BuySellBA

Administrator

ARBA with increase: new bills due in May begin to arrive - La Nacion Propiedades

Source:

www.lanacion.com.ar

www.lanacion.com.ar

May 07, 2025

The second installment of the tax collected by the Buenos Aires Province tax collection agency arrives with an increase

Taxpayers will pay the second installment of the property tax with an increaseRicardo Pristupluk

The Buenos Aires Province Revenue Agency (ARBA) has begun notifying taxpayers of the second installment of the Urban Property Tax , with an increase over the previous installment . Unlike other years, the issuance of invoices for this tax—which covers 7,298,887 properties in Buenos Aires— was delayed due to the postponement of the approval of Tax Law 2025 .

In February 2025, taxpayers received their bills for the first installment of the year . Discussion of the tax law extended until the end of December 2024 and failed to pass the Legislature. As a palliative measure, Governor Axel Kicillof signed a decree in early January to extend the validity of Law 15,479 (originally enacted for 2024) throughout 2025. Thus, the rate for the first installment remained unchanged and maintained the same values as a year ago .

But this month, new bills for the second installment began arriving, with an 8.61% increase over the 2024 amount. This new installment is scheduled to expire on May 8, 2025 .

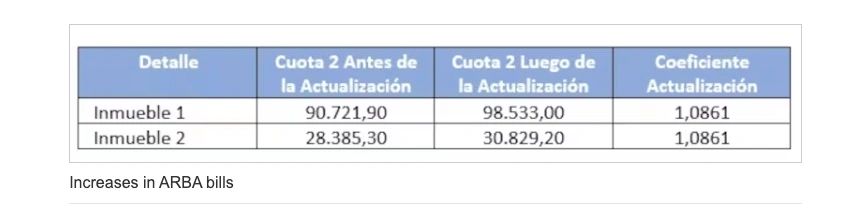

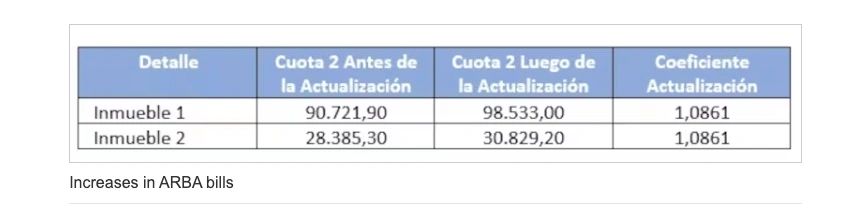

For example, two cases of real-life updates to the property tax in the Province of Buenos Aires with the increase in 2025 are as follows:

“For subsequent installments, current law authorizes ARBA to apply an update coefficient to the amounts—basic and supplementary—that cannot exceed the 30-day interest rate of Banco Provincia, increased by up to 100%. Regulatory Resolutions 8/2024 and 12/2024 regulated this calculation, but without detailing the formula or specific parameters, which generates uncertainty among taxpayers, ” explains Sebastián Domínguez, CEO of SDC Asesores Tributarios.

On the ballots already arriving , the coefficient applied is 1.0861 , reflecting an 8.61% increase over the amount of installment 1. This adjustment is in addition to the contribution to the Education Fund.

"Regarding the legality of the update, it could violate the principle of legal confidentiality, since the method of calculating the coefficient should be established in the law and not delegated to ARBA ," warns Domínguez. Although this method of updating could be challenged in court, "the costs and complexity of initiating individual legal actions discourage most taxpayers," he adds.

It remains to be seen how ARBA will act on installments 3 through 5. In 2024, the agency only updated the second installment—with a 20% increase—and kept the subsequent installments unchanged, then added a sixth extraordinary installment toward the end of the year . It remains to be seen how the agency will act for the remainder of this year.

Despite the increases, ARBA has once again recovered discounts for on-time payments.

According to the Buenos Aires Tax Collection Agency (ARBA), only 9% of real estate properties were affected by this additional amount, which could not exceed 20% of the total annual tax and represented an increase of up to 100% of the last installment. This additional payment was issued as installment 5, both for those who paid in installments and those who had already paid for the full year. The surcharge was applied—according to tax law—when the taxable base of the urban real estate tax corresponding to the property, or the sum of the taxable base for all properties, exceeded $31,465,000. For the rest of the taxpayers, the installment would have the same value as the previous installments.

ARBA explained that this was not an increase, but rather that the increase in the amount "is equivalent to an additional fee," and based its argument on the Tariff Law, which establishes that the responsible government departments can decide to apply an additional fee to certain goods and services. Therefore, "the amount reflected in fee 5 does not represent a 100% increase over the previous fee, but rather an additional fee added to the latter," the organization stated.

www.buysellba.com

Source:

ARBA con aumento: comienzan a llegar las nuevas boletas que vencen en mayo

La segunda cuota del impuesto que cobra la agencia de recaudación de la Provincia de Buenos Aires llega con un incremento

May 07, 2025

The second installment of the tax collected by the Buenos Aires Province tax collection agency arrives with an increase

Taxpayers will pay the second installment of the property tax with an increaseRicardo Pristupluk

The Buenos Aires Province Revenue Agency (ARBA) has begun notifying taxpayers of the second installment of the Urban Property Tax , with an increase over the previous installment . Unlike other years, the issuance of invoices for this tax—which covers 7,298,887 properties in Buenos Aires— was delayed due to the postponement of the approval of Tax Law 2025 .

In February 2025, taxpayers received their bills for the first installment of the year . Discussion of the tax law extended until the end of December 2024 and failed to pass the Legislature. As a palliative measure, Governor Axel Kicillof signed a decree in early January to extend the validity of Law 15,479 (originally enacted for 2024) throughout 2025. Thus, the rate for the first installment remained unchanged and maintained the same values as a year ago .

But this month, new bills for the second installment began arriving, with an 8.61% increase over the 2024 amount. This new installment is scheduled to expire on May 8, 2025 .

For example, two cases of real-life updates to the property tax in the Province of Buenos Aires with the increase in 2025 are as follows:

What will the next installments be like?

The Buenos Aires Urban Real Estate Tax applies to both built-up and vacant properties . Of the 7,298,887 properties covered, 5,254,335 are built-up urban property, 1,735,111 are vacant urban property, and 309,441 are rural property. For built-up urban property, the schedule provides for five installments throughout the year .“For subsequent installments, current law authorizes ARBA to apply an update coefficient to the amounts—basic and supplementary—that cannot exceed the 30-day interest rate of Banco Provincia, increased by up to 100%. Regulatory Resolutions 8/2024 and 12/2024 regulated this calculation, but without detailing the formula or specific parameters, which generates uncertainty among taxpayers, ” explains Sebastián Domínguez, CEO of SDC Asesores Tributarios.

On the ballots already arriving , the coefficient applied is 1.0861 , reflecting an 8.61% increase over the amount of installment 1. This adjustment is in addition to the contribution to the Education Fund.

"Regarding the legality of the update, it could violate the principle of legal confidentiality, since the method of calculating the coefficient should be established in the law and not delegated to ARBA ," warns Domínguez. Although this method of updating could be challenged in court, "the costs and complexity of initiating individual legal actions discourage most taxpayers," he adds.

It remains to be seen how ARBA will act on installments 3 through 5. In 2024, the agency only updated the second installment—with a 20% increase—and kept the subsequent installments unchanged, then added a sixth extraordinary installment toward the end of the year . It remains to be seen how the agency will act for the remainder of this year.

Despite the increases, ARBA has once again recovered discounts for on-time payments.

Can I pay with a discount?

ARBA has reinstated the on-time and direct debit discounts for 2025 , which were eliminated last year. Each discount provides a 5% discount , combinable with each other, which can mitigate the impact of the increase. Therefore, the discounts would be as follows:- 10% discount: For those who choose to pay installment by installment. In this case, they can access a 5% discount if they opt for automatic debit. Additionally, like those who pay annually, they can add an additional 5% discount if they are taxpayers with no outstanding debts.

- 5% discount: For those who do not subscribe to automatic debit but instead pay monthly, but have no debts.

What happened last year with the property tax?

In 2024, starting with the second installment of the tax, the procedure used to determine the adjustment coefficients generated controversy: between the first installment, which fell due in February, and the second installment, which fell due in April, there was an increase equivalent to 20%. Meanwhile, installments 3 and 4, which fell due in June and August, did not experience any increases. However , the last installment reflected an increase that could have doubled the value of the previous installment and exceeded the accumulated inflation so far this year.According to the Buenos Aires Tax Collection Agency (ARBA), only 9% of real estate properties were affected by this additional amount, which could not exceed 20% of the total annual tax and represented an increase of up to 100% of the last installment. This additional payment was issued as installment 5, both for those who paid in installments and those who had already paid for the full year. The surcharge was applied—according to tax law—when the taxable base of the urban real estate tax corresponding to the property, or the sum of the taxable base for all properties, exceeded $31,465,000. For the rest of the taxpayers, the installment would have the same value as the previous installments.

ARBA explained that this was not an increase, but rather that the increase in the amount "is equivalent to an additional fee," and based its argument on the Tariff Law, which establishes that the responsible government departments can decide to apply an additional fee to certain goods and services. Therefore, "the amount reflected in fee 5 does not represent a 100% increase over the previous fee, but rather an additional fee added to the latter," the organization stated.

www.buysellba.com