All the Answers

Well-known member

Food inflation: fruits, meats and vegetables showed lower prices in the last week of April - Infobae

Source:

Inflación de alimentos: frutas, carnes y verduras mostraron baja de precios en la última semana de abril

La consultora LCG midió que esos productos, al igual que aceites y panificados tuvieron un retroceso de precios. El Gobierno apuesta a un IPC de un dígito en abril y busca sostenerlo en mayo sin aumentos de tarifas

May 03, 2024

The consulting firm LCG measured that these products, as well as oils and baked goods, had a decline in prices. The Government is betting on a single-digit CPI in April and seeks to maintain it in May without rate increases

By Mariano Boettner

A woman shops in a supermarket, in Buenos Aires (Argentina), in a file photograph. EFE/Enrique García Medina

The last week of April would have had, according to a weekly price measurement carried out by a private consulting firm, a drop in consumer prices on shelves. This was recorded in the survey carried out by LCG, which observed that the last photo from April showed a 1% decline in beverages and foods , among which there are fruits, vegetables, meats and oils.

The Government believes that in April it will be able to show a new slowdown in inflation, already comfortably parked in the area of single monthly digits after 11% in March. Different private estimates reported the same phenomenon in recent days with the consolidated data for the fourth month of the year.

One factor that influenced it was the reversal in the prices of prepaid medicine , which subtracted 1.5 percentage points from the inflation measurement according to a private calculation. In May, the Executive Branch aims to continue with this trend of slower price increases, and to do so, it decided not to apply the public service rate increases planned for that month, so it will have to allocate more subsidies.

Source: LCG

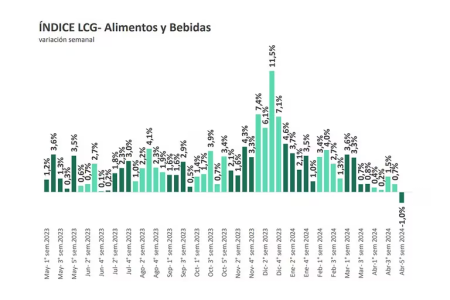

For now, the report from LCG, the consulting firm founded by the current radical senator Martín Lousteau , measured that the general price drop in food and beverages of 1% represents “a drop of 1.8 percentage points compared to the previous week.” , when it had been 0.7 percent. “The last 4 weeks reflect an increase of 2.3% on average and 1.4% end to end,” they detailed from that consultancy.

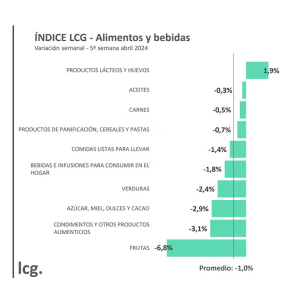

Specifically, LCG measured that there was a drop in prices in practically all the food and beverage items it registers with the exception of dairy products. Fruits, for example, had a nominal price decline of 6.8% in the last week. Condiments and other food products fell 3.1% , followed by Sugar, honey, sweets and cocoa ( -2.9% ), Vegetables (-2.4% ), Beverages and infusions to consume at home ( -1.8 % , Ready-to-go meals ( -1.4% ), Baked goods, pasta and cereals ( -0.7% ), Meats ( -0.5% ) and Oils ( -0.3 percent ). Dairy products rose 1.9 percent .

In May, the Executive Branch aims to continue with this trend of slower price increases, and to do so, it decided not to apply the public service rate increases planned for that month, so it must allocate more subsidies.

“The slowdown in monthly inflation continues: it subtracted 1 percentage point compared to the previous week, reducing to 2.3% monthly average (4 weeks) and 1.4% in the same period,” LCG concluded. When observing all of April, the food items that ended with a balance of falling prices were Sugar, honey, sweets and cocoa ( -5.7% ), Fruits ( -4.9%) and Baked goods, pasta and cereals ( -0.3 percent ).

Santiago Bausili (BCRA) and Luis Caputo (Ministry of Economy)

For its part, a report from C&T Economic Advisors estimated that “for the GBA region it presented a monthly increase of 8.7% in April, following the downward trend of recent months. In turn, the interannual variation was 298.1 percent . As has happened in February and March, we estimate that inflation at the national level will be lower than in the GBA due to the greater impact of the tariffs.”

"After the largest increase in the first week of the month, in which the impact of increases in regulated prices (gas, water and education) is computed, the C&T CPI registered practically zero weekly variations in the following three weeks," they explained from that consultant.

“An area that maintained increases well above the average is prepaid medicine. A 19 percent increase was planned for April. However, as a consequence of the advance protection measure ordered by the Industry Secretariat within the framework of a CNDC opinion following a complaint, the companies had to lower prices by 26%, so that the accumulated increase does not exceed the accumulated general inflation. This change has a direct impact of 1.5 percentage points on April inflation,” they detailed.

Source: LCG

“In this way, in the last week of the month, the C&T CPI had an increase of 7.6% compared to the same week in March. In turn, core inflation, which leaves aside regulated and seasonal prices, was 6.9% in the month, the lowest since July of last year," they concluded.

Meanwhile, for Eco Go, between December and January almost 90% of prices rose every week, while now that percentage has dropped to 40 percent. For this reason, they estimate that April inflation would be between 8% and 9% , although if the rise in prepaid bills does not ultimately impact because they roll back the increases, it will be in the order of 7 percent .April would end with a lower price increase than initially expected due to the effect of a decline in prepaid medicine prices determined by the Ministry of Commerce and which would have taken 1.5 percentage points off the CPI.

The Government once again adjusted the squeeze on the stock of pesos with interest rates that will continue in negative territory against inflation. Fixed terms for savers will have a return of less than 4% per month after the reduction in the monetary policy rate, which fell for the second consecutive week to 50% nominal annually.

A nominal 50% annual reference rate aligns the cost of money a little more with the update rate of the official exchange rate, which since December 13 has been 2% monthly . Thus, after accumulating during the first three months after the initial devaluation a certain exchange rate delay in the race between the crawling peg and the CPI, with the compression of rates this delay will begin to be much slower.