BuySellBA

Administrator

New rental contracts: In which Buenos Aires neighborhoods the supply grew the most after Milei's DNU - Infobae

Source:

Nuevos contratos de alquileres: en qué barrios porteños creció más la oferta luego del DNU de Milei

Seis de estos barrios concentran el 57,6% de la oferta promedio publicada en diferentes portales inmobiliarios

April 11, 2024

New rental contracts: In which Buenos Aires neighborhoods the supply grew the most after Milei's DNU

Six of these neighborhoods concentrate 57.6% of the average offer published on different real estate portals

By José Luis Cieri

There is more and more offer in different Buenos Aires neighborhoods: private report revealed where there are more apartment proposals for rent (Illustrative Image Infobae)

Since the DNU that repealed the Rental Law came into effect, the supply of properties for housing rental registered an unprecedented increase in the city of Buenos Aires, with an increase of 134% since the beginning of January.

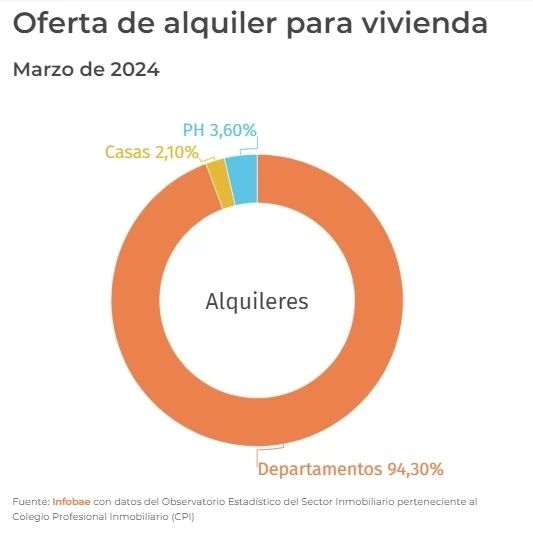

According to a private analysis, 94.33% of this offer corresponds to apartments, with six neighborhoods being the main drivers of this growth and with 57.6% of the available proposals.

Caballito stands out as the leader, with 16.4% of the homes for rent, closely followed by Palermo, Belgrano, Recoleta, Puerto Madero and Villa Urquiza, according to a report from the Statistical Observatory of the Real Estate Sector belonging to the Real Estate Professional College ( CPI) Buenos Aires.

Miguel Chef Muse , coordinator of the Observatory, explained to Infobae that contractual freedom, especially in terms of terms of duration of agreements and updating of values, and the good location and infrastructure of these neighborhoods, explain the trend.

The properties initially offered on the rental market are usually those acquired for investment purposes, which entails ongoing costs for their owners, such as expenses, basic services and taxes, as well as potential loss of income.

When the 2020 law was repealed, they decided to return to the traditional rental market.

Alberto Héctor Loyarte , Real Estate expert and real estate broker, highlighted that “these neighborhoods witnessed a boom in the construction of investment properties at another time, and by remaining unoccupied, they represent a financial burden for their owners, who seek to mitigate these expenses by putting it up for rent. That is why today they lead the number of proposals within the market.”

Why Caballito is number one

Within this panorama, Caballito is one of the areas with the greatest construction activity with a wide range of new properties for sale and rent.Marta Liotto , former head of the Buenos Aires CPI, pointed out: “The growth of the neighborhood is reflected in the transformation of its old mansions into modern developments, turning it into a real estate hub in constant expansion. Despite some criticism for the change in its urban landscape, the Buenos Aires and national governments supported these developments due to the high demand and population density that characterizes this unique commune, which is one of the largest in the city.

Currently, in this neighborhood in the geographical center of Buenos Aires, there are around 900 apartments available, with prices that vary between pesos and dollars.

Pedro Goyena Avenue in Caballito, one of the arteries that captured the most building progress in this Buenos Aires neighborhood

The most affordable ones start at $200,000 per month for 25 m2 studio apartments, such as in the Juan B. Ambrosetti location at 200, up to $1,100,000 per month for a 4-room, 90 m2 apartment located in Méndez de Andes at 500, which offers a brand new property with a wide range of amenities.

Prices on the decline

According to the Buenos Aires CPI Observatory, rental prices for housing are registering a decrease in real terms. From January 2024 to last March, the value experienced an average drop of 30%, and this downward trend continues in April.“This phenomenon is attributed to the growing supply. With contracts made outside the system being regularized in 2023 and with the introduction of new rentals, tenants now have the opportunity to compare between several offers, which not only differ in price, but also in the adjustment conditions and deadlines,” said Loyarte.

Tenants and owners are mostly agreeing on contracts for a 24-month term, in pesos, with quarterly or quarterly adjustments and using the Consumer Price Index or the Rental Contract Index (Freepik)

In the rental market, a more equitable and transparent approach is being promoted for both parties involved.

“After the difficulties caused by previous legislation that affected both owners and tenants, we seek to restore a fair balance in the rental market. Through dialogue and collaboration between the parties, the aim is to create an environment conducive to the search and offer of housing in CABA, avoiding the challenges that previously harmed those looking for a home under the repealed Rental Law that was negative for the market,” Liotto expanded.

24-month agreements prevail (it is estimated that 30% are twelve-month agreements) with quarterly or quarterly adjustments through the Consumer Price Index (CPI) or the Lease Contract Index (ICL).

Most tenants prefer to use the Lease Contract Index (ICL), which considers both inflation and salary increases for registered employees.

Loyarte added: “This index is adjusted quarterly or semiannually. This choice responds to the fact that the majority of tenants are in a dependency relationship, and must adjust their expenses in accordance with the joint provisions of the collective labor agreements. “Tenants prefer to avoid complications and want to be able to fulfill their commitments without problems.”

The sector recommends making quarterly or semiannual adjustments, instead of quarterly, based on the CPI or ICL and with a duration of 24 months (a more accepted practice in the market for decades).

Chef Muse concluded that “initial values are starting to stabilize. We hope that as inflation decreases, stability in the market will increase.”

www.buysellba.com