BuySellBA

Administrator

For sale: Property prices in the City had the largest increase in the last 6 years - La Nacion Propiedades

Source:

Para la venta: los precios de las propiedades en la Ciudad tuvieron el mayor aumento de los últimos 6 años

El mercado inmobiliario poco a poco muestra signos de mejora; el precio promedio por metro cuadrado de publicación en la Ciudad registró el mayor incremento mensual en los últimos 6 años

May 3, 2024

The real estate market is slowly showing signs of improvement; The average price per square meter of publication in the City registered the largest monthly increase in the last 6 years.

Properties in the City had the highest monthly increase in the last 6 years

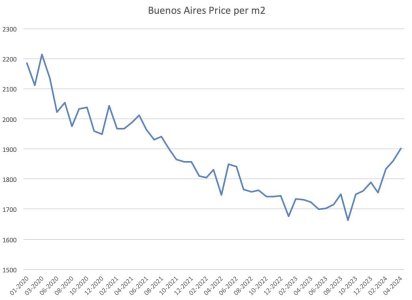

In the midst of a scenario where the real estate market is gradually reactivating , the average price per square meter (publication) in the City of Buenos Aires registered the largest monthly increase since April 2018 , according to the latest Zonaprop report.

The publication value increases 0.8% in April and stands at US$2,219 . If we look at the first four months of the year, prices accumulate an increase of 1.9% , while in the year-on-year comparison prices rise by 2.5%. This rise could be explained by the increase in the cost of construction which , measured in dollars, registers an increase of 40.4% in 2024. Currently, building costs almost triple what it cost in October 2020 , the minimum in the series , and 34.9% above the 2012-2023 average.

These numbers are reflected in increases in units to be sold. In April, 79% of the neighborhoods registered a monthly (publication) price increase, with well apartments being the ones with the greatest increase. For its part, the average publication price of the apartments rose by 1.9%.

Puerto Madero leads the ranking of the most expensive neighborhoods to rent in the City of Buenos Aires

The Zonaprop report exemplifies the prices by pointing out that a 40 m² studio apartment has a price of US$98,109 for sale, while a two-room apartment of 50 m² is worth US$117,474 and a three-room apartment of 70 m² is worth US$161,697 (all with publication prices).

In the neighborhood price ranking, Puerto Madero continues to be first on the podium, defending the highest values on the market , with a price of US$5,858/m². Palermo (US$3,108/m²) and Belgrano (US$2,827/m²) are still on the list . On the other hand, Lugano remains the most affordable neighborhood with an average value of US$981/m². It is followed by Nueva Pompeya (US$1,350/m²) and La Boca (US$1,443/m²).

The average price per square meter in the City of Buenos Aires is US$2,219

A market that is slowly reactivating

Slowly, the real estate market shows signs of improvement, not only due to the increase in property values, but also due to inquiries. The numbers from the Zonaprop report show that demand for apartments grew 7% month-on-month and 70% compared to the same month of the previous year.The report also refers to the volume of writings which, in March 2024, was 18% higher than the same month in 2023. This year, the volume of writings registers an increase of 16% compared to the volume of 2023 , although still 8.5% below 2019 and 48% below 2018.

The construction cost measured in dollars registers an increase of 40.4% in 2024

Another positive symptom is reflected in the fact that the volume of apartments for sale priced downwards stops falling in the last six months and remains stable at 18% in the first quarter of 2024. According to the report, the drop in the volume of advertisements delayed is one of the factors that explain the increase in the price registered since July 2023.

Investments in CABA

For those interested in investing, the rent/price ratio in profitability stands at 4.84% annually, which is why it registers a slight recovery. Today it takes 20.6 years of rental to recover the investment, 2.1% less than what was required a year ago.Lugano, the neighborhood that defends the lowest prices for sale, is presented as the best place for investors looking for income, with an average return of 7.3%, followed by Balvanera, with a return of 6.1%, and by La Boca, with a return of 6%. For their part, two of the neighborhoods with the highest prices, Palermo (4%) and Belgrano (4.2%), are the ones that generate the least profitability .

The rent/price ratio in CABA stands at 4.84% annually

www.buysellba.com