BuySellBA

Administrator

UVA loans vs. rent: What is the initial fee that each bank charges for a mortgage loan? - Infobae

Source:

www.infobae.com

www.infobae.com

August 13, 2025

Conditions vary depending on the entity, the amount, and the rate applied. The differences exceed one million pesos between the cheapest and most expensive options.

Banco Nación offers the lowest Annual Nominal Rate (TNA) in the system (4.5%), which allows it to provide the most affordable installments.

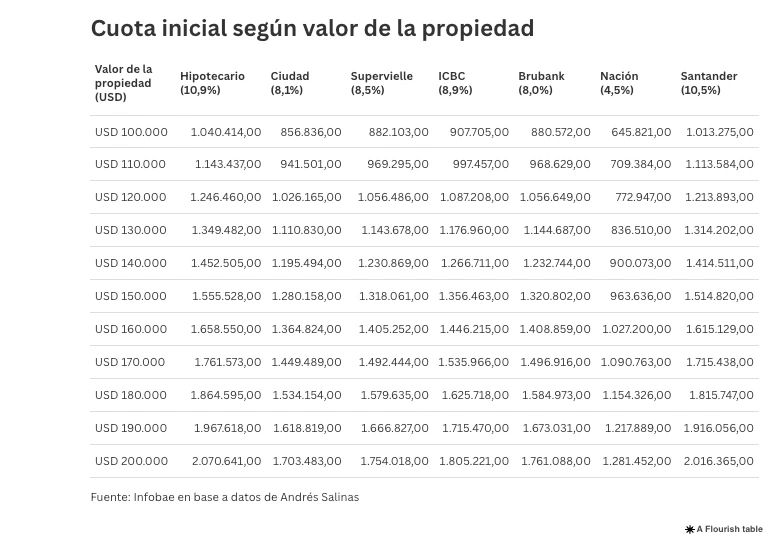

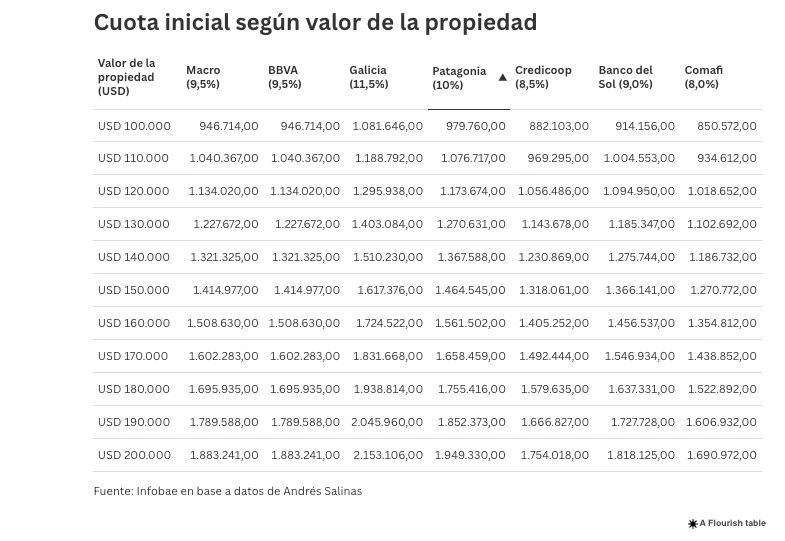

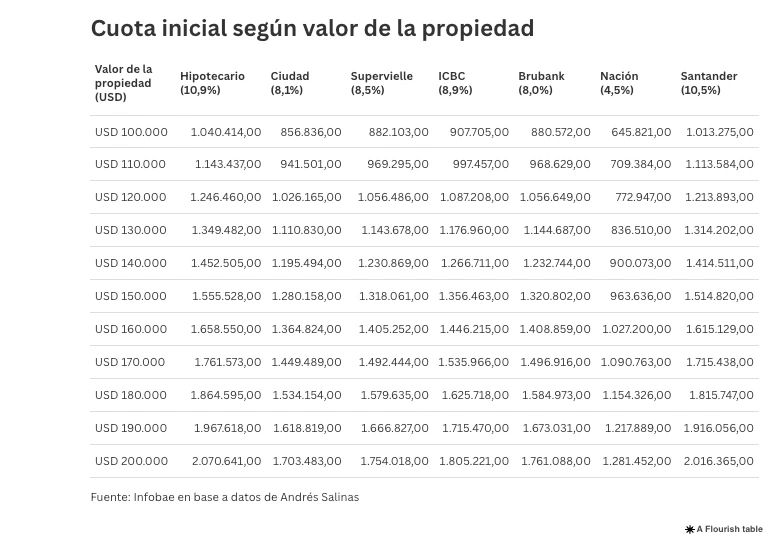

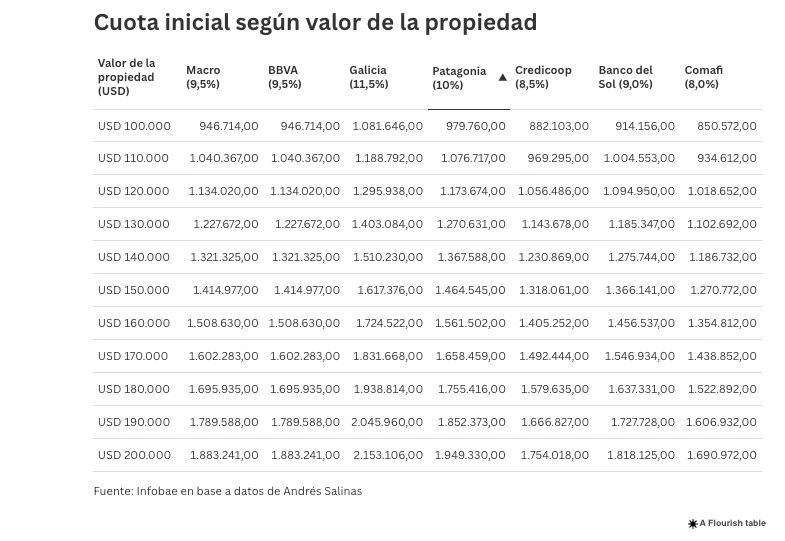

A survey conducted by economist Andrés Salinas found marked differences in the initial payments on 20-year UVA mortgages, depending on the bank selected. The analysis includes a loan covering 75% of the property's value, with credit to the bank, a UVA value of USD 1,548.80 , and an exchange rate of $1,339.62 per dollar .

Even so, despite the economic uncertainty the country is experiencing and the inflation-indexed payments, UVA loan defaults remain low. They remain the lowest in the entire Argentine financial system. This figure is striking given the context and demonstrates that a large portion of borrowers of this type of financing manage to stay current with their obligations.

Banco Nación offers the lowest Annual Percentage Rate (APR) in the system (4.5%), allowing it to offer the most affordable installments. For a home worth USD 100,000 , the initial installment is USD 645,821 . In contrast, Banco Galicia charges the highest APR (11.5%), with a payment amounting to USD 1,081,646 , representing a gap of more than USD 435,000 between the two extremes.

For properties valued at USD 200,000 , the rate in the country reaches USD 1,281,452 , while in Galicia it reaches USD 2,153,106 , widening the gap to more than USD 870,000 . These data show how the applied rate directly impacts the monthly cost of the loan.

Among the intermediate alternatives are Banco Comafi and Brubank , both with an APR of 8%, and Banco Ciudad with 8.1%. For a property worth USD 150,000 , Nación requires a monthly payment of $963,636 , Comafi $1,270,772 , and Galicia $1,617,376 .

Even among banks with similar rates, there are differences of several thousand pesos due to internal conditions and additional costs. This dispersion complicates direct comparison and emphasizes the need to analyze each proposal in detail .

In this context, the down payment on a UVA mortgage for a USD 100,000 property in Nación ( $645,821 ) slightly exceeds the rent for a one-bedroom apartment ( $600,000 ). At banks with higher rates, the down payment can even considerably exceed the rent for a two-bedroom apartment ( $800,000 ).

In the case of Banco Galicia , the initial payment for the same home of USD 100,000 ( $ 1,081,646 ) more than doubles the median rent for a two-bedroom apartment, which accentuates the challenge of accessing credit in certain segments .

Additionally, applicants must contribute the remaining 25% to complete the property value and cover expenses such as deed registration, taxes, and insurance, which raises the entry barrier .

Effective access depends on both prior savings and the applicant's income. Institutions require that the fee not exceed 30% to 35% of the monthly net household income, which excludes a significant portion of the population . In addition, there are additional costs associated with processing and formalizing the transaction.

The median rent in the Autonomous City of Buenos Aires is $500,000 for a studio apartment, $600,000 for a one-bedroom apartment, and $800,000 for a two-bedroom apartment (Matias Chiofalo / Europa Press)

Additional costs include stamp duty (between 1.5% and 2% of the value depending on the jurisdiction), bank and appraisal fees (0.5% to 1% of the requested amount), and notary fees (averaging 2%). Taxes and registry fees (approximately 1.5%) and certification and registration costs (up to 0.5%) must also be considered.

After signing, there will be ongoing obligations such as life insurance and fire insurance , both mandatory, with an approximate annual value of 0.1% to 0.2% of the loan balance . Municipal taxes must also be considered, the amount of which varies depending on the property's location.

In this regard, it is advisable to have some financial support—savings, liquid assets, or family support—to deal with potential contingencies without falling into default . Income stability and predictability are crucial to meeting the challenge of UVA mortgage loans .

www.buysellba.com

Source:

Créditos UVA vs alquileres: cuál es la cuota inicial que cobra cada banco por un préstamo hipotecario

Las condiciones varían según la entidad, el monto y la tasa aplicada. Las diferencias superan el millón de pesos entre la opción más barata y la más cara

August 13, 2025

Conditions vary depending on the entity, the amount, and the rate applied. The differences exceed one million pesos between the cheapest and most expensive options.

Banco Nación offers the lowest Annual Nominal Rate (TNA) in the system (4.5%), which allows it to provide the most affordable installments.

A survey conducted by economist Andrés Salinas found marked differences in the initial payments on 20-year UVA mortgages, depending on the bank selected. The analysis includes a loan covering 75% of the property's value, with credit to the bank, a UVA value of USD 1,548.80 , and an exchange rate of $1,339.62 per dollar .

Even so, despite the economic uncertainty the country is experiencing and the inflation-indexed payments, UVA loan defaults remain low. They remain the lowest in the entire Argentine financial system. This figure is striking given the context and demonstrates that a large portion of borrowers of this type of financing manage to stay current with their obligations.

Banco Nación offers the lowest Annual Percentage Rate (APR) in the system (4.5%), allowing it to offer the most affordable installments. For a home worth USD 100,000 , the initial installment is USD 645,821 . In contrast, Banco Galicia charges the highest APR (11.5%), with a payment amounting to USD 1,081,646 , representing a gap of more than USD 435,000 between the two extremes.

For properties valued at USD 200,000 , the rate in the country reaches USD 1,281,452 , while in Galicia it reaches USD 2,153,106 , widening the gap to more than USD 870,000 . These data show how the applied rate directly impacts the monthly cost of the loan.

Among the intermediate alternatives are Banco Comafi and Brubank , both with an APR of 8%, and Banco Ciudad with 8.1%. For a property worth USD 150,000 , Nación requires a monthly payment of $963,636 , Comafi $1,270,772 , and Galicia $1,617,376 .

Even among banks with similar rates, there are differences of several thousand pesos due to internal conditions and additional costs. This dispersion complicates direct comparison and emphasizes the need to analyze each proposal in detail .

Rate-rent ratio in CABA

According to data from the Scalabrini Ortiz Center for Economic and Social Studies (CESO) for July, the median rent in the Autonomous City of Buenos Aires is $500,000 for a studio apartment, $ 600,000 for a one-bedroom apartment, and $800,000 for a two-bedroom apartment.In this context, the down payment on a UVA mortgage for a USD 100,000 property in Nación ( $645,821 ) slightly exceeds the rent for a one-bedroom apartment ( $600,000 ). At banks with higher rates, the down payment can even considerably exceed the rent for a two-bedroom apartment ( $800,000 ).

In the case of Banco Galicia , the initial payment for the same home of USD 100,000 ( $ 1,081,646 ) more than doubles the median rent for a two-bedroom apartment, which accentuates the challenge of accessing credit in certain segments .

The impact of the rate on access to credit

Initial payment differences tend to increase over the life of the loan because the UVA system indexes both principal and interest to inflation. A lower rate reduces the monthly cost and limits real payment growth, as long as inflation doesn't skyrocket.Additionally, applicants must contribute the remaining 25% to complete the property value and cover expenses such as deed registration, taxes, and insurance, which raises the entry barrier .

Specific examples of fees and rents

- USD 100,000:

- Nation: $645,821 (similar amount to rent for one bedroom)

- Galicia: $ 1,081,646 ( 35% more than the rent for two bedrooms )

- USD 150,000:

- Nation: $ 963,636 ( 20% more than the rent for two bedrooms )

- Galicia: $ 1,617,376 (more than double the rent for two bedrooms)

Strategic choice and access limits

Salinas' study shows that, with the same amount of property, payments can fluctuate up to 65% depending on the bank. In the City of Buenos Aires, this difference determines whether the monthly obligation is similar to the amount of rent or significantly exceeds it, crucial information for those considering whether to continue renting or opt for a UVA mortgage loan .Effective access depends on both prior savings and the applicant's income. Institutions require that the fee not exceed 30% to 35% of the monthly net household income, which excludes a significant portion of the population . In addition, there are additional costs associated with processing and formalizing the transaction.

The median rent in the Autonomous City of Buenos Aires is $500,000 for a studio apartment, $600,000 for a one-bedroom apartment, and $800,000 for a two-bedroom apartment (Matias Chiofalo / Europa Press)

Additional costs include stamp duty (between 1.5% and 2% of the value depending on the jurisdiction), bank and appraisal fees (0.5% to 1% of the requested amount), and notary fees (averaging 2%). Taxes and registry fees (approximately 1.5%) and certification and registration costs (up to 0.5%) must also be considered.

After signing, there will be ongoing obligations such as life insurance and fire insurance , both mandatory, with an approximate annual value of 0.1% to 0.2% of the loan balance . Municipal taxes must also be considered, the amount of which varies depending on the property's location.

Risk and variability in the UVA system

The UVA scheme is characterized by adjusting both the installment and the principal owed to the Consumer Price Index (CPI) on a monthly basis. This mechanism introduces uncertainty : the installment is recalculated according to inflation and requires income to keep pace with this trend to avoid a mismatch between what is received and what is owed.In this regard, it is advisable to have some financial support—savings, liquid assets, or family support—to deal with potential contingencies without falling into default . Income stability and predictability are crucial to meeting the challenge of UVA mortgage loans .

www.buysellba.com