BuySellBA

Administrator

Real estate market in action: 19,000 mortgage loans were granted nationwide in just one semester - Ambito Financiero

Source:

www.ambito.com

www.ambito.com

August 24, 2025

The market reached its highest level in six years. 65% of new mortgages were concentrated in the AMBA region, with strong growth in housing.

Between January and May, 16,057 mortgages were issued, 60% more than in all of 2024, with the majority of transactions concentrated in the AMBA region.

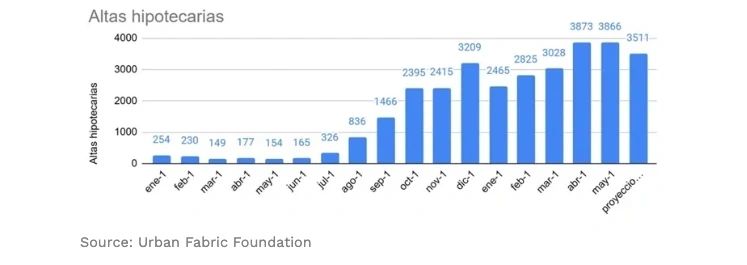

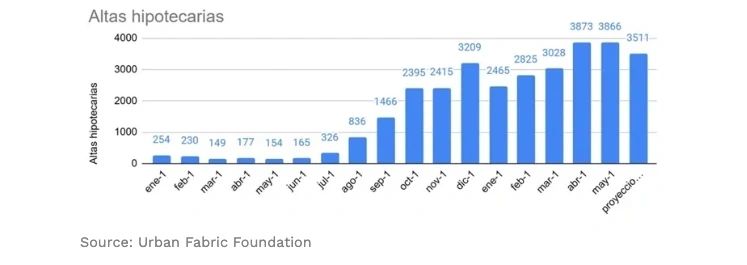

The Argentine mortgage market is experiencing its highest level of activity in six years. According to the latest report from the Tejido Urbano Foundation, 16,057 new mortgages were registered between January and May 2025, equivalent to 60% more than in all of 2024. The entity's projections indicate that, in the first half of the year, the total number of loans granted exceeded 19,000 transactions , a 72% year-over-year increase.

The main destination was once again home purchases, which had fallen to historic lows in July 2024. In that month, only 25% of the mortgage stock was earmarked for real estate purchases. Since August, that percentage rose to 53% and remained around that level for much of 2025. Dollar volumes followed this acceleration.

The trend is highly concentrated in the Buenos Aires Metropolitan Area. During 2024, the City and Province of Buenos Aires accounted for 65.4% of new mortgages and 63.5% of the outstanding mortgage stock as of December. In provinces such as Córdoba, Santa Fe, and Mendoza, mortgage activation was slower. Córdoba registered 1,377 new mortgages during 2024, Santa Fe 492, and Mendoza 365.

Factors such as the productive structure, the level of formal employment, and the banking sector explain part of the difference with AMBA. Mortgage deeds registered with the Notaries' Associations reflect the same trend. In 2024, 13,545 transactions were recorded, while in the first half of 2025, 16,871 were recorded (10,261 in PBA and 6,610 in CABA). This represents 18.9% of the total number of deeds in both jurisdictions, a percentage that has not been reached for several years.

The second quarter of 2025 marked a change in trend. The Central Bank's Credit Conditions Survey indicated that, for the first time since 2022, the percentage of banks that tightened requirements exceeded those that relaxed them. Twelve percent have already adjusted conditions in the last three months, and another 12 percent plan to do so in the next quarter. The lack of liquidity limits banks' ability to sustain loan volumes, and the underdeveloped secondary mortgage market impedes portfolio recycling. In this context, securitization is once again at the center of the debate.

In July, ADEBA published a report with proposals to activate this mechanism as a funding channel. Despite these restrictions, demand remains strong. 50% of the surveyed banks reported an increase in applications, while only 6% reported declines. This gap between rising demand and restricted supply could lead to longer approval times and higher access requirements. In fact, in June, the volume of loans granted fell 4% compared to May.

Fernando Álvarez de Celis , executive director of the Tejido Urbano Foundation, noted that the reactivation of credit is unprecedented in several years, albeit with pending challenges. “We are seeing the highest level of activity in six years, with a very marked jump compared to 2024. Credit has once again become a tool for accessing housing, but it still does not reach all sectors or all regions,” he stated.

He added that the continuity of the process requires new instruments. "If banks tighten their conditions and a secondary mortgage market doesn't emerge, we run the risk of this recovery being temporary. Securitization is key to sustaining the flow and allowing more families to access their own homes," said Álvarez de Celis.

He emphasized that mortgage lending is not immune to exchange rate volatility. “Costs rose sharply in April and May and then fell in June and July. The explanation is basically the exchange rate. In pesos, costs follow inflation, but when measured in dollars, the gap is directly reflected in construction,” he noted.

González Rouco indicated that this situation is leading developers to postpone investment decisions. “Today, we see a lot of land purchases and little construction. Costs in dollars are high, and many prefer to wait . During this period, profitability deteriorates, and the gap between new and existing properties widens. The market perceives projects under construction as more expensive compared to existing ones,” he stated.

The economist also compared mortgages and rents. "Whenever the loan payment is higher than the rent for the same home, it can be concluded that renting is cheaper. Today, in Buenos Aires City, the implicit rental market rate was 6.2%, higher than that of Banco Nación but lower than that of other banks. In Greater Buenos Aires, it stood at 5.8%, and in Rosario, it only surpassed 3% in June. Aside from Banco Nación, mortgage loans are relatively expensive compared to rent at most banks with current offers," he noted.

Álvarez de Celis concluded that "having comprehensive and up-to-date data is essential to guide decisions in a market where conditions change month by month. Mortgage loans boost the economy and play a central role in housing policy."

www.buysellba.com

Source:

Mercado inmobiliario en acción: en sólo un semestre se otorgaron 19.000 créditos hipotecarios en todo el país

El mercado alcanzó su mayor nivel en seis años. El 65% de las nuevas hipotecas se concentró en el AMBA, con fuerte impulso en vivienda.

August 24, 2025

The market reached its highest level in six years. 65% of new mortgages were concentrated in the AMBA region, with strong growth in housing.

Between January and May, 16,057 mortgages were issued, 60% more than in all of 2024, with the majority of transactions concentrated in the AMBA region.

The Argentine mortgage market is experiencing its highest level of activity in six years. According to the latest report from the Tejido Urbano Foundation, 16,057 new mortgages were registered between January and May 2025, equivalent to 60% more than in all of 2024. The entity's projections indicate that, in the first half of the year, the total number of loans granted exceeded 19,000 transactions , a 72% year-over-year increase.

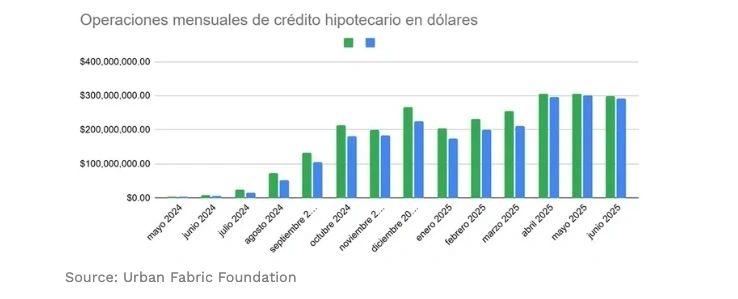

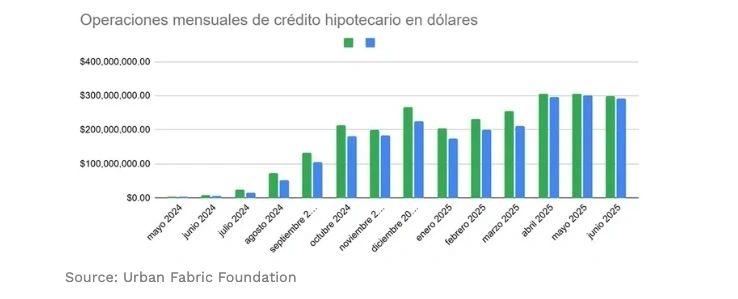

The main destination was once again home purchases, which had fallen to historic lows in July 2024. In that month, only 25% of the mortgage stock was earmarked for real estate purchases. Since August, that percentage rose to 53% and remained around that level for much of 2025. Dollar volumes followed this acceleration.

In the first half of the year, US$1.601 billion in loans were disbursed, surpassing the US$930 million total for all of 2024. However, since April, the monthly flow has stabilized around US$300 million. The lack of new highs suggests that the market has found a balance and that the recovery has entered a phase of more moderate growth.The trend is highly concentrated in the Buenos Aires Metropolitan Area. During 2024, the City and Province of Buenos Aires accounted for 65.4% of new mortgages and 63.5% of the outstanding mortgage stock as of December. In provinces such as Córdoba, Santa Fe, and Mendoza, mortgage activation was slower. Córdoba registered 1,377 new mortgages during 2024, Santa Fe 492, and Mendoza 365.

Factors such as the productive structure, the level of formal employment, and the banking sector explain part of the difference with AMBA. Mortgage deeds registered with the Notaries' Associations reflect the same trend. In 2024, 13,545 transactions were recorded, while in the first half of 2025, 16,871 were recorded (10,261 in PBA and 6,610 in CABA). This represents 18.9% of the total number of deeds in both jurisdictions, a percentage that has not been reached for several years.

Where access to credit is concentrated

Access to credit is concentrated in middle- and high-income segments with formal employment. The Central Bank's Financial Inclusion Report showed that, in 2024, 80% of mortgages corresponded to people between 30 and 49 years of age living in large urban centers. Those under 30 represented just 7.5% of the total, a proportion that reflects the limitations in accessing the labor market and the age restrictions imposed by banks when defining the maximum repayment period.

The second quarter of 2025 marked a change in trend. The Central Bank's Credit Conditions Survey indicated that, for the first time since 2022, the percentage of banks that tightened requirements exceeded those that relaxed them. Twelve percent have already adjusted conditions in the last three months, and another 12 percent plan to do so in the next quarter. The lack of liquidity limits banks' ability to sustain loan volumes, and the underdeveloped secondary mortgage market impedes portfolio recycling. In this context, securitization is once again at the center of the debate.

In July, ADEBA published a report with proposals to activate this mechanism as a funding channel. Despite these restrictions, demand remains strong. 50% of the surveyed banks reported an increase in applications, while only 6% reported declines. This gap between rising demand and restricted supply could lead to longer approval times and higher access requirements. In fact, in June, the volume of loans granted fell 4% compared to May.

Fernando Álvarez de Celis , executive director of the Tejido Urbano Foundation, noted that the reactivation of credit is unprecedented in several years, albeit with pending challenges. “We are seeing the highest level of activity in six years, with a very marked jump compared to 2024. Credit has once again become a tool for accessing housing, but it still does not reach all sectors or all regions,” he stated.

He added that the continuity of the process requires new instruments. "If banks tighten their conditions and a secondary mortgage market doesn't emerge, we run the risk of this recovery being temporary. Securitization is key to sustaining the flow and allowing more families to access their own homes," said Álvarez de Celis.

Keys

Federico González Rouco , an economist specializing in the real estate market at Empiria Consultores, argued that the upturn should be interpreted from a macroeconomic perspective. "Between January and July, more loans were granted than in the entire 2019-2024 period combined: US$1.792 billion compared to US$1.522 billion. This highlights both the magnitude of the recovery and the paralysis seen in previous years," he explained.

He emphasized that mortgage lending is not immune to exchange rate volatility. “Costs rose sharply in April and May and then fell in June and July. The explanation is basically the exchange rate. In pesos, costs follow inflation, but when measured in dollars, the gap is directly reflected in construction,” he noted.

González Rouco indicated that this situation is leading developers to postpone investment decisions. “Today, we see a lot of land purchases and little construction. Costs in dollars are high, and many prefer to wait . During this period, profitability deteriorates, and the gap between new and existing properties widens. The market perceives projects under construction as more expensive compared to existing ones,” he stated.

Rate hike

On the financial front, some banks raised their interest rates. Banco Ciudad raised them to 9.9% nominal annual interest rate, and Banco Galicia raised them to 11.5% for clients with credited assets. According to González Rouco, this move will take time to have an impact, as the loans being issued today were agreed upon with conditions set three months ago.The economist also compared mortgages and rents. "Whenever the loan payment is higher than the rent for the same home, it can be concluded that renting is cheaper. Today, in Buenos Aires City, the implicit rental market rate was 6.2%, higher than that of Banco Nación but lower than that of other banks. In Greater Buenos Aires, it stood at 5.8%, and in Rosario, it only surpassed 3% in June. Aside from Banco Nación, mortgage loans are relatively expensive compared to rent at most banks with current offers," he noted.

Follow-up

To monitor the market, the Tejido Urbano Foundation created a Mortgage Credit Monitor this year, which compiles financial, banking, and real estate statistics. The tool seeks to provide evidence for public policy design and private decision-making.Álvarez de Celis concluded that "having comprehensive and up-to-date data is essential to guide decisions in a market where conditions change month by month. Mortgage loans boost the economy and play a central role in housing policy."

www.buysellba.com