BuySellBA

Administrator

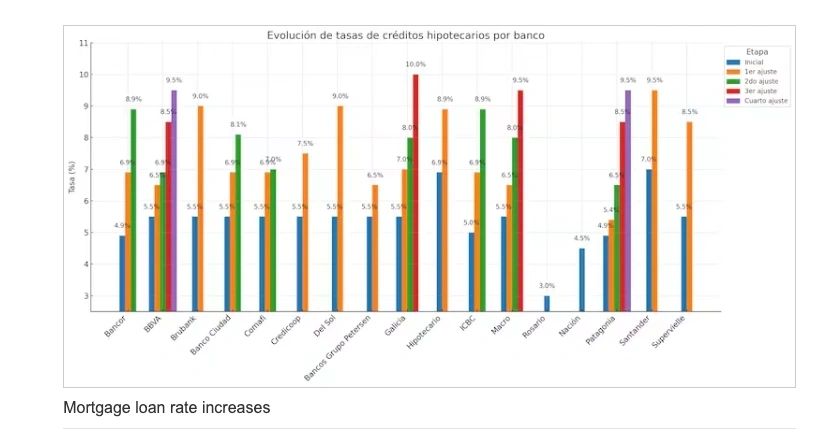

Mortgage loans: the reasons why banks raise rates - La Nacion Propiedades

Source:

Créditos hipotecarios: las razones por las que los bancos suben las tasas

En pocos meses 24 entidades bancarias lanzaron sus líneas de créditos hipotecarios porque “nadie quería quedarse afuera”, y hoy están subiendo sus tasas. ¿A qué se debe?

June 19, 2025

In just a few months, 24 banks launched mortgage lending lines because "no one wanted to be left out," and now they're raising their rates. Why is this?

By Candela Contreras

Rising rates make it difficult to access mortgage loans, but it is important to understand the reasons behind these adjustments.Shutterstock

Since their reactivation in April 2024, UVA (Purchasing Value Unit) mortgage loans have become one of the driving forces behind the real estate market's recovery . However, the rapid rise in demand —which surprised specialists— led to adjustments in terms : banks began raising the rates on their loan lines.

The big question is: Why did a context of high demand generate these increases?

To put this into context, so far in 2025, around US$1,193 million has been delivered , expressed in constant dollars adjusted for inflation (since the loans are calculated in UVAS, and this is updated for inflation), of which US$298 million according to data provided by the consulting firm Empiria.

This figure not only exceeds the US$825 million disbursed in all of 2024 , but also doubles the amount accumulated between 2020 and 2023 , when the banking system lent only US$430 million, according to a report by the Tejido Urbano Foundation.

However, despite these data, it's important to clarify: credit only began to gain traction after the second half of the year. Therefore, the comparison for 2025 would actually be compared to the last four months of 2024. This demonstrates a monthly stability in the number of loans granted, averaging around 3,000 per month , a figure that several market analysts define as "the ceiling for these lines . "

Although the credit context reflects a certain stability in the number of loans granted monthly, the sector is far from historical levels .

To understand the rate hike, it's important to understand the current market situation: demand outstrips the supply of funds.

Banks finance their portfolios with short-term deposits (generally less than 90 days), while UVA loans extend to 20 or even 30 years . This difference creates tension: "You can't finance for 30 years if your deposits are for 30 days," several specialists analyze.

This gap creates a liquidity problem : every time loans increase, banks need to borrow more expensively to maintain their supply. The system's natural response is to raise the Annual Nominal Rate (ANR) to moderate access.

"There's a huge demand that's grown very quickly, and at the same time, funding mortgage loans is expensive for banks because they involve very high-priced loans," says Federico González Rouco, an economist specializing in housing.

When rates are raised, more demonstrable income is needed. SaiArLawKa2 - Shutterstock

The absence of securitization

In countries where mortgage lending is available, institutions use instruments such as securitization or the sale of mortgage portfolios to transfer risk and release capital. This doesn't happen in Argentina."The structural solution should involve tools such as portfolio titling or securitization , but that doesn't exist in Argentina: it requires a level of financial sophistication that is far from being achieved today," explains González Rouco.

Without institutional investors—such as insurance companies or investment funds—mortgage lending falls exclusively on banks, which leads to interest rate adjustments to contain demand .

What do these changes imply?

Loans are becoming more expensive , and the number of people who can afford to own their own homes is shrinking."The mortgage payment amount will be more impacted by the rate offered by the bank than by the term applied for," explains José Rozados, director of Reporte Inmobiliario. The higher the rate, the higher the income the applicant must prove , since, due to bank regulations, the down payment cannot exceed 25% (and in some cases up to 30%) of the family income. Therefore, as the rate increases , the amount of the down payment also increases , so a higher demonstrable income will be required. This is what can prevent a person from accessing a mortgage, or they will have to look for a cheaper property.

Issel Kiperszmid, director of Dypsa International, goes a step further: he recommends the government explore capital market mechanisms that allow for the securitization of mortgages, for example, by using funds from the Sustainable Guarantee Fund or by promoting the participation of insurers and investment funds. Without this incentive, the Argentine mortgage system will maintain its capital structure with a cap that, sooner rather than later, will force rate increases.

For his part, Esteban Domecq, economist and director of Invecq, maintains that the underlying problem remains macroeconomic instability : “In the first months of the year, there was a new bout of instability that led to interest rate hikes. For mortgage lending to take off, sustained low inflation —going to zero—is needed. There can't be inflationary rebounds because all of that directly affects it.” He also warns that “if inflation drops and the economy stabilizes, interest rates will do so as well. We should move toward mortgage rates of 5% to 8%, as they were six months ago.”

The banks that raised rates

- Banco Ciudad : not only raised its rate to 8.1%, but also adjusted its preferential interest rate from 3.5% to 4.5%.

- Bancor : has already raised its rate from 4.9% to 6.9% for payroll account customers and reduced property financing from 100% to 75%. A new increase is underway , bringing the rate to 8.9% for current customers and 9.9% for non-customers.

- BBVA : The rate is currently 9.5% for customers with a payroll account and 12.5% for those without a payroll account. This bank is experiencing its third rate increase since launching its credit line.

- Brubank : raised the rate from 5.5% to 9%.

- Comafi : started with a rate of 5.5%, then went to 6.9% and is now at 7%.

- Credicoop : increased the rate to 7.5% (previously 5.5% ) for customers with deposits in the bank and to 8.5% (previously 6.5% ) for those without a payroll account.

- Del Sol : raised its rate from 5.5% to 9%.

- Galicia : It started with rates of 5.5% and 7%. Currently, it stands at 10% for first homes and 12% for second homes.

- Petersen Group Banks (San Juan, Santa Cruz, Santa Fe, and Entre Ríos): increased the rate from 5.5% to 6.5% for payroll accounts and from 7.5% to 8.9% for non-payroll accounts.

- Mortgage : started at 6.9% and is now at 8.9%.

- ICBC : First it was 5%, then it went up to 6.9%, and now it's at 8.9% and 10.5% without a payroll account.

- Macro : After going through three increases, today it has a rate of 9.5% for payroll accounts - up to $400 million - and 11% without payroll accounts.

- Patagonia : It started with a rate of 4.9% and went through four increases until reaching the current 9.5%.

- Santander : This is the second time it has raised its fixed rate. The initial increase was from 5.5% to 7% ; now it stands at 9.5% .

- Supervielle : at its launch it started with a rate of 5.5%, while currently it is at 8.5%.

As a result of the TNA increases, the impact on installments and minimum income requirements is significant. For example, a $100 million loan over 30 years went from:

Before the last adjustment:

- Initial fee: $658,446

- Minimum income required: $2,650,000

After the climb:

- Initial fee: $847,230

- Minimum income required: $3,388,922

This difference of almost $190,000 in the monthly payment and more than $700,000 in the required income demonstrates how a change in the TNA directly impacts the access capacity of aspiring homeowners .

www.buysellba.com