BuySellBA

Administrator

How UVA loan payments evolve and what risks those seeking to finance their homes face - Ámbito Financiero

Source:

Cómo evolucionan las cuotas de créditos UVA y qué riesgos enfrentan quienes buscan financiar su vivienda

En qué prestar atención en un contexto con récord de operaciones en CABA. En los primeros cinco meses se otorgaron 5.394 y superan a 2024.

July 11, 2025

What to watch out for in a context of record-breaking operations in Buenos Aires. In the first five months, 5,394 were granted, surpassing the number of 2,024.

By José Luis Cieri

A couple receives the key to their new home after finalizing their mortgage loan transaction. Artificial Intelligence Image.

The mortgage market is expected to recover significantly in 2025. According to data from the Real Estate Market Statistical Observatory of the Buenos Aires Real Estate Association, 5,394 mortgage deeds were signed in the first five months of the year, surpassing the 5,092 transactions recorded in all of 2024. Furthermore, in May, the impact of mortgage lending on sales reached 23%, with 1,300 mortgages out of 5,610 total transactions.

This upswing reveals renewed interest in financing home purchases with loans in inflation-adjusted pesos . However, for those considering a UVA mortgage, the scenario combines opportunities with risks that should be analyzed in detail.

Adjustment for inflation with lag

Andrés Salinas , an economist and professor at the National University of La Matanza (UNLAM), explained that the UVA-adjusted installments' behavior is "literally like the Consumer Price Index (CPI)," with a 45-day lag. In other words, the installments follow monthly inflation with a slight delay. Therefore, while overall inflation moderates, the installments continue to rise, albeit at a slower pace.The reasons for this relative stability are the same as those supporting the price slowdown: lower monetary issuance, fiscal adjustment, and a certain calm in the exchange rate. However, Salinas clarified that the adjustment hasn't disappeared completely. "Even if monthly inflation drops from 3% to 2%, the rate will continue to rise, just less. For it to fall, there would have to be deflation," he said.

This fact is key for those who imagine that lower inflation will translate into lighter payments. In reality, the increase is slowing but not eliminating. Therefore, buyers should consider this point when evaluating their disposable income and expected salary developments.

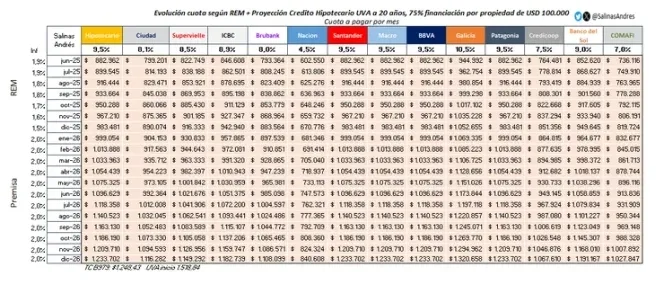

Quota projection and numerical example

To illustrate the impact of the current scenario, Salinas offered a concrete example: a 20-year loan with 75% financing for a property valued at US$100,000, with an average interest rate of 8%. In that case, the initial payment is around $793,000 per month. After 18 months, with an average monthly inflation rate of 2%, the payment would exceed $1,100,000.

"It's essential to understand that the adjustment follows inflation with a lag, which is why the installments are expected to follow the price dynamics. The more stable the index, the more predictable the installment-income relationship," he explained.

This scheme requires that the applicant's income be able to adjust to avoid losing ground to inflation. Salinas emphasized that many salaries are adjusted through bimonthly, quarterly, or even semiannual collective bargaining agreements, which creates a gap with the monthly UVA adjustment.

Source: Andrés Salinas, economist and professor at the National University of La Matanza (UNLAM). Here are the evolution and future projections of quotas.

“You have to look at the collective bargaining agreement and employment. Imagine the worst-case scenario: you lose your job. Do you have in-demand skills? Can you quickly find a position that maintains your income? Do you have assets you can liquidate to prepay your debt? These are all fundamental questions,” he emphasized.

Is it better than renting?

The comparison with renting immediately comes to mind. Salinas explained that deciding between renting or paying off a mortgage is a very personal matter. “There are people who don't want the burden of a 20- or 30-year debt because they value the flexibility to travel or move. There are also those who prefer to wait until they share that commitment with their partner. All of that is valid,” he stated.From a financial perspective, the advantage of credit lies in its capitalization: with each installment, the buyer advances toward the acquisition of an asset that often represents the largest asset of their lifetime. In contrast, renting does not create ownership.

However, debt brings rigidity. "If the economic situation becomes difficult, canceling a rental contract is easier than selling a property with a mortgage, especially if the price hasn't kept pace with inflation," Salinas warned.

Ultimately, there's no single answer to the comparison. It depends on the buyer's profile, job stability, income prospects, and risk tolerance.

Factors to consider before deciding

For Salinas, evaluating a UVA mortgage loan requires two analyses: one of the market and the other personal. At the market level, it is important to determine whether it is a good time to enter. Real wages have shown some recovery since 2023, after reaching historic lows. Furthermore, property prices have risen but could have room for further growth of 10 to 20%, although there is no guarantee they will continue to do so.In personal analysis, the key lies in the relationship between salary adjustment and the contribution adjustment. "We always talk about real rates. If the nominal annual rate is inflation +8%, your salary should be adjusted for inflation plus an additional 8% to keep the contribution-income ratio constant," he explained.

He also advised considering a safety cushion: "Do you have resources for an unexpected event? Can you turn to a family member, liquidate a car, or some other asset? Because the down payment is often similar to rent, but the commitment is much longer and more complex."

The advance and the best strategy

A common question is how much money to allocate as a down payment. Salinas explained that it depends greatly on the context and the buyer's profile. "If you have 70% of the property's value, it's usually best to avoid credit and cover the remainder with your own resources or even with family help, under better conditions," he noted.

In Buenos Aires, more mortgage loans were granted in the first five months of 2025 than in all of 2024, reflecting the reactivation of the market.

For those who have 35 or 40% of the value and the bank only demands 20%, the decision becomes more nuanced. According to Salinas, sometimes it's better to ask the bank for more (for example, 80/20 instead of 75/25) to keep more dollars in your pocket and preserve a prepayment margin if the situation improves. It all depends on the outlook for inflation and future devaluation.

What is key?

Mariana Lucángeli , an architect and real estate specialist, explained that deciding on a mortgage requires considering interest rates, terms, income, and additional costs. She emphasized the importance of comparing options based on the type of property and its use: primary residence, second home, construction, or renovation.Each option has different conditions. Purchases for single-family homes typically offer lower interest rates and longer terms. For construction and renovation projects, the money is disbursed in stages based on the progress of the project.

Lucángeli emphasized that many lines seek to match the payment to the cost of rent. However, he cautioned that applicants should consider the minimum income requirement, which is around $3,400,000 per month for an individual and $1,700,000 for a couple.

Several lenders allow co-signers, broadening the income base to qualify. Most finance up to 80% of the property's value, leaving the remaining 20% plus associated expenses as the buyer's responsibility.

Additional costs and comparison between banks

In addition to the monthly fee, there are significant costs: registration fees, notary and real estate agency fees, and stamp duty, which can add up to $6,000 on a $100,000 transaction.Lucángeli recommended comparing banks. Public banks usually offer lower rates but require longer processing times. Private banks are more flexible, although their rates are usually higher. He also suggested considering applying for a loan at the bank where you receive your salary, as they often offer reduced rates for these clients.

www.buysellba.com