BuySellBA

Administrator

Change of cycle: the apartments that disappeared from sale - La Nacion Propiedades

Source:

Cambio de ciclo: los departamentos que desaparecieron de la venta

La realidad del mercado inmobiliario cambió de forma abrupta en los primeros cinco meses del año

June 06 2025

The reality of the real estate market changed abruptly in the first five months of the year.

By Candela Contreras

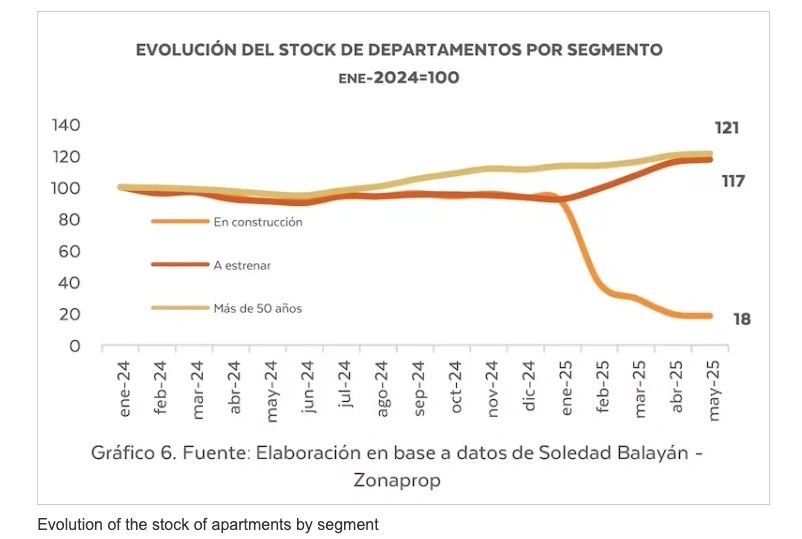

Since January 2025, the supply of units under construction has fallen by 82%.Santiago Filipuzzi

The supply of real estate for sale in the City of Buenos Aires has seen three consecutive months of year-over-year growth, following 29 consecutive months of decline. In terms of figures, there are approximately 72,000 apartments and 106,000 properties available in the main real estate sites, according to data from the Real Estate Radar compiled by the Fabián Achával real estate agency.

In this context, the data that caught the attention of specialists is that "apartments under construction" are experiencing a completely different reality. "Since January 2025, the supply of used apartments over 50 years old has fallen by 82% , while the increase in supply of used apartments over 50 years old has been 21%," explains Soledad Balayán, owner of Maure Inmobiliaria.

This phenomenon contrasts with the general recovery dynamics of the sector : listing prices continue to rise, sales transactions are growing month by month, and the share of mortgage loans in deeds is increasing, albeit at a moderate pace (around 20% of the total).

In numbers, in April 2025, 5,471 deeds of sale were signed in the City of Buenos Aires , which represents a 50% increase compared to the same month in 2024. If we compare the first four months of the year, 18,156 transactions were accumulated, a figure that represents the second best record in the last 18 years.

In the first quarter, the year-over-year increase was even more pronounced: growth reached 93.7% in January and 94% in February. These figures reflect that, despite the shortage of units under construction, demand for real estate remains steady.

What's happening with the units under construction?

In December 2024, the number of apartments under construction listed was around 11,000 —similar to the number of "new" apartments— but, starting in January, they began to decline, reaching fewer than 1,800 listings in May . This represents a drop of almost 85% in five months.

To understand the causes of the decline in listed apartments , it is necessary to understand two very important current dynamics in the real estate market: the situation of construction costs in a market focused on used apartments, and the costs of listing apartments.

“There is a relatively significant uptake in the used market, as evidenced by the deeds: in April, approximately 20% of transactions were driven by the surge in mortgage lending. The remainder is due to stable conditions in which, in many cases, the sale value of an apartment in a precarious situation is lower than its replacement cost ,” Issel Kiperszmid, director of Dypsa International, told LA NACION.

What the businessman is referring to is that when construction and material costs begin to exceed projected sales prices , developers choose to withdraw units from their offerings . "At the end of last year, there were projects under construction where it was decided to suspend sales because they weren't profitable. They prefer to wait for the market to adjust and for there to be a shortage of used stocks ," the real estate developer points out.

Adding to this scenario is a structural factor. Achaval analyzes a change in the cycle; today, the price signal indicates that buyers are better off buying a used apartment because there is a significant gap between the prices of these types of units—cheap by historical standards, with slow increases—and the cost of construction, which went from lows to highs in less than two years. "But these cycles reverse, and history shows this," he clarifies. Not long ago, in 2018, when the real estate crisis began, prices were at historic highs and construction was cheap. The question the broker is asking in this context, in which construction is slowing in anticipation of better prices, is when this relative price signal will change. "When the price of used residential properties clears out," he replies.

But the reality is that today more used cars are being sold than wells . So, if the number of wells being listed is decreasing, it's because they're selling less.

Therefore, another key point of this phenomenon is that there is a tacit agreement between developers and real estate agencies: given the sharp increase, even above inflation, in the costs of advertising on major real estate sites, everyone is looking to cut costs, and the easiest thing to cut are ads for underperforming units, because they sell poorly and, furthermore, there are many units in the same building.

So, the question arises: is it really necessary to list all the units in a single building? Or is it preferable to show only one or two to avoid skyrocketing real estate marketing costs? It's both: there are fewer listings because they aren't selling, and at the same time, to cut costs. It's a dual reality: it doesn't make sense to keep so many pre-owned units listed when the cycle favors used units .

Construction notices posted have droppedRodrigo Nespolo

When will the cycle return?

According to Issel Kiperszmid, this situation is temporary and will last until the "market adjustment" occurs, which comprises two stages:Stock depletion and price acceleration: As used units begin to run out, prices will rise even more sharply. "Today, the increase is slow, but there will come a time when the stock runs out. Then we will see a jump in sales prices," he asserts. This trend will further consolidate the gap between the used market and the under-construction segment.

Incorporation of imported technology and inputs : Economic liberalization allows for the incorporation of new technologies and sources of inputs from abroad, so in the medium term this will tend to gradually moderate construction costs. However, in the short term, rising prices will be the main driver.

Regarding the future of the cycle, Achával emphasizes: "When the cost of construction falls and relative prices in the economy adjust, or when the price per square meter of used construction rises significantly, the balance will tip back toward the bottom. We are still in the adjustment phase."

A slow process

This depletion of used stocks, which specialists emphasize, would occur more quickly if the granting of mortgage loans grew more abruptly .The problem is the limitations of the local financial system: "During the years of high inflation, banks financed themselves with their own resources, but that model has its limits. Today, they can't offer 20- or 30-year loans like other countries because they don't have a solid mortgage capital market," explains Kiperszmid.

For this reason, many developers are awaiting the evolution of official guidelines with uncertainty . "The government should promote more agile mechanisms to securitize mortgage loans, for example, through sustainable guarantee funds or by involving life insurance companies and other market players with medium- and long-term funds," he suggests. Without a steady flow of mortgage financing, access to homeownership risks stagnating, which in turn would delay the full recovery of the housing market.

" Today, the playing field is in favor of the used residential segment, which has very attractive prices : in real terms, they remain at 2006 values," Achával points out.

The difference between used and substandard prices—along with rising construction costs—creates a paradox: developers are discouraged from putting new units up for sale, while investors and buyers prefer used units due to their price-to-surface ratio . In concrete terms, the average square meter of a substandard apartment in the city averages US$2,893, while that of a used apartment averages US$2,211, and that of a brand-new apartment is around US$2,831, according to Zonaprop.

Therefore, the readjustment will depend on two variables: the speed with which the stock of used apartments is depleted and the speed with which the banking system can channel more financing . If the first factor accelerates, the sale prices of used properties will jump and, consequently, the bottom line will return to normal.

www.buysellba.com