hey

@Digital Nomad - this is my main interest in Argentina! here's some chatter about buying a place with Bitcoin (especially Bitcoin Cash/BCH for me)

cash is king in most of the world, from India to Russia to China to Argentina...really don't get the theme of a few folks here, thinking Buenos Aires has anything unique about it. you can say that any city in the world is the 'most difficult to ______' and there will be something that fits...

www.expatsba.com

El Salvador's president Bukele made BTC legal tender years back, and now he's re-elected and enjoying some profits. but BTC is slower and more expensive (this week $5 USD median fee, so it's worse than just using an app to send "fiat" money like Dollars/Pesos)

i use

Bitcoin Cash because it's worked for years and serves as the original blockchain of Bitcoin, with less-than-one-cent fees and quick transactions, peer-to-peer

https://whybitcoincash.com

Wallets: the best wallets are non-custodial, so you control the password, and if you mismanage it, your crypto is all gone; no FDIC or similar protections.

i use the

Bitcoin.com wallet for my 'hot wallet' daily spends, but it's recently become not open-source. i use ElectronCash as my 'cold' wallet for storage on my laptop.

there is a ton to research about Bitcoin/crypto; it's still the Wild West, not as user-friendly, and has its risks. but so does holding Dollars or Pesos or Stocks. if you end up making a Bitcoin Cash wallet, post your public address and i'll send you a couple bucks to try it out

🙂

based on what? so many people recommend staying away from new tech and tools, but i still have never met someone who has used crypto that argues this. have you ever sent a Bitcoin transaction? can you explain the Blockchain in 15 seconds without using the internet? i'd be "very wary" of holding Pesos, buying US stocks at all-time-highs, living in a country where you can be imprisoned for misgendering someone, etc. - yet most people on this forum are doing these things. it just depends on your risk levels; there are no perfect solutions, ony trade-offs (Thomas Sowell quote). i'd be happy to send some Crypto links if you actually want to know how Blockchain tech works (it's not just penny stocks or another CashApp/PayPal).

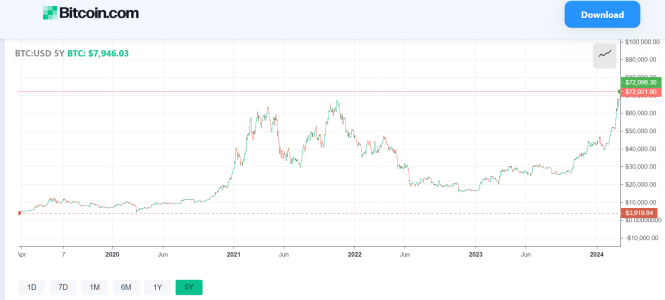

this year is starting off strong with crypto, as the world continues into instability:

and what about Pesos? US Dollar inflation in the past 100 years? the Internet didn't work perfectly in the 1990s, and Bitcoin/crypto are still very much fighting against the Central Banks (which Bitcoin was created to fight, if you read the original 'block' by Satoshi).

"Sheep"? you mean regular people, like here on this forum? so, they trade fiat/Dollars for crypto, take some profits, and that's somehow...bad? explain, please. because i'm certain you would do the same, and all of us have done the same when it comes to stocks/investments.

this seems to be your only educated comment on this topic.

oh, really? how many people? so they made a high-risk investment into a tech they didn't understand, watched it lose value relative to the USD after a huge spike, then sold at a Low? wow, what a powerful anecdote! sounds exactly like everyone on the Stock Market with their gambling. meanwhile, in the land of facts and reality, there is literally

no one right now that traded USD for BTC, who are 'down' (attached photo)

no, you're lying, as usual. you're making a claim that you know people who bought Bitcoin at an

all-time high at the end of 2021, and kept it without dollar-cost averaging or investing in lower-priced crypto, and they suddenly now look at their portfolio and it's even. it's not even; it's higher. and the USD lost value to inflation in that time, so it's even higher than just its price. so again, anyone listening to Larry on this forum (just Mute him) is going to have a bad time.

Bitcoin Cash (BCH) works great and is basically free to send. it's only around $400 USD per whole coin (you can invest up to 0.00000001 BCH - divisible by 8 digits, and just since Jan2023 it has

quadrupled relative to the US Dollar. still a bargain, to slowly and safely off-load Dollars, in my investment strategy.

www.gatewaytosouthamerica-newsblog.com

www.gatewaytosouthamerica-newsblog.com

www.gatewaytosouthamerica-newsblog.com

www.gatewaytosouthamerica-newsblog.com