BuySellBA

Administrator

Between Madrid and Buenos Aires: How much is a property worth and what profitability each real estate market offers? - Ambito Financiero

Source:

www.ambito.com

www.ambito.com

October 08, 2025

By Jose Luis Cieri

The stability of the euro and the appreciation of the square meter in Madrid attract Argentine buyers compared to the volatility of the Buenos Aires market.

Aerial view of Madrid, with the black and gold dome of the Metropolis Building, at the intersection of Gran Vía and Alcalá Street.

Argentines' interest in investing in Madrid's real estate market grew again in 2025. The Spanish capital combines macroeconomic stability, accessible credit, and sustained profitability in euros, factors that differentiate it from the context of Buenos Aires , where inflation and exchange rate instability continue to affect the real value of properties and rental yields.

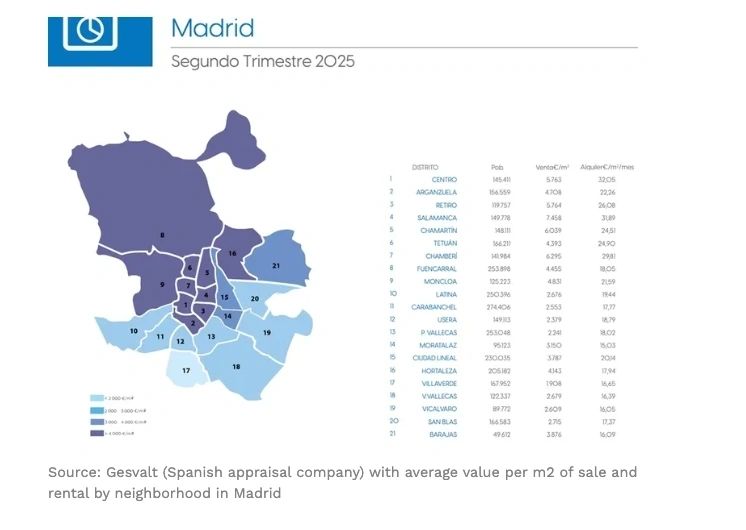

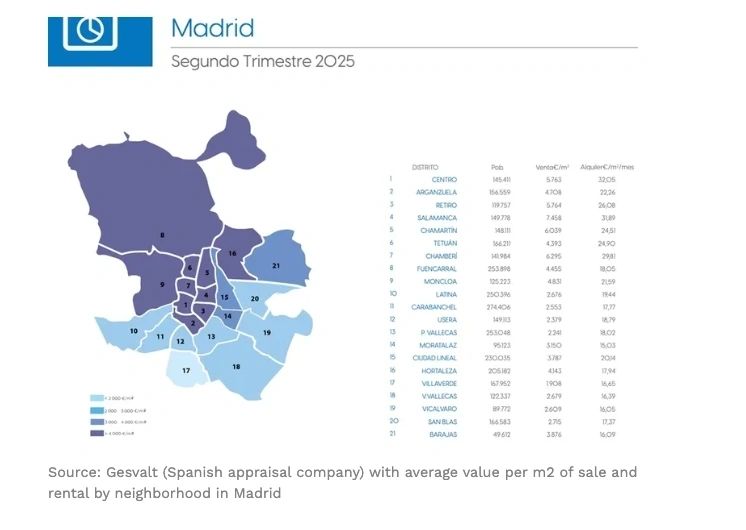

According to European market data, prices in the Spanish capital increased by 14% year-over-year and up to 20% in central areas such as Salamanca, Chamberí , and Malasaña . In contrast, property appreciation in Buenos Aires continues to be limited by the decline in transactions and a lack of financing.

For Claudio Bolotinsky , director of SiiMadrid Argentina/Spain, "the increase is due to several factors: there is a structural shortage of supply—Madrid is a city with growing population and has serious limitations on adding new subways—sustained demand, and prices still below those of other European capitals."

He added that the city "has established itself as an international investment center and a safe haven against global inflation, with clear expectations of continued inflation."

Mortgage loans, according to Bolotinsky, play a decisive role. “Local buyers take advantage of the low rates and long terms, and more and more foreign investors are also seeking access to this financing. It doesn't influence the purchase decision as much, but it does influence the timing: mortgage transactions typically take about 45 days until the deed is finalized,” he explained.

An apartment near Plaza Santa Ana, in the Las Letras neighborhood, within the Centro district of Madrid (Photo: SiiMadrid Argentina/Spain)

In Spain, investors are also reaping the benefits of capital appreciation. According to their estimate, "property capitalization has averaged around 10% annually in recent years." This predictability creates a notable gap compared to the Buenos Aires market, where prices in dollars remain lagging and rents are adjusted according to local payment capacity.

José Rozados , of Reporte Inmobiliario, noted that credit is a central driver in the Spanish market. “The market dynamics go hand in hand with mortgage loans. This instrument accounts for between 65 and 70% of transactions. A well-conditioned property, properly appraised and marketed, receives a purchase response compatible with the request within the first 30 days,” he explained.

Rozados explained that "the average annual gross profitability in Madrid for long-term rentals is 6.4%, which is slightly higher than what is currently achieved in Buenos Aires, and is also more stable."

In Argentina, according to industry surveys, gross annual profitability is between 4% and 5% in dollars for two- or three-room units, with average rents of $7 to $8 per square meter . In Madrid, monthly rents range between €20 and €22 per square meter , with returns ranging from 5% to 10% , depending on the area and property type.

Rozados noted that foreign demand in Madrid has particular characteristics. "It's predominantly a resident foreign buyer, unlike in more touristy areas where buyers don't reside permanently. This difference determines the use that will be given to the home and the price range. Non-residents generally lean toward higher-value products than urban residential," he explained.

He recalled that "the market absorbed a significant stock of bank-foreclosed properties at low prices, and in the last decade, prices began to rise, surpassing pre-crisis levels."

For Rodríguez Nader, the recovery was consolidated by GDP growth and tourism. "Spain has remained among the three most popular tourist destinations for over a decade. This has increased tourist rentals in residential buildings and boosted demand for housing," he explained.

The businessman emphasized that the Spanish market offers credit and financing conditions that encourage development. "There are various financial tools, such as intermediate loans from banks or investment funds that support investors or developers throughout the entire chain, even analyzing the viability of projects," he noted.

New projects also attract "albiceleste" investors

Rodríguez Nader also highlighted the added value of Argentine professionals. “We have been able to enter that market by raising the bar and working with financial institutions, presenting business plans, and collaborating with institutions. This challenge has allowed us to grow and become even more professional,” he said.

The foreign buyer profile is diverse. “Madrid has a heterogeneous composition. Each neighborhood caters to its own audience: Salamanca, Goya, and Retiro attract Latin American buyers, while the more peripheral areas attract demand from local residents and more competitive prices,” he explained.

Regarding prices, Rodríguez Nader noted that “one-bedroom apartments cost an average of €380,000; two-bedroom apartments cost around €550,000; and three-bedroom apartments cost between €900,000 and €920,000. The price per square meter in Madrid is double the Spanish average, at almost €6,000 per square meter. In neighborhoods like Salamanca, Goya, and Retiro, prices can reach €15,000, while in outlying areas, prices range between €4,000 and €6,000 per square meter.”

Rents are following this trend: "Between 1,100 and 1,300 euros for one-bedroom apartments, 1,400 to 1,600 euros for two-bedroom apartments, and 1,700 to 2,000 euros for three-bedroom apartments. In certain locations, prices can double," he added.

Bolotinsky agreed that profitability varies by area. "In central areas, it's around 5% annually, while in the suburbs, it can reach 10%. Furthermore, property value capitalization averages 10% annually, making Madrid's bricks and mortar a safe haven investment with growth potential," he explained.

Plaza de Santa Ana, in the heart of the Las Letras neighborhood, brings together bars, theaters, and hotels in the center of Madrid.

Rodríguez Nader agreed with this view. “With limited supply, new construction is quickly absorbed. The end of the pandemic raised construction costs, and high demand passed those values on to prices. In Spain, income is more stable and allows for long-term projections, between 4 and 8 points annually, with constant capital appreciation,” he said.

In a context where the Buenos Aires market continues to be affected by a lack of credit and macroeconomic instability, the Spanish capital is consolidating its position as a benchmark. "It remains one of the most attractive destinations for investment and safeguarding value, with room for growth and prices still below those of Germany, France, or Italy," concluded Rodríguez Nader.

www.buysellba.com

Source:

Entre Madrid y Buenos Aires: cuánto vale una propiedad y qué rentabilidad ofrece cada mercado inmobiliario

La estabilidad del euro y la revalorización del metro cuadrado en Madrid atraen a compradores argentinos frente a la volatilidad del mercado porteño.

October 08, 2025

By Jose Luis Cieri

The stability of the euro and the appreciation of the square meter in Madrid attract Argentine buyers compared to the volatility of the Buenos Aires market.

Aerial view of Madrid, with the black and gold dome of the Metropolis Building, at the intersection of Gran Vía and Alcalá Street.

Argentines' interest in investing in Madrid's real estate market grew again in 2025. The Spanish capital combines macroeconomic stability, accessible credit, and sustained profitability in euros, factors that differentiate it from the context of Buenos Aires , where inflation and exchange rate instability continue to affect the real value of properties and rental yields.

According to European market data, prices in the Spanish capital increased by 14% year-over-year and up to 20% in central areas such as Salamanca, Chamberí , and Malasaña . In contrast, property appreciation in Buenos Aires continues to be limited by the decline in transactions and a lack of financing.

For Claudio Bolotinsky , director of SiiMadrid Argentina/Spain, "the increase is due to several factors: there is a structural shortage of supply—Madrid is a city with growing population and has serious limitations on adding new subways—sustained demand, and prices still below those of other European capitals."

He added that the city "has established itself as an international investment center and a safe haven against global inflation, with clear expectations of continued inflation."

Mortgage loans, according to Bolotinsky, play a decisive role. “Local buyers take advantage of the low rates and long terms, and more and more foreign investors are also seeking access to this financing. It doesn't influence the purchase decision as much, but it does influence the timing: mortgage transactions typically take about 45 days until the deed is finalized,” he explained.

Profitability and comparison with Buenos Aires

The most visible difference between the two markets is reflected in the stability of the return. "In Madrid, rents are in euros, fixed and predictable, with no unforeseen expenses. In Buenos Aires, profitability is affected by market instability, constant ups and downs, inflation, the exchange rate, and variable costs such as utilities," said Bolotinsky.

An apartment near Plaza Santa Ana, in the Las Letras neighborhood, within the Centro district of Madrid (Photo: SiiMadrid Argentina/Spain)

In Spain, investors are also reaping the benefits of capital appreciation. According to their estimate, "property capitalization has averaged around 10% annually in recent years." This predictability creates a notable gap compared to the Buenos Aires market, where prices in dollars remain lagging and rents are adjusted according to local payment capacity.

José Rozados , of Reporte Inmobiliario, noted that credit is a central driver in the Spanish market. “The market dynamics go hand in hand with mortgage loans. This instrument accounts for between 65 and 70% of transactions. A well-conditioned property, properly appraised and marketed, receives a purchase response compatible with the request within the first 30 days,” he explained.

Rozados explained that "the average annual gross profitability in Madrid for long-term rentals is 6.4%, which is slightly higher than what is currently achieved in Buenos Aires, and is also more stable."

In Argentina, according to industry surveys, gross annual profitability is between 4% and 5% in dollars for two- or three-room units, with average rents of $7 to $8 per square meter . In Madrid, monthly rents range between €20 and €22 per square meter , with returns ranging from 5% to 10% , depending on the area and property type.

Rozados noted that foreign demand in Madrid has particular characteristics. "It's predominantly a resident foreign buyer, unlike in more touristy areas where buyers don't reside permanently. This difference determines the use that will be given to the home and the price range. Non-residents generally lean toward higher-value products than urban residential," he explained.

The new also attracts Argentines

Interest in the Madrid market also extends to the development of new construction projects. Leonardo Rodríguez Nader , co-founder and CEO of CMNV–Comunidad de Inversión, stated that "the acceleration in property prices in Spain, especially in high-demand cities like Madrid, Valencia, Alicante, and Málaga, has its roots in the 2009 financial crisis."He recalled that "the market absorbed a significant stock of bank-foreclosed properties at low prices, and in the last decade, prices began to rise, surpassing pre-crisis levels."

For Rodríguez Nader, the recovery was consolidated by GDP growth and tourism. "Spain has remained among the three most popular tourist destinations for over a decade. This has increased tourist rentals in residential buildings and boosted demand for housing," he explained.

The businessman emphasized that the Spanish market offers credit and financing conditions that encourage development. "There are various financial tools, such as intermediate loans from banks or investment funds that support investors or developers throughout the entire chain, even analyzing the viability of projects," he noted.

New projects also attract "albiceleste" investors

Rodríguez Nader also highlighted the added value of Argentine professionals. “We have been able to enter that market by raising the bar and working with financial institutions, presenting business plans, and collaborating with institutions. This challenge has allowed us to grow and become even more professional,” he said.

Prices, areas and opportunities

Madrid's appeal also lies in its predictability. "Unlike in Argentina, the challenge is finding the opportunity, locating land or a building to renovate, and closing the deal. Budgets aren't adjusted for distorting indices; they're only adjusted by the CPI, which can fluctuate between 2 and 3% annually," explained Rodríguez Nader.The foreign buyer profile is diverse. “Madrid has a heterogeneous composition. Each neighborhood caters to its own audience: Salamanca, Goya, and Retiro attract Latin American buyers, while the more peripheral areas attract demand from local residents and more competitive prices,” he explained.

Regarding prices, Rodríguez Nader noted that “one-bedroom apartments cost an average of €380,000; two-bedroom apartments cost around €550,000; and three-bedroom apartments cost between €900,000 and €920,000. The price per square meter in Madrid is double the Spanish average, at almost €6,000 per square meter. In neighborhoods like Salamanca, Goya, and Retiro, prices can reach €15,000, while in outlying areas, prices range between €4,000 and €6,000 per square meter.”

Rents are following this trend: "Between 1,100 and 1,300 euros for one-bedroom apartments, 1,400 to 1,600 euros for two-bedroom apartments, and 1,700 to 2,000 euros for three-bedroom apartments. In certain locations, prices can double," he added.

Bolotinsky agreed that profitability varies by area. "In central areas, it's around 5% annually, while in the suburbs, it can reach 10%. Furthermore, property value capitalization averages 10% annually, making Madrid's bricks and mortar a safe haven investment with growth potential," he explained.

Madrid as a refuge of courage

For Rozados, the appeal of the Spanish capital lies in its predictability. “Beyond the location or the investment amount, what distinguishes Madrid is the stability of the hard currency income. It's a destination where the rules are upheld and the return is predictable,” he said.

Plaza de Santa Ana, in the heart of the Las Letras neighborhood, brings together bars, theaters, and hotels in the center of Madrid.

Rodríguez Nader agreed with this view. “With limited supply, new construction is quickly absorbed. The end of the pandemic raised construction costs, and high demand passed those values on to prices. In Spain, income is more stable and allows for long-term projections, between 4 and 8 points annually, with constant capital appreciation,” he said.

In a context where the Buenos Aires market continues to be affected by a lack of credit and macroeconomic instability, the Spanish capital is consolidating its position as a benchmark. "It remains one of the most attractive destinations for investment and safeguarding value, with room for growth and prices still below those of Germany, France, or Italy," concluded Rodríguez Nader.

www.buysellba.com