stock situation is different: “Especially in the north, the amount of available supply, both in square meters of apartments and square meters of houses, is historic. In 70 years of history, we've never seen a time when there was so little supply ; today, we have 50% less than we had two years ago.”

Another specialist, José Rozados, director of Reporte Inmobiliario, asserts that the increase in real estate supply in Buenos Aires is occurring across the board, but is more pronounced in some neighborhoods than others. He explains that, thanks to mortgage loans, some areas are now recovering, beginning to experience a demand that didn't exist before because they didn't have this financing tool.

" Those properties weren't advertised ; it didn't make sense to invest in advertising them when the potential demand they were targeting, given the location, didn't have the resources to buy them. Today, that property is feasible to sell because of the credit available ," Rozados explains.

Will prices go down?

“The increase in the supply of properties for sale in recent months isn't significant, but it sets a different standard and raises questions about how much prices will rise this year, since for there to be a sharp increase, the property supply must be depleted .” This is raising concerns, especially among real estate developers, who are eagerly awaiting the rise in prices for used properties. After the increase in construction costs, existing property values grew sharply, creating a gap between the prices of used and existing properties. “Today, the playing field is in favor of the existing residential segment, which has very attractive prices , as they remain at 2006 values in real terms. If that market begins to deplete, existing property prices will rise even more sharply, which will also generate greater attraction for existing properties,” Achával adds.Soledad Balayan believes the good news about the increased supply is that people have more purchasing options, although she also believes it may slow price increases. At the same time, she adds a component to the analysis: "We must ask ourselves if the increase in supply is what people are looking for ." In this regard, she points out that the most in-demand options for purchase in the capital today are three- and four-bedroom apartments, but they are not what has seen the greatest increase in supply. To illustrate this, she provides figures for the year-over-year increase in the supply of apartments for sale in Buenos Aires by type in one week in May (compared to the same week in May 2024): supply increased 29% for studio apartments, 15% for two-bedroom apartments, but only 3% for three-bedroom apartments, and 5% for four-bedroom apartments.

Rozados also analyzes the supply figures, focusing on Palermo. He notes that the difference between April 2024 and April 2025 shows a 67% increase in the supply of studio apartments, a 41% increase in two-bedroom apartments, but only a 1.3% increase in three-bedroom apartments. Regarding this, Balayan explains: “ The impact on prices will depend on demand pressure : the more people fight over the same property, the higher the value will be. In the case of studio apartments, there is a lot of supply and little demand pressure, so I don't see much price increase in that segment.”

www.buysellba.com