BuySellBA

Administrator

Property: falling costs, recovering sales, and more expensive mortgages - La Nacion Propiedades

Source:

www.lanacion.com.ar

www.lanacion.com.ar

August 18, 2025

A private report by the Chamber of Urban Developers (CEDU) reveals how the dollar and credit are reshaping the real estate market.

Dollar increases directly impact real estate market costs.Hernan Zenteno - La Nacion/Hernan Zenteno

The Argentine real estate market is undergoing a period of readjustment and readjustment . In this context, a new report highlights how the dollar's performance —which has seen a jump in recent weeks compared to previous months— and the conditions for accessing mortgage credit —which has begun to curb supply in recent months—are shaping the present and future of developments : from construction costs to the profitability of selling off the shelf or buying with mortgage financing.

All of these variables showed significant changes starting in 2024. It's worth remembering that after construction costs increased significantly in dollar terms in one year, many properties in the pipeline began to be valued above those of brand-new properties , an unusual situation in the market. Another impact on the sector was the return of UVA (Purchasing Value Unit) mortgage loans more than a year ago, which offered a glimmer of hope for all market players.

The latest quarterly survey by Metadato, the industry intelligence platform of the Chamber of Urban Developers (CEDU), refers to these three variables : construction costs, recovery sales, and mortgage loans .

Meanwhile, the wellhead sale price has recovered over the last year and a half , but remains 2.57% below the last best price (July 2018). For the past year and a half, the CAC Index has been growing at a monthly rate closer to inflation. However, its high indicator remained well above the CPI, and even more so above the blue dollar . Therefore, the elimination of the exchange rate restrictions in April had initially caused a drop in the parallel dollar (-6.5% on the first day and -11.64% through the end of June), increasing costs in dollars and reducing project profitability . However, the currency's 8.51% rise in July moderated this impact .

Despite this improvement, gross rental profitability plummeted 6.06% in July , also due to the rise in the dollar. The mismatch between costs, prices, and profitability remains a challenge for the business.

"There has been an improvement in the selling price of units, with improved performance of apartments for sale in July and sharply declining profitability given the higher value of the blue dollar ," the survey summarizes.

This increase is primarily due to two factors: a 14.42% increase in the installment due compared to June and the strong rise in the official dollar. Despite strong growth in mortgage deeds in Buenos Aires (959.29% from January to June 2025 compared to the previous year), mortgage transactions stagnation was observed in June , attributed to tightening access conditions for financing, including higher interest rates and stricter requirements.

For CEDU, the current scenario forces the entire real estate value chain to make data-driven decisions and anticipate trends , with the goal of promoting policies that foster inclusive and sustainable cities.

www.buysellba.com

Source:

Propiedades: costos que bajan, ventas que se recuperan y créditos hipotecarios más caros

Un informe privado de la Cámara Empresaria de Desarrolladores Urbanos (CEDU) revela cómo el dólar y el crédito están reconfigurando el mercado inmobiliario

August 18, 2025

A private report by the Chamber of Urban Developers (CEDU) reveals how the dollar and credit are reshaping the real estate market.

Dollar increases directly impact real estate market costs.Hernan Zenteno - La Nacion/Hernan Zenteno

The Argentine real estate market is undergoing a period of readjustment and readjustment . In this context, a new report highlights how the dollar's performance —which has seen a jump in recent weeks compared to previous months— and the conditions for accessing mortgage credit —which has begun to curb supply in recent months—are shaping the present and future of developments : from construction costs to the profitability of selling off the shelf or buying with mortgage financing.

All of these variables showed significant changes starting in 2024. It's worth remembering that after construction costs increased significantly in dollar terms in one year, many properties in the pipeline began to be valued above those of brand-new properties , an unusual situation in the market. Another impact on the sector was the return of UVA (Purchasing Value Unit) mortgage loans more than a year ago, which offered a glimmer of hope for all market players.

The latest quarterly survey by Metadato, the industry intelligence platform of the Chamber of Urban Developers (CEDU), refers to these three variables : construction costs, recovery sales, and mortgage loans .

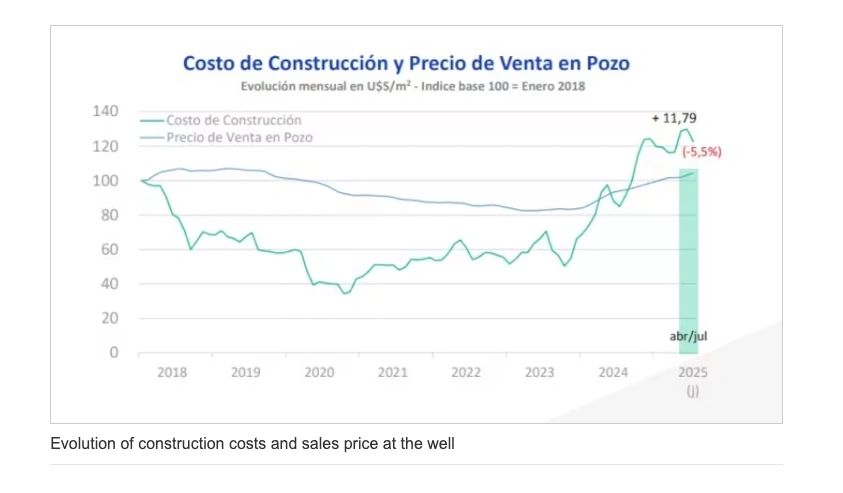

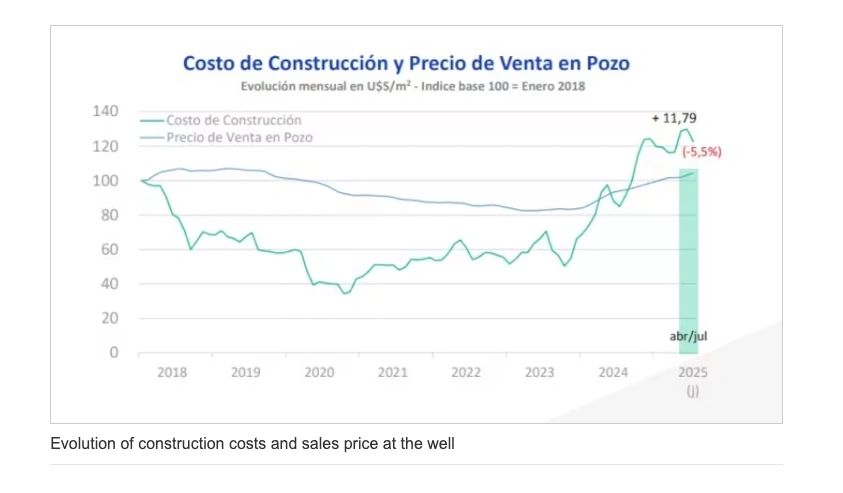

1) Construction costs: record and rebound

In June, the construction cost indicator reached its highest level in seven years , after accumulating an increase of 11.79% in the April-June quarter . However, in July, the outlook changed: the cost fell 5.5% in pesos, a decline that analysts directly link to the rise in the dollar.Meanwhile, the wellhead sale price has recovered over the last year and a half , but remains 2.57% below the last best price (July 2018). For the past year and a half, the CAC Index has been growing at a monthly rate closer to inflation. However, its high indicator remained well above the CPI, and even more so above the blue dollar . Therefore, the elimination of the exchange rate restrictions in April had initially caused a drop in the parallel dollar (-6.5% on the first day and -11.64% through the end of June), increasing costs in dollars and reducing project profitability . However, the currency's 8.51% rise in July moderated this impact .

2) Sale at the pit: slow recovery

The CEDU report notes that units under construction are recovering ground , although they are still 2.57% below the peak in July 2018. In the second quarter of 2025, prices rose 1.52%, and in July, sales in this segment exceeded those of completed units: 1.02% versus 0.74% .Despite this improvement, gross rental profitability plummeted 6.06% in July , also due to the rise in the dollar. The mismatch between costs, prices, and profitability remains a challenge for the business.

"There has been an improvement in the selling price of units, with improved performance of apartments for sale in July and sharply declining profitability given the higher value of the blue dollar ," the survey summarizes.

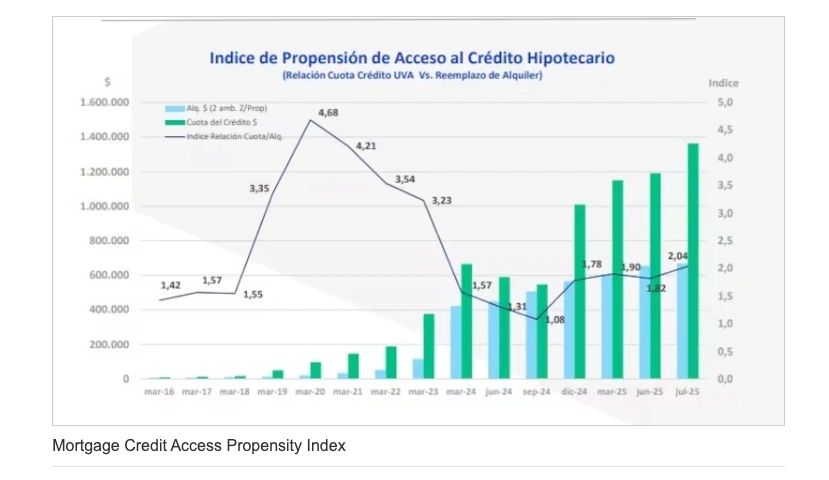

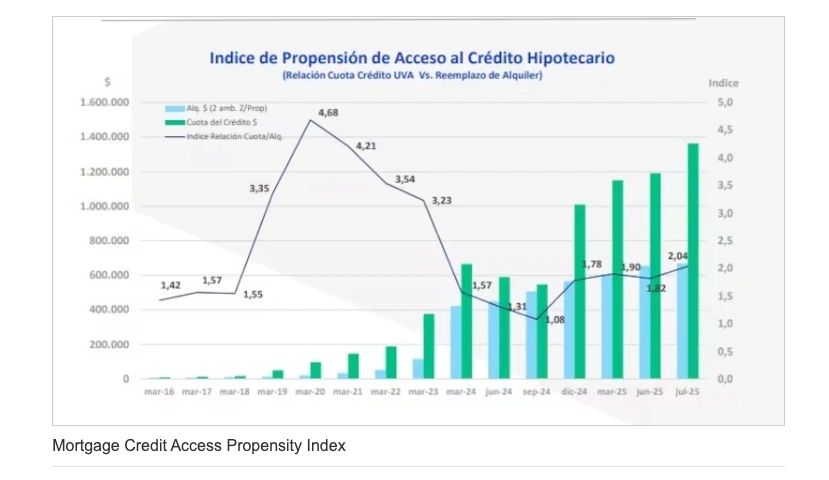

3) Mortgage loans: higher installments and stricter conditions

The Mortgage Loan Propensity Index, which measures the ratio of mortgage payments to equivalent rent, showed significant fluctuations . In June 2025, the indicator was 1.82 points. However, in July, this index reached 2.04 points, the highest value since March 2023. The higher the index, the lower the willingness to take out a loan .This increase is primarily due to two factors: a 14.42% increase in the installment due compared to June and the strong rise in the official dollar. Despite strong growth in mortgage deeds in Buenos Aires (959.29% from January to June 2025 compared to the previous year), mortgage transactions stagnation was observed in June , attributed to tightening access conditions for financing, including higher interest rates and stricter requirements.

For CEDU, the current scenario forces the entire real estate value chain to make data-driven decisions and anticipate trends , with the goal of promoting policies that foster inclusive and sustainable cities.

www.buysellba.com