BuySellBA

Administrator

Under construction, more expensive than new: apartments under construction already cost 31% more than used apartments - Ambito Financiero

Source:

www.ambito.com

www.ambito.com

June 06, 2025

Under construction, more expensive than new: apartments under construction already cost 31% more than used apartments.

By Jose Luis Cieri

The value of units under development in the city of Buenos Aires has reached levels that surpass those of ready-to-move-in properties, according to a private analysis. The price gap with existing properties is widening and is due to a combination of market recovery, expectations of appreciation in value, and concentration in premium areas.

The cost values for building the well gradually push the final price of the units under construction.

According to a report based on Zonaprop publications, the price of underdeveloped apartments is now at US$2,893 per square meter. The price has risen 3.3% so far in 2025 and has accumulated a 22% increase compared to November 2023, when the trend began to change. However, it is still 4.8% below the peak recorded in March 2019.

A one-bedroom apartment of 50 square meters costs around US$150,000 ( in Villa del Parque it exceeds US$116,000 ), while a three-bedroom apartment of 70 square meters costs closer to US$225,700. Compared to the average value of used apartments, estimated at US$2,211 per square meter, the gap rises to 31%. It is also 2.2% higher than the average for brand-new units ( in Villa Crespo a new studio apartment starts at US$50,000 ), which is priced at US$2,831 per square meter.

Construction costs explain much of the difference. In 2024, construction costs measured in dollars rose by nearly 70%, boosting the market value of developments underway.

Added to this is a rebound in square meter prices, which have been depressed since 2019, amid the real estate market recession.

And fewer launches are being recorded at this point, with developers cautious; many prefer to buy land and wait until the price hikes stabilize.

This jump is explained by inflation in pesos exceeding 130%, with adjustments in materials and labor tied to the Argentine Chamber of Construction (CAC) index, without a compensatory devaluation. "Everything in the Argentine economy has doubled in dollar terms in the last year and a half: costs, salaries, goods and services. But property prices have only increased by an average of 15%," Lucángeli explained.

From the developers' perspective, the current situation is seen as a snapshot showing compressed margins, but in a "movie" that could change. "It's almost unprofitable to build today due to high costs and lagging prices. However, we expect the market to rebound. A building takes between three and four years to complete. And during that time, prices should follow the general rise in the economy," Lucángeli noted.

In this context, some sector players choose to move forward with projects without selling the units, with the expectation of selling them later at higher prices.

Mortgage loans emerge as another key factor in the projections. According to Lucángeli, there are already more than one million applications being processed in Buenos Aires. “If 20% are approved, that means 200,000 new buyers. And each mortgage transaction typically triggers two or three more. With limited supply and expanding demand, prices tend to rise,” he analyzed.

Added to this is rising rental yields—which rose from 2% to 5.6% annually in March—and dollar inflation, which has revalued bricks and mortar as a safe haven. Lucángeli added: “That's why, despite the current context, developers continue to build. Not because of what they see today, but because of what they expect to see when the work is completed.”

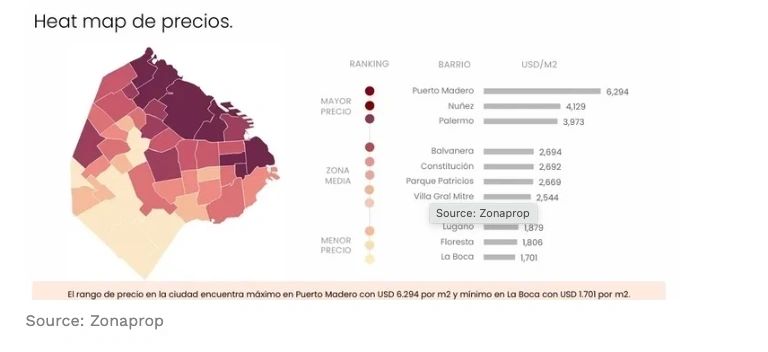

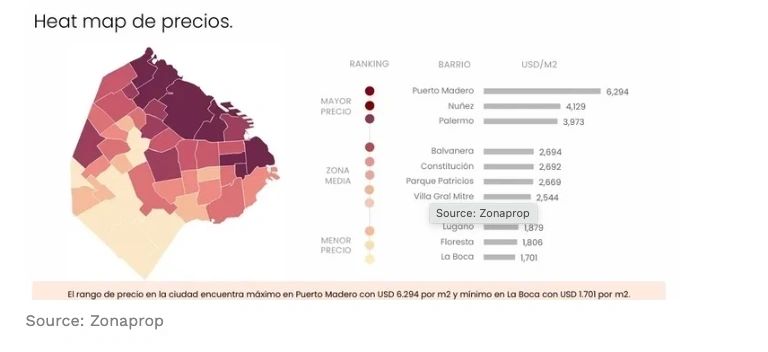

At the other end of the spectrum, La Boca remains the most affordable neighborhood, with an average price of $1,701. Floresta and Lugano are also among the most affordable areas, with average prices of $1,806 and $1,879, respectively.

As the real estate market seeks to regain ground, developers are focusing on advancing new construction phases and adjusting prices to medium-term expectations. Within this framework, there has been a notable increase in both demand and supply of projects underway.

Currently, 66% of the current supply corresponds to apartments with up to two bedrooms. This segment, which represented 72% in 2022, lost share to units with three bedrooms or more, which now account for 34% of the total. The trend reflects an adjustment to post-pandemic public preferences, with increased demand for additional square meters.

Palermo leads the ranking of neighborhoods with the highest volume of developments, accounting for 9% of the total published. It is followed by Belgrano, with 5%, and Caballito, with 4%. The selection of these areas is based on a combination of expected profitability, connectivity, infrastructure, and price levels.

Furthermore, under-construction units typically offer more flexible payment plans than finished properties. This factor is crucial for many buyers looking to purchase a unit without having the full amount available. The option of making a down payment in dollars and paying the remainder in installments in pesos adjusted by the Argentine Chamber of Construction (CAC) index is becoming a viable option.

www.buysellba.com

Source:

En pozo, más caros que a estrenar: los departamentos en obras ya superan un 31% al usado

El valor de las unidades en desarrollo en la ciudad de Buenos Aires alcanza niveles que dejan atrás a los inmuebles listos para habitar según un análisis privado. La diferencia de precios con los usados se amplía y responde a una combinación de recuperación del mercado, expectativas de...

June 06, 2025

Under construction, more expensive than new: apartments under construction already cost 31% more than used apartments.

By Jose Luis Cieri

The value of units under development in the city of Buenos Aires has reached levels that surpass those of ready-to-move-in properties, according to a private analysis. The price gap with existing properties is widening and is due to a combination of market recovery, expectations of appreciation in value, and concentration in premium areas.

The cost values for building the well gradually push the final price of the units under construction.

According to a report based on Zonaprop publications, the price of underdeveloped apartments is now at US$2,893 per square meter. The price has risen 3.3% so far in 2025 and has accumulated a 22% increase compared to November 2023, when the trend began to change. However, it is still 4.8% below the peak recorded in March 2019.

A one-bedroom apartment of 50 square meters costs around US$150,000 ( in Villa del Parque it exceeds US$116,000 ), while a three-bedroom apartment of 70 square meters costs closer to US$225,700. Compared to the average value of used apartments, estimated at US$2,211 per square meter, the gap rises to 31%. It is also 2.2% higher than the average for brand-new units ( in Villa Crespo a new studio apartment starts at US$50,000 ), which is priced at US$2,831 per square meter.

Construction costs explain much of the difference. In 2024, construction costs measured in dollars rose by nearly 70%, boosting the market value of developments underway.

Added to this is a rebound in square meter prices, which have been depressed since 2019, amid the real estate market recession.

And fewer launches are being recorded at this point, with developers cautious; many prefer to buy land and wait until the price hikes stabilize.

Today a photo, you have to see the full movie

The price increase in developments in the pit is largely due to the sharp increase in construction costs in dollars. "A year and a half ago, the cost per square meter for a high-rise building was around US$750 and US$800. Today it's doubled: it's at US$1,500," explained Mariana Lucángeli , architect and real estate expert.This jump is explained by inflation in pesos exceeding 130%, with adjustments in materials and labor tied to the Argentine Chamber of Construction (CAC) index, without a compensatory devaluation. "Everything in the Argentine economy has doubled in dollar terms in the last year and a half: costs, salaries, goods and services. But property prices have only increased by an average of 15%," Lucángeli explained.

From the developers' perspective, the current situation is seen as a snapshot showing compressed margins, but in a "movie" that could change. "It's almost unprofitable to build today due to high costs and lagging prices. However, we expect the market to rebound. A building takes between three and four years to complete. And during that time, prices should follow the general rise in the economy," Lucángeli noted.

In this context, some sector players choose to move forward with projects without selling the units, with the expectation of selling them later at higher prices.

Mortgage loans emerge as another key factor in the projections. According to Lucángeli, there are already more than one million applications being processed in Buenos Aires. “If 20% are approved, that means 200,000 new buyers. And each mortgage transaction typically triggers two or three more. With limited supply and expanding demand, prices tend to rise,” he analyzed.

Added to this is rising rental yields—which rose from 2% to 5.6% annually in March—and dollar inflation, which has revalued bricks and mortar as a safe haven. Lucángeli added: “That's why, despite the current context, developers continue to build. Not because of what they see today, but because of what they expect to see when the work is completed.”

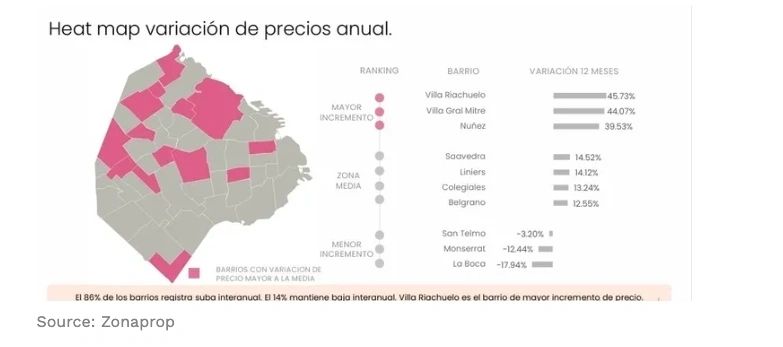

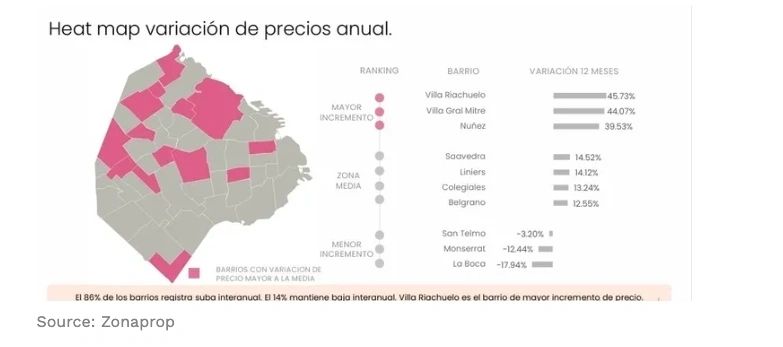

Uploads in most neighborhoods

The report indicates that 86% of Buenos Aires neighborhoods show year-over-year increases in sales prices. The remaining 14% continue to experience declines. Puerto Madero leads the price ranking, with an average of US$6,294 per square meter. Núñez follows with US$4,129 and Palermo with US$3,973.At the other end of the spectrum, La Boca remains the most affordable neighborhood, with an average price of $1,701. Floresta and Lugano are also among the most affordable areas, with average prices of $1,806 and $1,879, respectively.

As the real estate market seeks to regain ground, developers are focusing on advancing new construction phases and adjusting prices to medium-term expectations. Within this framework, there has been a notable increase in both demand and supply of projects underway.

More demand and change in the type of supply

Compared to last year, demand for under-construction units grew 4.9%, according to Zonaprop, while supply volume increased 10.7%. The expansion is due to a relative improvement in buyer confidence, but also to a price adjustment and greater payment options offered by some developers.

Currently, 66% of the current supply corresponds to apartments with up to two bedrooms. This segment, which represented 72% in 2022, lost share to units with three bedrooms or more, which now account for 34% of the total. The trend reflects an adjustment to post-pandemic public preferences, with increased demand for additional square meters.

Palermo leads the ranking of neighborhoods with the highest volume of developments, accounting for 9% of the total published. It is followed by Belgrano, with 5%, and Caballito, with 4%. The selection of these areas is based on a combination of expected profitability, connectivity, infrastructure, and price levels.

Outlook: Dollar, Costs, and Credit

The future evolution of ex-hole prices will depend on construction costs, the value of the official dollar, and the eventual resumption of mortgage lending. Given current replacement values, developers maintain that new developments will be unlikely to offer prices lower than those seen today.Furthermore, under-construction units typically offer more flexible payment plans than finished properties. This factor is crucial for many buyers looking to purchase a unit without having the full amount available. The option of making a down payment in dollars and paying the remainder in installments in pesos adjusted by the Argentine Chamber of Construction (CAC) index is becoming a viable option.

www.buysellba.com