BuySellBA

Administrator

Incredible: Rents increased more than 1,100% in 5 years, but rose less than half of general inflation - Infobae

Source:

Increíble: los alquileres aumentaron más de 1.100% en 5 años, pero subieron menos de la mitad que la inflación general

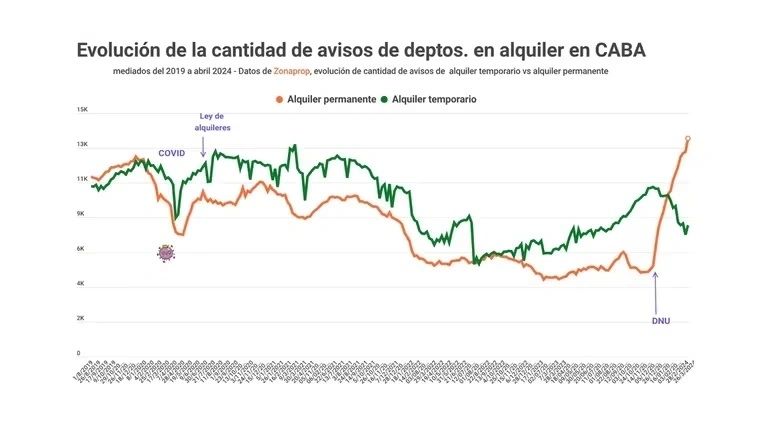

La ley de 2020 contuvo un tiempo los aumentos, pero hizo caer drásticamente la cantidad de unidades. Desde mediados de 2022 los valores explotaron. Tras el DNU desregulatorio, la oferta sigue creciendo

April 20, 2024

The 2020 law contained the increases for a time, but caused the number of units to drop drastically. Since mid-2022, values have exploded. After the deregulatory DNU, the supply continues to grow

By José Luis Cieri

Housing rents rose sharply but according to private research it was not the most expensive thing in Argentina from the end of 2018 to date (Illustrative Image Infobae)

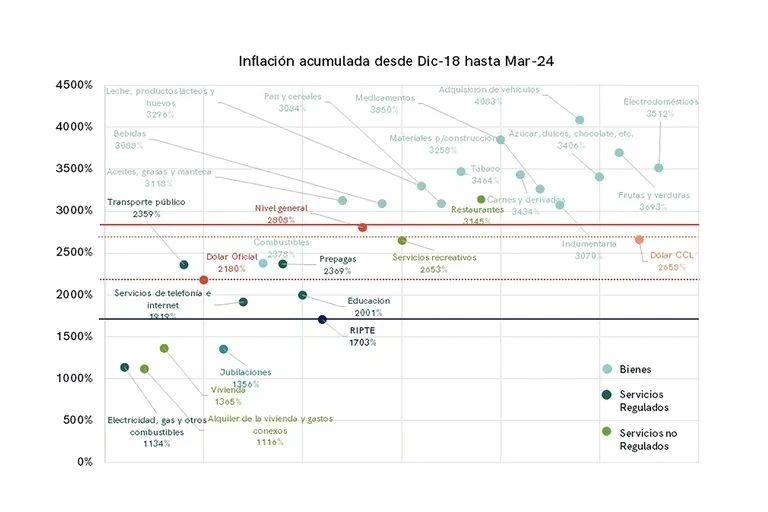

Rental prices in Argentina registered an increase of 1,116% from the end of 2018 to the present, as confirmed by a private analysis based on Indec figures.

Despite this notable increase, a historical record for costs associated with housing, it was not the largest increase in the last five years. The largest increases in this period were recorded in “Vehicle Acquisition”, “Medicines”, and “Fruits and Vegetables”: they were 4,083%, 3,850% and 3,693%, respectively.

Furthermore, in the same period of time, general inflation, always according to INDEC data, was 2,808%, percentage-wise more than double what rents increased.

The most critical period of increases in the latter in CABA was recorded between 2023 and January 2024, when prices rose by 308% , exceeding the accumulated inflation in the same period by 54 percentage points, which was 254 percent.

Sebastián Menescaldi , economist and associate director of the consulting firm Eco Go (which generated the report), analyzed the situation of the rental market, highlighting that, although there was a notable increase in prices during the last quarter of 2023, it was not extraordinary in historical terms. nor compared to other goods. “Rents did not experience such a significant increase; rather, the regulation introduced by the Rental Law (repealed by the current Government's DNU) resulted in a moderate increase. The real problem was not a sharp increase in prices but a marked reduction in supply.”

Maintaining a home and facing daily expenses is a challenge for tenants, especially now that the average rent for a three-room apartment in AMBA reaches $500,000 per month.

The shortage of rental options was not a direct result of price increases, but rather regulations that limited the availability of units.

This situation led to a negative reaction on the part of the owners, who, faced with the regulations of updating prices only once a year and with increases below inflation, concluded that it was not convenient to offer their properties in the traditional rental market.

Source: Eco Go Consulting

Factors

There are several causes behind the increase in rental prices, in addition to persistent inflation and regulatory aspects of entering into contracts. This situation led hundreds of owners in the last two years to increase their prices above inflation to protect themselves. Others directly chose until the end of the year to withdraw their properties from the rental market, thus exacerbating the increase in costs for tenants.“The reaction of landlords to the restrictions imposed on updating rents resulted in a marked increase in rents above inflation. This behavior responds to an attempt by property owners to safeguard their profitability in the face of an adverse economic context,” explained Fernando Álvarez de Celis , executive director of the Tejido Urbano Foundation.

The last time in a historical context that home rental values experienced such a significant increase was in 1907.

Álvarez de Celis evoked the so-called Tenants' Strike in Argentina , a historic event that brought together 32,000 workers in protest against rental conditions in the city of Buenos Aires, marking one of the first significant conflicts between tenants and owners in the country.

Since then, various difficult circumstances for tenants arose, linked to strict regulations and periods of inflation or hyperinflation.

Post DNU the supply of properties grew and tenants find greater possibilities of accessing a rental (Illustrative image Infobae)

“Although the current situation, which began in 2018, shares certain parallels with historical events, the difference is that currently around 40% of the population lives in tenancy conditions,” said Álvarez de Celis.

Since September 2017, the rental market in the city of Buenos Aires was subject to regulations that influenced prices. To understand whether they increased significantly, it is necessary to compare them with other prices within a context of regulatory control.

Soledad Balayan , from Maure Inmobiliaria, pointed out that, after the implementation of these regulations, rental prices were negatively affected, to which is added the high inflation that the country suffered in recent years. “The combination of a regulated market with inflation cannot have good results.”

Expanding offer and stable prices

After the implementation of the DNU, a growth is observed in the real estate supply, characterized by short-term contracts and price adjustments every four or three months, negotiated directly between owners and tenants (also in the following graph we can see how the housing market evolved. rentals in CABA from mid-2019 to present).

Source: Analysis generated by Soledad Balayan of Maure Inmobiliaria

If inflation declines, an increase in initial rental contract prices seems unlikely. It is essential to consider the evolution of salaries as a determining factor in this context.

Balayan gave his opinion on how to address the current challenges in the housing space and reverse the growing trend towards tenancy. “The necessary improvements in the housing sector must focus on economic stability and the review of current regulations, which established negative incentives, adversely impacting the market in the long term. The Rental Law turned out to be excessively costly in several ways, even more harmful than the exchange rate. If the situation is not correctly understood, the proposed solutions could make the problem worse. An accurate diagnosis is key to implementing effective measures,” he stressed.

Horizon

Looking towards the future and the resolution of the housing issue, Menescaldi considers it crucial to recover and expand the rental supply.“It would be important that, in addition to regulating the existing offer, new options emerged. In the coming months, if salaries begin to recover, it could be relevant for a new mortgage loan offer to appear, something that would be facilitated by the decrease in economic uncertainty. As the economic process strengthens and employment grows, it is reasonable to expect a reactivation of the mortgage sector and, with it, a boost for the real estate market,” he noted.

However, he is cautious about the short term: “The reality is that we are currently at very low levels of activity in the real estate market and there is still some way to go. “Probably, this year's real estate growth will focus on the supply of properties for sale rather than on the reactivation of mortgage loans, which could only begin to change next year.”

It will be difficult to overcome the current situation without the reactivation of mortgage credit accessible to the middle and lower class sectors. To achieve this, it is necessary to implement public policies that promote this type of housing, following examples from countries such as Uruguay, Chile or Paraguay, where successful initiatives were developed.

Álvarez de Celis concluded: “Thousands of tenants face rental costs comparable to what would be mortgage credit installments. But it must be recognized that the financial system is not yet prepared to adopt housing development policies. If a significant reduction in inflation is achieved, mortgage credit could gradually begin to flourish.”

www.buysellba.com