BuySellBA

Administrator

The April data proves that more and more people are deciding to buy a property in record time - La Nacion Propiedades

Source:

www.lanacion.com.ar

www.lanacion.com.ar

May 27, 2025

In a context of economic announcements that have a direct impact on the real estate market, the number of property purchase and sale transactions in April was announced.

By Candela Contreras

The weight that mortgage loans have in formalized sales acts month by monthGonzalo Colini

The real estate market in the city of Buenos Aires continues its upward trend and shows signs of recovery in property sales transactions .

" We've had 35 consecutive months of year-over-year growth , and that's no small feat considering that we've seen a declining real estate market for a long time," says Jorge De Bártolo, president of the Buenos Aires Notary Association.

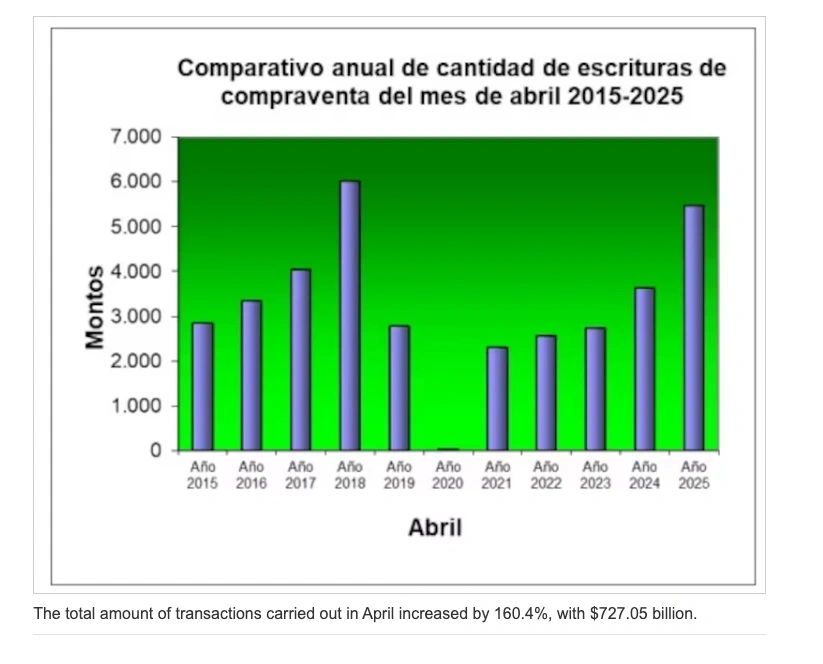

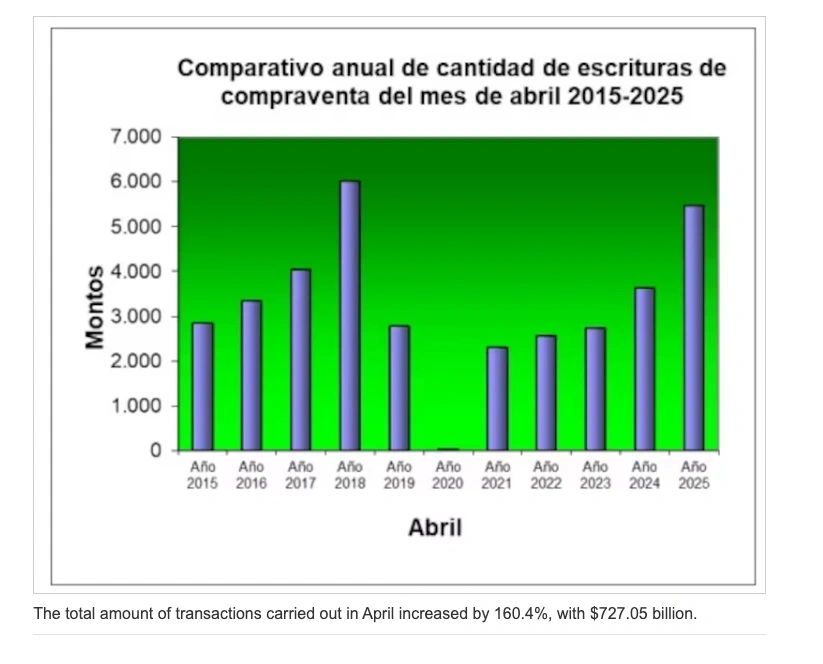

So much so that, in the fourth month of the year, 5,471 deeds of sale were registered in the City , "the best April in the last six years." This figure represents 50% more than a year ago and 15.2% more than last month (4,747 transactions in March).

Thus, the total amount involved in the transactions amounted to $727.05 billion , with a year-on-year increase of 160.4% .

In terms of value, the average transaction amount was $132,891,748 , equivalent to US$114,767, according to the average official exchange rate. This marks a 73% increase in pesos and a 36.3% increase in dollars compared to April 2024.

"This recovery may be due in part to greater macroeconomic predictability, exchange rate stability, and the needs and desires of families who have been putting off their decisions and are finding a more favorable environment to make them," shares Gabriela Goldszer, director of Ocampo Properties.

"There's a considerable increase in mortgages, measured monthly, of 20% , and that outlook should be encouraging as the dollar rate stabilizes," explains De Bártolo, adding: "These are new stages, with a dollar without restrictions , and now we'll have to analyze all the state regulations regarding new flexibilities in transaction reporting."

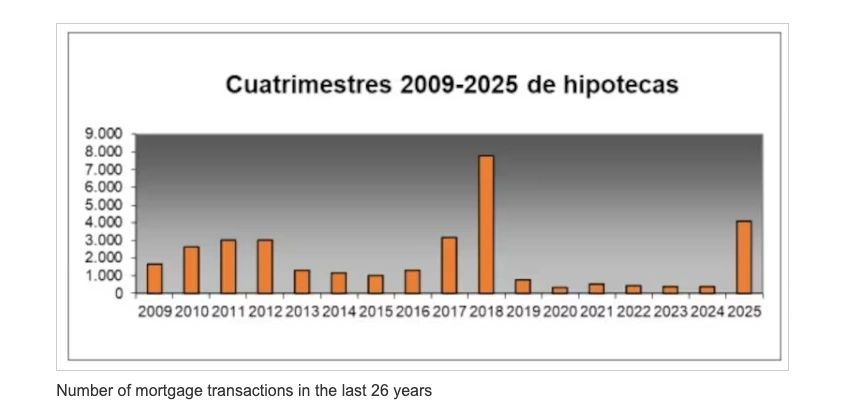

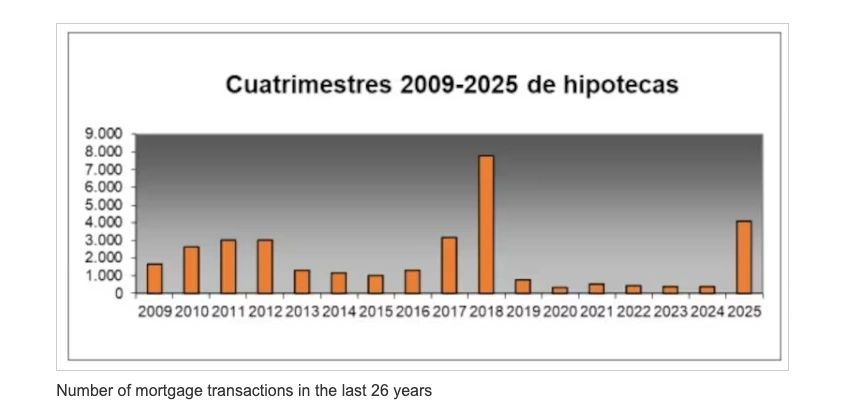

The following graph, shared by the College, shows that despite an upswing in the number of mortgage transactions, it is still far from the levels of 2018 —the peak period for UVA mortgage loans.

"The lack of credit for so many years, combined with the perception that property prices could rise, is driving people to decide to go ahead with the transaction," Goldszer explains.

Market analysts agree that for credit transactions to become more relevant and demand to increase, several factors must be met, such as: lower rates, improved incomes, and continued downward inflation .

The director of Ocampo Properties refers to this: "For the volume of credit operations to grow significantly, medium-term policies that increase confidence, combined with greater formal employment, are needed."

“Exchange rate stability is one of the keys to someone making the decision to go into debt, but for credit to once again play a leading role , in addition to short-term measures, a comprehensive and sustainable housing policy is needed ,” Goldszer asserts.

Laura Porto, director of the Narvaez real estate agency, agrees with the broker and adds that continued stability in economic variables, lower inflation, and the generation of a fiscal surplus would allow banks to reduce interest rates or at least keep them stable . "At the same time, a gradual recovery in the purchasing power of salaries could free up disposable income that could then be used to pay off a mortgage instead of rent. This would be a possible combination that could boost the number of mortgage transactions," she asserts.

However, it is necessary to analyze how mortgage financing continues to evolve. Since the end of 2024, the Argentine mortgage market has been experiencing constant rate adjustments . Between November and December of that year, UVA mortgage rates began to skyrocket, and by May 2025, several entities had already implemented their third or fourth rate increases.

This makes loans more expensive and reduces the number of people who can afford to own their own homes. The higher the interest rate, the higher the income the applicant must justify , since, due to bank regulations, the down payment cannot exceed 25% (and in some cases, up to 30%) of the family income.

In light of this increase, the director of Narvaez clarifies that it's important to consider the "time element ." "There's a time lag between official statistics, the time of the application, and the time of the loan being granted, which can take between 45 and 60 days, so it may or may not have a negative impact depending on the borrower."

Juan Manuel Tapiola, CEO of Spazios, adds that there are expectations regarding the exchange rate law and the increase in salaries in dollars, and their impact on unit sales. "More salaries in dollars, better expectations for the future, more mortgage loans, more sales," he shares.

However, it's important to clarify that this second round of rate hikes has not yet been reflected in sales transactions . Therefore, we'll have to wait and see how it impacts the market in the coming months. "The mortgage transactions being closed today are generally from reservations made between December and January; we'll begin to see the impact of the rate hike between July and August. We understand that the coming months will see market stabilization ," explains Agustin Celia, Director and Co-founder of Lendar.

And, in light of the rising interest rates, Carlos D'Odorico, CEO of the real estate company of the same name, adds that the market is growing. "Rates need to drop to allow for more credit transactions, but it's important that banks streamline the granting process and relax eligibility requirements ."

Compared to March of this year, the increase in transactions was 18%. “The April figures confirm the continuation of the recovery process we have been observing since last year. Not only are sales increasing, but we are also seeing a sustained upturn in mortgages, which is very encouraging for the sector,” said Guillermo Longhi, president of the Notaries Association of the Province of Buenos Aires.

One of the drivers of the growth in property sales was mortgage lending. In April, 2,110 mortgage transactions were recorded, representing a 606% increase compared to the 299 registered in the same month last year.

“Access to financing is essential to consolidating this positive trend. If credit is expanded, many more people will be able to achieve their dream of owning a home, and that will undoubtedly have a significant impact on the overall dynamics of the market,” Longhi concluded.

www.buysellba.com

Source:

El dato de abril que prueba que cada vez más gente decide comprar una propiedad en tiempo récord

En un contexto de anuncios económicos que impactan de lleno en el mercado inmobiliario, se conoció la cantidad de operaciones de compraventa de inmuebles en abril

May 27, 2025

In a context of economic announcements that have a direct impact on the real estate market, the number of property purchase and sale transactions in April was announced.

By Candela Contreras

The weight that mortgage loans have in formalized sales acts month by monthGonzalo Colini

The real estate market in the city of Buenos Aires continues its upward trend and shows signs of recovery in property sales transactions .

" We've had 35 consecutive months of year-over-year growth , and that's no small feat considering that we've seen a declining real estate market for a long time," says Jorge De Bártolo, president of the Buenos Aires Notary Association.

So much so that, in the fourth month of the year, 5,471 deeds of sale were registered in the City , "the best April in the last six years." This figure represents 50% more than a year ago and 15.2% more than last month (4,747 transactions in March).

Thus, the total amount involved in the transactions amounted to $727.05 billion , with a year-on-year increase of 160.4% .

In terms of value, the average transaction amount was $132,891,748 , equivalent to US$114,767, according to the average official exchange rate. This marks a 73% increase in pesos and a 36.3% increase in dollars compared to April 2024.

"This recovery may be due in part to greater macroeconomic predictability, exchange rate stability, and the needs and desires of families who have been putting off their decisions and are finding a more favorable environment to make them," shares Gabriela Goldszer, director of Ocampo Properties.

The role of mortgage loans

One of the report's highlights is the growth in mortgage loan transactions : 1,192 deeds were signed in April , a 1,012% increase compared to the same month last year. It's worth noting that UVA loans were relaunched at the end of that month in 2024, so financing transactions had not yet begun to grow. Meanwhile, in the first four months of 2025, 4,094 transactions were recorded. "Credit creates a market," the entity asserts."There's a considerable increase in mortgages, measured monthly, of 20% , and that outlook should be encouraging as the dollar rate stabilizes," explains De Bártolo, adding: "These are new stages, with a dollar without restrictions , and now we'll have to analyze all the state regulations regarding new flexibilities in transaction reporting."

The following graph, shared by the College, shows that despite an upswing in the number of mortgage transactions, it is still far from the levels of 2018 —the peak period for UVA mortgage loans.

"The lack of credit for so many years, combined with the perception that property prices could rise, is driving people to decide to go ahead with the transaction," Goldszer explains.

Market analysts agree that for credit transactions to become more relevant and demand to increase, several factors must be met, such as: lower rates, improved incomes, and continued downward inflation .

The director of Ocampo Properties refers to this: "For the volume of credit operations to grow significantly, medium-term policies that increase confidence, combined with greater formal employment, are needed."

“Exchange rate stability is one of the keys to someone making the decision to go into debt, but for credit to once again play a leading role , in addition to short-term measures, a comprehensive and sustainable housing policy is needed ,” Goldszer asserts.

Laura Porto, director of the Narvaez real estate agency, agrees with the broker and adds that continued stability in economic variables, lower inflation, and the generation of a fiscal surplus would allow banks to reduce interest rates or at least keep them stable . "At the same time, a gradual recovery in the purchasing power of salaries could free up disposable income that could then be used to pay off a mortgage instead of rent. This would be a possible combination that could boost the number of mortgage transactions," she asserts.

However, it is necessary to analyze how mortgage financing continues to evolve. Since the end of 2024, the Argentine mortgage market has been experiencing constant rate adjustments . Between November and December of that year, UVA mortgage rates began to skyrocket, and by May 2025, several entities had already implemented their third or fourth rate increases.

This makes loans more expensive and reduces the number of people who can afford to own their own homes. The higher the interest rate, the higher the income the applicant must justify , since, due to bank regulations, the down payment cannot exceed 25% (and in some cases, up to 30%) of the family income.

In light of this increase, the director of Narvaez clarifies that it's important to consider the "time element ." "There's a time lag between official statistics, the time of the application, and the time of the loan being granted, which can take between 45 and 60 days, so it may or may not have a negative impact depending on the borrower."

Juan Manuel Tapiola, CEO of Spazios, adds that there are expectations regarding the exchange rate law and the increase in salaries in dollars, and their impact on unit sales. "More salaries in dollars, better expectations for the future, more mortgage loans, more sales," he shares.

However, it's important to clarify that this second round of rate hikes has not yet been reflected in sales transactions . Therefore, we'll have to wait and see how it impacts the market in the coming months. "The mortgage transactions being closed today are generally from reservations made between December and January; we'll begin to see the impact of the rate hike between July and August. We understand that the coming months will see market stabilization ," explains Agustin Celia, Director and Co-founder of Lendar.

And, in light of the rising interest rates, Carlos D'Odorico, CEO of the real estate company of the same name, adds that the market is growing. "Rates need to drop to allow for more credit transactions, but it's important that banks streamline the granting process and relax eligibility requirements ."

The situation in the province of Buenos Aires

Regarding provincial data, the Notaries Association revealed that the number of sales transactions in April increased by 60% compared to the same month last year. Specifically, 12,158 sales transactions were recorded in the fourth month of the year, compared to 7,617 in 2024.Compared to March of this year, the increase in transactions was 18%. “The April figures confirm the continuation of the recovery process we have been observing since last year. Not only are sales increasing, but we are also seeing a sustained upturn in mortgages, which is very encouraging for the sector,” said Guillermo Longhi, president of the Notaries Association of the Province of Buenos Aires.

One of the drivers of the growth in property sales was mortgage lending. In April, 2,110 mortgage transactions were recorded, representing a 606% increase compared to the 299 registered in the same month last year.

“Access to financing is essential to consolidating this positive trend. If credit is expanded, many more people will be able to achieve their dream of owning a home, and that will undoubtedly have a significant impact on the overall dynamics of the market,” Longhi concluded.

www.buysellba.com