BuySellBA

Administrator

High construction costs and limited access to credit: what are the opportunities for divisible mortgages? - Ambito Financiero

Source:

www.ambito.com

www.ambito.com

July 18, 2025

By Jose Luis Cieri

A private report revealed the impact of the rise in construction prices and the lack of credit, and evaluated the limits and scope of mortgages for purchasing existing units.

The regulation of divisible mortgages improves predictability for developers and expands the base of solvent demand in a market with more than 50,000 units under construction in Buenos Aires.

From 2017 to mid-2025, construction costs —as measured by the Argentine Chamber of Construction (CAC) index—increased 95-fold, even surpassing the consumer price index, which grew by nearly 80 times. This difference reflects a structural trend: construction is much more expensive today than it was a decade ago , even compared to other goods in the economy.

This price increase was combined with another significant distortion. According to recent data from real estate portals, the value of units under construction exceeded that of completed homes, reversing traditional market logic (this is happening in more than 20 Buenos Aires neighborhoods, for example) . This dynamic reinforces the speculative nature of development investments and further alienates buyers seeking a concrete housing solution.

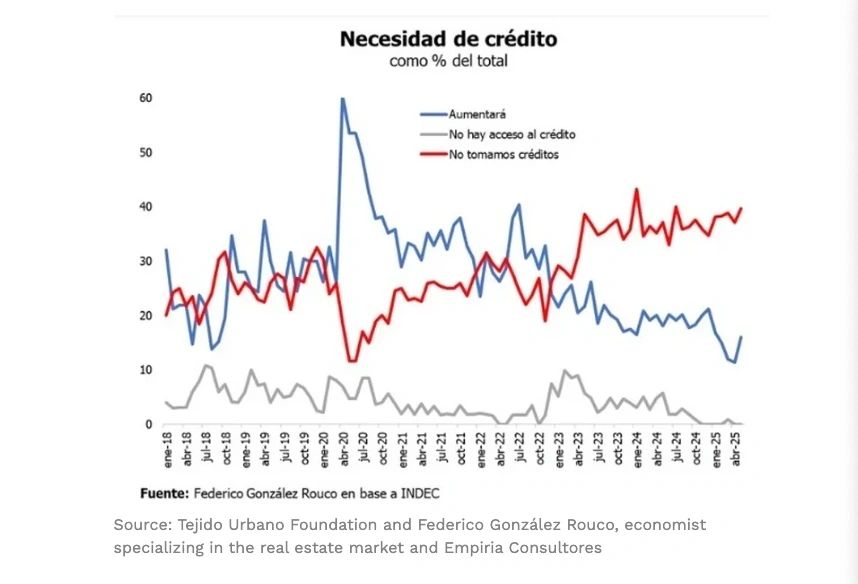

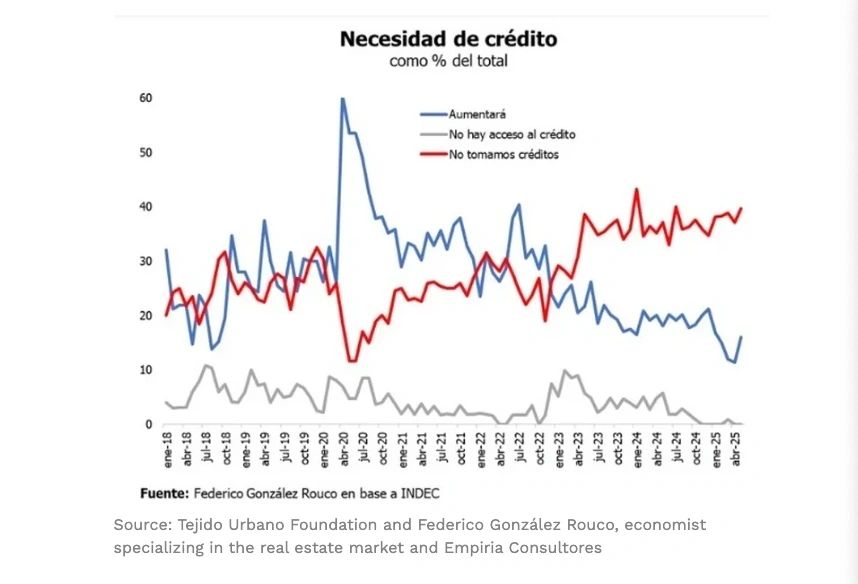

Faced with this situation, bank financing for housing construction remains virtually nonexistent. According to a report by the Tejido Urbano Foundation, more than 40% of construction companies declared they would not take out credit in 2025, a 15-point increase compared to the average between 2018 and 2023. The lack of access to credit restricts the scale of developments, concentrates supply in premium segments, and limits the possibility of expanding access to housing. Without financing, the Argentine real estate market operates below its potential, both in economic and social terms.

In a scenario of falling activity and costs above US$1,600 per square meter, a long-awaited piece of news arrived yesterday: the national government formalized the divisible mortgage regime—or mortgages for future assets—through Joint Resolution 2/2025 of the Ministries of Economy and Justice .

The measure seeks to expand mortgage lending and facilitate access to housing for unfinished projects. The new scheme allows for loans to be granted before the formal subdivision of properties, for units still under construction or lots in planned developments, enabling more flexible operations.

Unlike the traditional system, credit can be established from the start of the project and then divided among future buyers, each assuming their own debt.

"Without credit, the market lacks scale or predictability," notes the report by the Tejido Urbano Foundation. "This not only affects the private sector, but also public policy, which loses its ability to direct investment toward reducing the housing deficit," emphasized Fernando Álvarez de Celis , the organization's executive director.

The divisible mortgage tool, regulated by DNU 1017/2024 , appears as a potential turning point in this scenario. Its operation allows a developer to divide a general mortgage and assign each buyer a portion of that loan as the project progresses.

This provides a dual source of financing: one for the construction company and another for the future owners, without having to wait for the completion of the project to sign the deed or mortgage.

This model allows for entry with less equity and access to credit at an earlier stage of the process. However, this tool still requires clearer regulations and oversight mechanisms to ensure construction quality and developer accountability.

According to the administrative records compiled by the Tejido Urbano Foundation in Buenos Aires, the average time from project submission to completion is four years. The construction permit is typically granted six months after the process begins. These delays, in a context lacking adequate oversight, multiply the risks for buyers.

“The divisible mortgage doesn't eliminate risk; it redistributes it,” Álvarez de Celis added. “The bank shares and monitors it, but if the project isn't completed on time, the entire system becomes strained.”

The main challenge, he warns, lies in banks' adoption of the tool. "Today, they have difficulty even financing the purchase. Imagine what it means to finance the construction. It's a different type of project and a different type of analysis. It may work in the medium term, but in the short term, it will be challenging."

According to González Rouco, if banks manage to incorporate this approach into their processes, they could significantly expand the financing spectrum for projects that currently lack support. However, he emphasizes that the key will be to "create clear rules, reduce bureaucratic friction, and ensure minimum conditions for projects to move forward with predictability."

A 65 m2 unit valued at approximately US$80,000 requires, under the traditional model, a 35% down payment and 24 installments adjusted by the CAC. During the construction process, the buyer—if they rent—faces a double expense: they pay installments without signing the deed or taking possession, and they assume full risk in the event of any default by the developer.

With a divisible mortgage, on the other hand, you could make a smaller down payment (for example, $15,000 ) and sign a registered mortgage. The bank finances the developer, monitors progress, and upon completion, formalizes an individual loan. However, if the construction is delayed, the buyer is left in an intermediate position: they continue paying without effective access to the home and without the final loan being activated.

Compared to the traditional approach, the divisible mortgage incorporates the bank as an intermediary actor, but its role does not replace public controls or eliminate the buyer's risk. "The housing solution cannot rest on the individual back of those who access it," said Álvarez de Celis, emphasizing the need for clear regulatory frameworks, professionalized execution, and a system that guarantees compliance with promises.

Álvarez de Celis concluded: "Bank lending remains at rock-bottom levels. Divisible or future-proof mortgages can help, but first, we must rebuild confidence and macroeconomic stability."

www.buysellba.com

Source:

Altos costos para edificar y poco acceso al crédito: cuáles son las oportunidades de las hipotecas divisibles

Informe privado reveló el impacto del alza para construir y la falta de crédito, y evaluó los límites y alcances de las hipotecas para comprar unidades en pozo.

July 18, 2025

By Jose Luis Cieri

A private report revealed the impact of the rise in construction prices and the lack of credit, and evaluated the limits and scope of mortgages for purchasing existing units.

The regulation of divisible mortgages improves predictability for developers and expands the base of solvent demand in a market with more than 50,000 units under construction in Buenos Aires.

From 2017 to mid-2025, construction costs —as measured by the Argentine Chamber of Construction (CAC) index—increased 95-fold, even surpassing the consumer price index, which grew by nearly 80 times. This difference reflects a structural trend: construction is much more expensive today than it was a decade ago , even compared to other goods in the economy.

This price increase was combined with another significant distortion. According to recent data from real estate portals, the value of units under construction exceeded that of completed homes, reversing traditional market logic (this is happening in more than 20 Buenos Aires neighborhoods, for example) . This dynamic reinforces the speculative nature of development investments and further alienates buyers seeking a concrete housing solution.

Faced with this situation, bank financing for housing construction remains virtually nonexistent. According to a report by the Tejido Urbano Foundation, more than 40% of construction companies declared they would not take out credit in 2025, a 15-point increase compared to the average between 2018 and 2023. The lack of access to credit restricts the scale of developments, concentrates supply in premium segments, and limits the possibility of expanding access to housing. Without financing, the Argentine real estate market operates below its potential, both in economic and social terms.

In a scenario of falling activity and costs above US$1,600 per square meter, a long-awaited piece of news arrived yesterday: the national government formalized the divisible mortgage regime—or mortgages for future assets—through Joint Resolution 2/2025 of the Ministries of Economy and Justice .

The measure seeks to expand mortgage lending and facilitate access to housing for unfinished projects. The new scheme allows for loans to be granted before the formal subdivision of properties, for units still under construction or lots in planned developments, enabling more flexible operations.

Unlike the traditional system, credit can be established from the start of the project and then divided among future buyers, each assuming their own debt.

Structural constraints and technical opportunity

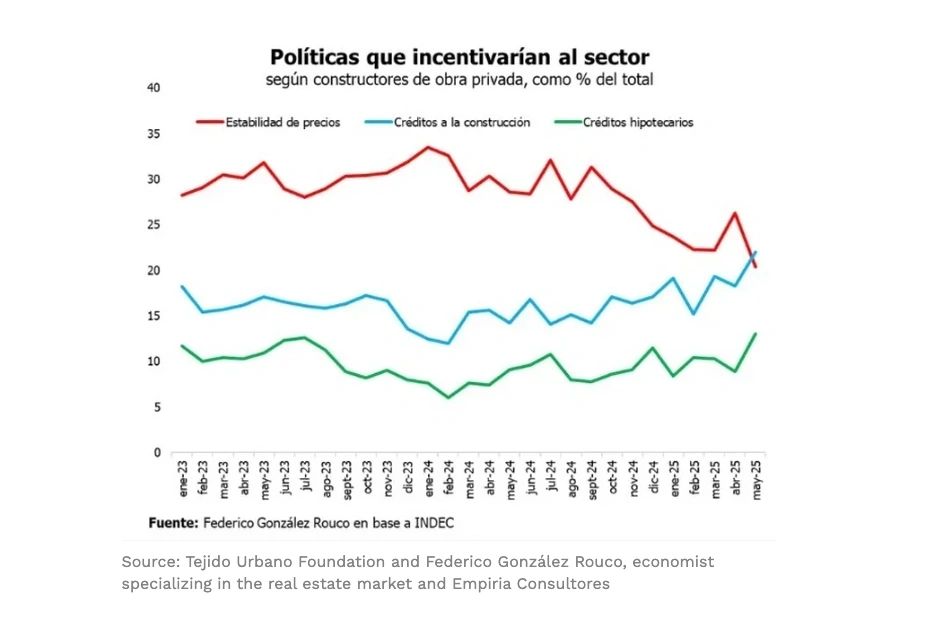

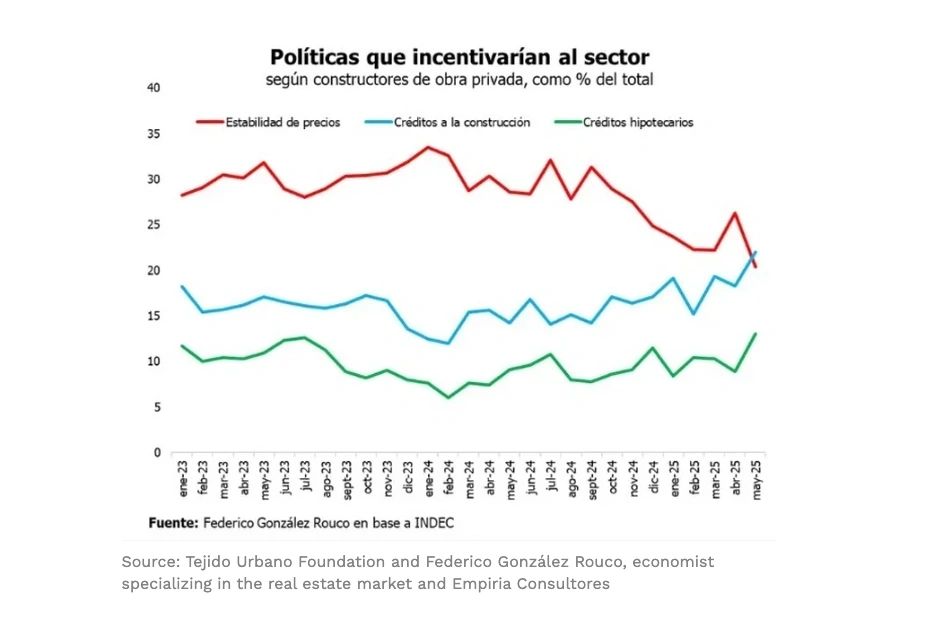

The lack of credit is partly due to macroeconomic conditions. Inflation, exchange rate volatility, and regulatory uncertainty impede long-term planning. But there are also barriers inherent to the financial system and the construction sector: high interest rates, informality in the production chain, and low bank participation in real estate projects. This situation creates a vicious cycle: without credit, there is less supply; with less supply, prices rise; with higher prices, effective demand decreases.

"Without credit, the market lacks scale or predictability," notes the report by the Tejido Urbano Foundation. "This not only affects the private sector, but also public policy, which loses its ability to direct investment toward reducing the housing deficit," emphasized Fernando Álvarez de Celis , the organization's executive director.

The divisible mortgage tool, regulated by DNU 1017/2024 , appears as a potential turning point in this scenario. Its operation allows a developer to divide a general mortgage and assign each buyer a portion of that loan as the project progresses.

This provides a dual source of financing: one for the construction company and another for the future owners, without having to wait for the completion of the project to sign the deed or mortgage.

How the divisible mortgage works

The first concrete experience was carried out in 2025 through Banco Ciudad. The scheme applies to homes up to 70 m2 intended for permanent use. The buyer makes a down payment in dollars and signs a registered bill of sale. During construction, they pay installments adjusted by the Argentine Chamber of Construction (CAC) Index. Upon completion, the final mortgage is issued, usually in UVA (UVA-type mortgages), and long-term repayment begins.

This model allows for entry with less equity and access to credit at an earlier stage of the process. However, this tool still requires clearer regulations and oversight mechanisms to ensure construction quality and developer accountability.

According to the administrative records compiled by the Tejido Urbano Foundation in Buenos Aires, the average time from project submission to completion is four years. The construction permit is typically granted six months after the process begins. These delays, in a context lacking adequate oversight, multiply the risks for buyers.

“The divisible mortgage doesn't eliminate risk; it redistributes it,” Álvarez de Celis added. “The bank shares and monitors it, but if the project isn't completed on time, the entire system becomes strained.”

The vision from the economic sector

For Federico González Rouco , an economist specializing in the real estate market at Empiria Consultores, this is a valuable, if challenging, technical opportunity: "It's great news. It allows us to generate bank financing, and begin to build a credit system for construction and purchase in a single chain." In his opinion, the divisible mortgage can also contribute to professionalizing a process historically associated with trusts and informal investments. "We need to move that forward and generate a capital market for construction," he explained.The main challenge, he warns, lies in banks' adoption of the tool. "Today, they have difficulty even financing the purchase. Imagine what it means to finance the construction. It's a different type of project and a different type of analysis. It may work in the medium term, but in the short term, it will be challenging."

According to González Rouco, if banks manage to incorporate this approach into their processes, they could significantly expand the financing spectrum for projects that currently lack support. However, he emphasizes that the key will be to "create clear rules, reduce bureaucratic friction, and ensure minimum conditions for projects to move forward with predictability."

What changes for the buyer

In practical terms, the divisible mortgage scheme allows the buyer to access a unit without having the full capital or waiting for the deed to be signed. But it doesn't guarantee complete certainty.A 65 m2 unit valued at approximately US$80,000 requires, under the traditional model, a 35% down payment and 24 installments adjusted by the CAC. During the construction process, the buyer—if they rent—faces a double expense: they pay installments without signing the deed or taking possession, and they assume full risk in the event of any default by the developer.

With a divisible mortgage, on the other hand, you could make a smaller down payment (for example, $15,000 ) and sign a registered mortgage. The bank finances the developer, monitors progress, and upon completion, formalizes an individual loan. However, if the construction is delayed, the buyer is left in an intermediate position: they continue paying without effective access to the home and without the final loan being activated.

Compared to the traditional approach, the divisible mortgage incorporates the bank as an intermediary actor, but its role does not replace public controls or eliminate the buyer's risk. "The housing solution cannot rest on the individual back of those who access it," said Álvarez de Celis, emphasizing the need for clear regulatory frameworks, professionalized execution, and a system that guarantees compliance with promises.

An innovation with potential, but without immediate impact

Although it represents an important innovation, the divisible mortgage still operates as a complementary tool, more aligned with the dynamics of the development sector. For it to become a structural policy, it will be necessary to expand its adoption throughout the financial system and articulate it with public policies that prioritize housing access.Álvarez de Celis concluded: "Bank lending remains at rock-bottom levels. Divisible or future-proof mortgages can help, but first, we must rebuild confidence and macroeconomic stability."

www.buysellba.com