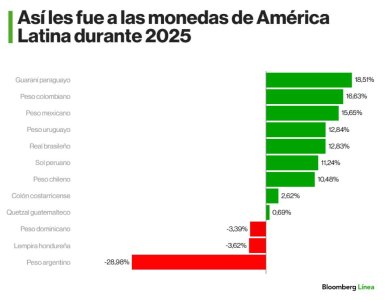

Good points on the short swings. But that goes to show you the peso is not a stable currency. I would agree depends on when you look at it as it can swing even within a few months. Such is the nature of the peso here.

It IS being heavily controlled.

@Esposas you are correct the cepo cambiario restriction is still in place for companies and many transactions. I applaud Caputo for lifting some currency controls but they need to remove all of the limitations. Otherwise it is not free floating. They have limitations when they can access FX markets or repatriate profits. That isn't free. That is being controlled.

Once that is lifted then we will know what the exchange rate is that is fair. To Craig's point it is anyone's guess.

www.bloomberglinea.com