BuySellBA

Administrator

Properties: The unusual outcome of prices in the northern zone so far this year - La Nacion Propiedades

Source:

www.lanacion.com.ar

www.lanacion.com.ar

May 09, 2025

The real estate market continues to recover and property prices are a testament to this.

By Maria Josefina Lanzi

Record price increases in the northern region: in just four months, prices rose by the same amount as they did in the entire previous year.

The real estate market continues to surprise, and the northern region is one of the places at the top of the list. After just four months, listing prices for apartments in this latitude increased by the same percentage they grew throughout 2024.

This was revealed in a report by Zonaprop, which indicated that the square meter in the northern zone rose 0.8% in April and will accumulate a 3% increase in 2025. The striking fact is that, looking at 2024, prices had also risen 3.1%, but throughout the entire year.

Thus, the average square meter of property offered is US$2,298 , 4.5% below the price in Buenos Aires (US$2,407). If the analysis is applied to specific types, a one-bedroom apartment with 50 m² sells for US$112,606, while a two-bedroom apartment with 70 m² sells for US$172,250.

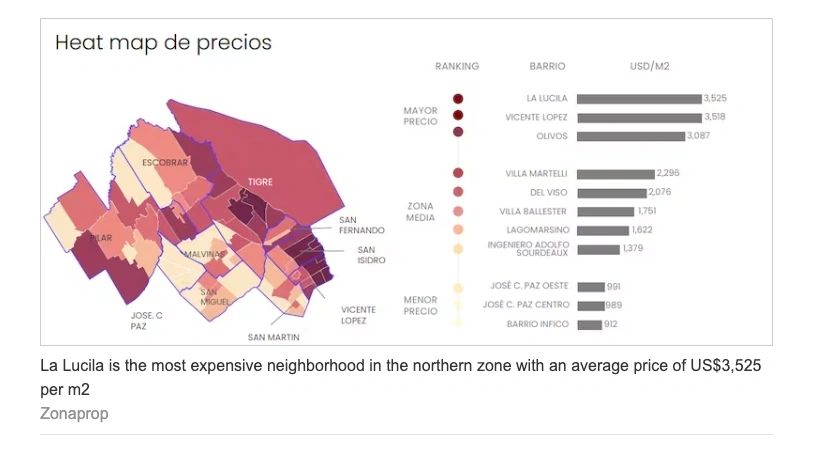

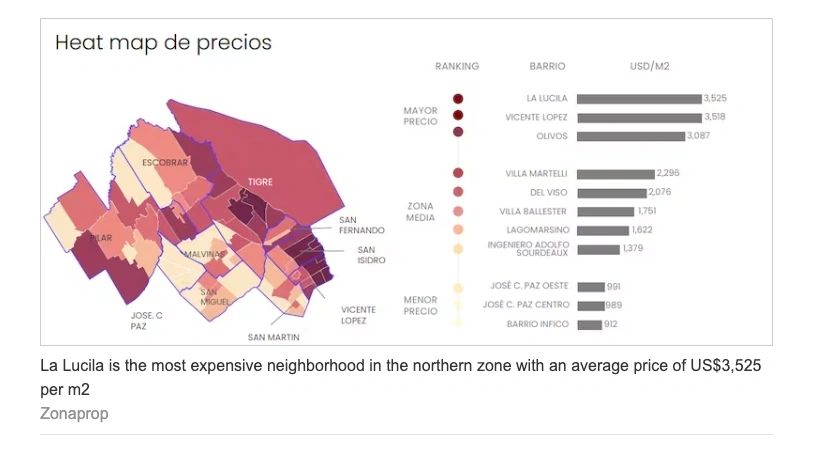

If the analysis is carried out by neighborhood, La Lucila tops the list of neighborhoods with the most expensive prices for purchase, with an average price of US$3,525/m². Vicente López (US$3,518/m²) and Olivos (US$3,087/m²) complete the podium. On the other hand, Barrio Infico, José C. Paz Centro, and José C. Paz Oeste have the lowest prices, with US$912, US$989, and US$991 per square meter, respectively.

The broker also emphasizes that closing prices have also risen , since negotiation margins "are practically nonexistent for small products - from US$150,000 to US$300,000." Daniel Salaya Romera, from the eponymous real estate agency, agrees with Mieres that negotiation today is almost nonexistent and assures that "two years ago it was normal to hear counteroffers of 10%, 12% or 15%, today, a large percentage of sales are closed at the listed price . "

Some brokers consulted by LA NACION explain that owners who previously waited to list their properties are now offering them again.Ricardo Pristupluk

"We're not surprised by the rise in property values; we're experiencing a period of market expansion, and at a faster pace than in recent years," shares Laura Porto, director of Inmobiliaria Narvaez. She explains that this growth is driven by the expansion of mortgage lending , which is significantly boosting the market by converting potential inactive demand into concrete transactions, which also generates more chain purchases. In Salaya Romera's words: "For every property sold with credit, that translates into two or three more sales."

Porto adds that money laundering and regulatory measures such as the repeal of the rental law also played a role in the rise in values; the latter generated "a more secure environment for investors and buyers, with historic rental yields between 4% and 5%." Added to this is the fact that many properties that were for sale during the rental law's validity are now being offered for rent again, as the new rules make them a more attractive investment. Furthermore, in a context of rising prices, many owners hope that by offering the property for rent and waiting a little longer, they will be able to sell their property at a higher price later.

Porto also points out that rising prices due to increased construction costs are also pushing up used prices. Indeed, according to data from Zonaprop, there has been a cumulative increase of 98% since October 2023. For his part, he notes that "demand is validating prices, although it is not a boom."

Finally, it's important to note that all of these factors, combined with the ongoing sales transactions in the market, have caused the stock of properties for sale to continue to decline. This could further push prices up, due to reduced supply and growing demand.

www.buysellba.com

Source:

Propiedades: el insólito desenlace que tuvieron los precios de zona norte en lo que va del año

El mercado inmobiliario sigue recuperándose y los precios de las propiedades son testigos de esto

May 09, 2025

The real estate market continues to recover and property prices are a testament to this.

By Maria Josefina Lanzi

Record price increases in the northern region: in just four months, prices rose by the same amount as they did in the entire previous year.

The real estate market continues to surprise, and the northern region is one of the places at the top of the list. After just four months, listing prices for apartments in this latitude increased by the same percentage they grew throughout 2024.

This was revealed in a report by Zonaprop, which indicated that the square meter in the northern zone rose 0.8% in April and will accumulate a 3% increase in 2025. The striking fact is that, looking at 2024, prices had also risen 3.1%, but throughout the entire year.

Thus, the average square meter of property offered is US$2,298 , 4.5% below the price in Buenos Aires (US$2,407). If the analysis is applied to specific types, a one-bedroom apartment with 50 m² sells for US$112,606, while a two-bedroom apartment with 70 m² sells for US$172,250.

If the analysis is carried out by neighborhood, La Lucila tops the list of neighborhoods with the most expensive prices for purchase, with an average price of US$3,525/m². Vicente López (US$3,518/m²) and Olivos (US$3,087/m²) complete the podium. On the other hand, Barrio Infico, José C. Paz Centro, and José C. Paz Oeste have the lowest prices, with US$912, US$989, and US$991 per square meter, respectively.

Why have property prices accelerated in the northern region?

Some brokers consulted by LA NACION explain that owners who previously waited to list their properties are now putting them back on the market, at prices higher than 2024. “ These owners see that there is less supply and that prices, in general, are following an upward trend , and perhaps they need to get rid of the property, so they are encouraged to list their property at higher prices,” explains Santiago Mieres, of the eponymous real estate agency.The broker also emphasizes that closing prices have also risen , since negotiation margins "are practically nonexistent for small products - from US$150,000 to US$300,000." Daniel Salaya Romera, from the eponymous real estate agency, agrees with Mieres that negotiation today is almost nonexistent and assures that "two years ago it was normal to hear counteroffers of 10%, 12% or 15%, today, a large percentage of sales are closed at the listed price . "

Some brokers consulted by LA NACION explain that owners who previously waited to list their properties are now offering them again.Ricardo Pristupluk

"We're not surprised by the rise in property values; we're experiencing a period of market expansion, and at a faster pace than in recent years," shares Laura Porto, director of Inmobiliaria Narvaez. She explains that this growth is driven by the expansion of mortgage lending , which is significantly boosting the market by converting potential inactive demand into concrete transactions, which also generates more chain purchases. In Salaya Romera's words: "For every property sold with credit, that translates into two or three more sales."

Porto adds that money laundering and regulatory measures such as the repeal of the rental law also played a role in the rise in values; the latter generated "a more secure environment for investors and buyers, with historic rental yields between 4% and 5%." Added to this is the fact that many properties that were for sale during the rental law's validity are now being offered for rent again, as the new rules make them a more attractive investment. Furthermore, in a context of rising prices, many owners hope that by offering the property for rent and waiting a little longer, they will be able to sell their property at a higher price later.

Porto also points out that rising prices due to increased construction costs are also pushing up used prices. Indeed, according to data from Zonaprop, there has been a cumulative increase of 98% since October 2023. For his part, he notes that "demand is validating prices, although it is not a boom."

Finally, it's important to note that all of these factors, combined with the ongoing sales transactions in the market, have caused the stock of properties for sale to continue to decline. This could further push prices up, due to reduced supply and growing demand.

www.buysellba.com