All the Answers

Well-known member

Moody's predicted a gloomy outlook for Argentina, but the country returned to an important global investment ranking - Infobae

Source:

Moody´s pronosticó un sombrío panorama para la Argentina, pero el país volvió a un importante ránking global de inversiones

La calificadora de riesgo prevé que la economía local caerá 5% este año y advirtió sobre el impacto en los costos de las altas tasas de interés. Sin embargo, después de 10 años, el país volvió a una lista de las 25 naciones más atractivas para invertir

May 01, 2024

The risk rating agency predicts that the local economy will fall 5% this year and warned about the impact on costs of high interest rates. However, after 10 years, the country returned to a list of the 25 most attractive nations to invest in.

“The economy will contract for the second year, as the Government seeks to resolve the fiscal and economic distortions in force for two decades,” said the risk rating agency.

The risk rating agency Moody's warned about the risks and prospects for banks and public service companies in different Latin American countries, including Argentina. This panorama is conditioned by the international scenario of high interest rates but also by the macroeconomic and regulatory conditions of each country. In particular, the agency's forecast for Argentina is gloomy in terms of overall activity.

According to estimates, the local economy will fall 5% this year, a projection that places the rating agency among the most pessimistic in the market regarding the depth of the recession in the country.

“Argentina's economy (Ca stable) will contract for the second year, as the Government seeks to resolve the fiscal and economic distortions in force for two decades. After 2025, strong agricultural exports and shale gas production in Argentina will offer some relief,” Moody's predicted, adding that high interest rates translate into high financing costs for infrastructure companies in different sectors.

“These heavily regulated companies rely on government approval to raise rates enough to recoup high operating costs and the high cost of debt. The risk of government intervention will persist for infrastructure operators, but regulatory frameworks and the rule of law in relation to contract laws have historically supported the majority of infrastructure companies whose refinancing risks are more manageable now than in the past. recent years,” considered the consultant.

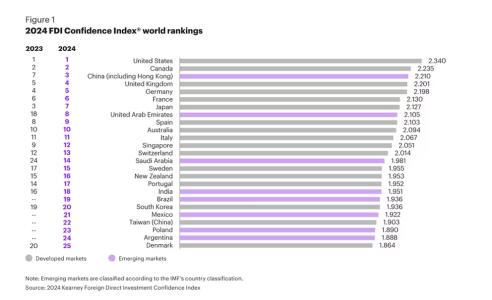

In contrast to this uninspiring outlook, Argentina returned to an investment ranking in which it last appeared 10 years ago. This year it is part of the traditional list of the 25 most attractive countries to invest in, published annually by the consulting firm Kearney. The United States heads the list while Brazil does so at the regional level.

Argentina, for its part, came in 24th place, which beyond the clear economic difficulties and the prevailing recession, indicates an improvement in the business and investment climate.

Kearney's ranking, with Argentina in 24th place

Another relevant fact is that it was in eighth place among emerging nations, advancing one position compared to 2023. Although the country's re-entry did not have a major impact at the local level, the region's media highlighted the fact, beyond the position of their respective countries. For example, the economic magazine Exame focused more on the return of Argentina as a good investment destination rather than the position in which Brazil appears, much more competitive. The data was highlighted by the media. In fact, 2 years ago it was ranked 22nd on the list and in 2023 it did not appear, while this year it entered 19th place, surpassing the other Latin American country that appears by 2 places, Mexico (21st).

“Argentina is once again a destination for foreign investment after 10 years out of the world ranking,” Exame titled the publication in which it states that the country, which has been out of the spotlight for ten years, has changed its economic direction with the victory of Javier Milei. as president he has encouraged investors,” according to Kearney's partner in Brazil, Mark Essle . The executive considered that after suffering inflation of 211% in 2023 – now almost 300% year-on-year this year – there has been a sudden change in the country's economic direction that, at least initially, encouraged the executives interviewed by Kearney.

“In just two months, Milei has managed to meet its 'zero deficit' objective, that is, getting out of the red. The markets reacted positively, with the country's bonds and stocks rising, the dollar free," Essle contributed.

The survey takes into account businessmen's investment prospects for the next three years. To conduct it, Kearney interviewed executives from companies with annual revenues of $500 million or more. In total, the companies are based in 30 countries and cover all sectors.