earlyretirement

Moderator

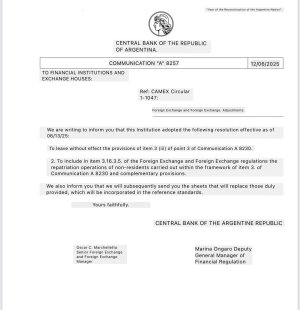

🇦🇷🏦The Central Bank of Argentina Eliminates Cross Restriction for Non-Residents and Removes the 6-Month Minimum Term

The Central Bank of the Argentine Republic (BCRA) has announced the removal of two key restrictions affecting non-resident investors: the cross restriction and the six-month minimum holding period for investments in the country.

What does the elimination of the cross restriction mean?

The cross restriction required non-residents operating in the capital market (for example, buying dollars through the financial market, such as the MEP or CCL dollar) to wait a set period before being able to access the Single and Free Exchange Market (MULC) again or transfer funds abroad. This measure, originally implemented to prevent arbitrage and rapid capital outflows, was one of the most criticized by the international financial market.

With this restriction lifted, non-resident investors can now bring funds into and out of the country more easily, without having to comply with waiting periods or additional restrictions between operations in different markets.

End of the 6-Month Minimum Term

Until now, non-residents investing in Argentine public securities or Treasury instruments had to keep their investments for at least six months before being able to repatriate funds or access the official exchange market. This limitation was designed to discourage the entry of short-term speculative capital and reduce exchange rate volatility.

The new regulation eliminates this requirement, allowing foreign investors to enter and exit the Argentine market without time restrictions, as long as the instruments have maturities longer than six months. According to BCRA President Santiago Bausili, the measure responds to the need to attract genuine investments and remove barriers that, in practice, discouraged the entry of capital into the country.

Objectives and Context of the Measure

These relaxations are part of the third phase of the Argentine government's economic program, aimed at attracting investment, strengthening international reserves, and normalizing the capital market. The removal of these restrictions seeks to:

☑️Facilitate the entry of foreign capital.

☑️Improve the liquidity and depth of the local financial market.

☑️Meet eligibility requirements for major international indices, encouraging the arrival of global institutional funds.

The elimination of the cross restriction and the minimum holding period takes effect immediately.

This decision is expected to increase the attractiveness of Argentine assets, facilitate debt refinancing, and contribute to macroeconomic stability by allowing greater capital mobility.

📣BCRA has removed two of the main obstacles for foreign investment in the Argentine market, in line with a strategy of financial openness and normalization. These are GREAT signs for Argentina.

The Central Bank of the Argentine Republic (BCRA) has announced the removal of two key restrictions affecting non-resident investors: the cross restriction and the six-month minimum holding period for investments in the country.

What does the elimination of the cross restriction mean?

The cross restriction required non-residents operating in the capital market (for example, buying dollars through the financial market, such as the MEP or CCL dollar) to wait a set period before being able to access the Single and Free Exchange Market (MULC) again or transfer funds abroad. This measure, originally implemented to prevent arbitrage and rapid capital outflows, was one of the most criticized by the international financial market.

With this restriction lifted, non-resident investors can now bring funds into and out of the country more easily, without having to comply with waiting periods or additional restrictions between operations in different markets.

End of the 6-Month Minimum Term

Until now, non-residents investing in Argentine public securities or Treasury instruments had to keep their investments for at least six months before being able to repatriate funds or access the official exchange market. This limitation was designed to discourage the entry of short-term speculative capital and reduce exchange rate volatility.

The new regulation eliminates this requirement, allowing foreign investors to enter and exit the Argentine market without time restrictions, as long as the instruments have maturities longer than six months. According to BCRA President Santiago Bausili, the measure responds to the need to attract genuine investments and remove barriers that, in practice, discouraged the entry of capital into the country.

Objectives and Context of the Measure

These relaxations are part of the third phase of the Argentine government's economic program, aimed at attracting investment, strengthening international reserves, and normalizing the capital market. The removal of these restrictions seeks to:

☑️Facilitate the entry of foreign capital.

☑️Improve the liquidity and depth of the local financial market.

☑️Meet eligibility requirements for major international indices, encouraging the arrival of global institutional funds.

The elimination of the cross restriction and the minimum holding period takes effect immediately.

This decision is expected to increase the attractiveness of Argentine assets, facilitate debt refinancing, and contribute to macroeconomic stability by allowing greater capital mobility.

📣BCRA has removed two of the main obstacles for foreign investment in the Argentine market, in line with a strategy of financial openness and normalization. These are GREAT signs for Argentina.