BuySellBA

Administrator

The neighborhoods that have recovered and have more apartments for those who buy with credit - La Nacion Propiedades

Source:

www.lanacion.com.ar

www.lanacion.com.ar

July 24, 2025

Neighborhoods that have historically been overlooked in searches are once again on the radar of those who want to own a home.

By Candela Contreras

There are neighborhoods that have begun to be the protagonists of the offer of properties for saleHernan Zenteno - La Nacion/Hernan Zenteno

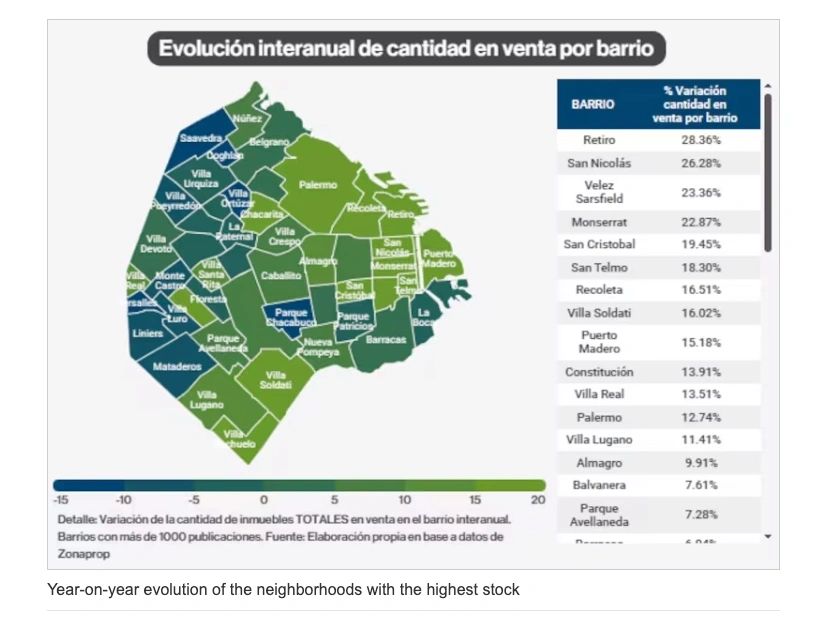

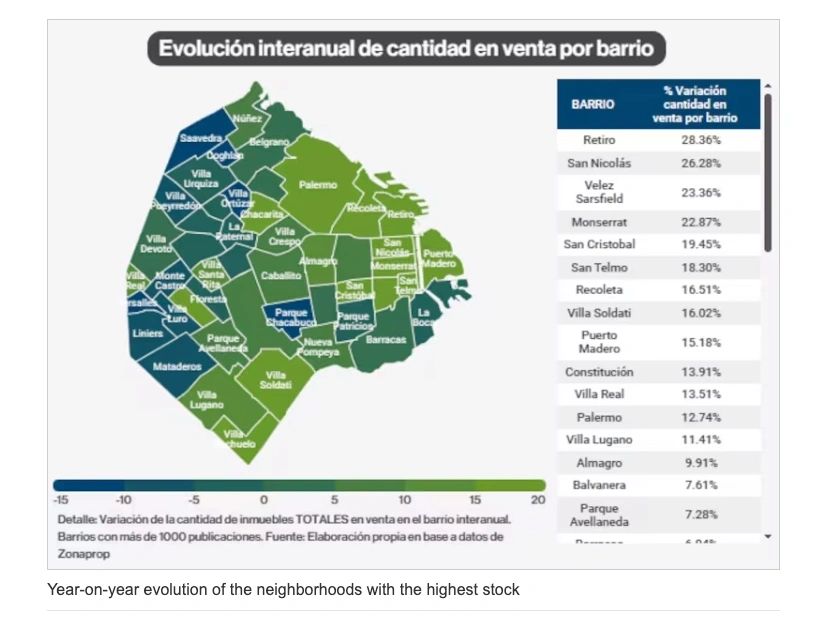

The "For Sale" sign has returned to the forefront in some Buenos Aires neighborhoods where, until recently, temporary rentals or waiting for a mortgage were the norm . Retiro, San Nicolás, Vélez Sarsfield, Monserrat, and San Cristóbal top the list of neighborhoods where the supply of properties for sale has grown the most in recent months, according to a survey conducted by Daniel Bryn based on the Zonaprop platform.

The phenomenon can be explained by a combination of factors:

"These neighborhoods contain a high proportion of small apartments, which were previously used for Airbnb or offices converted into homes. With low profitability, the decline in tourism, and new rules for short-term rentals , many owners have opted to sell ," explains Daniel Bryn, head of Invertire Real Estate.

At the same time, developments initiated between 2020 and 2022 began to be delivered in areas like Monserrat, for example. “In many cases, these are brand-new units that are added to the inventory, but they aren't selling at the same pace because the market doesn't absorb as much supply in these areas as it would in neighborhoods like Palermo ,” Bryn adds.

In concrete numbers, the data show increases in stock over the last year of 28.3% in Retiro, 26.3% in San Nicolás, 23.3% in Vélez Sarsfield, 19.9% in Monserrat, and 18.5% in San Cristóbal.

Alejandro Moretti, of Nuevo Siglo Propiedades, agrees: “Much of the new supply comes from developments that were delayed by the pandemic and are now coming onto the market all at once. Added to this is the fact that many homeowners prefer to sell rather than wait for a buyer to get a mortgage , because, for example, Banco Nación—which handles the majority of transactions—is saturated, and processing times are taking longer.”

On this point, Daniel Salaya Romera, from the eponymous real estate company, offers a more structural perspective: “During 2024, banks received incentives from the Central Bank to grant mortgage loans . This generated a strong upswing in real estate activity: each loan issued generates revenue, but above all, it triggers up to two more sales, boosting its driving force. However, once these favorable conditions were exhausted, rates began to rise, and the process became slower .”

Interest rates, which have risen in recent months, complicate the outlook for those seeking credit. With incomes unable to offset the rising cost of financing, many buyers have begun to look for neighborhoods where the square footage is more affordable . And those at the top of the supply list appear there.

For example, while the square meter in Palermo is around US$3399 , in Belgrano US$3125 and in Colegiales US$3033 , in Retiro it is available for US$2620 , in San Nicolás US$1874 , in Monserrat US$2182 and in San Cristóbal US$1837 , for an average one-bedroom apartment according to Zonaprop.

“Buyers are forced to move geographically to be able to afford the rate the bank is offering them, since with the rise in interest rates, more money is needed to access a property with similar characteristics,” real estate brokers agree. “Many regret having waited, because not only has credit increased, but so have the price per square meter, and there is less supply in the most sought-after neighborhoods ,” Bryn maintains.

This not only reflects a shift in buyer strategy , but also an opportunity. With more inventory, lower prices, and less competition, these areas present a gateway for those looking to take advantage of current market conditions. Of course, challenges persist: the perception of insecurity, the lack of green spaces, and a lower residential appeal compared to other areas of the city continue to be factors that hinder purchase decisions.

For sale signs are once again seen hanging on properties. Daniel Basualdo

These figures correspond to an average of around 3,000 loans per month since the beginning of the year, a figure that several market analysts define as "the ceiling of the lines ," meaning that under current market conditions they do not believe it will continue to rise.

This is due to the increasing interest rate increases on bank loans, a situation that makes it impossible for more and more people to access them. Higher rates require higher incomes. However, the restriction isn't limited to this increase; financing terms are also becoming shorter, which also increases the cost of the loan.

But why is this situation happening? What's causing these restrictive conditions?

Banks finance their portfolios with short-term deposits (generally less than 90 days), while UVA loans extend to 20 or even 30 years . This difference creates tension: "You can't finance for 30 years if your deposits are for 30 days," several specialists analyze.

This gap creates a liquidity problem : every time the volume of loans granted increases, banks need to borrow more expensively to maintain their supply. The system's natural response is to raise the Annual Nominal Rate (ANR) to restrict access.

"There's a huge demand that's grown very quickly, and at the same time, funding mortgage loans is expensive for banks because they involve very high-priced loans," says Federico González Rouco, an economist specializing in housing.

The answer? In countries where mortgage lending is available, institutions use instruments such as securitization or the sale of mortgage portfolios to transfer risk and free up capital. This doesn't happen in Argentina.

"The structural solution should involve tools such as portfolio titling or securitization , but that doesn't exist in Argentina: it requires a level of financial sophistication that is far from being achieved today," explains González Rouco.

Without institutional investors—such as insurance companies or investment funds—mortgage lending falls exclusively on banks, which leads to interest rate adjustments to contain demand .

www.buysellba.com

Source:

Los barrios que de un día para el otro se poblaron de carteles de venta

Barrios históricamente relegados en las búsquedas vuelven a estar en el radar de quienes quieren tener su casa

July 24, 2025

Neighborhoods that have historically been overlooked in searches are once again on the radar of those who want to own a home.

By Candela Contreras

There are neighborhoods that have begun to be the protagonists of the offer of properties for saleHernan Zenteno - La Nacion/Hernan Zenteno

The "For Sale" sign has returned to the forefront in some Buenos Aires neighborhoods where, until recently, temporary rentals or waiting for a mortgage were the norm . Retiro, San Nicolás, Vélez Sarsfield, Monserrat, and San Cristóbal top the list of neighborhoods where the supply of properties for sale has grown the most in recent months, according to a survey conducted by Daniel Bryn based on the Zonaprop platform.

The phenomenon can be explained by a combination of factors:

- On the one hand, the conversion of small units that were previously used for tourist rentals , which are now less profitable.

- On the other hand, the entry into the market of newly completed apartments , launched during the pandemic, which are not being absorbed as quickly as expected.

- And a context in which mortgage loans became more expensive (due to restrictions imposed by banks due to their lack of liquidity), reducing the possibilities of purchasing in the most sought-after neighborhoods where the opportunities lay.

"These neighborhoods contain a high proportion of small apartments, which were previously used for Airbnb or offices converted into homes. With low profitability, the decline in tourism, and new rules for short-term rentals , many owners have opted to sell ," explains Daniel Bryn, head of Invertire Real Estate.

At the same time, developments initiated between 2020 and 2022 began to be delivered in areas like Monserrat, for example. “In many cases, these are brand-new units that are added to the inventory, but they aren't selling at the same pace because the market doesn't absorb as much supply in these areas as it would in neighborhoods like Palermo ,” Bryn adds.

In concrete numbers, the data show increases in stock over the last year of 28.3% in Retiro, 26.3% in San Nicolás, 23.3% in Vélez Sarsfield, 19.9% in Monserrat, and 18.5% in San Cristóbal.

Alejandro Moretti, of Nuevo Siglo Propiedades, agrees: “Much of the new supply comes from developments that were delayed by the pandemic and are now coming onto the market all at once. Added to this is the fact that many homeowners prefer to sell rather than wait for a buyer to get a mortgage , because, for example, Banco Nación—which handles the majority of transactions—is saturated, and processing times are taking longer.”

On this point, Daniel Salaya Romera, from the eponymous real estate company, offers a more structural perspective: “During 2024, banks received incentives from the Central Bank to grant mortgage loans . This generated a strong upswing in real estate activity: each loan issued generates revenue, but above all, it triggers up to two more sales, boosting its driving force. However, once these favorable conditions were exhausted, rates began to rise, and the process became slower .”

Interest rates, which have risen in recent months, complicate the outlook for those seeking credit. With incomes unable to offset the rising cost of financing, many buyers have begun to look for neighborhoods where the square footage is more affordable . And those at the top of the supply list appear there.

For example, while the square meter in Palermo is around US$3399 , in Belgrano US$3125 and in Colegiales US$3033 , in Retiro it is available for US$2620 , in San Nicolás US$1874 , in Monserrat US$2182 and in San Cristóbal US$1837 , for an average one-bedroom apartment according to Zonaprop.

“Buyers are forced to move geographically to be able to afford the rate the bank is offering them, since with the rise in interest rates, more money is needed to access a property with similar characteristics,” real estate brokers agree. “Many regret having waited, because not only has credit increased, but so have the price per square meter, and there is less supply in the most sought-after neighborhoods ,” Bryn maintains.

This not only reflects a shift in buyer strategy , but also an opportunity. With more inventory, lower prices, and less competition, these areas present a gateway for those looking to take advantage of current market conditions. Of course, challenges persist: the perception of insecurity, the lack of green spaces, and a lower residential appeal compared to other areas of the city continue to be factors that hinder purchase decisions.

For sale signs are once again seen hanging on properties. Daniel Basualdo

It is increasingly difficult to access a mortgage loan

So far in 2025, around US$300 million per month have been delivered , expressed in constant dollars adjusted for inflation (since the credits are calculated in UVAS, and this is updated for inflation).These figures correspond to an average of around 3,000 loans per month since the beginning of the year, a figure that several market analysts define as "the ceiling of the lines ," meaning that under current market conditions they do not believe it will continue to rise.

This is due to the increasing interest rate increases on bank loans, a situation that makes it impossible for more and more people to access them. Higher rates require higher incomes. However, the restriction isn't limited to this increase; financing terms are also becoming shorter, which also increases the cost of the loan.

But why is this situation happening? What's causing these restrictive conditions?

Banks finance their portfolios with short-term deposits (generally less than 90 days), while UVA loans extend to 20 or even 30 years . This difference creates tension: "You can't finance for 30 years if your deposits are for 30 days," several specialists analyze.

This gap creates a liquidity problem : every time the volume of loans granted increases, banks need to borrow more expensively to maintain their supply. The system's natural response is to raise the Annual Nominal Rate (ANR) to restrict access.

"There's a huge demand that's grown very quickly, and at the same time, funding mortgage loans is expensive for banks because they involve very high-priced loans," says Federico González Rouco, an economist specializing in housing.

The answer? In countries where mortgage lending is available, institutions use instruments such as securitization or the sale of mortgage portfolios to transfer risk and free up capital. This doesn't happen in Argentina.

"The structural solution should involve tools such as portfolio titling or securitization , but that doesn't exist in Argentina: it requires a level of financial sophistication that is far from being achieved today," explains González Rouco.

Without institutional investors—such as insurance companies or investment funds—mortgage lending falls exclusively on banks, which leads to interest rate adjustments to contain demand .

www.buysellba.com