BuySellBA

Administrator

Buying a new apartment is becoming more and more expensive: the price gap with used apartments is growing - La Nacion Propiedades

Source:

www.lanacion.com.ar

www.lanacion.com.ar

October 21, 2024

According to a private survey, brand-new apartments today cost 30% more than used ones, the largest difference recorded since 2015.

By Candela Contreras

Prices for brand new apartments are 30% more expensive than used ones.GaudiLab - Shutterstock

The Buenos Aires real estate market is showing no respite and is experiencing a new paradox : while published property prices generally show a stable trend, the gap between the price of a new apartment and a used one is widening like never before in the last 10 years.

The gap between the two segments reaches 30% , the highest recorded since December 2015 , when it was just 7% . On average, a brand-new apartment is listed for US$2,898/m² , while a used one is listed for US$2,219/m² , according to a report by the real estate platform Zonaprop.

During 2025, new apartments registered an annual increase of 5.2%, while existing apartments increased by 3.32% . Meanwhile, in the monthly comparison, the value of existing properties remained virtually unchanged (US$2,218 in August and US$2,219 in September), while new apartments registered an increase of 0.24%.

Despite these increases, under construction apartments lead the annual price increases with 8.29% , reaching US$3,033/m² , 4.4% more than new units. Although they are not yet finished, their performance anticipates a trend: new product prices remain tied to construction costs , which continue to rise.

"The acceleration in construction cost increases that continued until July of this year directly impacted the values of existing and newly built properties. Building today costs almost three times more than it did five years ago, during the pandemic," says Leandro Molina, country manager of Zonaprop.

The analyst adds that given this reality, "used units began to present themselves as a more stable and negotiable option, especially in the last year, when demand progressively increased as a result of mortgage loans for finished units ."

Used apartments have increased by 3.32% so far in 2025.Daniel Basualdo

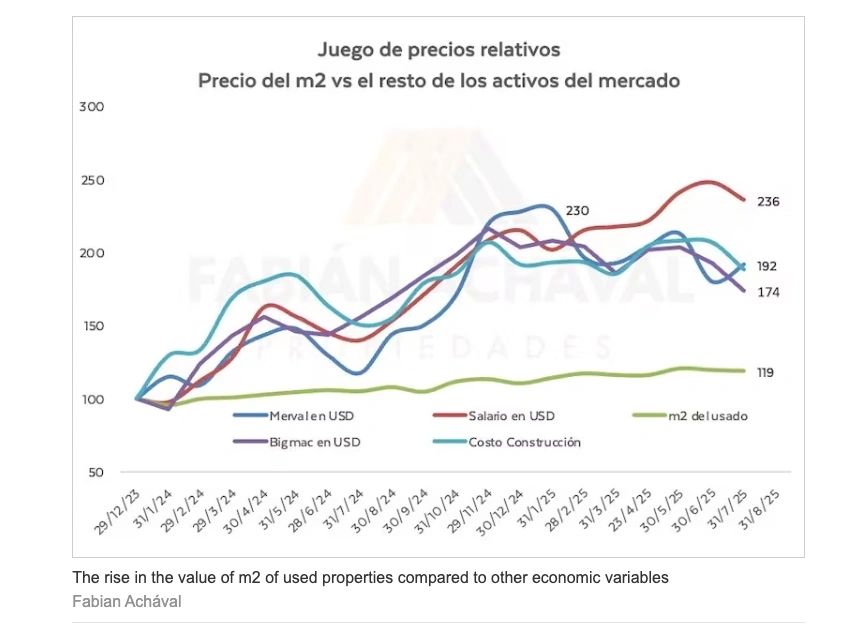

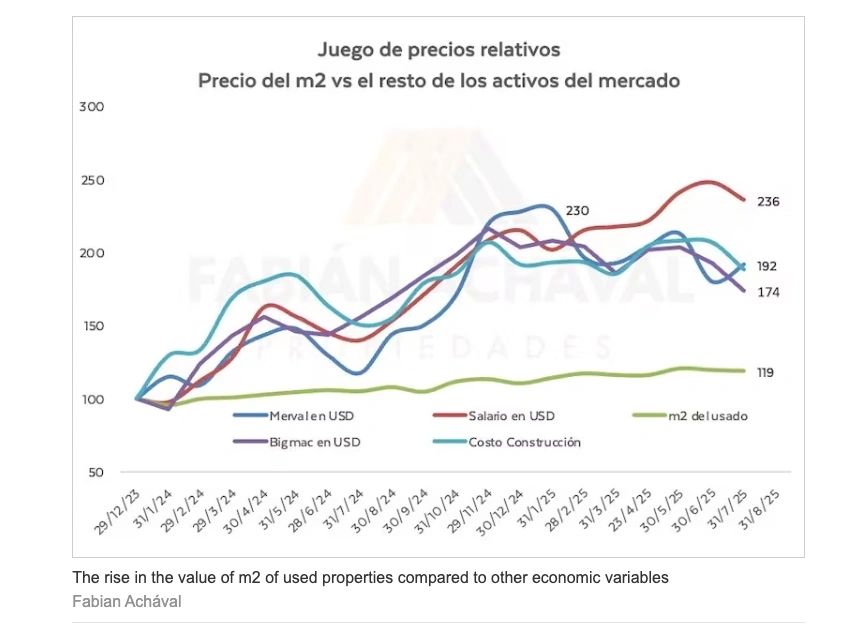

And that's the key: while everything went up (cars, materials, food), used apartments lagged behind . Achával sums it up with a clear image: "Not only did the cost of construction increase significantly, but used properties fell behind other assets in the economy."

Although construction costs have shown a slight decline since July, they remain at historically high levels . The index is 94% higher than in October 2023 and almost three times more expensive than at the historic low of October 2020.

This base price increase is directly reflected in the value of new apartments . "On the one hand, the cost of construction increases, so the gap will continue to widen. It's very large, and in a context where there isn't much dynamism," Achával warns.

For her part, Soledad Balayán, owner of Maure Inmobiliaria, adds that the gap between the two is widening because genuine demand pressure for used properties has dropped significantly in the last two months . "And the prices of brand-new properties have a much greater component of replacement costs than demand pressure," she maintains.

However, the increase in supply contrasts directly with the current shortage of mortgage credit . Rising interest rates on mortgage loans and political (pre-election) and economic (due to exchange rate hikes) uncertainty have had a direct impact on demand for long-term financing.

In this context, used car prices are stabilized at low levels . "I don't think they'll go any lower. There's no room for error: they're already well below other costs," the businessman adds.

Despite the stagnation in the mid-range segment, demand for high-priced prices is returning. "The audience may be different, but it's a sign that square footage remains cheap by historical standards," Achával notes.

Thus, the market is divided between a universe of new properties with rising prices and another of used units with a high supply, more affordable and with little demand pressure.

On the other hand, Villa Riachuelo is the most affordable neighborhood for new construction. The price there is US$1,742 per square meter . It is followed by Parque Avellaneda (US$1,830/m²) and Nueva Pompeya (US$1,855/m²) .

www.buysellba.com

Source:

Comprar un departamento nuevo es cada vez más caro: crece la brecha de precios con los usados

Según un relevamiento privado, los departamentos a estrenar hoy cuestan un 30% más caros que los usados, la mayor diferencia registrada desde 2015

October 21, 2024

According to a private survey, brand-new apartments today cost 30% more than used ones, the largest difference recorded since 2015.

By Candela Contreras

Prices for brand new apartments are 30% more expensive than used ones.GaudiLab - Shutterstock

The Buenos Aires real estate market is showing no respite and is experiencing a new paradox : while published property prices generally show a stable trend, the gap between the price of a new apartment and a used one is widening like never before in the last 10 years.

The gap between the two segments reaches 30% , the highest recorded since December 2015 , when it was just 7% . On average, a brand-new apartment is listed for US$2,898/m² , while a used one is listed for US$2,219/m² , according to a report by the real estate platform Zonaprop.

During 2025, new apartments registered an annual increase of 5.2%, while existing apartments increased by 3.32% . Meanwhile, in the monthly comparison, the value of existing properties remained virtually unchanged (US$2,218 in August and US$2,219 in September), while new apartments registered an increase of 0.24%.

Despite these increases, under construction apartments lead the annual price increases with 8.29% , reaching US$3,033/m² , 4.4% more than new units. Although they are not yet finished, their performance anticipates a trend: new product prices remain tied to construction costs , which continue to rise.

"The acceleration in construction cost increases that continued until July of this year directly impacted the values of existing and newly built properties. Building today costs almost three times more than it did five years ago, during the pandemic," says Leandro Molina, country manager of Zonaprop.

The analyst adds that given this reality, "used units began to present themselves as a more stable and negotiable option, especially in the last year, when demand progressively increased as a result of mortgage loans for finished units ."

Used apartments have increased by 3.32% so far in 2025.Daniel Basualdo

“The gap is a quotient between two different realities”

For Fabián Achával, owner of the eponymous real estate company, the current gap can be explained as an equation between two opposing forces : the rising cost of construction and the stability of existing units. “The gap is a quotient between the numerator, which is the number of units under construction or brand new, and the denominator, the price of existing units. There are two effects here: in the numerator, the cost of construction, which continues to rise , and in the denominator, existing units are the ones that have increased the least in the entire Argentine economy ,” he explains.And that's the key: while everything went up (cars, materials, food), used apartments lagged behind . Achával sums it up with a clear image: "Not only did the cost of construction increase significantly, but used properties fell behind other assets in the economy."

Although construction costs have shown a slight decline since July, they remain at historically high levels . The index is 94% higher than in October 2023 and almost three times more expensive than at the historic low of October 2020.

This base price increase is directly reflected in the value of new apartments . "On the one hand, the cost of construction increases, so the gap will continue to widen. It's very large, and in a context where there isn't much dynamism," Achával warns.

For her part, Soledad Balayán, owner of Maure Inmobiliaria, adds that the gap between the two is widening because genuine demand pressure for used properties has dropped significantly in the last two months . "And the prices of brand-new properties have a much greater component of replacement costs than demand pressure," she maintains.

The situation of the used car: supply increases, but prices do not

Adding to the cost pressure is a market peculiarity: the supply of used cars continues to grow . "We don't see it falling. There are more than 110,000 units for sale, which is a lot. Until that stock decreases, we'll continue to see this gap," Achával explains.However, the increase in supply contrasts directly with the current shortage of mortgage credit . Rising interest rates on mortgage loans and political (pre-election) and economic (due to exchange rate hikes) uncertainty have had a direct impact on demand for long-term financing.

In this context, used car prices are stabilized at low levels . "I don't think they'll go any lower. There's no room for error: they're already well below other costs," the businessman adds.

Despite the stagnation in the mid-range segment, demand for high-priced prices is returning. "The audience may be different, but it's a sign that square footage remains cheap by historical standards," Achával notes.

Thus, the market is divided between a universe of new properties with rising prices and another of used units with a high supply, more affordable and with little demand pressure.

The neighborhoods with the most expensive new apartment offerings

Puerto Madero leads the ranking of neighborhoods with the most expensive apartment options. In this case, a brand-new unit costs US$6,701/m² . Palermo is in second place at US$3,309/m² , followed by Belgrano at US$3,774/m² .On the other hand, Villa Riachuelo is the most affordable neighborhood for new construction. The price there is US$1,742 per square meter . It is followed by Parque Avellaneda (US$1,830/m²) and Nueva Pompeya (US$1,855/m²) .

www.buysellba.com